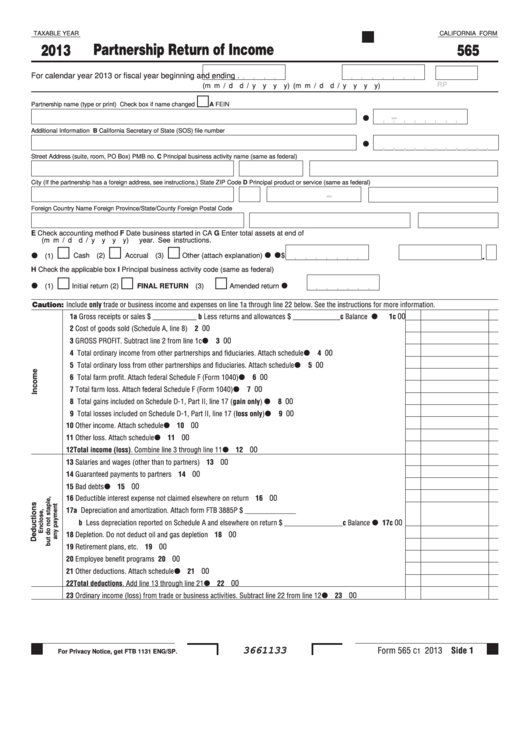

California Form 565 - General partnerships file partnership return of income (form 565). Does california treat small partnerships the same way as federal? What form do i file for my general partnership? Since the limited partnership is doing business in both nevada and california, it must file a partnership return of income (california form 565) and use schedule r to apportion income. A partnership (including remics classified as partnerships) that engages in a trade or business in california or has income from a california source must file form 565. 3661223 form 565 2022 side 1 partnership return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest). Since the limited liability partnership is doing business in both nevada and california, it must file a california form 565, partnership return of income and use schedule r to apportion.

Since the limited partnership is doing business in both nevada and california, it must file a partnership return of income (california form 565) and use schedule r to apportion income. 3661223 form 565 2022 side 1 partnership return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest). Does california treat small partnerships the same way as federal? General partnerships file partnership return of income (form 565). What form do i file for my general partnership? A partnership (including remics classified as partnerships) that engages in a trade or business in california or has income from a california source must file form 565. Since the limited liability partnership is doing business in both nevada and california, it must file a california form 565, partnership return of income and use schedule r to apportion.

What form do i file for my general partnership? 3661223 form 565 2022 side 1 partnership return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest). General partnerships file partnership return of income (form 565). Since the limited liability partnership is doing business in both nevada and california, it must file a california form 565, partnership return of income and use schedule r to apportion. Does california treat small partnerships the same way as federal? A partnership (including remics classified as partnerships) that engages in a trade or business in california or has income from a california source must file form 565. Since the limited partnership is doing business in both nevada and california, it must file a partnership return of income (california form 565) and use schedule r to apportion income.

