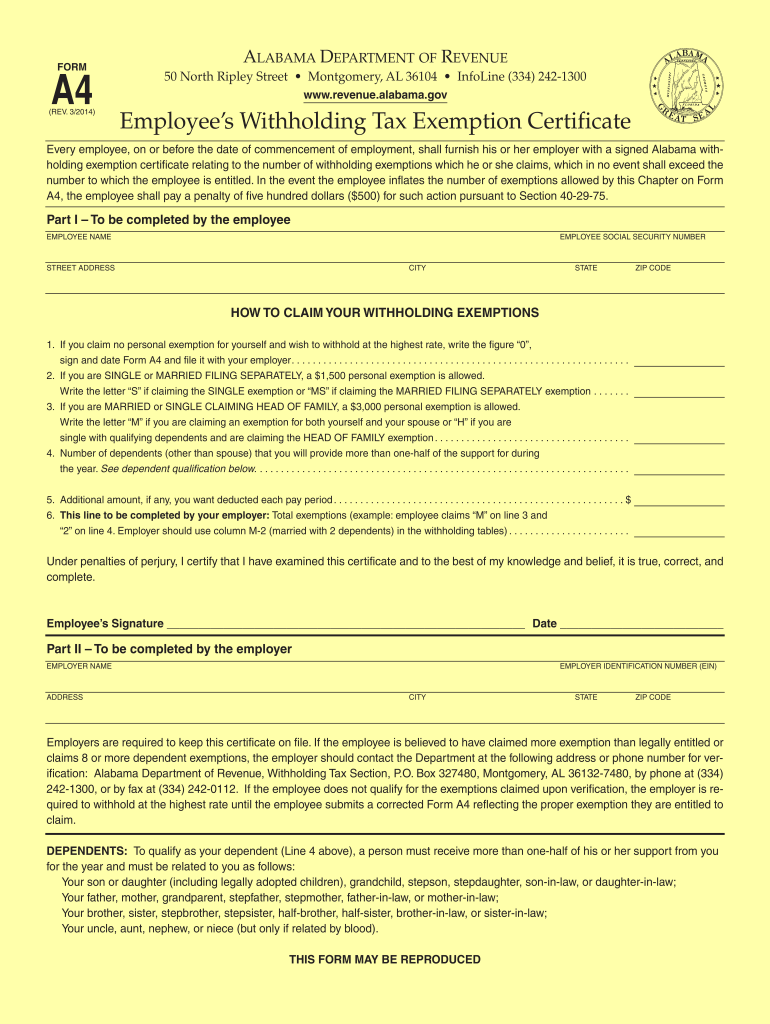

A 4 Form Alabama - Please see mailing link below. This is what tells your payroll provider how much money to withhold. Complete form a 4 and file it with your employer.otherwise, tax will be with held without exemption. Keep this certificate on file. In the event the employee inflates the number of exemptions allowed by this chapter on form a4, the employee shall pay a penalty of five hundred dollars ($500) for such action pursuant to. In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099. Before sharing sensitive information, make sure you’re on an official government site. If an employee is believed to have claimed. The.gov means it's official government websites often end in.gov or.mil.

In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099. Please see mailing link below. Before sharing sensitive information, make sure you’re on an official government site. Keep this certificate on file. The.gov means it's official government websites often end in.gov or.mil. This is what tells your payroll provider how much money to withhold. In the event the employee inflates the number of exemptions allowed by this chapter on form a4, the employee shall pay a penalty of five hundred dollars ($500) for such action pursuant to. Complete form a 4 and file it with your employer.otherwise, tax will be with held without exemption. If an employee is believed to have claimed.

In the event the employee inflates the number of exemptions allowed by this chapter on form a4, the employee shall pay a penalty of five hundred dollars ($500) for such action pursuant to. Please see mailing link below. This is what tells your payroll provider how much money to withhold. In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099. Before sharing sensitive information, make sure you’re on an official government site. Complete form a 4 and file it with your employer.otherwise, tax will be with held without exemption. Keep this certificate on file. If an employee is believed to have claimed. The.gov means it's official government websites often end in.gov or.mil.

Printable A 4 Form For Alabama Printable Forms Free Online

If an employee is believed to have claimed. In the event the employee inflates the number of exemptions allowed by this chapter on form a4, the employee shall pay a penalty of five hundred dollars ($500) for such action pursuant to. In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099. Keep.

