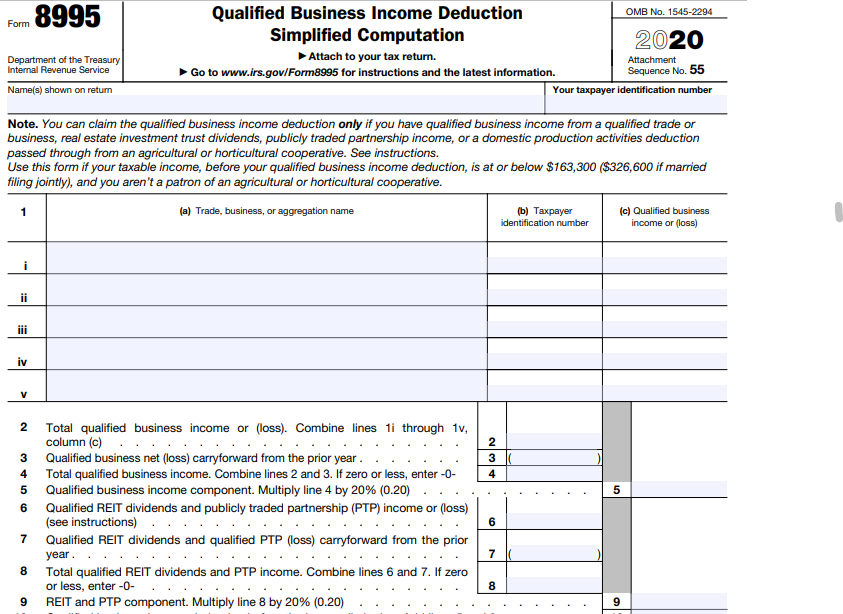

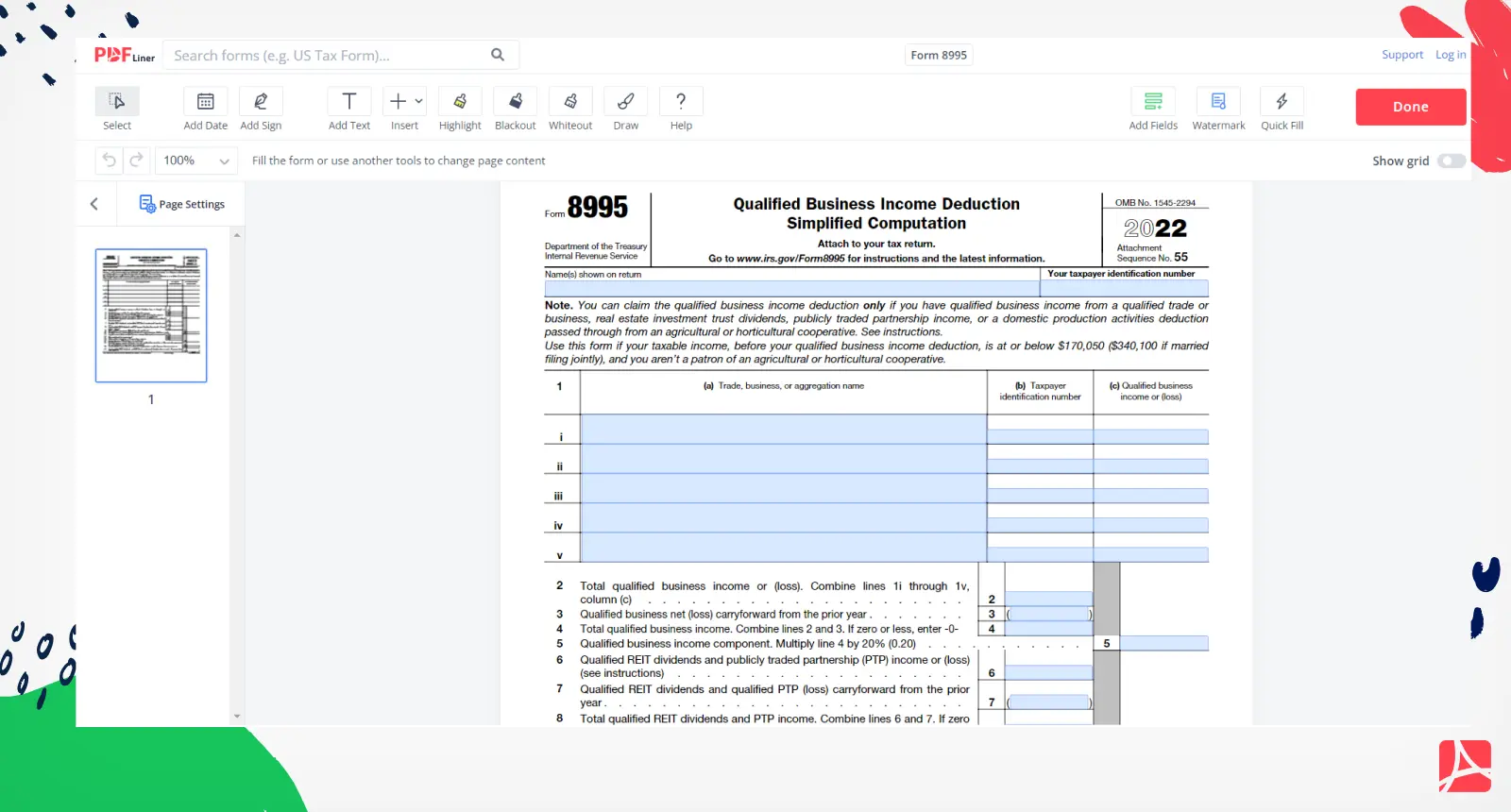

2022 Form 8995 - Use form 8995 to figure your qualified business income deduction for tax year 2022. Use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married filing. Find the latest updates, instructions, and related forms. Form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). This is the official pdf form for claiming the qualified business income deduction for tax year 2022.

Use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married filing. This is the official pdf form for claiming the qualified business income deduction for tax year 2022. Find the latest updates, instructions, and related forms. Form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Use form 8995 to figure your qualified business income deduction for tax year 2022.

This is the official pdf form for claiming the qualified business income deduction for tax year 2022. Form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Find the latest updates, instructions, and related forms. Use form 8995 to figure your qualified business income deduction for tax year 2022. Use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married filing.

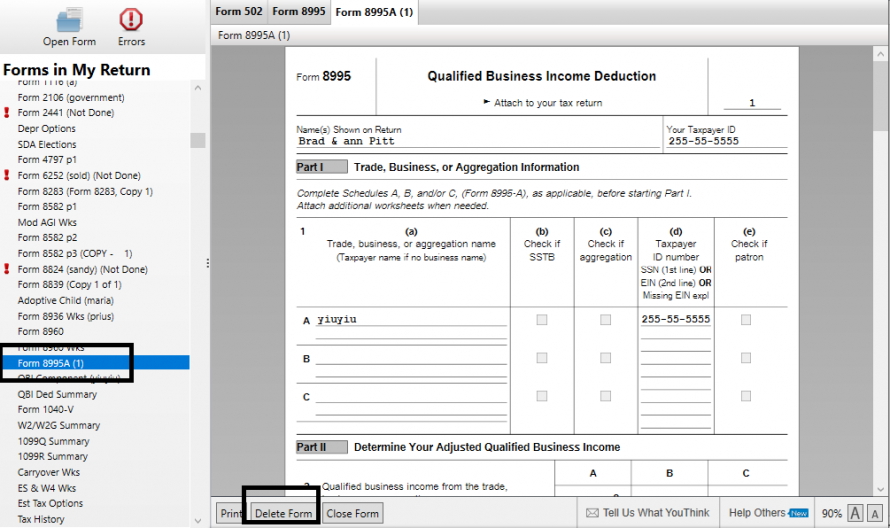

