8594 Tax Form - Irs form 8594 is the paperwork you file with your taxes if you are buying or selling a business. The buyers and sellers of a group of assets that make up a business use form 8594. Both the seller and purchaser of a group of assets that makes up a trade or business must use. A form 8594 needs to be completed and both the seller and buyer need to attach.

Irs form 8594 is the paperwork you file with your taxes if you are buying or selling a business. The buyers and sellers of a group of assets that make up a business use form 8594. A form 8594 needs to be completed and both the seller and buyer need to attach. Both the seller and purchaser of a group of assets that makes up a trade or business must use.

Irs form 8594 is the paperwork you file with your taxes if you are buying or selling a business. Both the seller and purchaser of a group of assets that makes up a trade or business must use. The buyers and sellers of a group of assets that make up a business use form 8594. A form 8594 needs to be completed and both the seller and buyer need to attach.

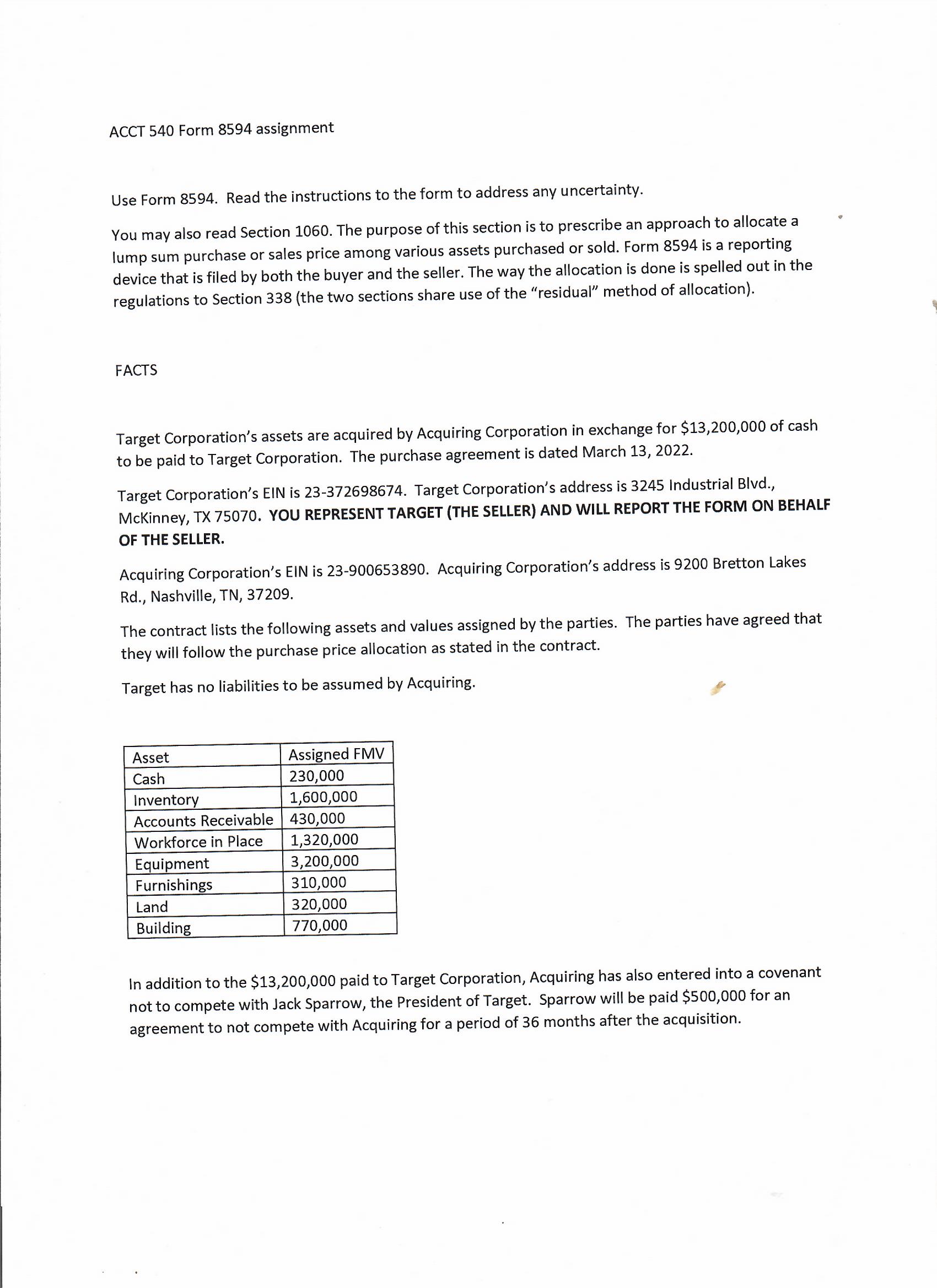

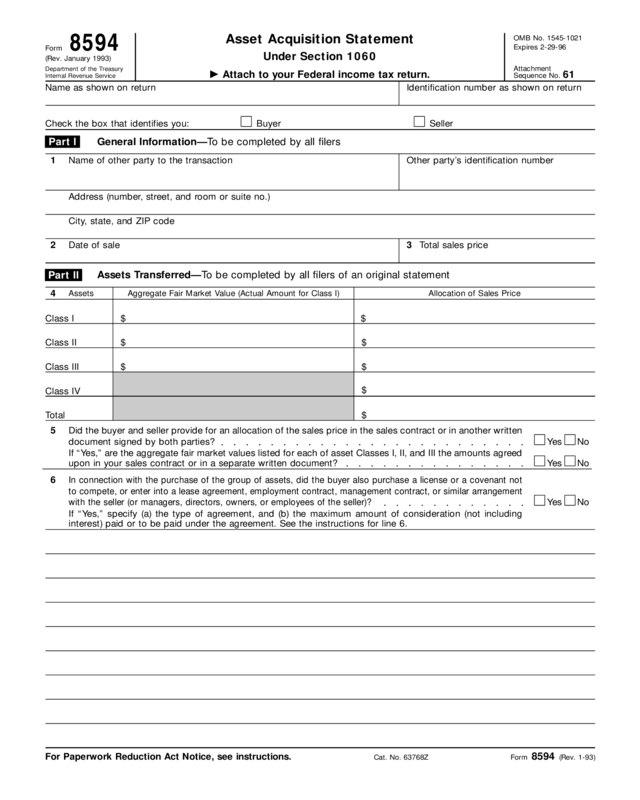

ACCT 540 Form 8594 assignment Use Form 8594. Read the

Irs form 8594 is the paperwork you file with your taxes if you are buying or selling a business. The buyers and sellers of a group of assets that make up a business use form 8594. A form 8594 needs to be completed and both the seller and buyer need to attach. Both the seller and purchaser of a group.

Instructions for Form 8594 2024 2025

The buyers and sellers of a group of assets that make up a business use form 8594. A form 8594 needs to be completed and both the seller and buyer need to attach. Irs form 8594 is the paperwork you file with your taxes if you are buying or selling a business. Both the seller and purchaser of a group.

Form 8594 Edit, Fill, Sign Online Handypdf

