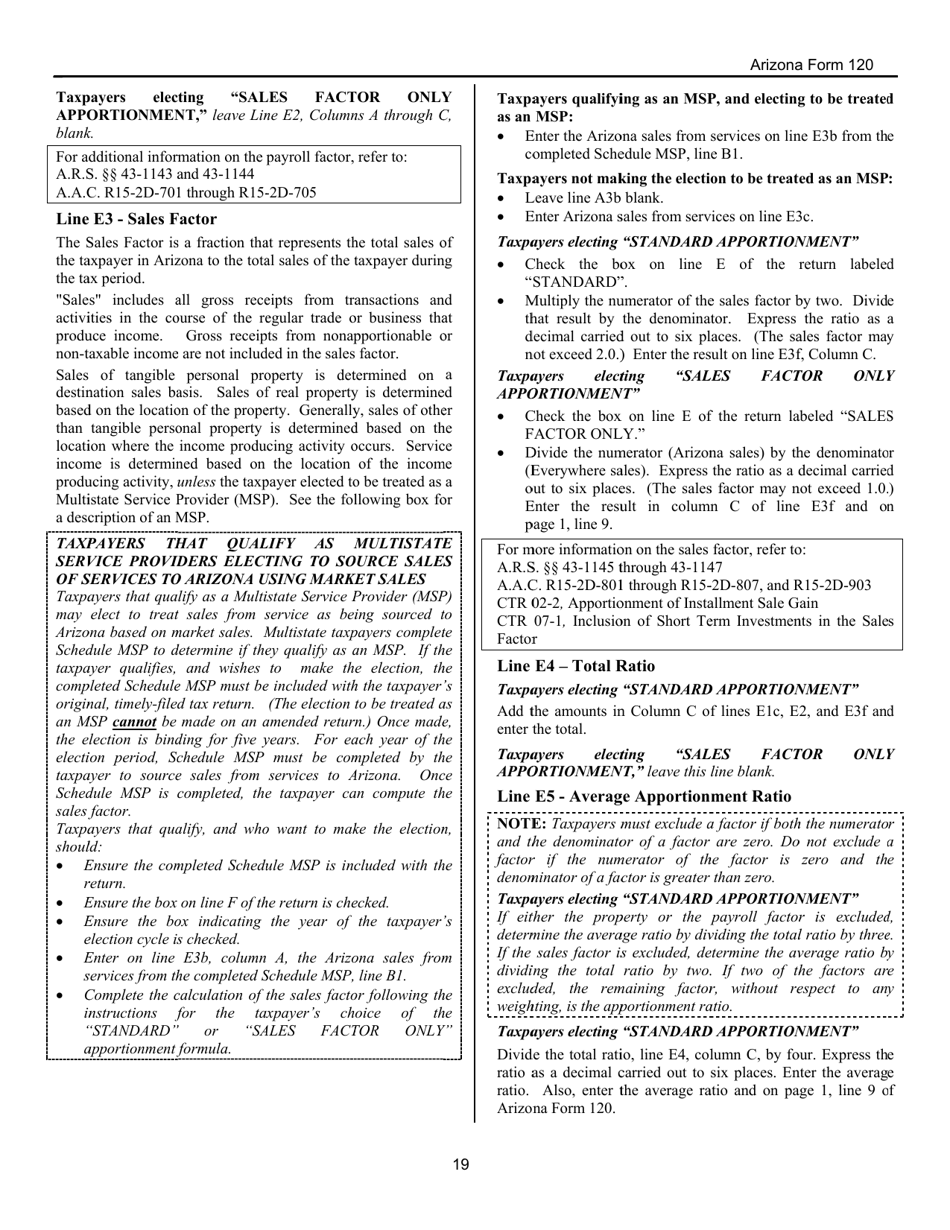

Az Form 120 Instructions - Therefore, a unitary group, as a single taxpayer, must make. Corporations taxed as s corporations under subchapter s of the internal revenue code. • has income from business activity that is taxable in more than one state (a “multistate. Az form 120 (2016) page 3 of 4 schedule e apportionment formula (multistate corporations only) important: Learn how to fill out arizona form 120, the corporation income tax return for 2020. Form 120 must make arizona estimated tax payments on a combined basis. Who must use arizona form 120s. Every corporation subject to the arizona income tax act of 1978 must file an arizona corporate income tax return. Find out the filing method, apportionment, taxable. Complete arizona form 120 if the corporation:

