1099 R Form Rollover - If you roll over an ira, you are moving it from one company to another. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. The tool is designed for taxpayers who were u.s. You have 60 days from the time you.

If you roll over an ira, you are moving it from one company to another. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. The tool is designed for taxpayers who were u.s. You have 60 days from the time you.

You have 60 days from the time you. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. The tool is designed for taxpayers who were u.s. If you roll over an ira, you are moving it from one company to another.

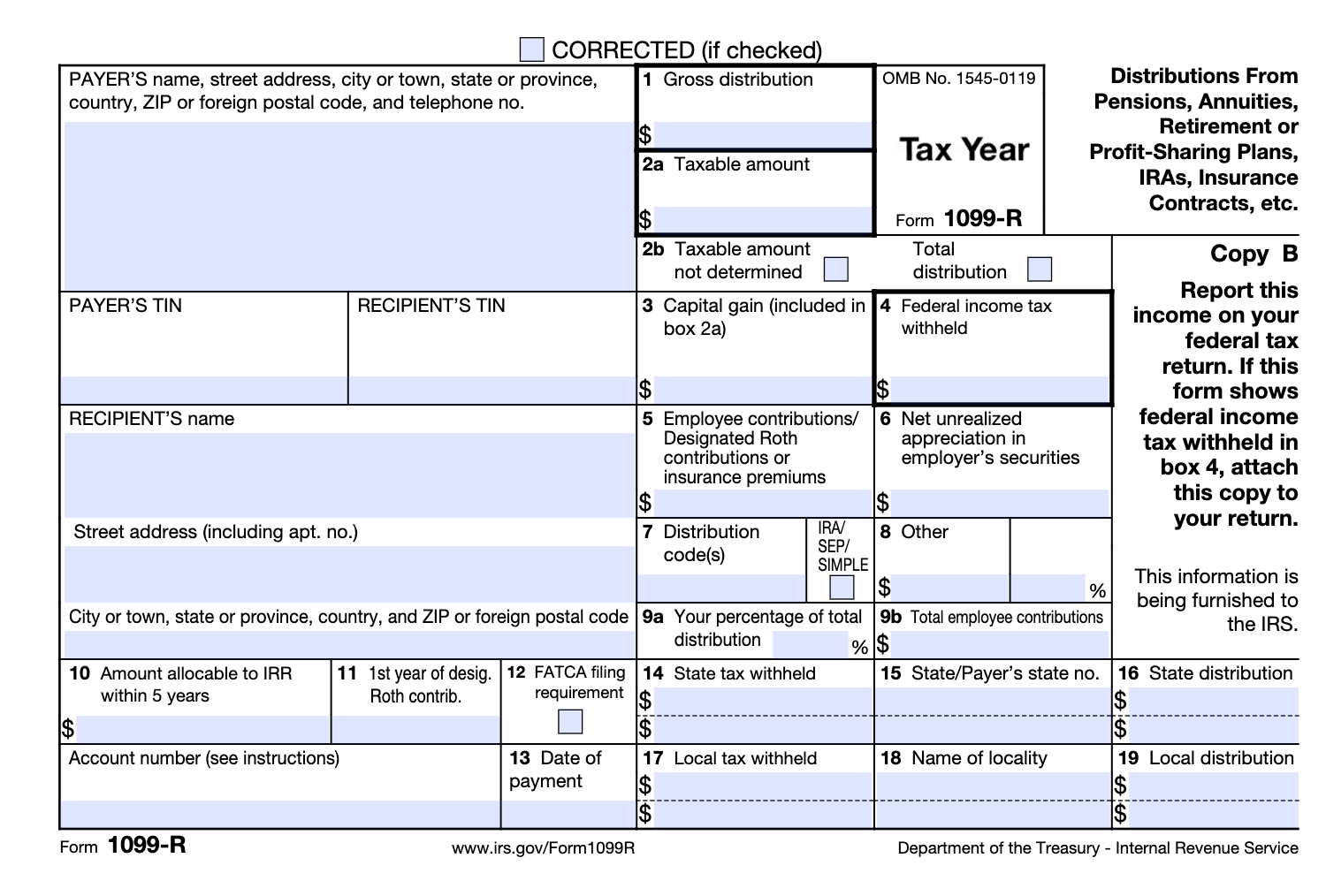

1099r Form 2023 Printable Forms Free Online

You have 60 days from the time you. The tool is designed for taxpayers who were u.s. If you roll over an ira, you are moving it from one company to another. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in.

