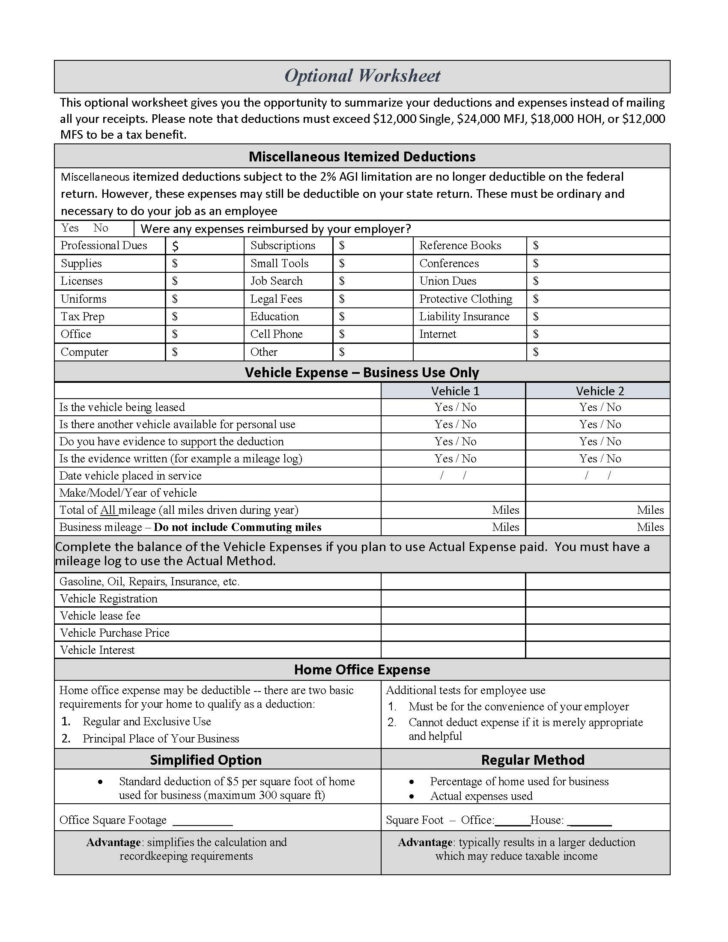

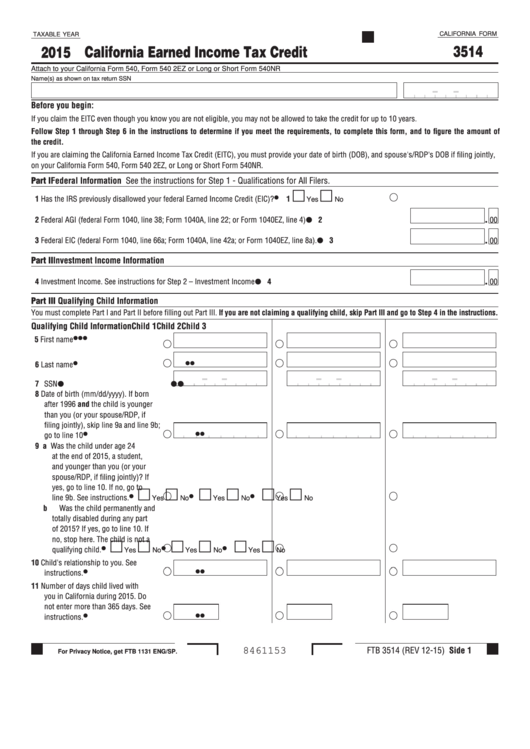

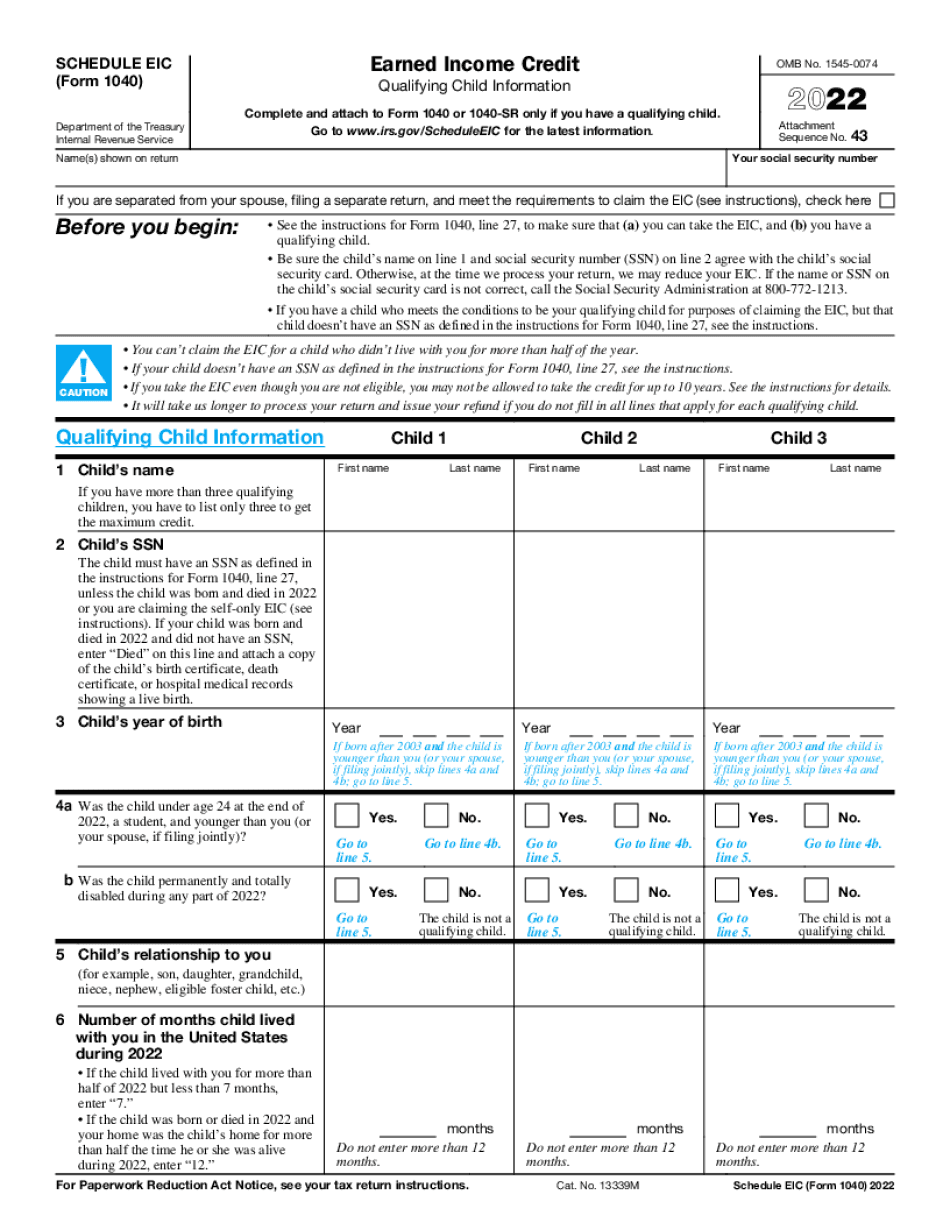

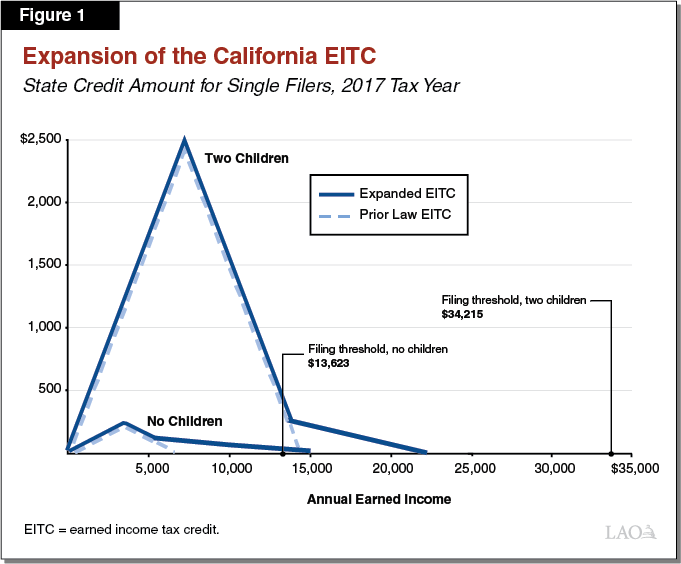

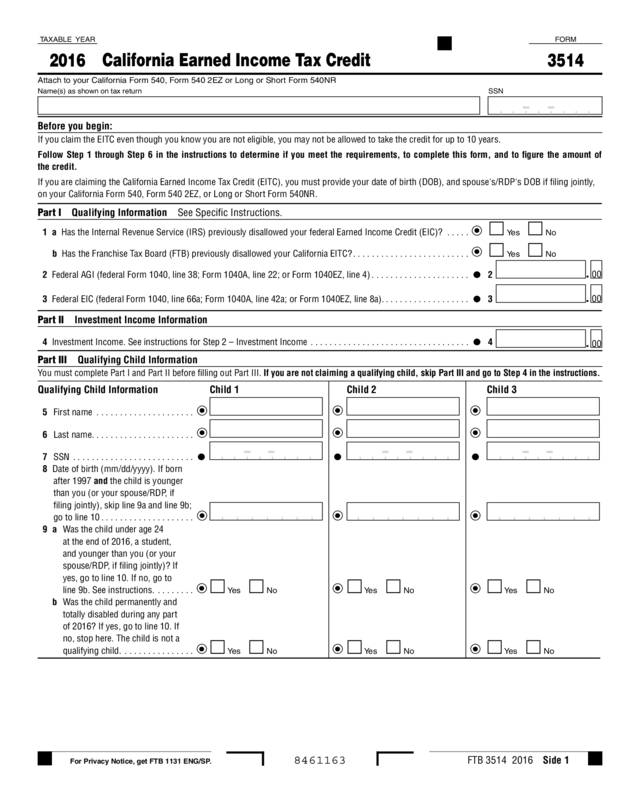

California Earned Income Tax Credit Worksheet Part Iii Line 6 - Use form ftb 3514 to. California earned income tax credit (eitc) the refundable california eitc is available to taxpayers who earned wage income subject. Download or print the 2024 california form 3514 (california earned income tax credit) for free from the california franchise tax board. This amount should also be entered on form 540, line 75; Look up the amount on line 3 in the eic table in the instructions to find the credit. Enter amount from california earned income tax credit worksheet, part iii, line 6. California tax return to claim the credit and attach a completed form ftb 3514, california earned income tax credit. If you qualify, you will claim your earned income tax credit when you file your federal tax return. To calculate the value of your eitc, you can use. Enter the amount from line 2 on line 6.

To calculate the value of your eitc, you can use. If you qualify, you will claim your earned income tax credit when you file your federal tax return. Use form ftb 3514 to. This amount should also be entered on form 540, line 75; California earned income tax credit (eitc) the refundable california eitc is available to taxpayers who earned wage income subject. Look up the amount on line 3 in the eic table in the instructions to find the credit. California tax return to claim the credit and attach a completed form ftb 3514, california earned income tax credit. Enter the amount from line 2 on line 6. Download or print the 2024 california form 3514 (california earned income tax credit) for free from the california franchise tax board. Enter amount from california earned income tax credit worksheet, part iii, line 6.