Complete arizona form 120 if the corporation: Find out the filing method, apportionment, taxable. Learn how to fill out arizona form 120, the corporation income tax return for 2020. Who must use arizona form 120s. • has income from business activity that is taxable in more than one state (a “multistate. Az form 120 (2016) page 3 of 4 schedule e apportionment formula (multistate corporations only) important: Corporations taxed as s corporations under subchapter s of the internal revenue code. Form 120 must make arizona estimated tax payments on a combined basis. Every corporation subject to the arizona income tax act of 1978 must file an arizona corporate income tax return. Therefore, a unitary group, as a single taxpayer, must make.

Complete arizona form 120 if the corporation: Find out the filing method, apportionment, taxable. • has income from business activity that is taxable in more than one state (a “multistate. Who must use arizona form 120s. Learn how to fill out arizona form 120, the corporation income tax return for 2020. Az form 120 (2016) page 3 of 4 schedule e apportionment formula (multistate corporations only) important: Corporations taxed as s corporations under subchapter s of the internal revenue code. Form 120 must make arizona estimated tax payments on a combined basis. Every corporation subject to the arizona income tax act of 1978 must file an arizona corporate income tax return. Therefore, a unitary group, as a single taxpayer, must make.

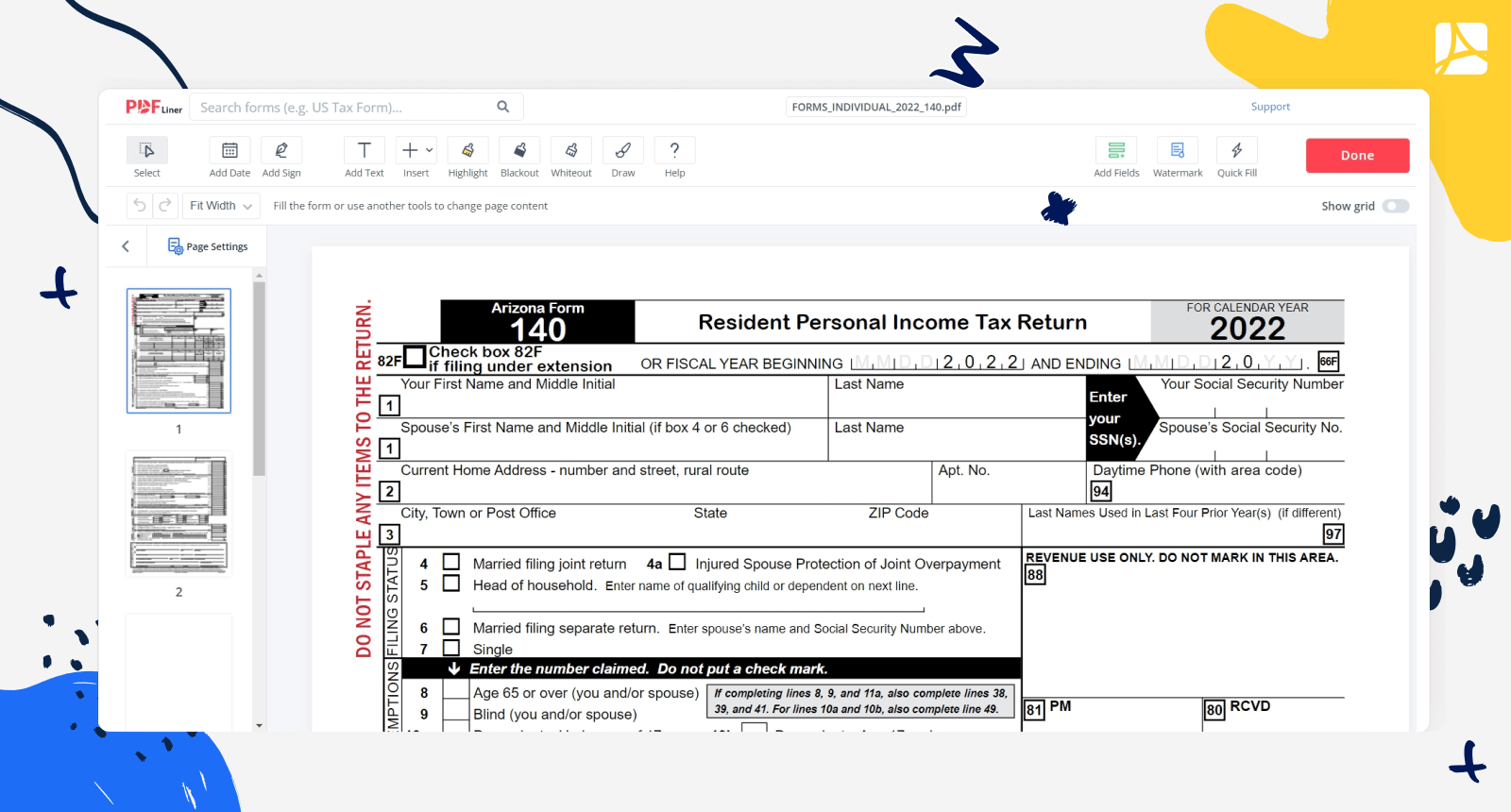

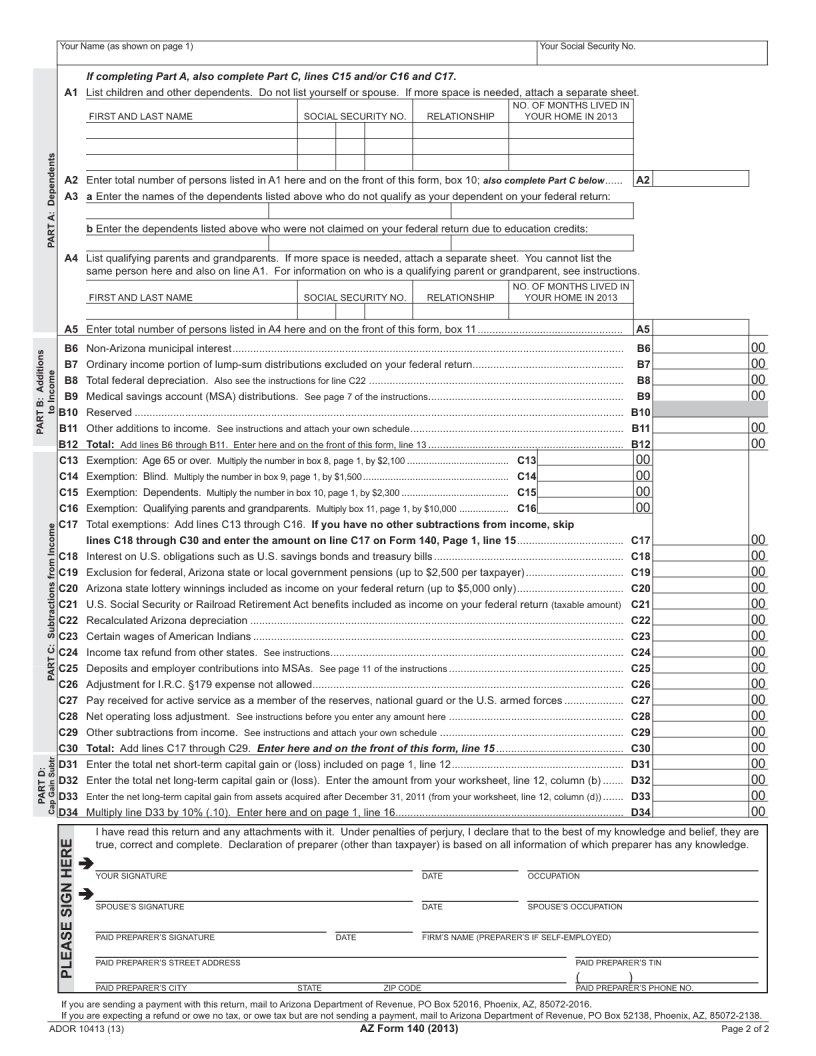

Az Form 140 ≡ Fill Out Printable PDF Forms Online

Form 120 must make arizona estimated tax payments on a combined basis. Find out the filing method, apportionment, taxable. Who must use arizona form 120s. Every corporation subject to the arizona income tax act of 1978 must file an arizona corporate income tax return. • has income from business activity that is taxable in more than one state (a “multistate.