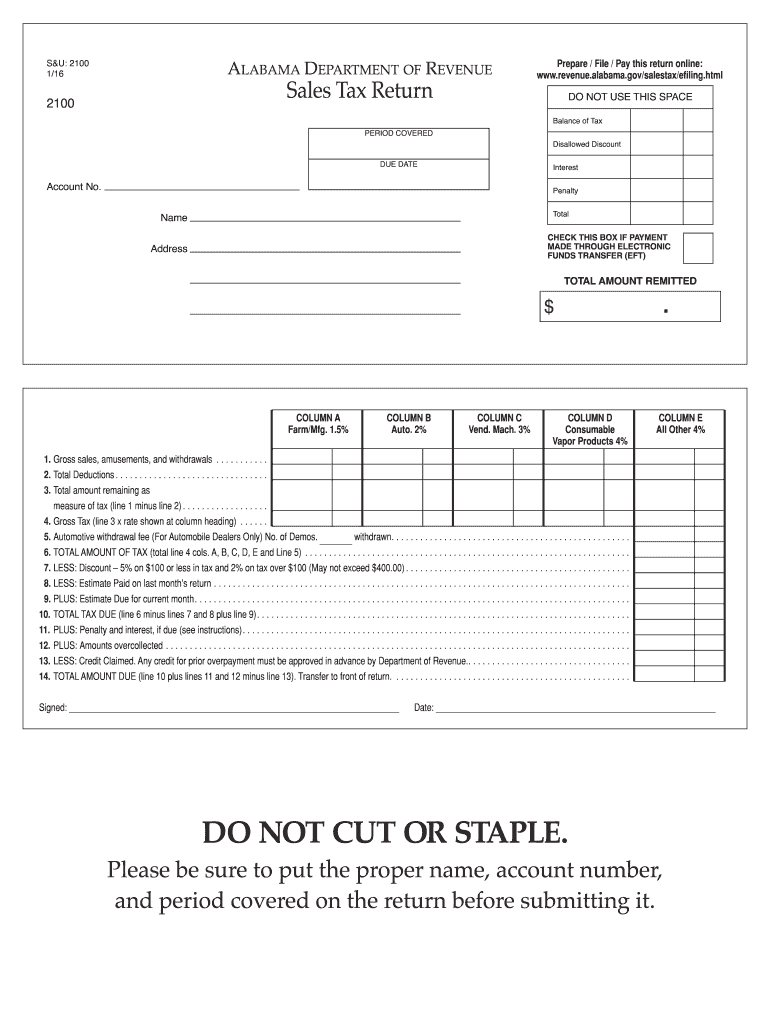

20162024 Form AL ADoR 2100 Fill Online, Printable, Fillable, Blank

In the event the employee inflates the number of exemptions allowed by this chapter on form a4, the employee shall pay a penalty of five hundred dollars ($500) for such action pursuant to. This is what tells your payroll provider how much money to withhold. Please see mailing link below. Complete form a 4 and file it with your employer.otherwise,.

20142024 Form AL DoR A4 Fill Online, Printable, Fillable, Blank

Complete form a 4 and file it with your employer.otherwise, tax will be with held without exemption. The.gov means it's official government websites often end in.gov or.mil. Before sharing sensitive information, make sure you’re on an official government site. Please see mailing link below. If an employee is believed to have claimed.

