2022 Form Il 1120 St Instructions - For all other situations, see instructions. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Printed by the authority of. The shareholders of these corporations. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. For all other situations, see instructions.

This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. For all other situations, see instructions. Printed by the authority of. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. For all other situations, see instructions. The shareholders of these corporations.

For all other situations, see instructions. For all other situations, see instructions. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Printed by the authority of. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. The shareholders of these corporations.

Fillable Online tax illinois 2022 Form IL1120ST, Small Business

This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. The shareholders of these corporations. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Printed by the authority of. For all other situations, see instructions.

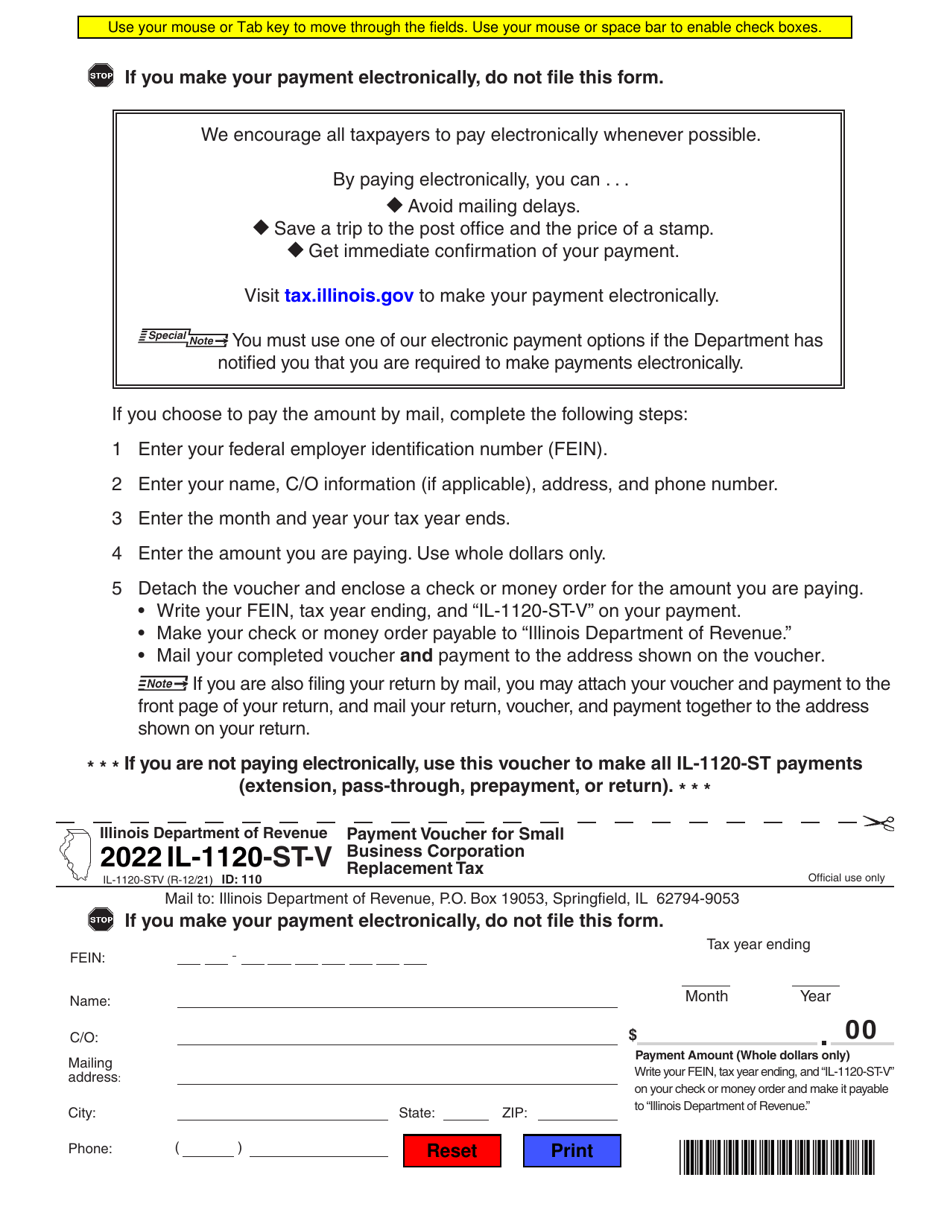

Form IL1120STV Download Fillable PDF or Fill Online Payment Voucher

Printed by the authority of. The shareholders of these corporations. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. For all other situations, see instructions. For all other situations, see instructions.