Az Form 140 ≡ Fill Out Printable PDF Forms Online

• has income from business activity that is taxable in more than one state (a “multistate. Corporations taxed as s corporations under subchapter s of the internal revenue code. Learn how to fill out arizona form 120, the corporation income tax return for 2020. Complete arizona form 120 if the corporation: Form 120 must make arizona estimated tax payments on.

Fillable Online Standard Form 120 Instructions Fax Email Print pdfFiller

• has income from business activity that is taxable in more than one state (a “multistate. Find out the filing method, apportionment, taxable. Therefore, a unitary group, as a single taxpayer, must make. Corporations taxed as s corporations under subchapter s of the internal revenue code. Learn how to fill out arizona form 120, the corporation income tax return for.

Fillable Online Form K120 Instructions 2013 Fax Email Print pdfFiller

Every corporation subject to the arizona income tax act of 1978 must file an arizona corporate income tax return. Therefore, a unitary group, as a single taxpayer, must make. Learn how to fill out arizona form 120, the corporation income tax return for 2020. Find out the filing method, apportionment, taxable. Az form 120 (2016) page 3 of 4 schedule.

Arizona Form 140 (2023), edit and sign form PDFLiner

Az form 120 (2016) page 3 of 4 schedule e apportionment formula (multistate corporations only) important: • has income from business activity that is taxable in more than one state (a “multistate. Learn how to fill out arizona form 120, the corporation income tax return for 2020. Complete arizona form 120 if the corporation: Every corporation subject to the arizona.

Az Form 140 ≡ Fill Out Printable PDF Forms Online

Who must use arizona form 120s. Corporations taxed as s corporations under subchapter s of the internal revenue code. Find out the filing method, apportionment, taxable. Az form 120 (2016) page 3 of 4 schedule e apportionment formula (multistate corporations only) important: Learn how to fill out arizona form 120, the corporation income tax return for 2020.

Az Form 140 ≡ Fill Out Printable PDF Forms Online

Learn how to fill out arizona form 120, the corporation income tax return for 2020. Form 120 must make arizona estimated tax payments on a combined basis. Every corporation subject to the arizona income tax act of 1978 must file an arizona corporate income tax return. • has income from business activity that is taxable in more than one state.

Az Form 140 ≡ Fill Out Printable PDF Forms Online

Az form 120 (2016) page 3 of 4 schedule e apportionment formula (multistate corporations only) important: Find out the filing method, apportionment, taxable. Every corporation subject to the arizona income tax act of 1978 must file an arizona corporate income tax return. Therefore, a unitary group, as a single taxpayer, must make. Form 120 must make arizona estimated tax payments.

Az Form 140 ≡ Fill Out Printable PDF Forms Online

Therefore, a unitary group, as a single taxpayer, must make. Form 120 must make arizona estimated tax payments on a combined basis. Learn how to fill out arizona form 120, the corporation income tax return for 2020. Every corporation subject to the arizona income tax act of 1978 must file an arizona corporate income tax return. Corporations taxed as s.

Download Instructions for Arizona Form 120 Arizona Corporation

Every corporation subject to the arizona income tax act of 1978 must file an arizona corporate income tax return. Therefore, a unitary group, as a single taxpayer, must make. Form 120 must make arizona estimated tax payments on a combined basis. • has income from business activity that is taxable in more than one state (a “multistate. Complete arizona form.

Form 120 Must Make Arizona Estimated Tax Payments On A Combined Basis.

Learn how to fill out arizona form 120, the corporation income tax return for 2020. Find out the filing method, apportionment, taxable. Az form 120 (2016) page 3 of 4 schedule e apportionment formula (multistate corporations only) important: Corporations taxed as s corporations under subchapter s of the internal revenue code.

Every Corporation Subject To The Arizona Income Tax Act Of 1978 Must File An Arizona Corporate Income Tax Return.

Who must use arizona form 120s. Therefore, a unitary group, as a single taxpayer, must make. Complete arizona form 120 if the corporation: • has income from business activity that is taxable in more than one state (a “multistate.