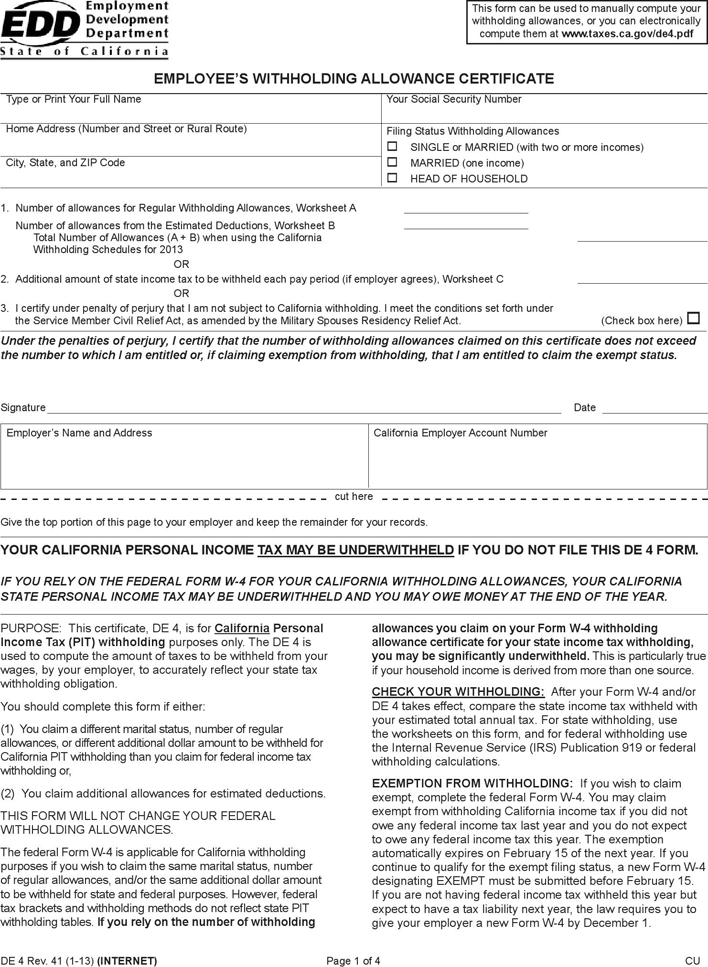

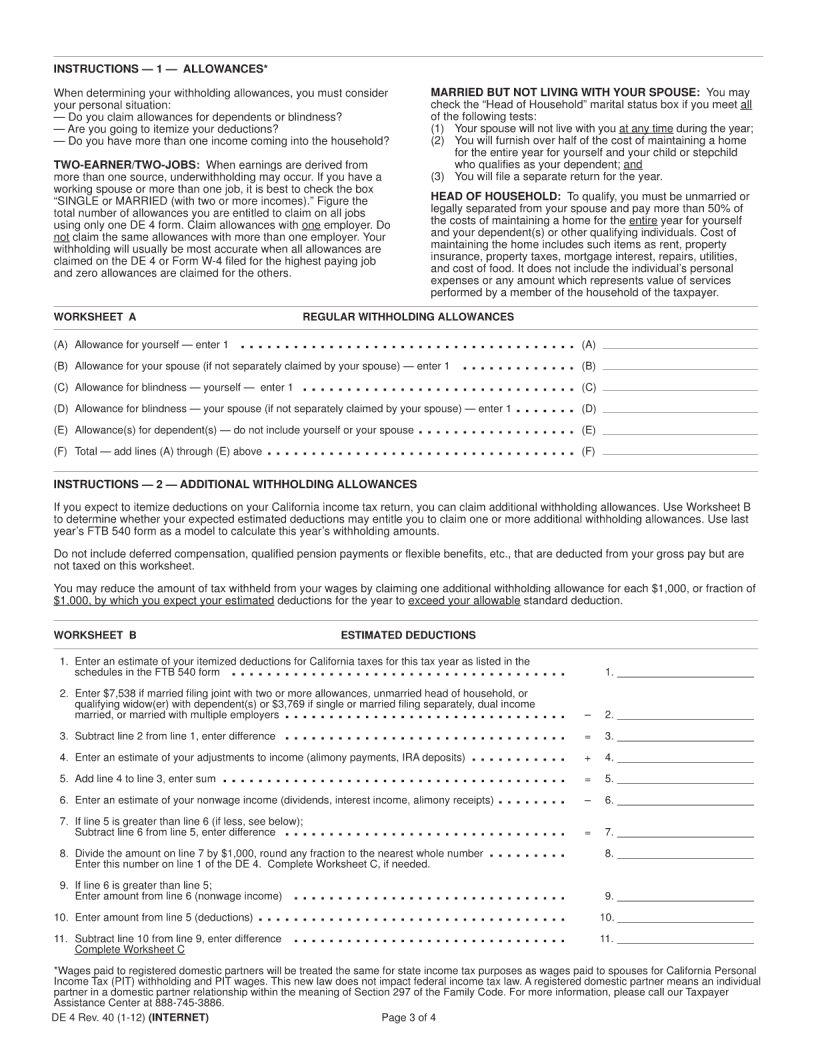

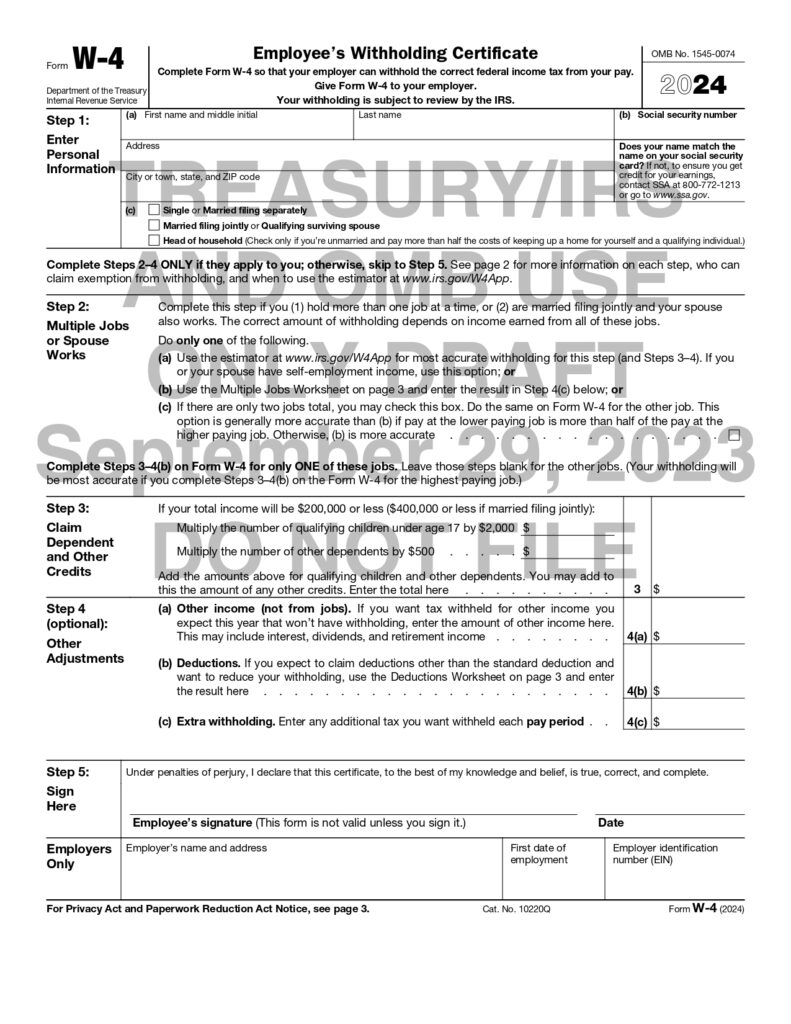

California Tax Form De 4 - This certificate, de 4, is for california personal income tax withholding purposes only. The de 4 is used to compute the amount of. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. The de 4 is used to compute the amount. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in.

This certificate, de 4, is for california personal income tax (pit) withholding purposes only. The de 4 is used to compute the amount of. The de 4 is used to compute the amount. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. This certificate, de 4, is for california personal income tax withholding purposes only.

Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. The de 4 is used to compute the amount of. This certificate, de 4, is for california personal income tax withholding purposes only. The de 4 is used to compute the amount. This certificate, de 4, is for california personal income tax (pit) withholding purposes only.

Form 540 2ez instructions Fill out & sign online DocHub

The de 4 is used to compute the amount. This certificate, de 4, is for california personal income tax withholding purposes only. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. The.

Free California Form DE PDF 638KB 4 Page(s) Page 4

This certificate, de 4, is for california personal income tax (pit) withholding purposes only. The de 4 is used to compute the amount. The de 4 is used to compute the amount of. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. This certificate, de 4,.

2023 De4 Form California Printable Forms Free Online

This certificate, de 4, is for california personal income tax withholding purposes only. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. The de 4 is used to compute the amount. The.

California Tax Withholding Form (DE 4 Form) Ultimate Guide