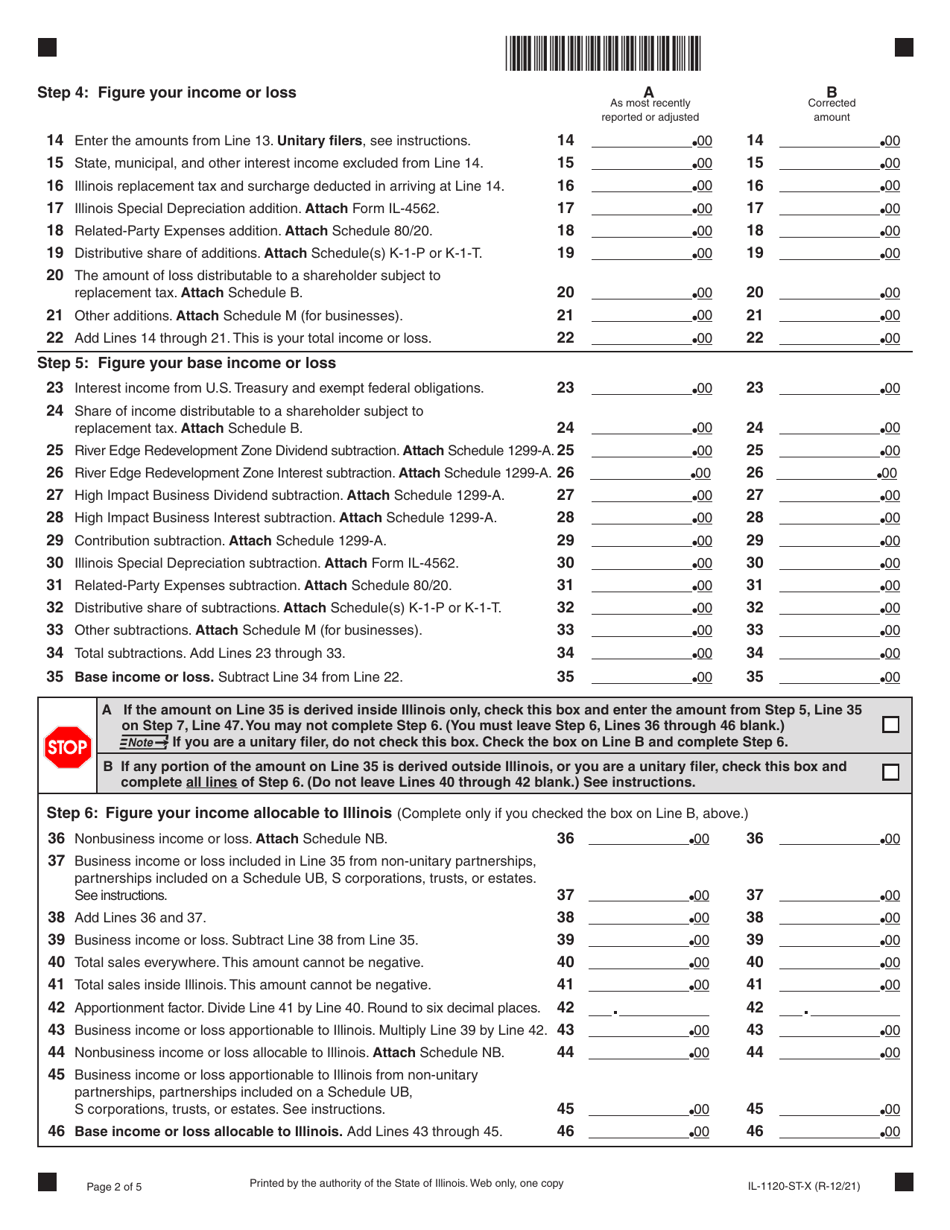

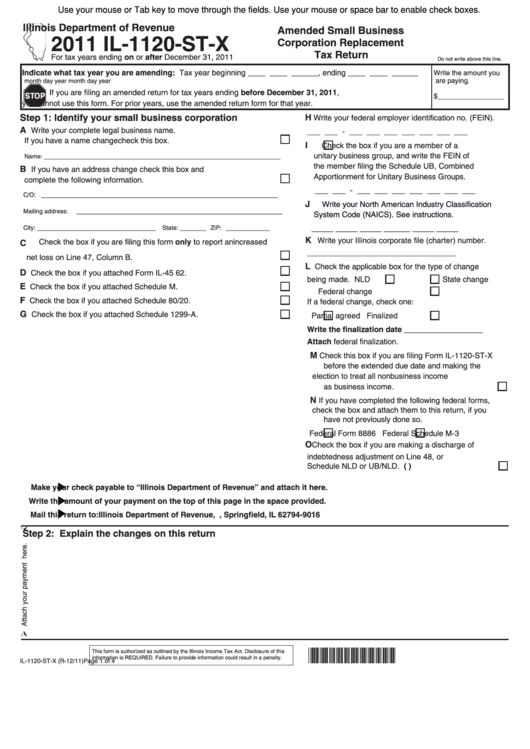

Form IL1120STX 2021 Fill Out, Sign Online and Download Fillable

The shareholders of these corporations. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Printed by the authority of. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. For all other situations, see instructions.

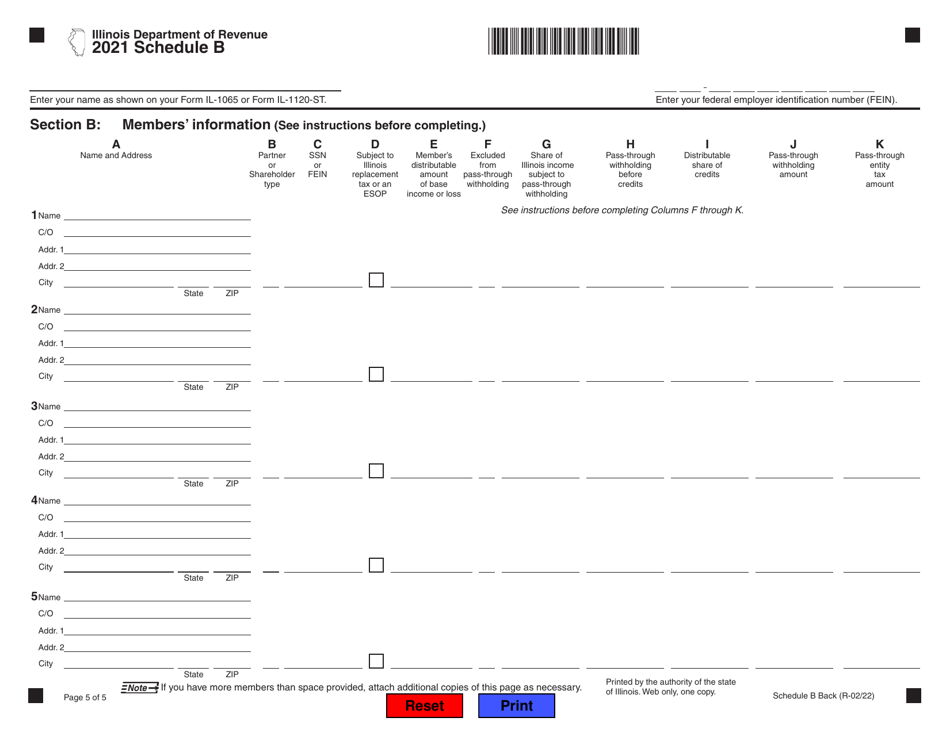

Form IL1120ST 2021 Fill Out, Sign Online and Download Fillable

This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. For all other situations, see instructions. Printed by the authority of. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. For all other situations, see instructions.

Irs Instructions Form 1120s Fillable and Editable PDF Template

This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. For all other situations, see instructions. The shareholders of these corporations. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. For all other situations, see instructions.