The buyers and sellers of a group of assets that make up a business use form 8594. A form 8594 needs to be completed and both the seller and buyer need to attach. Both the seller and purchaser of a group of assets that makes up a trade or business must use. Irs form 8594 is the paperwork you file.

Fillable Online Form 8594 prepaid expenses class. Form 8594 prepaid

The buyers and sellers of a group of assets that make up a business use form 8594. Both the seller and purchaser of a group of assets that makes up a trade or business must use. A form 8594 needs to be completed and both the seller and buyer need to attach. Irs form 8594 is the paperwork you file.

Form 8594

The buyers and sellers of a group of assets that make up a business use form 8594. A form 8594 needs to be completed and both the seller and buyer need to attach. Irs form 8594 is the paperwork you file with your taxes if you are buying or selling a business. Both the seller and purchaser of a group.

How to Create Form 8594 With Fill's Customizable Template

Irs form 8594 is the paperwork you file with your taxes if you are buying or selling a business. A form 8594 needs to be completed and both the seller and buyer need to attach. The buyers and sellers of a group of assets that make up a business use form 8594. Both the seller and purchaser of a group.

8594 Fillable and Editable PDF Template

Irs form 8594 is the paperwork you file with your taxes if you are buying or selling a business. A form 8594 needs to be completed and both the seller and buyer need to attach. The buyers and sellers of a group of assets that make up a business use form 8594. Both the seller and purchaser of a group.

Form 8594 Asset Acquisition Statement Under Section 1060 (2012) Free

Irs form 8594 is the paperwork you file with your taxes if you are buying or selling a business. Both the seller and purchaser of a group of assets that makes up a trade or business must use. A form 8594 needs to be completed and both the seller and buyer need to attach. The buyers and sellers of a.