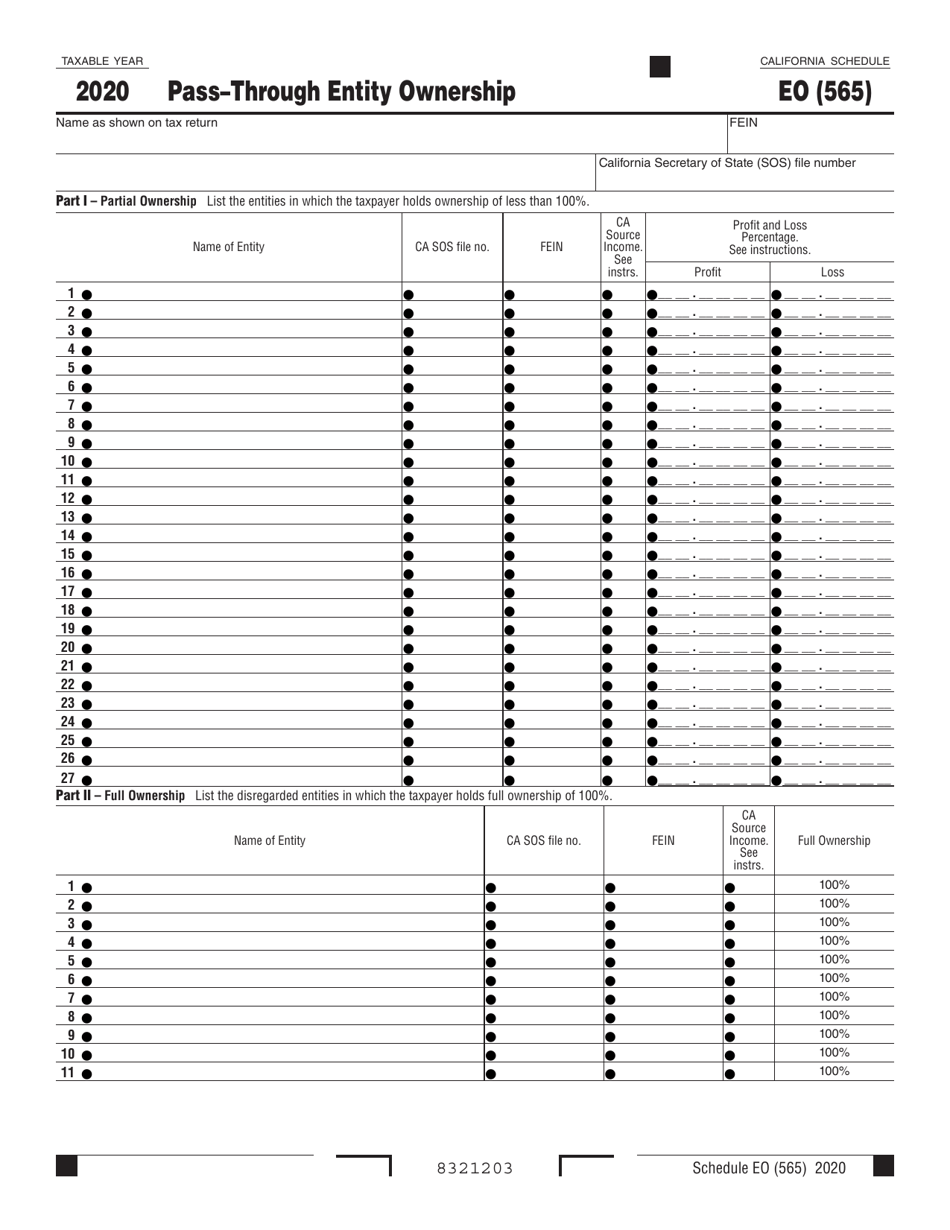

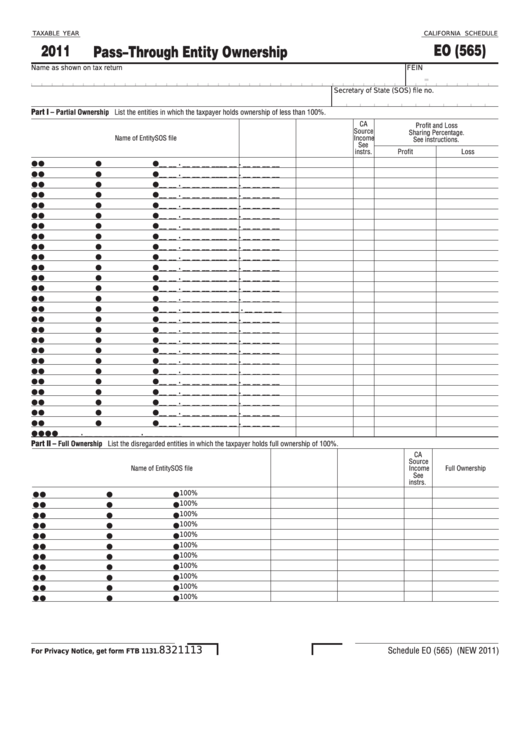

Form 565 Schedule EO Download Fillable PDF or Fill Online PassThrough

What form do i file for my general partnership? Since the limited partnership is doing business in both nevada and california, it must file a partnership return of income (california form 565) and use schedule r to apportion income. Since the limited liability partnership is doing business in both nevada and california, it must file a california form 565, partnership.

