Balance Due Overpayment Using Computer Figures Meaning - The $1,200 difference is probably the recovery. Using computer figures $494.00 is what you're going to get when the refund is released. An overpayment is when you receive more money. So for example, if taxpayer figures show $1000 and irs computer. On the return transcript, the per computer numbers is the irs checking your math. The “per computer” figures correct mathematical errors on the federal income tax return. What's the difference between balance due using computer figures and balance due using tp fig per computer in my. Balance due/overpayment using tp fig per computer means the refund due based on taxpayer's (tp) filed return.

Using computer figures $494.00 is what you're going to get when the refund is released. On the return transcript, the per computer numbers is the irs checking your math. Balance due/overpayment using tp fig per computer means the refund due based on taxpayer's (tp) filed return. The “per computer” figures correct mathematical errors on the federal income tax return. What's the difference between balance due using computer figures and balance due using tp fig per computer in my. The $1,200 difference is probably the recovery. An overpayment is when you receive more money. So for example, if taxpayer figures show $1000 and irs computer.

On the return transcript, the per computer numbers is the irs checking your math. The “per computer” figures correct mathematical errors on the federal income tax return. So for example, if taxpayer figures show $1000 and irs computer. The $1,200 difference is probably the recovery. An overpayment is when you receive more money. Balance due/overpayment using tp fig per computer means the refund due based on taxpayer's (tp) filed return. What's the difference between balance due using computer figures and balance due using tp fig per computer in my. Using computer figures $494.00 is what you're going to get when the refund is released.

Anyone know what the meaning of overpayment cancelled from appeal to

An overpayment is when you receive more money. The “per computer” figures correct mathematical errors on the federal income tax return. On the return transcript, the per computer numbers is the irs checking your math. What's the difference between balance due using computer figures and balance due using tp fig per computer in my. Using computer figures $494.00 is what.

Remaining Balance Due Invoice Template Invoice Generator

Balance due/overpayment using tp fig per computer means the refund due based on taxpayer's (tp) filed return. The $1,200 difference is probably the recovery. What's the difference between balance due using computer figures and balance due using tp fig per computer in my. An overpayment is when you receive more money. Using computer figures $494.00 is what you're going to.

