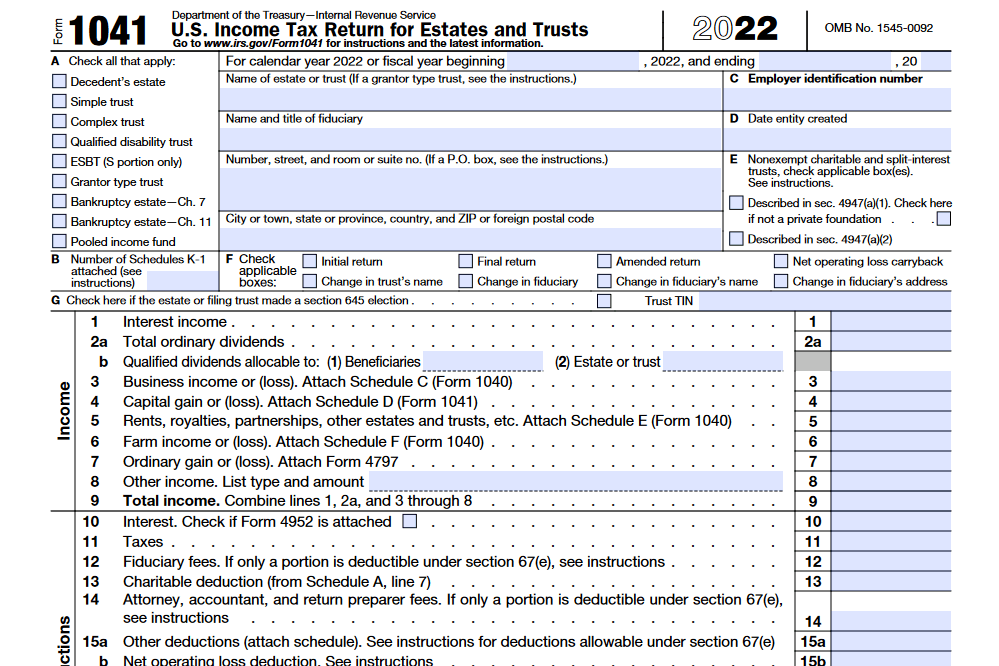

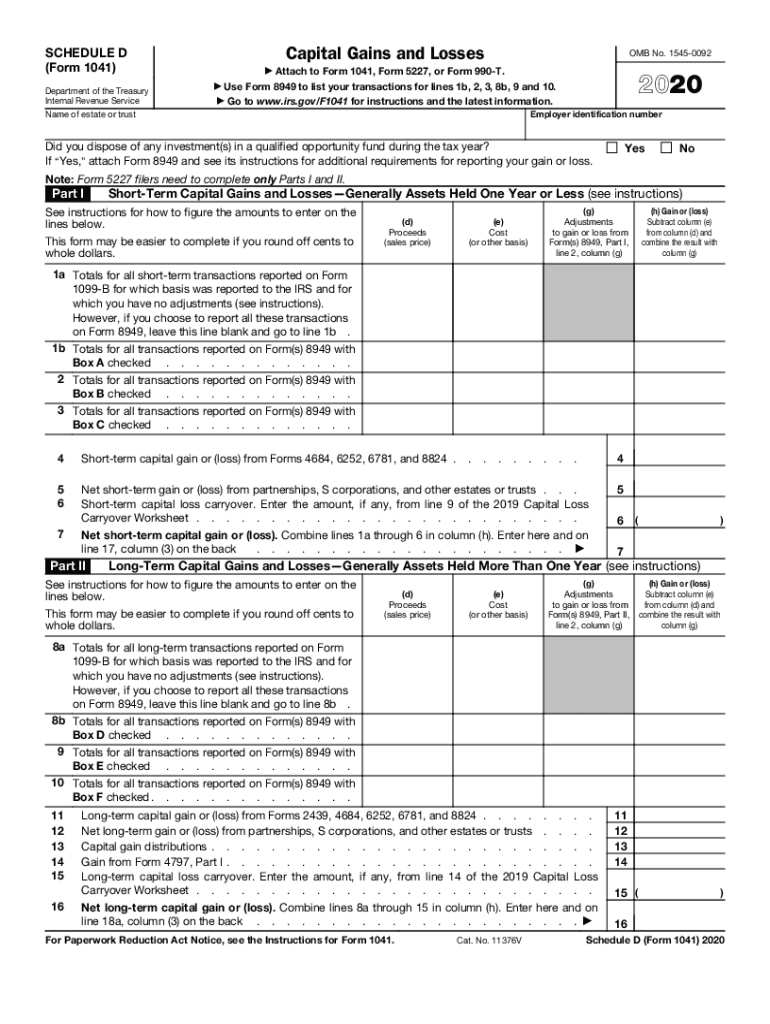

Are Probate Fees Deductible On Form 1041 - Legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form 1041) if. Reasonable legal fees incurred in the administration of a decedent's estate may be deducted from the decedent's gross estate as. You may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s.

You may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s. Legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form 1041) if. Reasonable legal fees incurred in the administration of a decedent's estate may be deducted from the decedent's gross estate as.

Legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form 1041) if. Reasonable legal fees incurred in the administration of a decedent's estate may be deducted from the decedent's gross estate as. You may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s.

What Expenses Are Deductible On Form 1041 Why Is

Reasonable legal fees incurred in the administration of a decedent's estate may be deducted from the decedent's gross estate as. Legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form 1041) if. You may deduct the expense from the estate's gross income in figuring the estate's income tax on form.

Form Instructions 1041 (Schedule K1) and Form 1041 Main Differences

Legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form 1041) if. You may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s. Reasonable legal fees incurred in the administration of a decedent's estate may be deducted from the decedent's gross.

Form 1041 U.S. Tax Return for Estates and Trusts

You may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s. Reasonable legal fees incurred in the administration of a decedent's estate may be deducted from the decedent's gross estate as. Legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form.

Are Probate Fees Tax Deductible? Inheritance Funding

You may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s. Reasonable legal fees incurred in the administration of a decedent's estate may be deducted from the decedent's gross estate as. Legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form.

What Expenses Are Deductible On Form 1041 Why Is

Legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form 1041) if. Reasonable legal fees incurred in the administration of a decedent's estate may be deducted from the decedent's gross estate as. You may deduct the expense from the estate's gross income in figuring the estate's income tax on form.

Fillable Online Probate Estate Tax Return (Form 1041) Fax Email

You may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s. Reasonable legal fees incurred in the administration of a decedent's estate may be deducted from the decedent's gross estate as. Legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form.

What Expenses Are Deductible On Form 1041 Why Is

Reasonable legal fees incurred in the administration of a decedent's estate may be deducted from the decedent's gross estate as. You may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s. Legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form.

Are Probate Fees Tax Deductible? Trust & Will

You may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s. Reasonable legal fees incurred in the administration of a decedent's estate may be deducted from the decedent's gross estate as. Legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form.

What Expenses Are Deductible On Form 1041 Why Is

You may deduct the expense from the estate's gross income in figuring the estate's income tax on form 1041, u.s. Reasonable legal fees incurred in the administration of a decedent's estate may be deducted from the decedent's gross estate as. Legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form.

Are Executor Fees Deductible on Form 1041?

Reasonable legal fees incurred in the administration of a decedent's estate may be deducted from the decedent's gross estate as. Legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form 1041) if. You may deduct the expense from the estate's gross income in figuring the estate's income tax on form.

You May Deduct The Expense From The Estate's Gross Income In Figuring The Estate's Income Tax On Form 1041, U.s.

Legal expenses for probate are deductible, but they are deductible to the estate on the estate's income tax return (form 1041) if. Reasonable legal fees incurred in the administration of a decedent's estate may be deducted from the decedent's gross estate as.