Printable Form 8995 Blog 8995 Form Website

Use form 8995 to figure your qualified business income deduction for tax year 2022. Find the latest updates, instructions, and related forms. Form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). This is the official pdf form for claiming the qualified business income deduction for tax year 2022. Use this form if.

2022 form 8995 Fill out & sign online DocHub

Find the latest updates, instructions, and related forms. Form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married filing. This is the official pdf form for claiming the qualified business income deduction.

Online Form 8995 Blog 8995 Form Website

Use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married filing. This is the official pdf form for claiming the qualified business income deduction for tax year 2022. Form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Use form 8995 to.

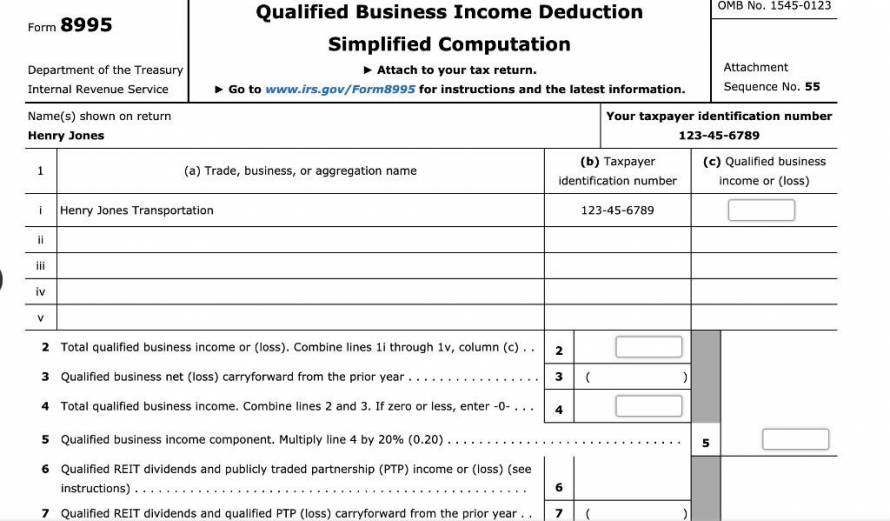

IRS Form 8995 Walkthrough (QBI Deduction Simplified, 57 OFF

Use form 8995 to figure your qualified business income deduction for tax year 2022. Form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Find the latest updates, instructions, and related forms. Use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married.