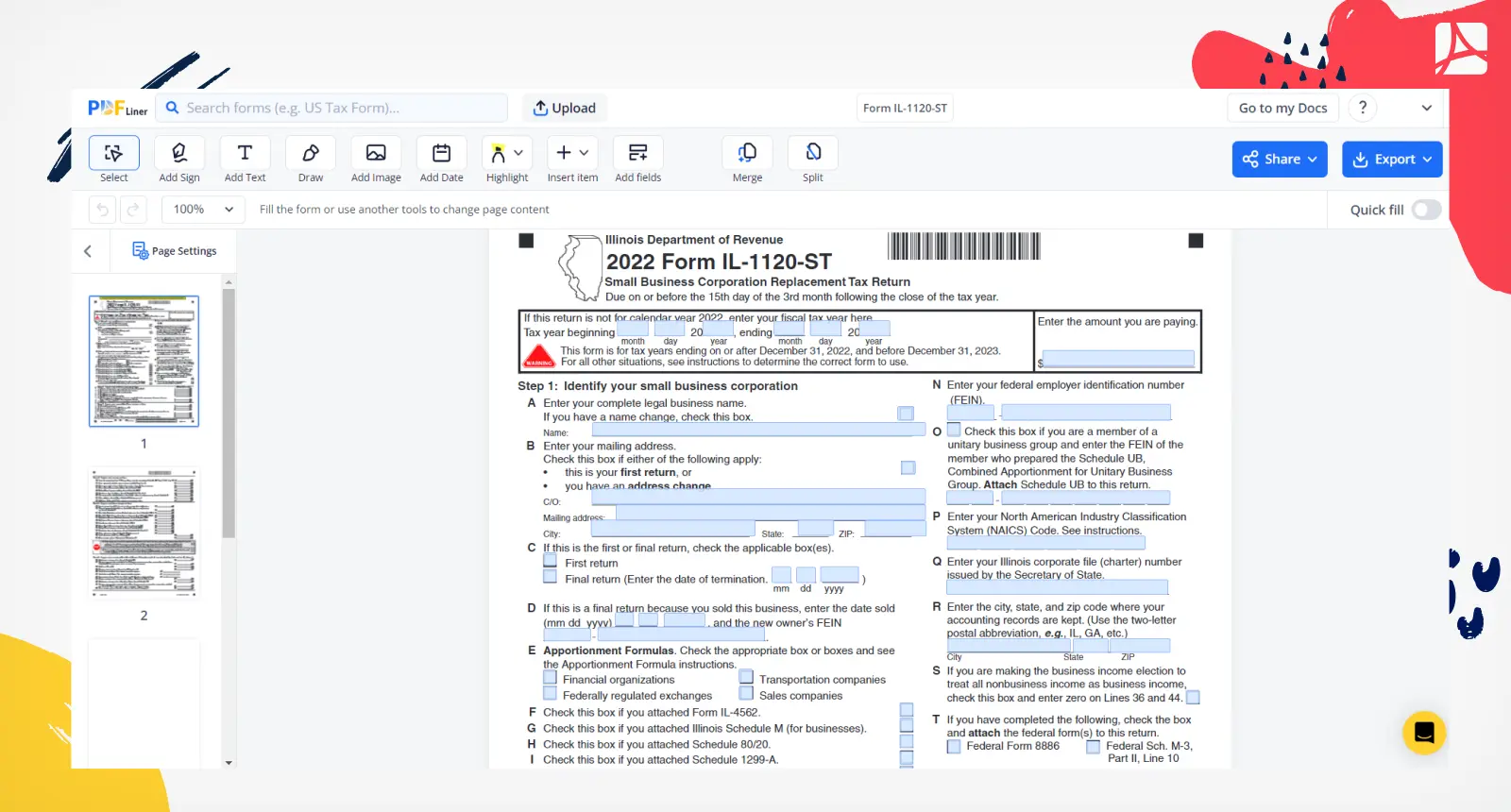

Form IL1120ST, fill out and sign the form online PDFliner

This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. For all other situations, see instructions. Printed by the authority of. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. The shareholders of these corporations.

1120 s instructions 2022 Fill out & sign online DocHub

This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Printed by the authority of. For all other situations, see instructions. The shareholders of these corporations. For all other situations, see instructions.

Download Instructions for Form IL1120STX Amended Small Business

For all other situations, see instructions. The shareholders of these corporations. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. For all other situations, see instructions. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023.

Fillable Online tax illinois 2008 IL1120ST Instructions Illinois

Printed by the authority of. For all other situations, see instructions. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. For all other situations, see instructions.

Fillable Form Il1120StX Amended Small Business Corporation

For all other situations, see instructions. The shareholders of these corporations. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. Printed by the authority of. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023.

For All Other Situations, See Instructions.

Printed by the authority of. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. This form is for tax years ending on or after december 31, 2022, and before december 31, 2023. For all other situations, see instructions.