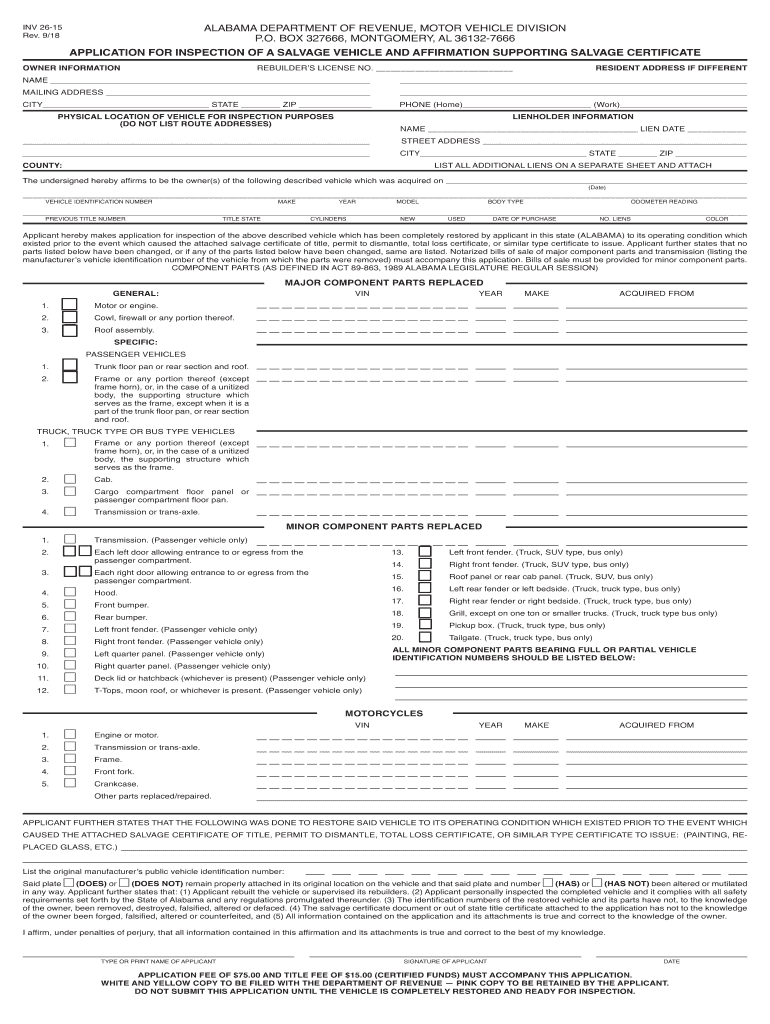

Alabama Power of Attorney Form Free Templates in PDF, Word, Excel to

Keep this certificate on file. If an employee is believed to have claimed. In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099. This is what tells your payroll provider how much money to withhold. Before sharing sensitive information, make sure you’re on an official government site.

change of address form alabama Fill Online, Printable, Fillable, Blank

Complete form a 4 and file it with your employer.otherwise, tax will be with held without exemption. In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099. Please see mailing link below. If an employee is believed to have claimed. In the event the employee inflates the number of exemptions allowed by.

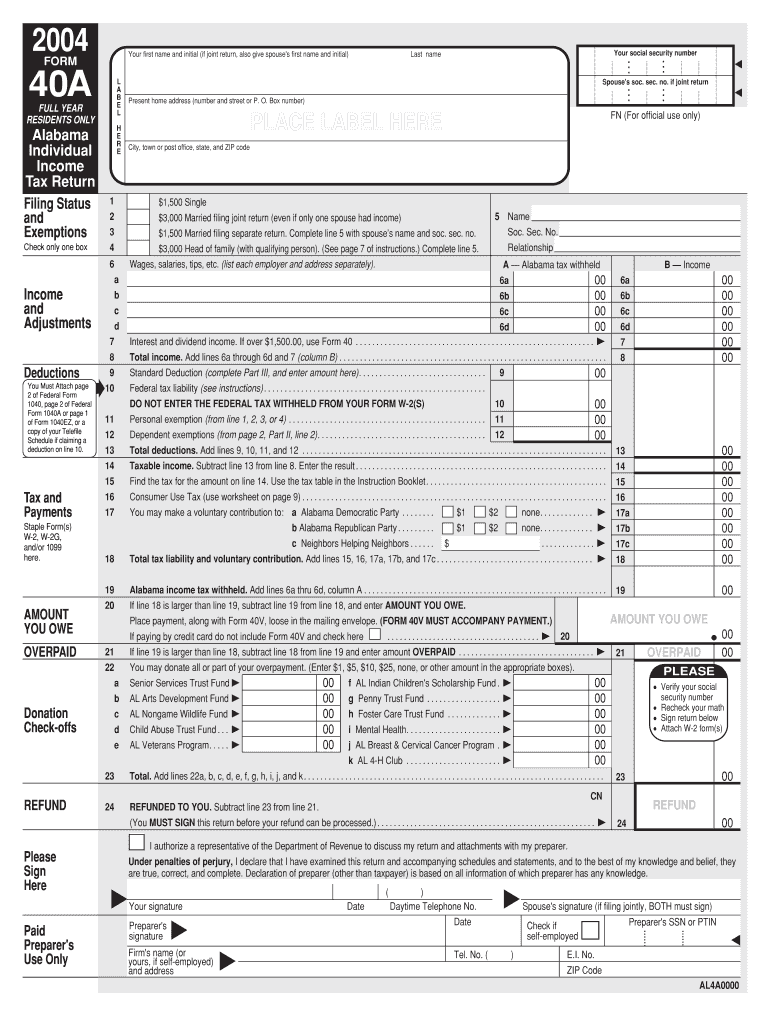

2004 Form AL 40A Fill Online, Printable, Fillable, Blank pdfFiller

Please see mailing link below. If an employee is believed to have claimed. In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099. Before sharing sensitive information, make sure you’re on an official government site. Complete form a 4 and file it with your employer.otherwise, tax will be with held without exemption.