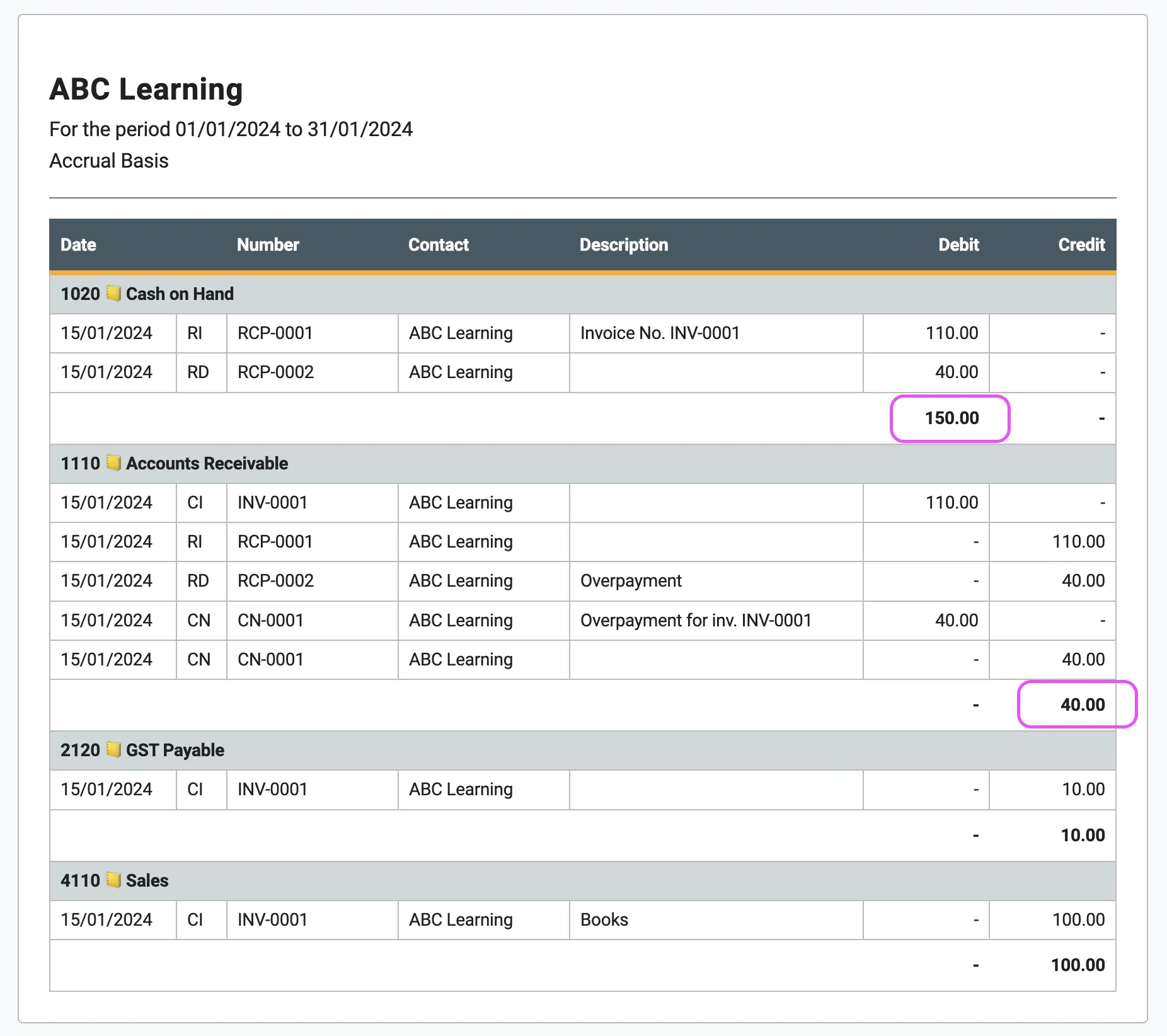

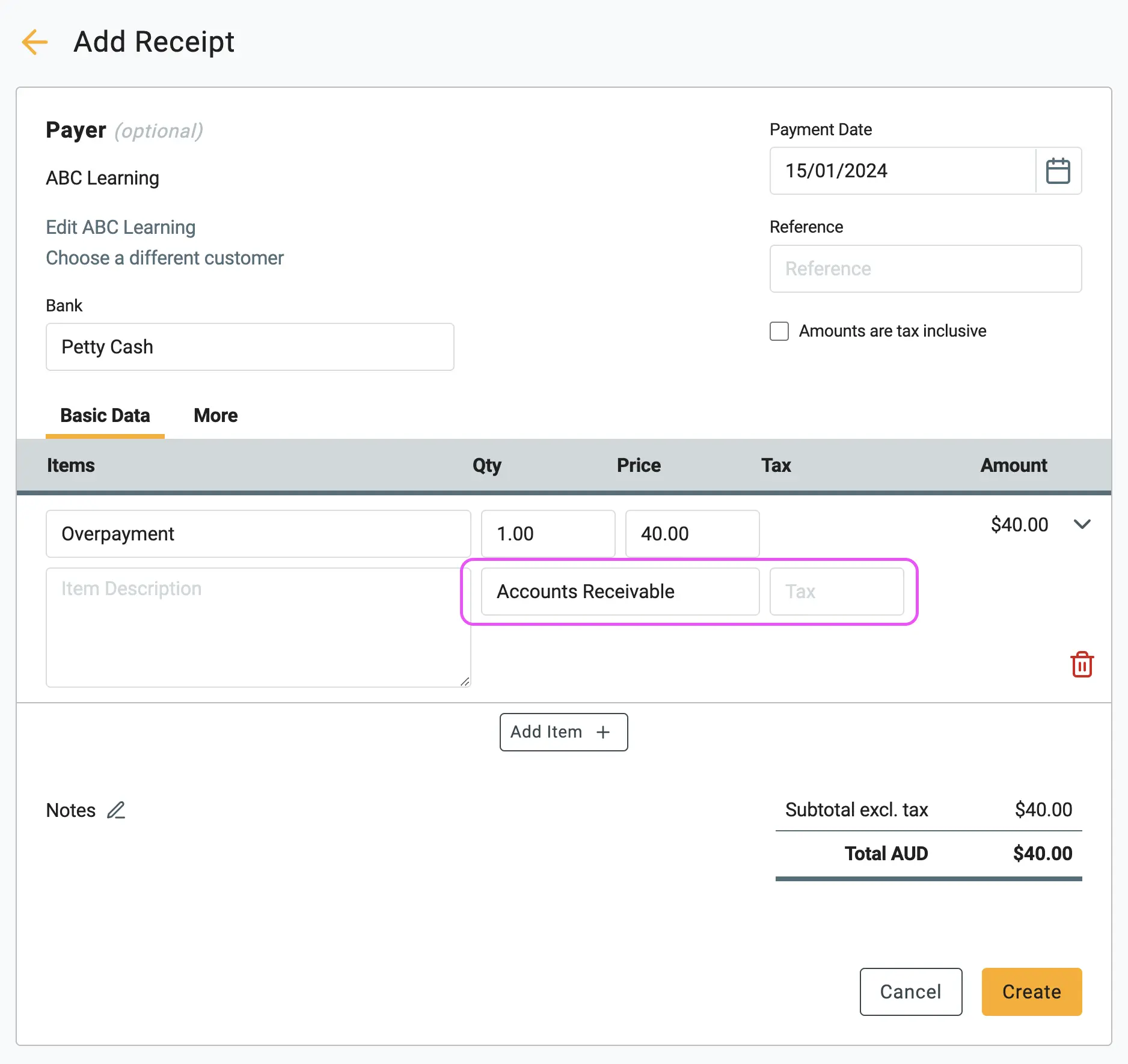

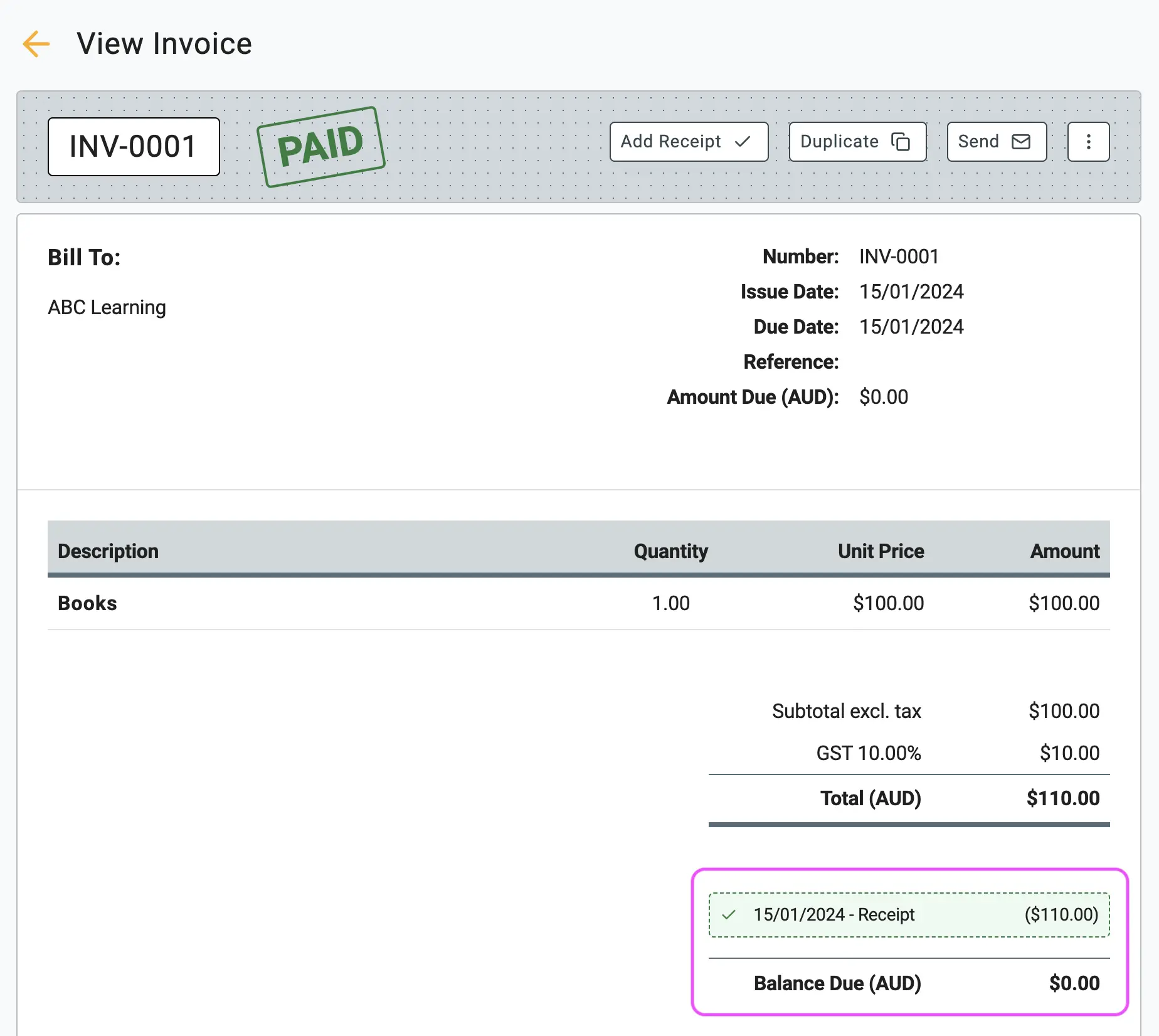

Record an overpayment

The $1,200 difference is probably the recovery. Using computer figures $494.00 is what you're going to get when the refund is released. What's the difference between balance due using computer figures and balance due using tp fig per computer in my. On the return transcript, the per computer numbers is the irs checking your math. Balance due/overpayment using tp fig.

Balance owing CRA Benefits overpayment BBTS Accountax Inc.

The “per computer” figures correct mathematical errors on the federal income tax return. What's the difference between balance due using computer figures and balance due using tp fig per computer in my. The $1,200 difference is probably the recovery. An overpayment is when you receive more money. On the return transcript, the per computer numbers is the irs checking your.

Negative balance on overpayment Support

Using computer figures $494.00 is what you're going to get when the refund is released. An overpayment is when you receive more money. On the return transcript, the per computer numbers is the irs checking your math. What's the difference between balance due using computer figures and balance due using tp fig per computer in my. So for example, if.