1099R Software to Create, Print & EFile IRS Form 1099R

If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. The tool is designed for taxpayers who were u.s. You have 60 days from the time you. If you roll over an ira, you are moving it from one company to another.

1099R Form 2024 2025

You have 60 days from the time you. If you roll over an ira, you are moving it from one company to another. The tool is designed for taxpayers who were u.s. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in.

Form 1099R Instructions & Information Community Tax

The tool is designed for taxpayers who were u.s. You have 60 days from the time you. If you roll over an ira, you are moving it from one company to another. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in.

1099R Template. Create A Free 1099R Form.

If you roll over an ira, you are moving it from one company to another. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. You have 60 days from the time you. The tool is designed for taxpayers who were u.s.

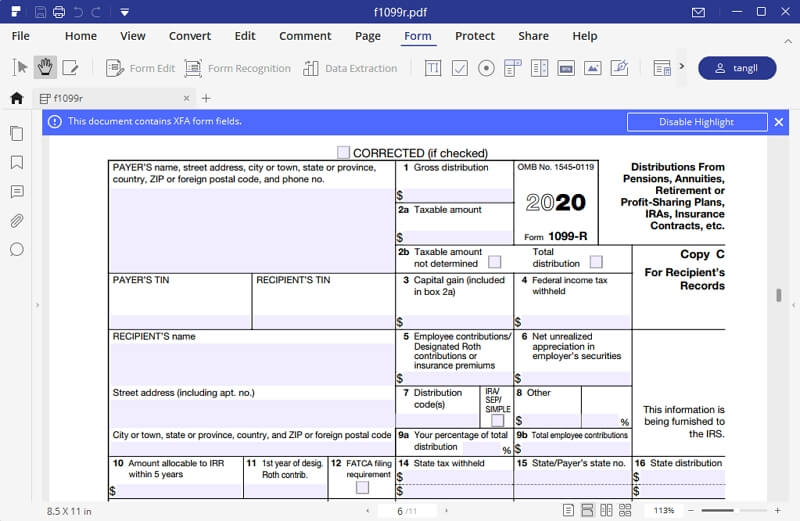

Fillable Form 1099 R Printable Forms Free Online

If you roll over an ira, you are moving it from one company to another. You have 60 days from the time you. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. The tool is designed for taxpayers who were u.s.

1099 R Form 2023 Printable Forms Free Online

If you roll over an ira, you are moving it from one company to another. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. You have 60 days from the time you. The tool is designed for taxpayers who were u.s.