Fillable California Form 565 Partnership Return Of 2013

Does california treat small partnerships the same way as federal? Since the limited liability partnership is doing business in both nevada and california, it must file a california form 565, partnership return of income and use schedule r to apportion. Since the limited partnership is doing business in both nevada and california, it must file a partnership return of income.

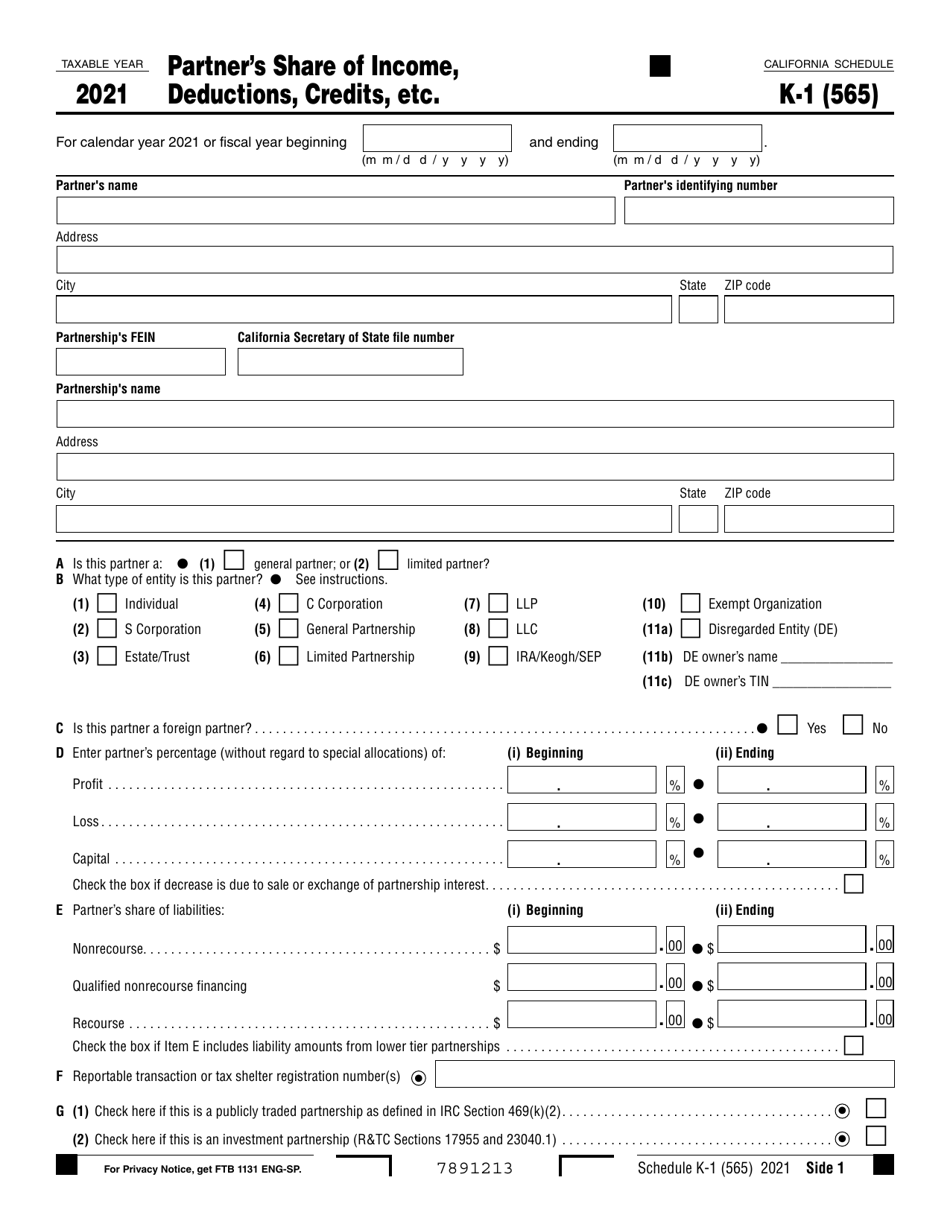

Ca 565 instructions 2021 Fill out & sign online DocHub

General partnerships file partnership return of income (form 565). Does california treat small partnerships the same way as federal? 3661223 form 565 2022 side 1 partnership return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest). Since the limited partnership is doing business in both.