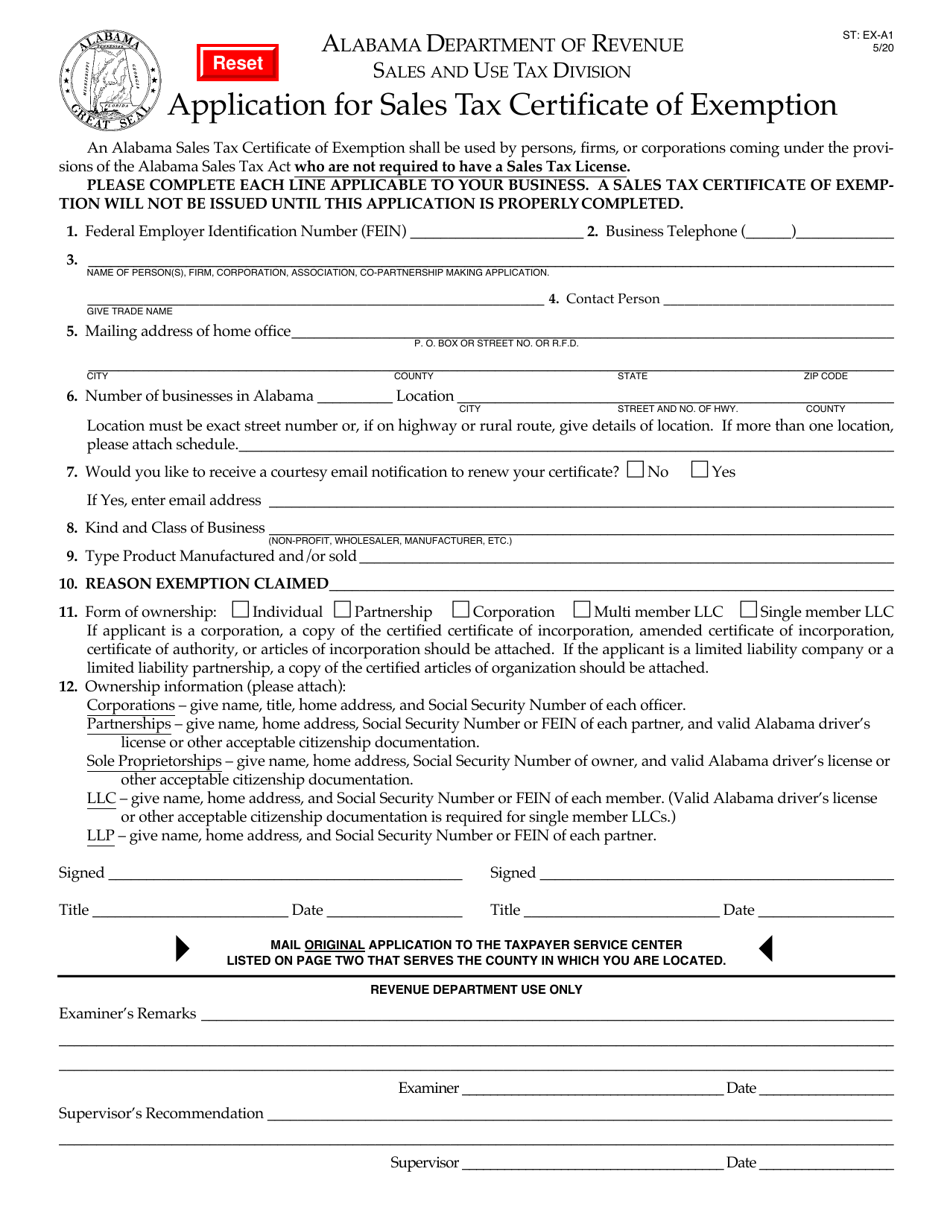

Form ST EXA1 Fill Out, Sign Online and Download Fillable PDF

Keep this certificate on file. This is what tells your payroll provider how much money to withhold. Before sharing sensitive information, make sure you’re on an official government site. Please see mailing link below. In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099.

