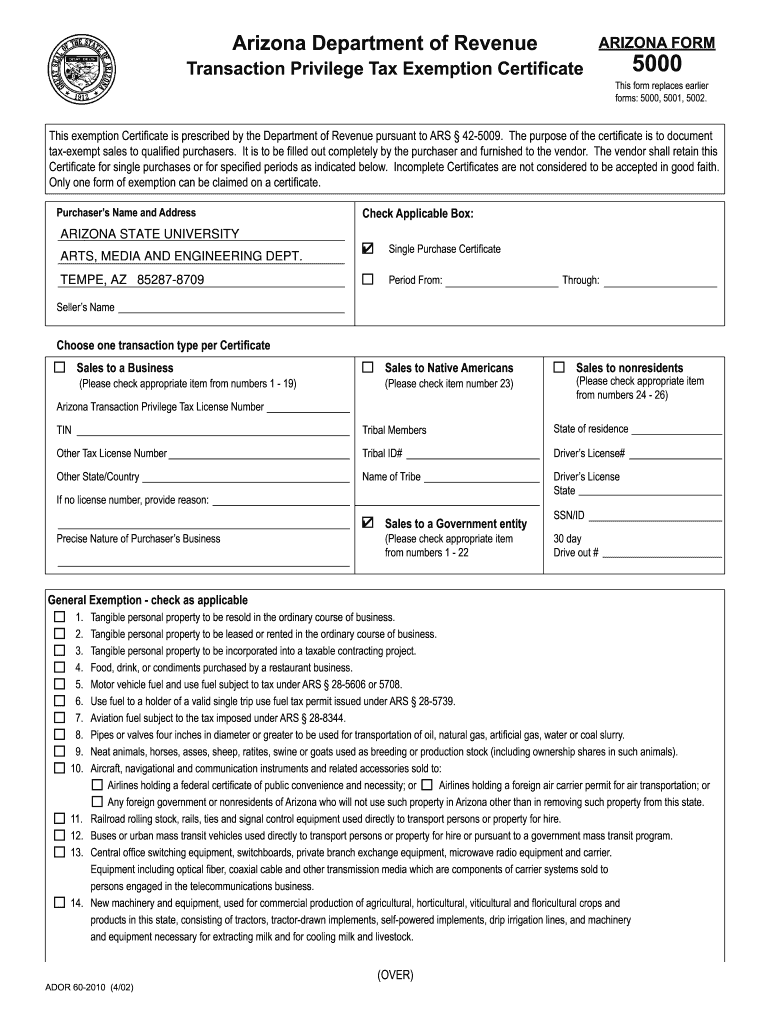

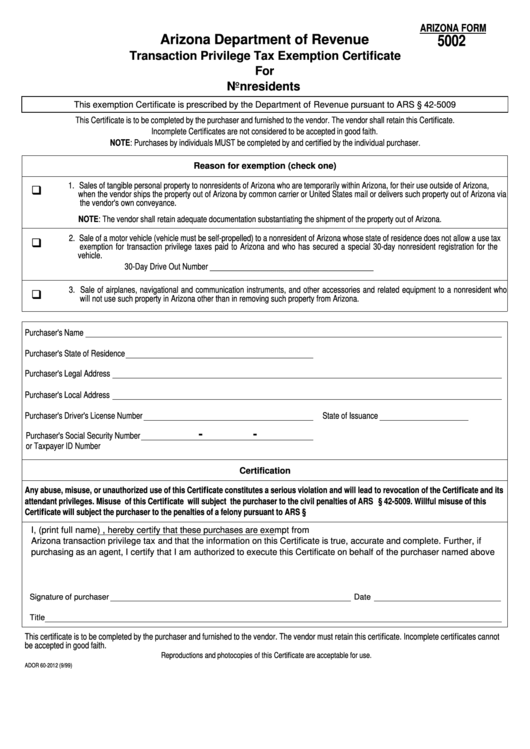

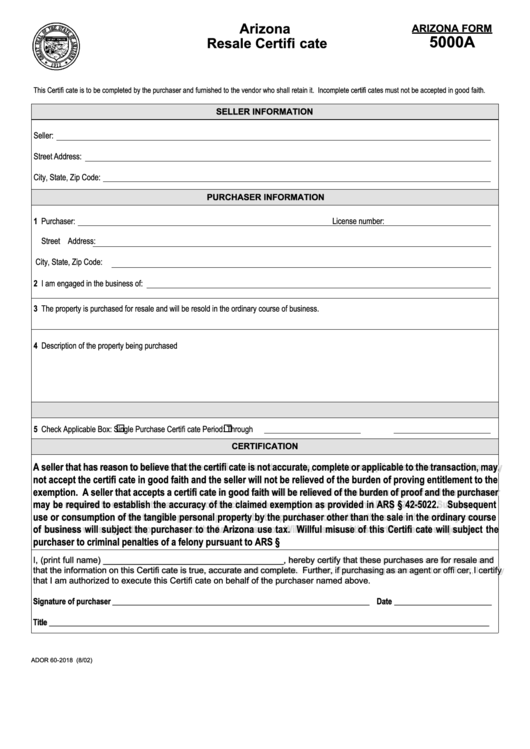

Arizona Form 5000 Instructions - This certificate is prescribed by the department of revenue pursuant to a.r.s. Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. The certificate is provided to vendors so they can document why sales tax was not charged to the. Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Do not use form 5000 to claim sale for resale. Arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state. This certificate is prescribed by the department of revenue pursuant to a.r.s. We strongly encourage taxpayers to file online via the aztaxes.gov website for faster. The certificate must be provided to the vendor in order for the vendor to document why sales tax is not.

Arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state. We strongly encourage taxpayers to file online via the aztaxes.gov website for faster. This certificate is prescribed by the department of revenue pursuant to a.r.s. The certificate must be provided to the vendor in order for the vendor to document why sales tax is not. Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Do not use form 5000 to claim sale for resale. This certificate is prescribed by the department of revenue pursuant to a.r.s. The certificate is provided to vendors so they can document why sales tax was not charged to the. Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor.

The certificate must be provided to the vendor in order for the vendor to document why sales tax is not. We strongly encourage taxpayers to file online via the aztaxes.gov website for faster. Do not use form 5000 to claim sale for resale. The certificate is provided to vendors so they can document why sales tax was not charged to the. Arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state. Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. This certificate is prescribed by the department of revenue pursuant to a.r.s. This certificate is prescribed by the department of revenue pursuant to a.r.s. Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor.

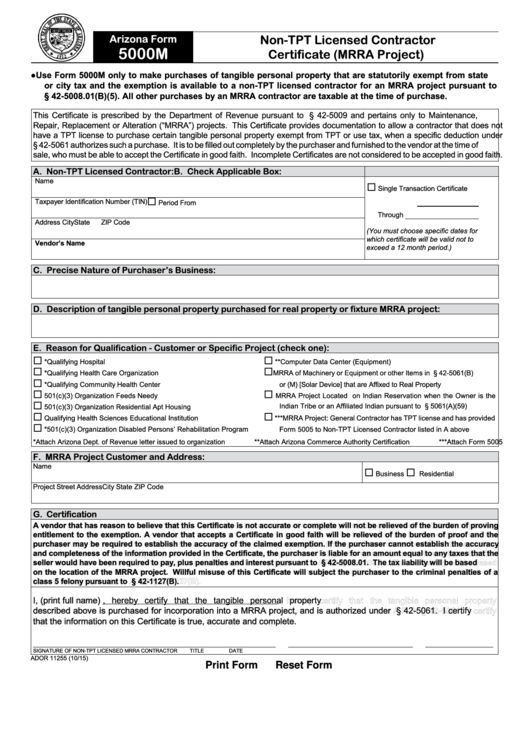

AZ TPT2 2016 Fill out Tax Template Online US Legal Forms

This certificate is prescribed by the department of revenue pursuant to a.r.s. Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. The certificate must be provided to the vendor in order for the vendor to document why sales tax is not. The certificate is provided to vendors so they can document why sales tax.

