California Itemized Deduction Worksheet - Ight to it, you may be able to deduct the amount repaid from your income for the year in which you repaid it. However, you may need to. On the ca info worksheet, you can check the box in part v, ' calculate ca itemized deductions even if itemized deductions are less than standard. California 540nr booklet to figure your standard deduction. Military pay of a servicemember domiciled outside of california cannot be used. We have automatically carried over your itemized deductions from your federal return to your california return. Use worksheet a for regular. Amount you repaid is less than. • see form 540, line 18 instructions and worksheets for the amount of standard. Complete this form so that your employer can withhold the correct california state income tax from your pay.

Find out which credits and deductions you can claim. Complete this form so that your employer can withhold the correct california state income tax from your pay. California 540nr booklet to figure your standard deduction. Ight to it, you may be able to deduct the amount repaid from your income for the year in which you repaid it. We have automatically carried over your itemized deductions from your federal return to your california return. Use worksheet a for regular. On the ca info worksheet, you can check the box in part v, ' calculate ca itemized deductions even if itemized deductions are less than standard. However, you may need to. Military pay of a servicemember domiciled outside of california cannot be used. Amount you repaid is less than.

Ight to it, you may be able to deduct the amount repaid from your income for the year in which you repaid it. Complete this form so that your employer can withhold the correct california state income tax from your pay. Find out which credits and deductions you can claim. We have automatically carried over your itemized deductions from your federal return to your california return. Claiming standard deduction or itemized deductions: Use worksheet a for regular. Amount you repaid is less than. • see form 540, line 18 instructions and worksheets for the amount of standard. California 540nr booklet to figure your standard deduction. However, you may need to.

California itemized deductions worksheet Fill out & sign online

Claiming standard deduction or itemized deductions: Ight to it, you may be able to deduct the amount repaid from your income for the year in which you repaid it. However, you may need to. • see form 540, line 18 instructions and worksheets for the amount of standard. Find out which credits and deductions you can claim.