Alabama State Tax Form 2024 Jody Rosina

In the event the employee inflates the number of exemptions allowed by this chapter on form a4, the employee shall pay a penalty of five hundred dollars ($500) for such action pursuant to. In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099. Please see mailing link below. If an employee is.

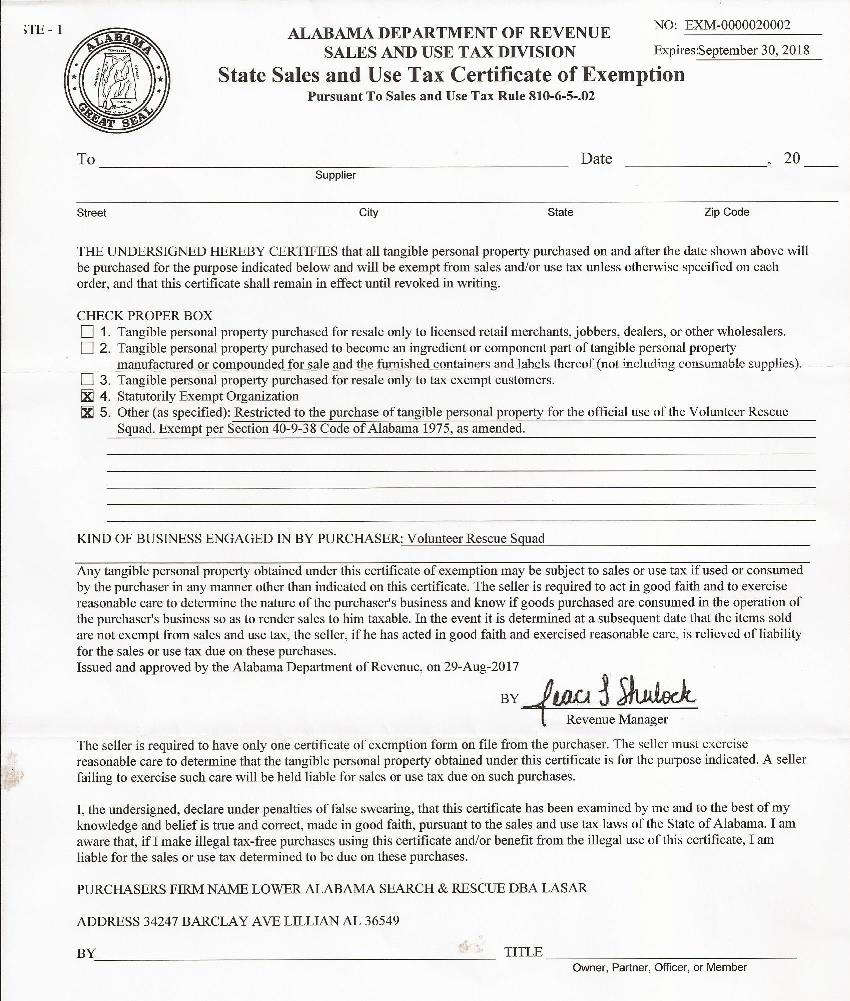

Alabama Sales Use Tax Exempt Form

Keep this certificate on file. Please see mailing link below. This is what tells your payroll provider how much money to withhold. Complete form a 4 and file it with your employer.otherwise, tax will be with held without exemption. In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099.

Printable A 4 Form For Alabama Printable Forms Free Online

Please see mailing link below. If an employee is believed to have claimed. Keep this certificate on file. In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099. This is what tells your payroll provider how much money to withhold.

Before Sharing Sensitive Information, Make Sure You’re On An Official Government Site.

Complete form a 4 and file it with your employer.otherwise, tax will be with held without exemption. If an employee is believed to have claimed. The.gov means it's official government websites often end in.gov or.mil. In the event the employee inflates the number of exemptions allowed by this chapter on form a4, the employee shall pay a penalty of five hundred dollars ($500) for such action pursuant to.

This Is What Tells Your Payroll Provider How Much Money To Withhold.

Keep this certificate on file. Please see mailing link below. In lieu of alabama form 99 and form 96, please submit a copy of the federal form 1096/1099.