Enter amount from california earned income tax credit worksheet, part iii, line 6. Use form ftb 3514 to. To calculate the value of your eitc, you can use. If you qualify, you will claim your earned income tax credit when you file your federal tax return. California tax return to claim the credit and attach a completed form ftb 3514, california earned income tax credit. Look up the amount on line 3 in the eic table in the instructions to find the credit. Enter the amount from line 2 on line 6. California earned income tax credit (eitc) the refundable california eitc is available to taxpayers who earned wage income subject. Download or print the 2024 california form 3514 (california earned income tax credit) for free from the california franchise tax board. This amount should also be entered on form 540, line 75;

California Earned Tax Credit Worksheet

If you qualify, you will claim your earned income tax credit when you file your federal tax return. Look up the amount on line 3 in the eic table in the instructions to find the credit. Use form ftb 3514 to. This amount should also be entered on form 540, line 75; Enter the amount from line 2 on line.

California Earned Tax Credit Worksheet

Look up the amount on line 3 in the eic table in the instructions to find the credit. If you qualify, you will claim your earned income tax credit when you file your federal tax return. California tax return to claim the credit and attach a completed form ftb 3514, california earned income tax credit. Use form ftb 3514 to..

California Earned Tax Credit Worksheet 2020 ideas 2022

If you qualify, you will claim your earned income tax credit when you file your federal tax return. To calculate the value of your eitc, you can use. Look up the amount on line 3 in the eic table in the instructions to find the credit. This amount should also be entered on form 540, line 75; California tax return.

Earned Tax Worksheet 2014

This amount should also be entered on form 540, line 75; Enter the amount from line 2 on line 6. California tax return to claim the credit and attach a completed form ftb 3514, california earned income tax credit. Download or print the 2024 california form 3514 (california earned income tax credit) for free from the california franchise tax board..

California Earned Tax Credit Worksheet 2015 Worksheet Resume

California earned income tax credit (eitc) the refundable california eitc is available to taxpayers who earned wage income subject. To calculate the value of your eitc, you can use. Enter amount from california earned income tax credit worksheet, part iii, line 6. This amount should also be entered on form 540, line 75; If you qualify, you will claim your.

California Earned Tax Credit Worksheet Part Iii Line 6 Worksheet

To calculate the value of your eitc, you can use. Download or print the 2024 california form 3514 (california earned income tax credit) for free from the california franchise tax board. California earned income tax credit (eitc) the refundable california eitc is available to taxpayers who earned wage income subject. Enter the amount from line 2 on line 6. This.

Fillable Online California earned tax credit worksheet part iii

Use form ftb 3514 to. This amount should also be entered on form 540, line 75; Look up the amount on line 3 in the eic table in the instructions to find the credit. If you qualify, you will claim your earned income tax credit when you file your federal tax return. Enter amount from california earned income tax credit.

California Earned Tax Credit Eligible

To calculate the value of your eitc, you can use. Enter the amount from line 2 on line 6. Enter amount from california earned income tax credit worksheet, part iii, line 6. California earned income tax credit (eitc) the refundable california eitc is available to taxpayers who earned wage income subject. This amount should also be entered on form 540,.

California Earned Tax Credit Worksheet

If you qualify, you will claim your earned income tax credit when you file your federal tax return. To calculate the value of your eitc, you can use. California tax return to claim the credit and attach a completed form ftb 3514, california earned income tax credit. Use form ftb 3514 to. Enter amount from california earned income tax credit.

2016 Form 3514 California Earned Tax Credit Edit, Fill, Sign

Look up the amount on line 3 in the eic table in the instructions to find the credit. Enter the amount from line 2 on line 6. Use form ftb 3514 to. California earned income tax credit (eitc) the refundable california eitc is available to taxpayers who earned wage income subject. California tax return to claim the credit and attach.

If You Qualify, You Will Claim Your Earned Income Tax Credit When You File Your Federal Tax Return.

California tax return to claim the credit and attach a completed form ftb 3514, california earned income tax credit. Look up the amount on line 3 in the eic table in the instructions to find the credit. To calculate the value of your eitc, you can use. This amount should also be entered on form 540, line 75;

Download Or Print The 2024 California Form 3514 (California Earned Income Tax Credit) For Free From The California Franchise Tax Board.

Use form ftb 3514 to. Enter the amount from line 2 on line 6. Enter amount from california earned income tax credit worksheet, part iii, line 6. California earned income tax credit (eitc) the refundable california eitc is available to taxpayers who earned wage income subject.