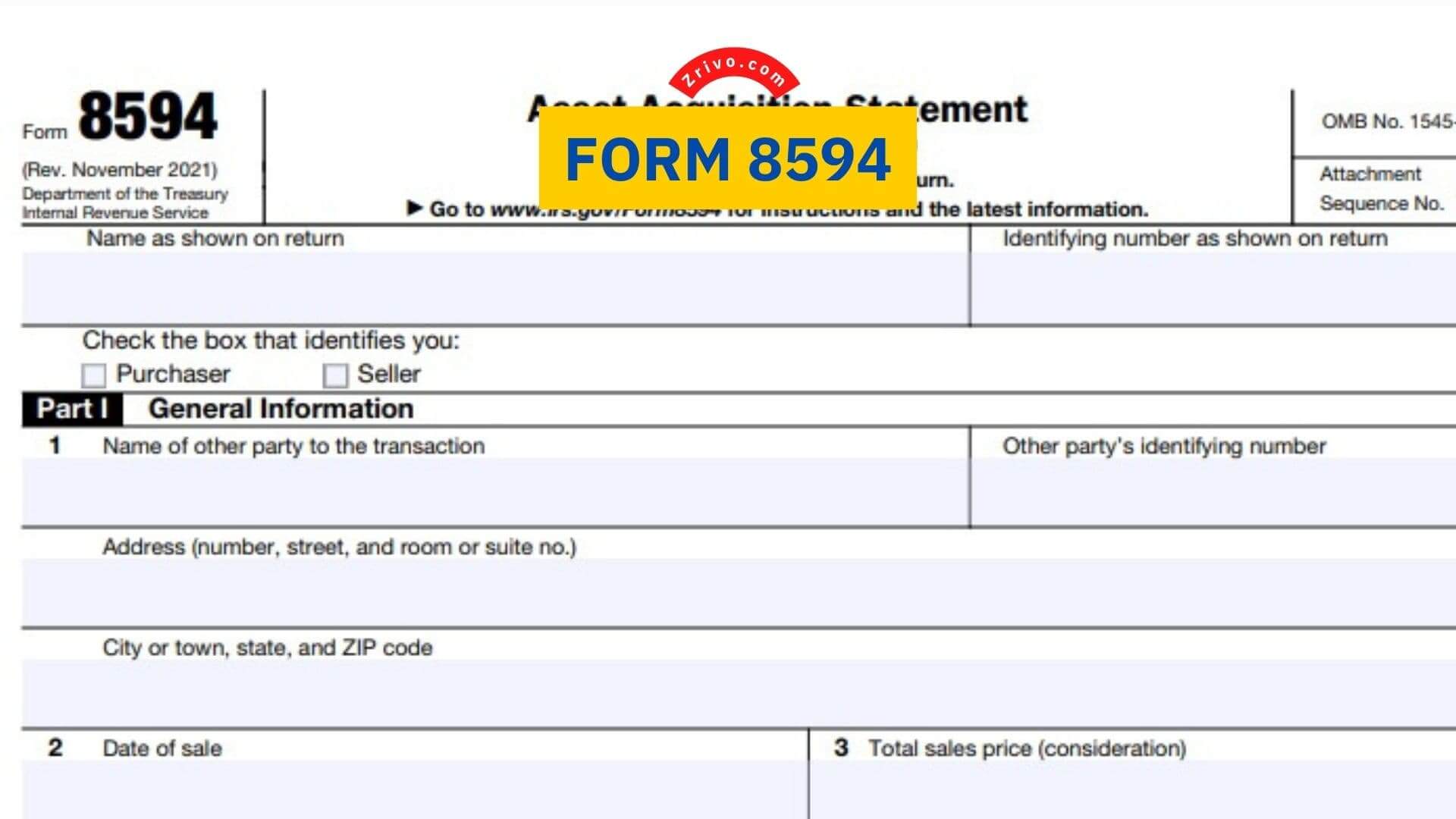

8594 Instructions 2024 2025 IRS Forms Zrivo

Both the seller and purchaser of a group of assets that makes up a trade or business must use. Irs form 8594 is the paperwork you file with your taxes if you are buying or selling a business. The buyers and sellers of a group of assets that make up a business use form 8594. A form 8594 needs to.

IRS Form 8594 Instructions Asset Acquisition Statement

Irs form 8594 is the paperwork you file with your taxes if you are buying or selling a business. A form 8594 needs to be completed and both the seller and buyer need to attach. The buyers and sellers of a group of assets that make up a business use form 8594. Both the seller and purchaser of a group.

Both The Seller And Purchaser Of A Group Of Assets That Makes Up A Trade Or Business Must Use.

A form 8594 needs to be completed and both the seller and buyer need to attach. The buyers and sellers of a group of assets that make up a business use form 8594. Irs form 8594 is the paperwork you file with your taxes if you are buying or selling a business.