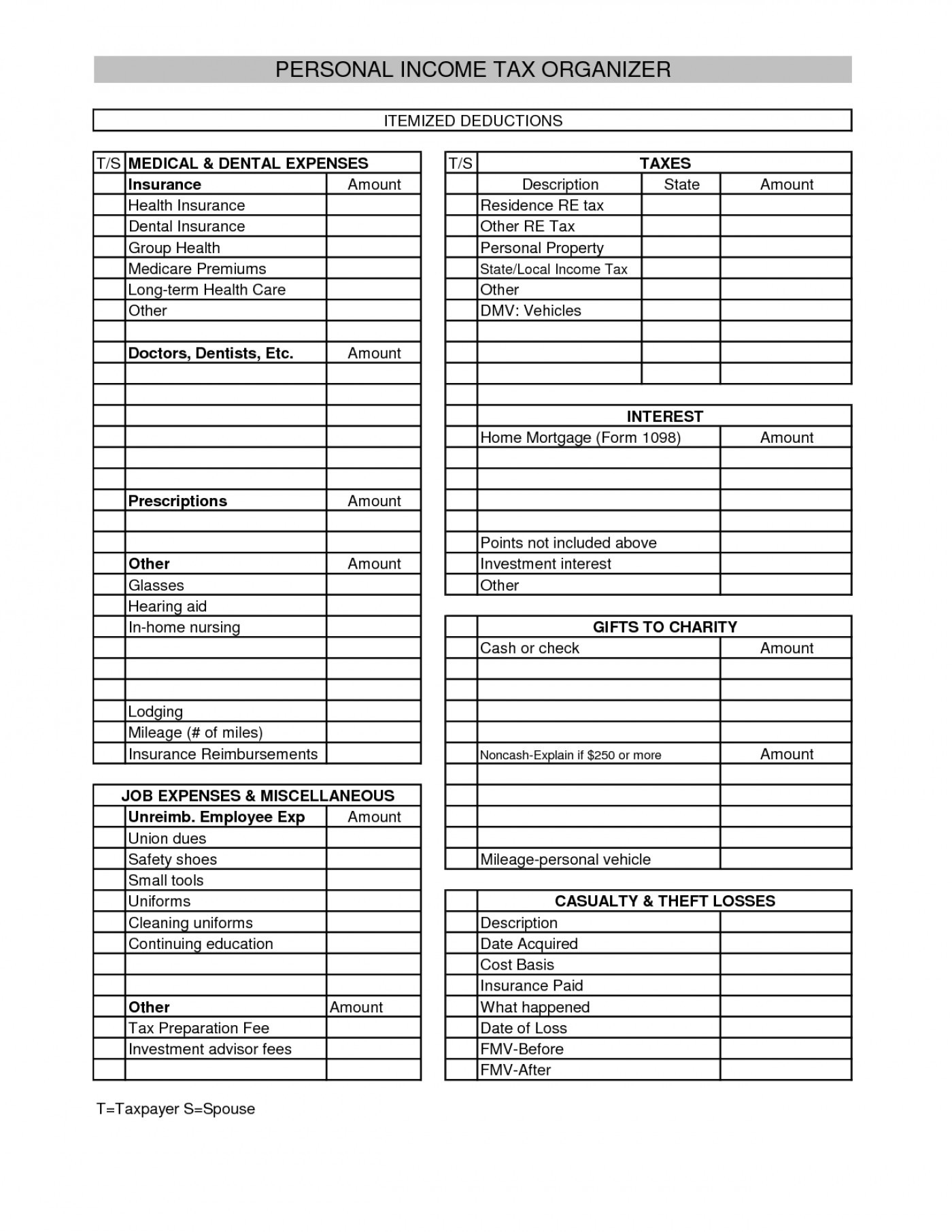

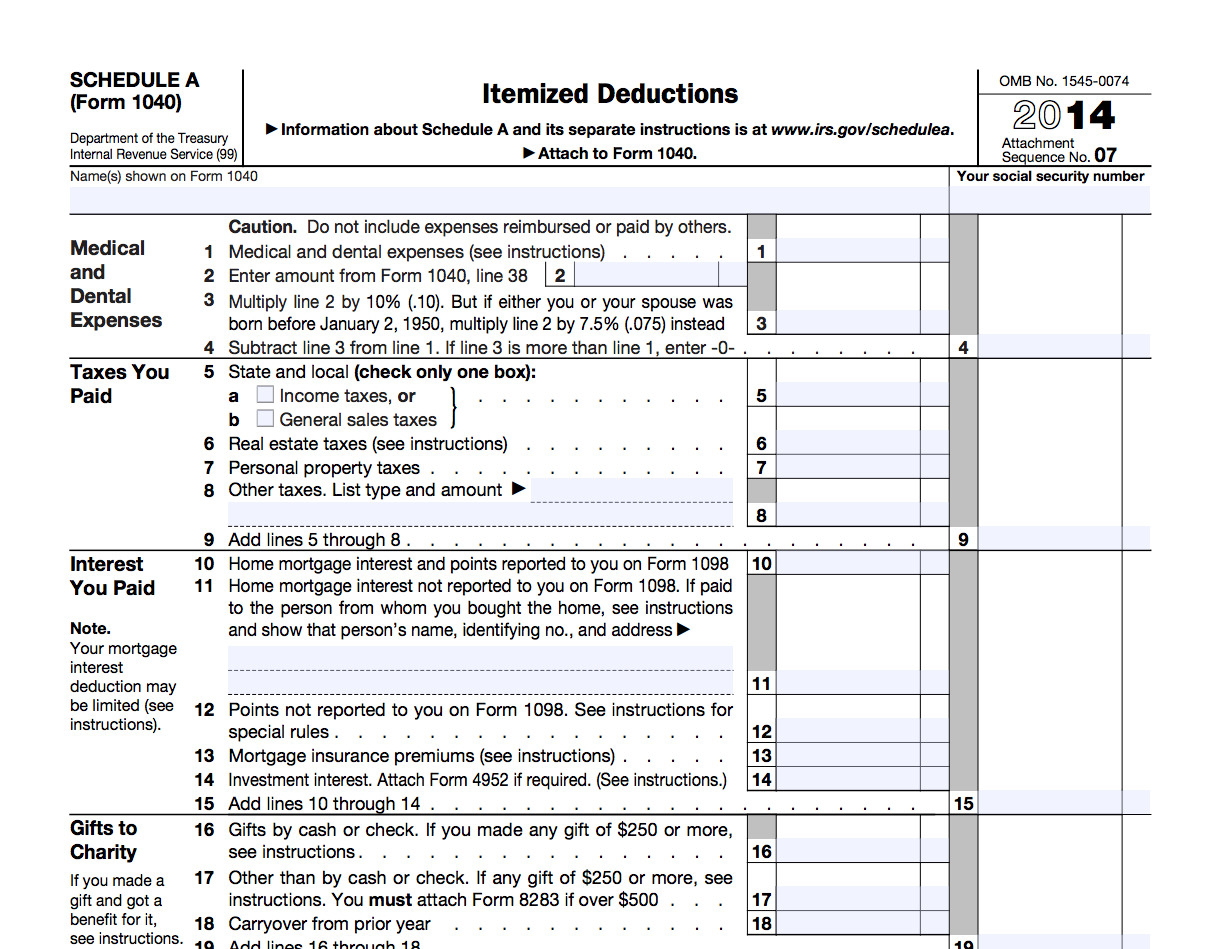

Itemized Tax Deduction Worksheet Oaklandeffect Deductions —

However, you may need to. • see form 540, line 18 instructions and worksheets for the amount of standard. On the ca info worksheet, you can check the box in part v, ' calculate ca itemized deductions even if itemized deductions are less than standard. We have automatically carried over your itemized deductions from your federal return to your california.

California Itemized Deductions Worksheet

Military pay of a servicemember domiciled outside of california cannot be used. Complete this form so that your employer can withhold the correct california state income tax from your pay. Use worksheet a for regular. Amount you repaid is less than. Ight to it, you may be able to deduct the amount repaid from your income for the year in.

California Itemized Deduction Worksheet

We have automatically carried over your itemized deductions from your federal return to your california return. • see form 540, line 18 instructions and worksheets for the amount of standard. Complete this form so that your employer can withhold the correct california state income tax from your pay. Amount you repaid is less than. Claiming standard deduction or itemized deductions:

California Itemized Deductions Worksheets

• see form 540, line 18 instructions and worksheets for the amount of standard. Use worksheet a for regular. Ight to it, you may be able to deduct the amount repaid from your income for the year in which you repaid it. We have automatically carried over your itemized deductions from your federal return to your california return. Claiming standard.

Printable Itemized Deductions Worksheet

Amount you repaid is less than. Find out which credits and deductions you can claim. Military pay of a servicemember domiciled outside of california cannot be used. California 540nr booklet to figure your standard deduction. On the ca info worksheet, you can check the box in part v, ' calculate ca itemized deductions even if itemized deductions are less than.

Itemized Deduction Worksheet Best Printable Resources

