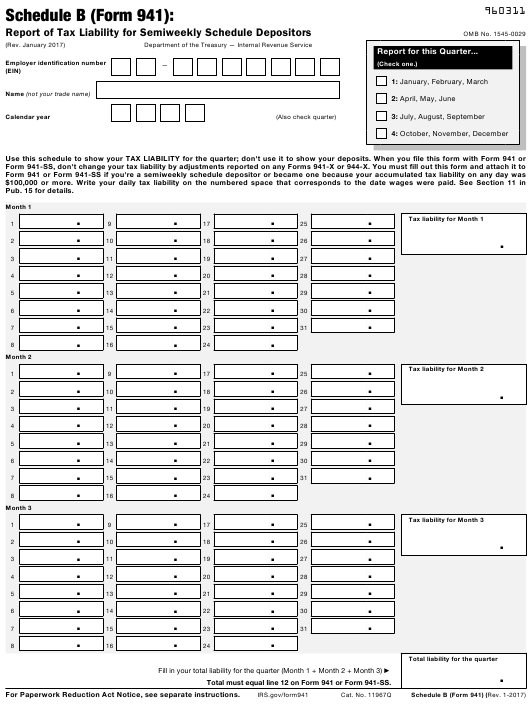

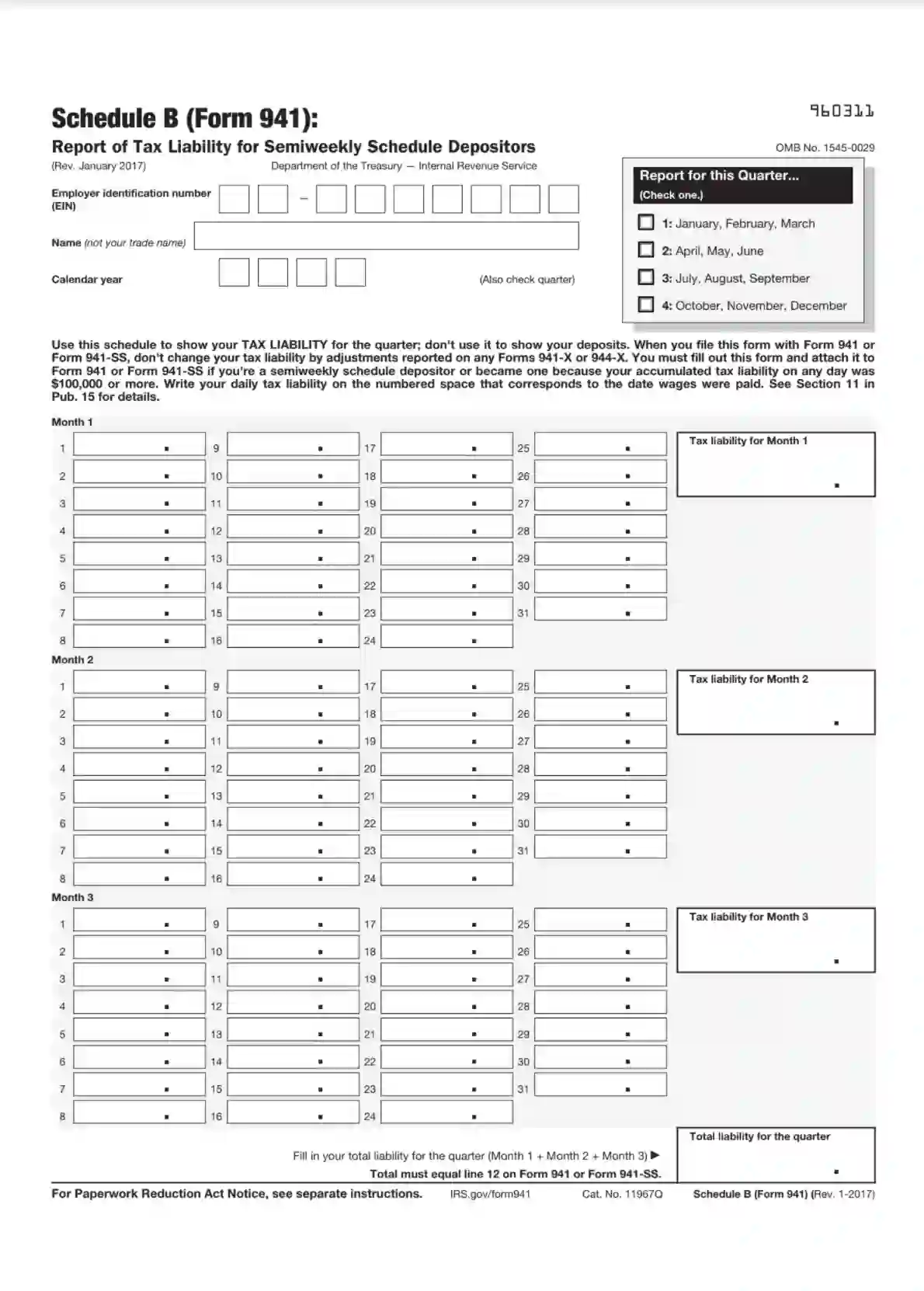

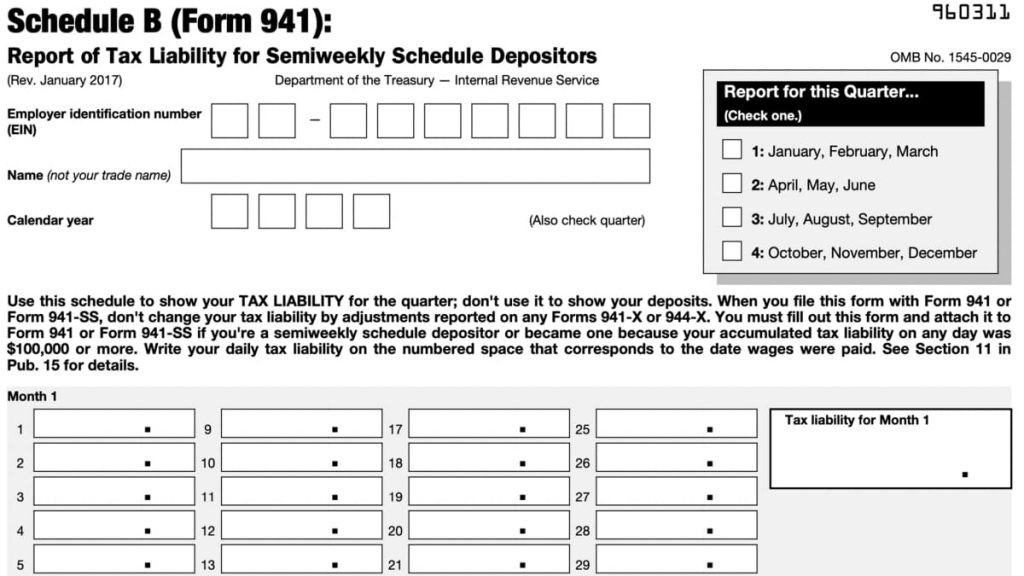

941 Schedule B 2023 Form - On schedule b, list your tax liability for each day. Your tax liability is based on the dates wages were paid. Updated 3 months ago by greg hatfield. Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. The form 941 module contains. Irs form 941 schedule b is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. If you’re a semiweekly schedule depositor, attach. If you’re a monthly schedule depositor, complete the deposit schedule below;

Updated 3 months ago by greg hatfield. If you’re a semiweekly schedule depositor, attach. Your tax liability is based on the dates wages were paid. Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. On schedule b, list your tax liability for each day. Irs form 941 schedule b is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. The form 941 module contains. If you’re a monthly schedule depositor, complete the deposit schedule below;

The form 941 module contains. If you’re a semiweekly schedule depositor, attach. If you’re a monthly schedule depositor, complete the deposit schedule below; Your tax liability is based on the dates wages were paid. On schedule b, list your tax liability for each day. Updated 3 months ago by greg hatfield. Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Irs form 941 schedule b is used by semiweekly schedule depositors that report more than $50,000 in employment taxes.

Printable Schedule B Form 941 Fillable Form 2024

If you’re a semiweekly schedule depositor, attach. If you’re a monthly schedule depositor, complete the deposit schedule below; Updated 3 months ago by greg hatfield. On schedule b, list your tax liability for each day. Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941.