CA JV565 20132022 Complete Legal Document Online US Legal Forms

General partnerships file partnership return of income (form 565). Since the limited liability partnership is doing business in both nevada and california, it must file a california form 565, partnership return of income and use schedule r to apportion. Since the limited partnership is doing business in both nevada and california, it must file a partnership return of income (california.

California 565 Fillable Form Printable Forms Free Online

3661223 form 565 2022 side 1 partnership return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest). Since the limited liability partnership is doing business in both nevada and california, it must file a california form 565, partnership return of income and use schedule r.

Form 565 Schedule K1 Download Fillable PDF or Fill Online Partner's

Since the limited liability partnership is doing business in both nevada and california, it must file a california form 565, partnership return of income and use schedule r to apportion. 3661223 form 565 2022 side 1 partnership return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a.

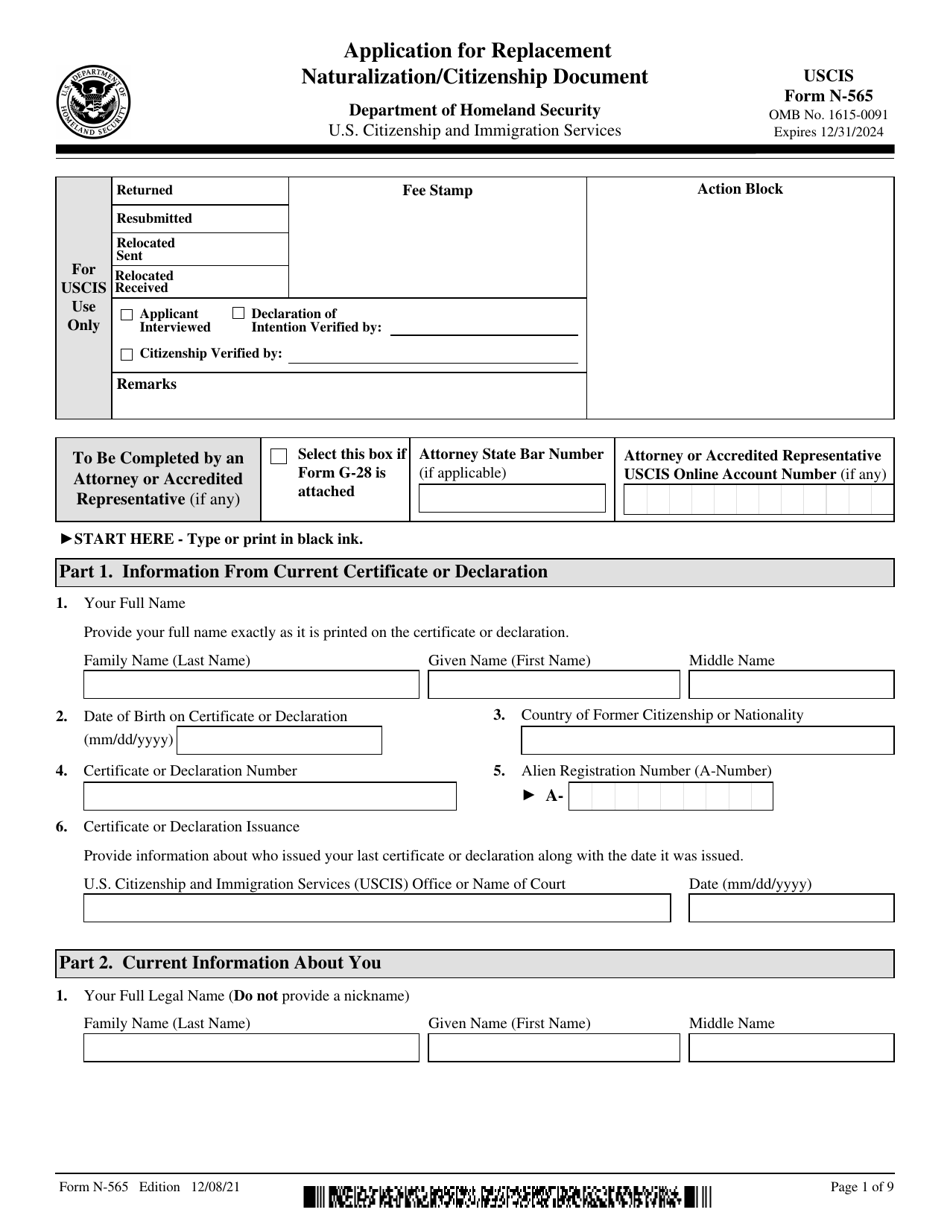

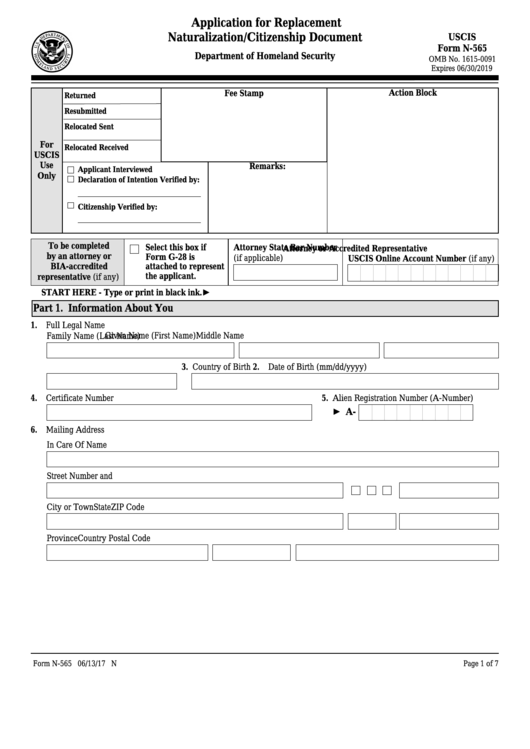

Form N 565 ≡ Fill Out Printable PDF Forms Online

Since the limited partnership is doing business in both nevada and california, it must file a partnership return of income (california form 565) and use schedule r to apportion income. General partnerships file partnership return of income (form 565). 3661223 form 565 2022 side 1 partnership return of income i (1) during this taxable year, did another person or legal.

USCIS Form N565 Fill Out, Sign Online and Download Fillable PDF