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

Form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Use form 8995 to figure your qualified business income deduction for tax year 2022. Use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married filing. Find the latest updates, instructions, and related.

Form 8995 2024 2025

Use form 8995 to figure your qualified business income deduction for tax year 2022. This is the official pdf form for claiming the qualified business income deduction for tax year 2022. Form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Find the latest updates, instructions, and related forms. Use this form if.

IRS Form 8995 Walkthrough (QBI Deduction Simplified, 57 OFF

Use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married filing. Find the latest updates, instructions, and related forms. Use form 8995 to figure your qualified business income deduction for tax year 2022. This is the official pdf form for claiming the qualified business income deduction for tax year.

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

Use form 8995 to figure your qualified business income deduction for tax year 2022. Use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married filing. Form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Find the latest updates, instructions, and related.

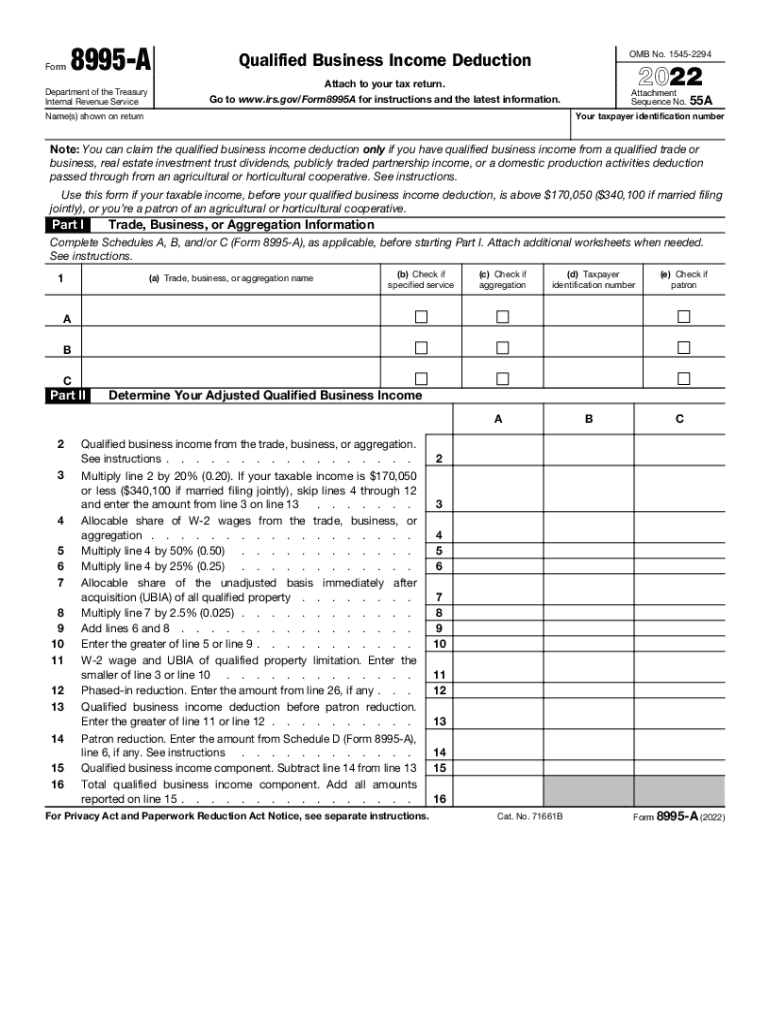

Schedule C (Form 8995A) Fill and sign online with Lumin

This is the official pdf form for claiming the qualified business income deduction for tax year 2022. Find the latest updates, instructions, and related forms. Use form 8995 to figure your qualified business income deduction for tax year 2022. Form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Use this form if.

IRS Form 8995 Printable Form 8995 blank, sign form online — PDFliner

This is the official pdf form for claiming the qualified business income deduction for tax year 2022. Form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Use form 8995 to figure your qualified business income deduction for tax year 2022. Find the latest updates, instructions, and related forms. Use this form if.

Use Form 8995 To Figure Your Qualified Business Income Deduction For Tax Year 2022.

Find the latest updates, instructions, and related forms. Use this form if your taxable income, before your qualified business income deduction, is at or below $170,050 ($340,100 if married filing. Form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). This is the official pdf form for claiming the qualified business income deduction for tax year 2022.