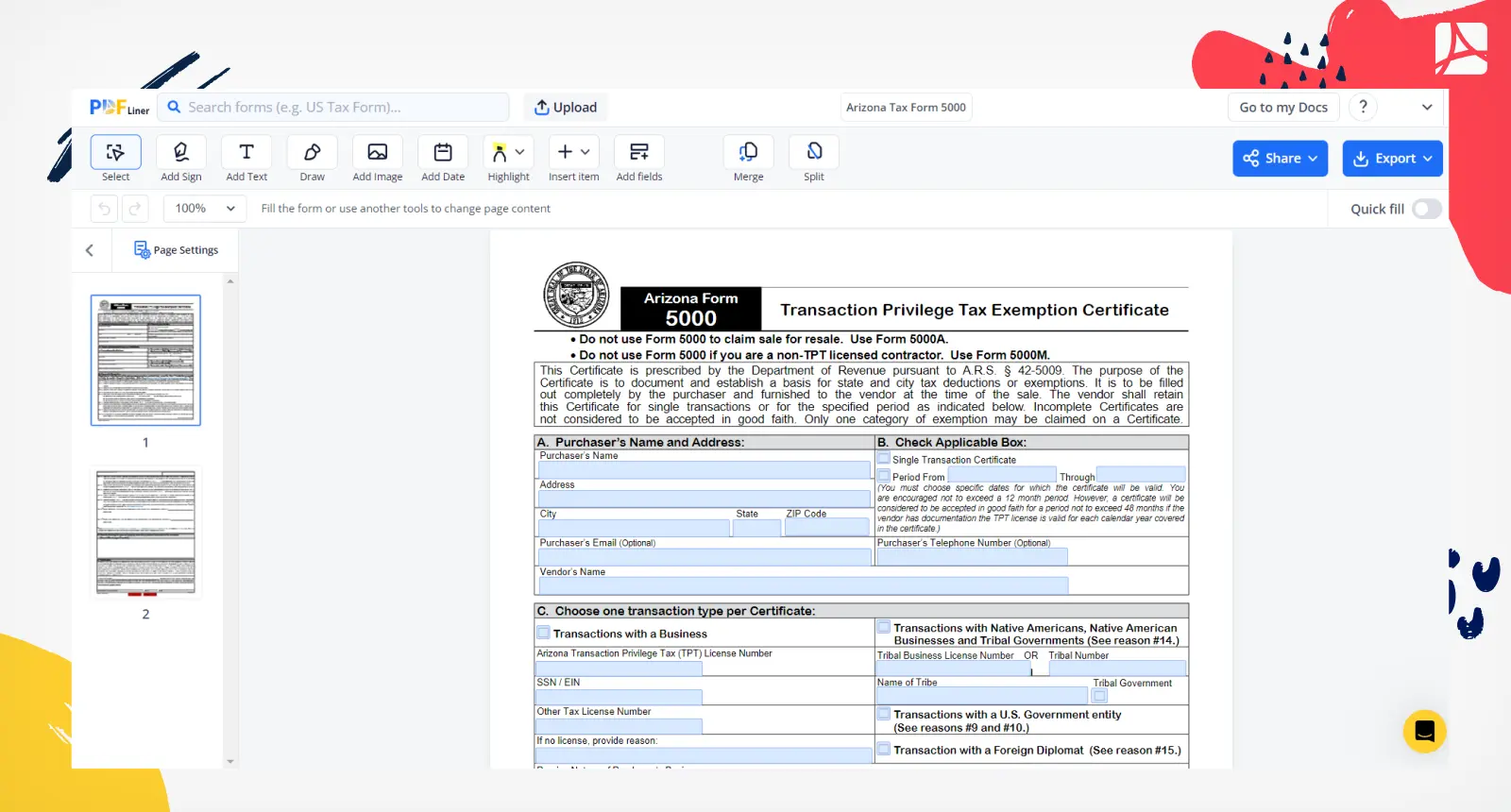

Arizona Tax Form 5000 blank, sign forms online — PDFliner

Arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state. This certificate is prescribed by the department of revenue pursuant to a.r.s. This certificate is prescribed by the department of revenue pursuant to a.r.s. Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Arizona.

Arizona Form 5000 Fillable Printable Forms Free Online

This certificate is prescribed by the department of revenue pursuant to a.r.s. Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. The certificate must be provided to the vendor in order for the vendor to document why sales tax.

Arizona Form 5000 Instructions

Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Do not use form 5000 to claim sale for resale. The certificate is provided to vendors so they can document why sales tax was not charged to the. This certificate is prescribed by the department of revenue pursuant to a.r.s. This certificate is prescribed by.

Az Form 5000a Fillable Printable Forms Free Online

We strongly encourage taxpayers to file online via the aztaxes.gov website for faster. Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business.