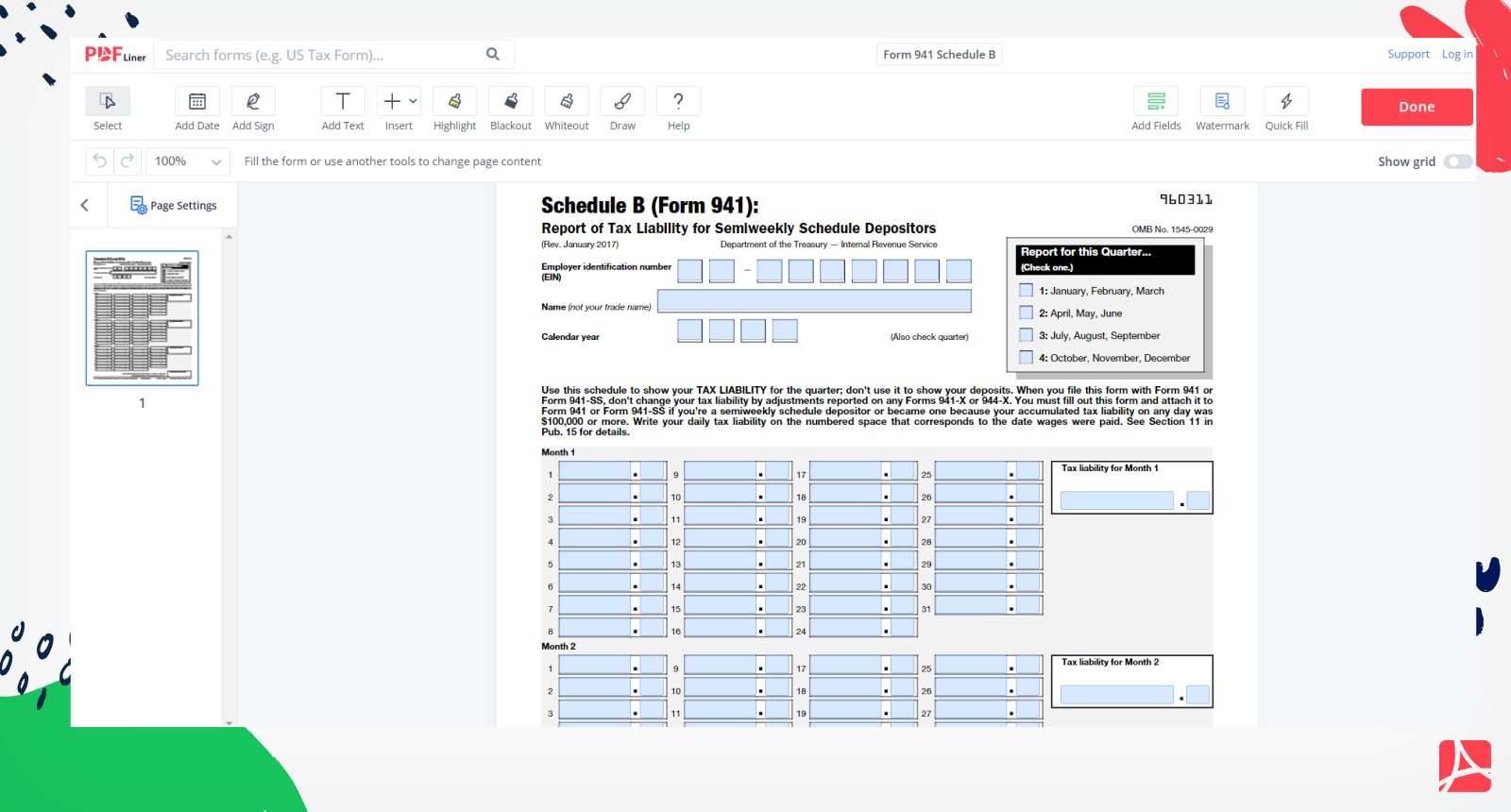

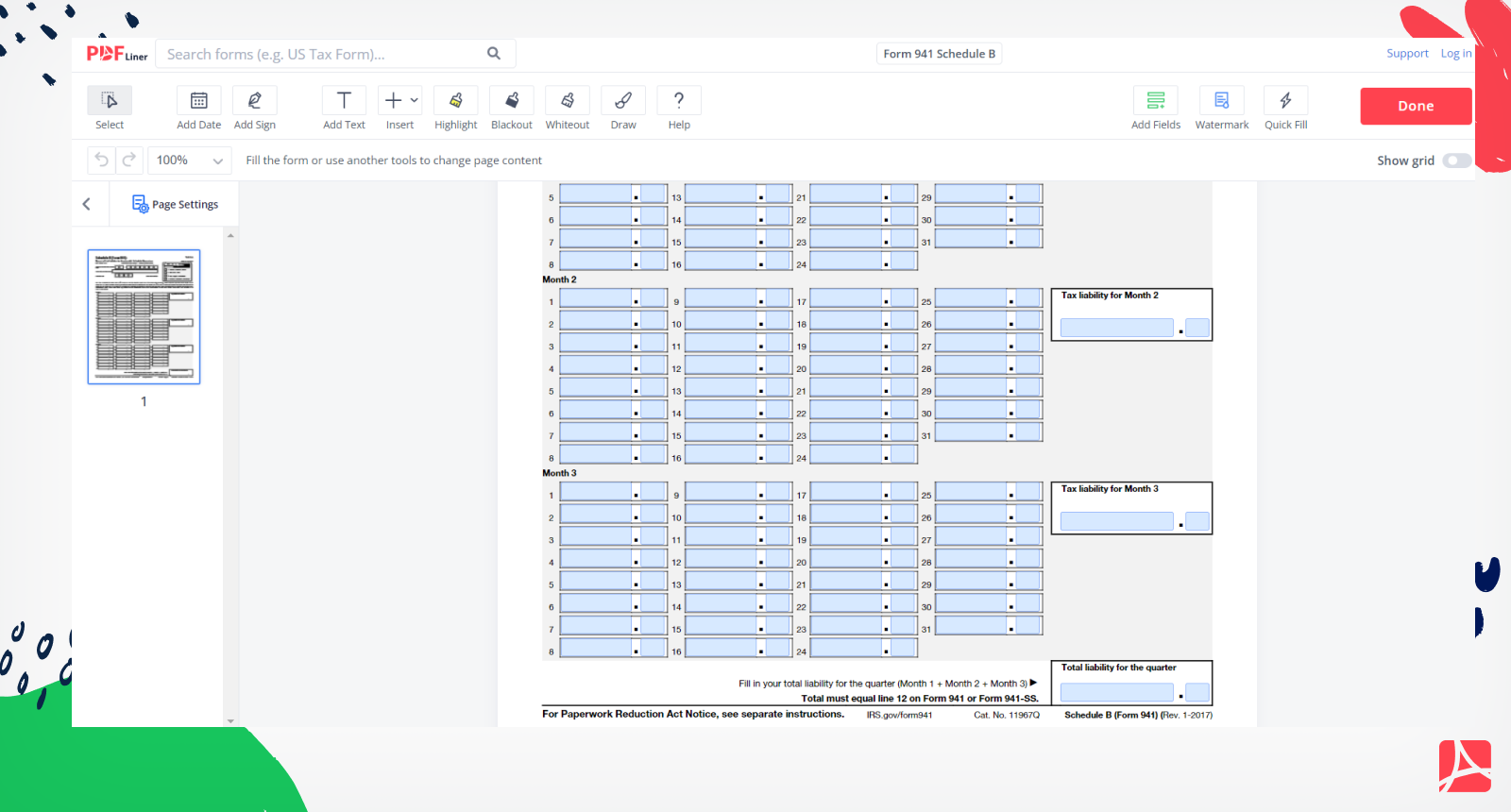

20172024 Form IRS 941 Schedule B Fill Online, Printable, Fillable

Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Irs form 941 schedule b is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Your tax liability is based on the dates wages were paid. If you’re a semiweekly schedule depositor, attach. On schedule b, list.

941 Form 2023 Schedule B Form Printable Forms Free Online

On schedule b, list your tax liability for each day. Irs form 941 schedule b is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Updated 3 months ago by greg hatfield. Your tax liability is based on the dates wages were paid. If you’re a monthly schedule depositor, complete the deposit schedule below;

IRS Form 941 Schedule B Instructions For 2023, 41 OFF

On schedule b, list your tax liability for each day. Irs form 941 schedule b is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. If you’re a monthly schedule depositor, complete the deposit schedule below; If you’re a semiweekly schedule depositor, attach. The form 941 module contains.

2023 Schedule B Form 941 Printable Forms Free Online

If you’re a semiweekly schedule depositor, attach. The form 941 module contains. Your tax liability is based on the dates wages were paid. Updated 3 months ago by greg hatfield. Irs form 941 schedule b is used by semiweekly schedule depositors that report more than $50,000 in employment taxes.

Irs Form 941 Schedule B 2023 Printable Forms Free Online

Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. If you’re a semiweekly schedule depositor, attach. The form 941 module contains. Your tax liability is based on the dates wages were paid. If you’re a monthly schedule depositor, complete the deposit schedule below;