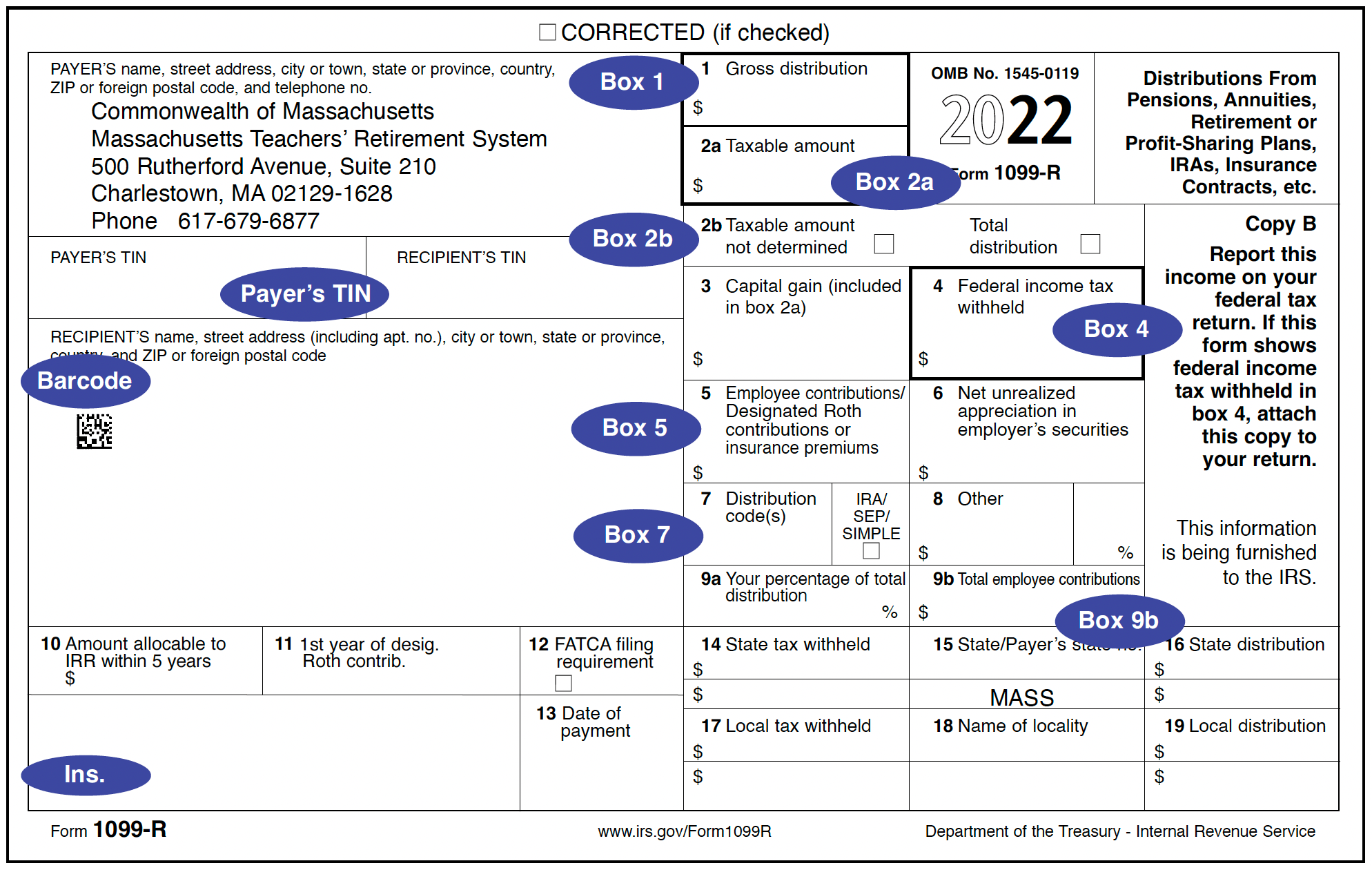

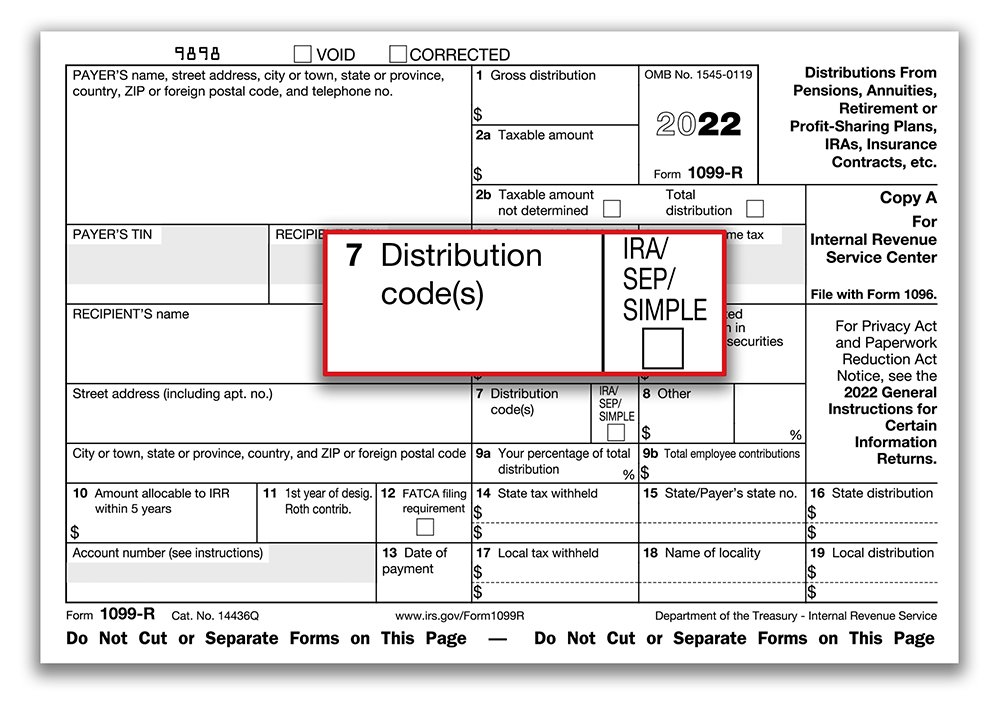

1099r form 2022 lopersways

You have 60 days from the time you. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. If you roll over an ira, you are moving it from one company to another. The tool is designed for taxpayers who were u.s.