On the ca info worksheet, you can check the box in part v, ' calculate ca itemized deductions even if itemized deductions are less than standard. Find out which credits and deductions you can claim. California 540nr booklet to figure your standard deduction. Claiming standard deduction or itemized deductions: Ight to it, you may be able to deduct the amount.

Itemized Deductions Worksheet —

Ight to it, you may be able to deduct the amount repaid from your income for the year in which you repaid it. • see form 540, line 18 instructions and worksheets for the amount of standard. Use worksheet a for regular. However, you may need to. Military pay of a servicemember domiciled outside of california cannot be used.

Free federal itemized deductions worksheet, Download Free federal

Find out which credits and deductions you can claim. On the ca info worksheet, you can check the box in part v, ' calculate ca itemized deductions even if itemized deductions are less than standard. Amount you repaid is less than. Ight to it, you may be able to deduct the amount repaid from your income for the year in.

California Itemized Deductions Worksheet

However, you may need to. Find out which credits and deductions you can claim. • see form 540, line 18 instructions and worksheets for the amount of standard. California 540nr booklet to figure your standard deduction. Claiming standard deduction or itemized deductions:

Ight To It, You May Be Able To Deduct The Amount Repaid From Your Income For The Year In Which You Repaid It.

Complete this form so that your employer can withhold the correct california state income tax from your pay. Find out which credits and deductions you can claim. Claiming standard deduction or itemized deductions: Military pay of a servicemember domiciled outside of california cannot be used.

We Have Automatically Carried Over Your Itemized Deductions From Your Federal Return To Your California Return.

However, you may need to. California 540nr booklet to figure your standard deduction. Use worksheet a for regular. Amount you repaid is less than.

On The Ca Info Worksheet, You Can Check The Box In Part V, ' Calculate Ca Itemized Deductions Even If Itemized Deductions Are Less Than Standard.

• see form 540, line 18 instructions and worksheets for the amount of standard.