2023 Schedule B Form 941 Printable Forms Free Online

Irs form 941 schedule b is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. On schedule b, list your tax liability for each day. If you’re a semiweekly schedule depositor, attach. Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Updated 3 months ago by.

IRS Form 941 Schedule B Instructions For 2023, 41 OFF

If you’re a monthly schedule depositor, complete the deposit schedule below; On schedule b, list your tax liability for each day. Irs form 941 schedule b is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. If you’re a semiweekly schedule depositor, attach. Updated 3 months ago by greg hatfield.

941 Form 2023

Updated 3 months ago by greg hatfield. The form 941 module contains. On schedule b, list your tax liability for each day. If you’re a semiweekly schedule depositor, attach. If you’re a monthly schedule depositor, complete the deposit schedule below;

2023 Schedule B Form 941 Printable Forms Free Online

Updated 3 months ago by greg hatfield. On schedule b, list your tax liability for each day. If you’re a monthly schedule depositor, complete the deposit schedule below; Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Irs form 941 schedule b is used by semiweekly schedule depositors that report.

Your Tax Liability Is Based On The Dates Wages Were Paid.

The form 941 module contains. On schedule b, list your tax liability for each day. Updated 3 months ago by greg hatfield. Irs form 941 schedule b is used by semiweekly schedule depositors that report more than $50,000 in employment taxes.

If You’re A Monthly Schedule Depositor, Complete The Deposit Schedule Below;

Complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. If you’re a semiweekly schedule depositor, attach.