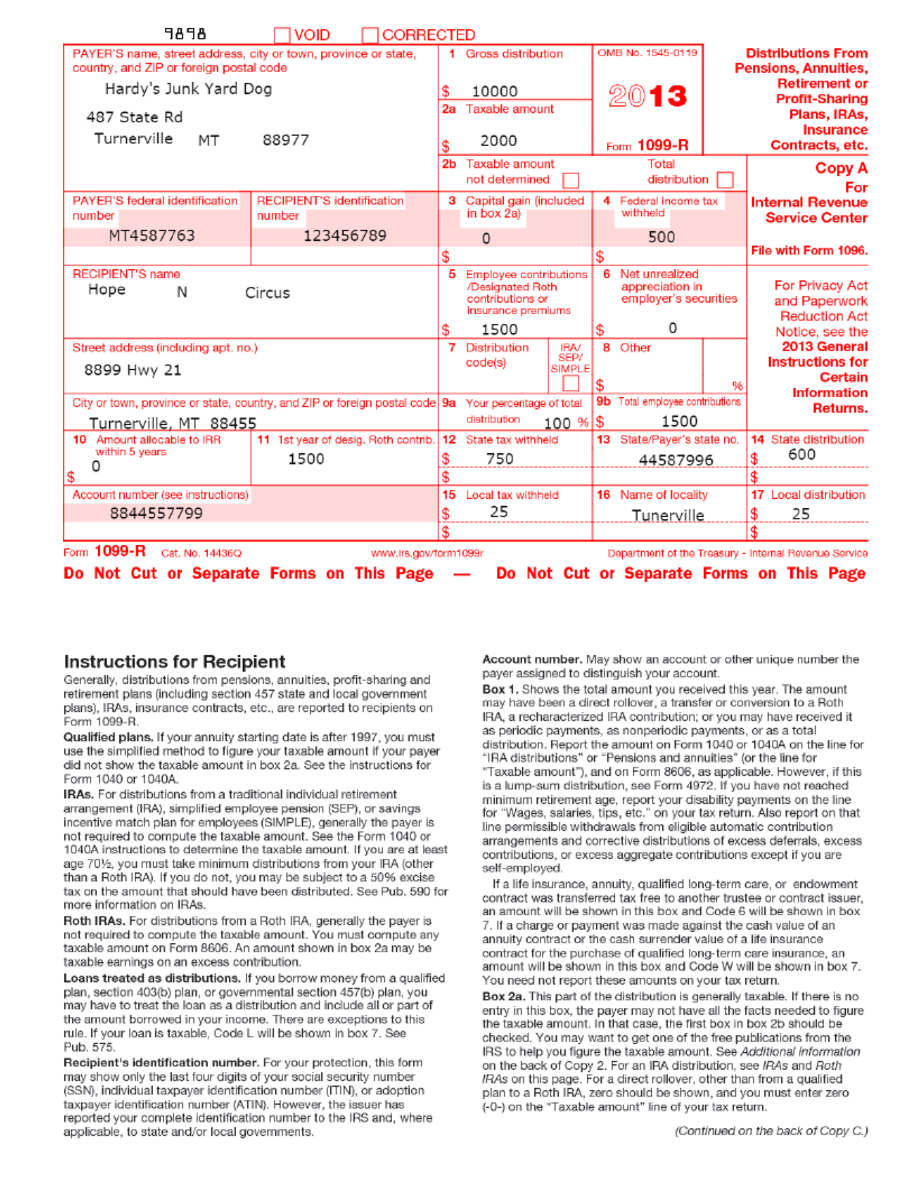

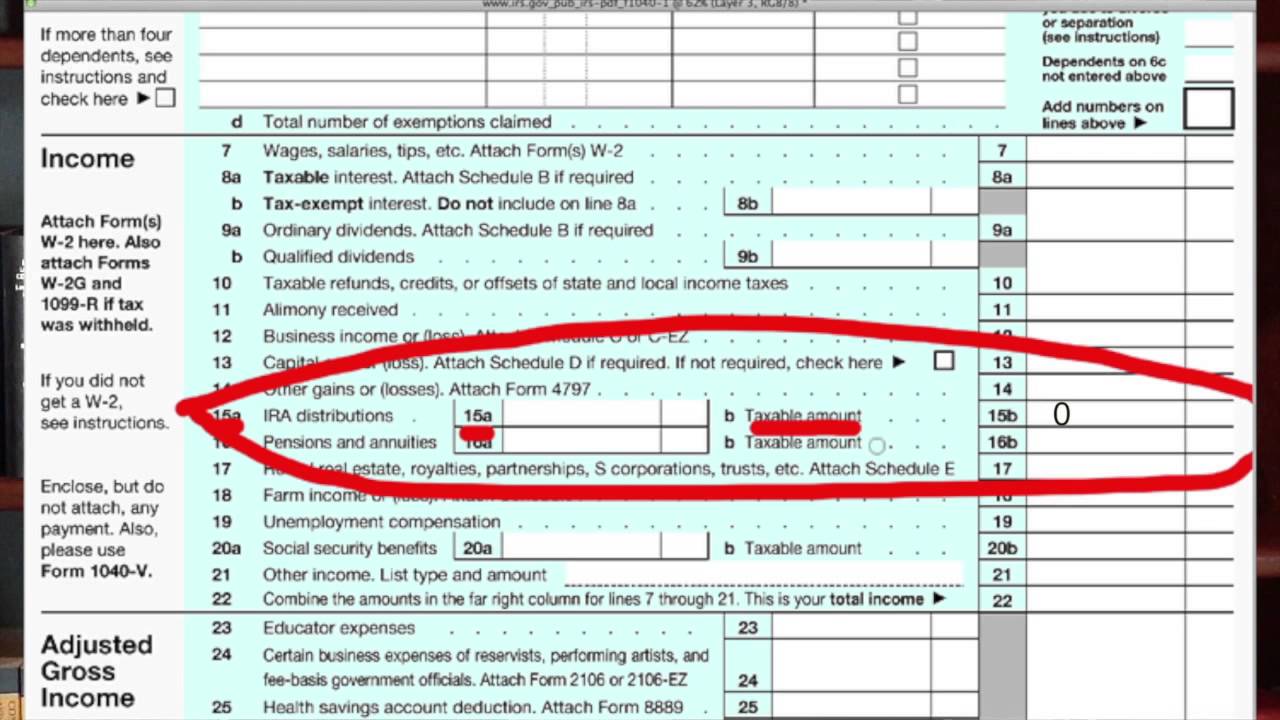

1099R Distributions from Retirement Accounts, IRA, Pensions

You have 60 days from the time you. The tool is designed for taxpayers who were u.s. If you roll over an ira, you are moving it from one company to another. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in.

Printable 1099 R Form Printable Forms Free Online

If you roll over an ira, you are moving it from one company to another. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in. You have 60 days from the time you. The tool is designed for taxpayers who were u.s.

You Have 60 Days From The Time You.

The tool is designed for taxpayers who were u.s. If you roll over an ira, you are moving it from one company to another. If a rollover contribution is made to a traditional or roth ira that is later revoked or closed, and distribution is made to the taxpayer, enter in.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)