Does california treat small partnerships the same way as federal? A partnership (including remics classified as partnerships) that engages in a trade or business in california or has income from a california source must file form 565. General partnerships file partnership return of income (form 565). Since the limited liability partnership is doing business in both nevada and california, it.

Fillable California Schedule Eo (Form 565) PassThrough Entity

Since the limited partnership is doing business in both nevada and california, it must file a partnership return of income (california form 565) and use schedule r to apportion income. Since the limited liability partnership is doing business in both nevada and california, it must file a california form 565, partnership return of income and use schedule r to apportion..

California 565 Fillable Form Printable Forms Free Online

Since the limited liability partnership is doing business in both nevada and california, it must file a california form 565, partnership return of income and use schedule r to apportion. Does california treat small partnerships the same way as federal? General partnerships file partnership return of income (form 565). 3661223 form 565 2022 side 1 partnership return of income i.

General Partnerships File Partnership Return Of Income (Form 565).

Since the limited partnership is doing business in both nevada and california, it must file a partnership return of income (california form 565) and use schedule r to apportion income. 3661223 form 565 2022 side 1 partnership return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest). What form do i file for my general partnership? Does california treat small partnerships the same way as federal?

A Partnership (Including Remics Classified As Partnerships) That Engages In A Trade Or Business In California Or Has Income From A California Source Must File Form 565.

Since the limited liability partnership is doing business in both nevada and california, it must file a california form 565, partnership return of income and use schedule r to apportion.