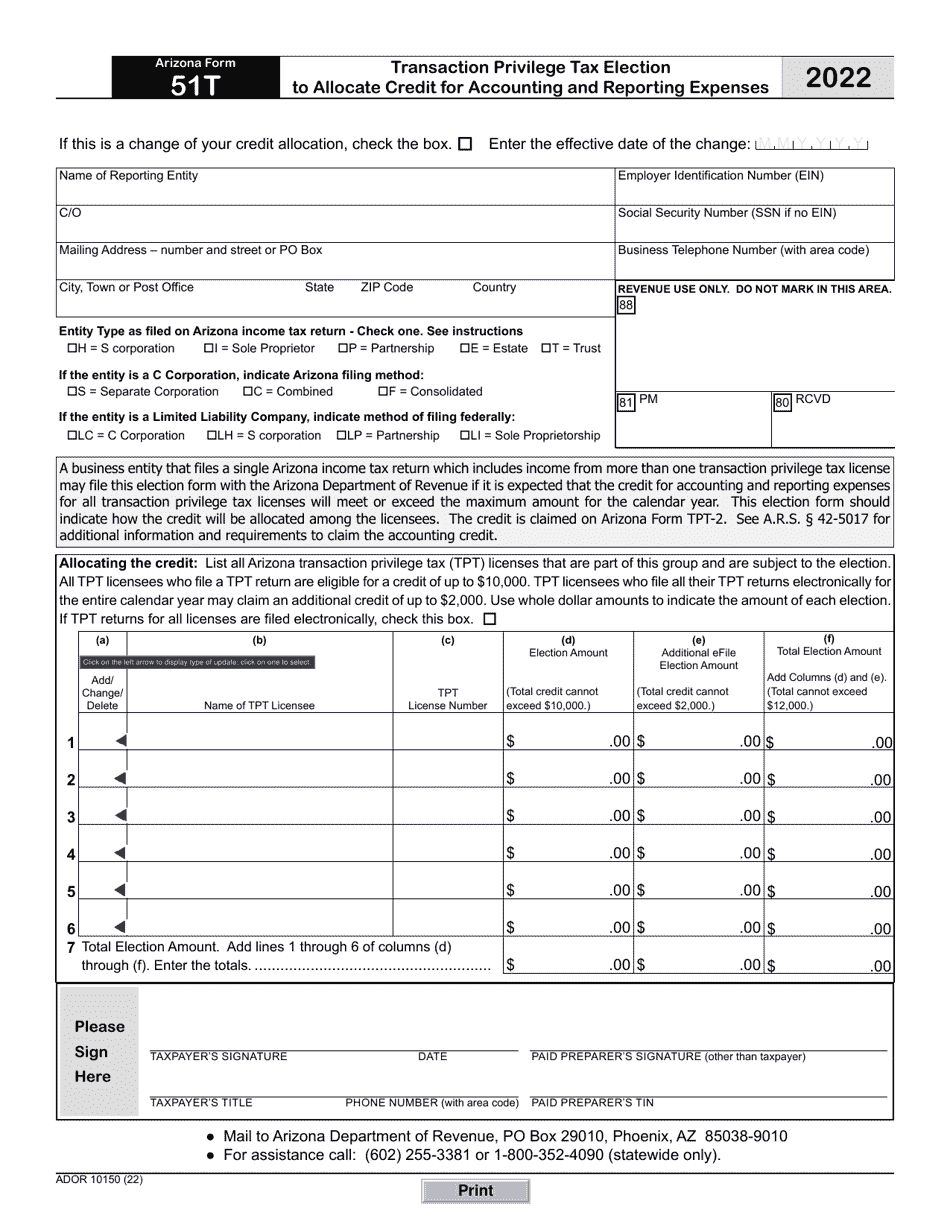

Arizona Form 51T (ADOR10150) Download Fillable PDF or Fill Online

The certificate must be provided to the vendor in order for the vendor to document why sales tax is not. This certificate is prescribed by the department of revenue pursuant to a.r.s. The certificate is provided to vendors so they can document why sales tax was not charged to the. Do not use form 5000 to claim sale for resale..

Arizona Form 5000 Fillable Printable Forms Free Online

Do not use form 5000 to claim sale for resale. Arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state. This certificate is prescribed by the department of revenue pursuant to a.r.s. We strongly encourage taxpayers to file online via the aztaxes.gov website for faster. The certificate must be provided.

Form 5000 Fillable Printable Forms Free Online

The certificate must be provided to the vendor in order for the vendor to document why sales tax is not. This certificate is prescribed by the department of revenue pursuant to a.r.s. We strongly encourage taxpayers to file online via the aztaxes.gov website for faster. Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor..

Arizona Form 5000a Fillable Printable Forms Free Online

We strongly encourage taxpayers to file online via the aztaxes.gov website for faster. The certificate is provided to vendors so they can document why sales tax was not charged to the. Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. This certificate is prescribed by the department of revenue pursuant to a.r.s. This certificate.

Instructions for Arizona Form 5000 TPT Exemption Certificate PDF

This certificate is prescribed by the department of revenue pursuant to a.r.s. Do not use form 5000 to claim sale for resale. Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. We strongly encourage taxpayers to file online via the aztaxes.gov website for faster. The certificate must be provided to the vendor in order.

This Certificate Is Prescribed By The Department Of Revenue Pursuant To A.r.s.

Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. The certificate is provided to vendors so they can document why sales tax was not charged to the. This certificate is prescribed by the department of revenue pursuant to a.r.s. Arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor.

We Strongly Encourage Taxpayers To File Online Via The Aztaxes.gov Website For Faster.

The certificate must be provided to the vendor in order for the vendor to document why sales tax is not. Arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state. Do not use form 5000 to claim sale for resale.