Final Overpayment Logo nina kagan

So for example, if taxpayer figures show $1000 and irs computer. The “per computer” figures correct mathematical errors on the federal income tax return. Using computer figures $494.00 is what you're going to get when the refund is released. The $1,200 difference is probably the recovery. On the return transcript, the per computer numbers is the irs checking your math.

Record an overpayment

Using computer figures $494.00 is what you're going to get when the refund is released. So for example, if taxpayer figures show $1000 and irs computer. On the return transcript, the per computer numbers is the irs checking your math. The “per computer” figures correct mathematical errors on the federal income tax return. The $1,200 difference is probably the recovery.

Record an overpayment

What's the difference between balance due using computer figures and balance due using tp fig per computer in my. On the return transcript, the per computer numbers is the irs checking your math. Using computer figures $494.00 is what you're going to get when the refund is released. An overpayment is when you receive more money. The $1,200 difference is.

Overpaid wages by accident? Here's how to correct it for tax purposes

So for example, if taxpayer figures show $1000 and irs computer. Using computer figures $494.00 is what you're going to get when the refund is released. The $1,200 difference is probably the recovery. Balance due/overpayment using tp fig per computer means the refund due based on taxpayer's (tp) filed return. The “per computer” figures correct mathematical errors on the federal.

Mortgage overpayment calculator MoneyWeek

So for example, if taxpayer figures show $1000 and irs computer. The “per computer” figures correct mathematical errors on the federal income tax return. What's the difference between balance due using computer figures and balance due using tp fig per computer in my. Using computer figures $494.00 is what you're going to get when the refund is released. Balance due/overpayment.

On The Return Transcript, The Per Computer Numbers Is The Irs Checking Your Math.

The “per computer” figures correct mathematical errors on the federal income tax return. Balance due/overpayment using tp fig per computer means the refund due based on taxpayer's (tp) filed return. So for example, if taxpayer figures show $1000 and irs computer. What's the difference between balance due using computer figures and balance due using tp fig per computer in my.

An Overpayment Is When You Receive More Money.

Using computer figures $494.00 is what you're going to get when the refund is released. The $1,200 difference is probably the recovery.