The de 4 is used to compute the amount of. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. The de 4 is used to compute the amount. This certificate, de 4, is for california personal income tax withholding purposes only. This certificate, de 4, is.

California DE4 App

The de 4 is used to compute the amount. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. This certificate, de 4, is for california personal income tax withholding purposes only. The de 4 is used to compute the amount of. This certificate, de 4, is.

Ca De 4 Printable Form California Employee's Withholding Allowance

This certificate, de 4, is for california personal income tax (pit) withholding purposes only. This certificate, de 4, is for california personal income tax withholding purposes only. The de 4 is used to compute the amount. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. The.

California DE 4 form Employee's withholding allowance certificate how

This certificate, de 4, is for california personal income tax withholding purposes only. The de 4 is used to compute the amount. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. The.

California De4 2024 Lena Babette

The de 4 is used to compute the amount. The de 4 is used to compute the amount of. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. This certificate, de 4,.

California Tax Withholding Form (DE 4 Form) Ultimate Guide

This certificate, de 4, is for california personal income tax (pit) withholding purposes only. The de 4 is used to compute the amount. The de 4 is used to compute the amount of. This certificate, de 4, is for california personal income tax withholding purposes only. Filling out the california withholding form de 4 is an important step to ensure.

California State Tax Withholding Form 2024 Printable Sissy Ealasaid

This certificate, de 4, is for california personal income tax withholding purposes only. The de 4 is used to compute the amount. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. The.

Filling Out The California Withholding Form De 4 Is An Important Step To Ensure Accurate Tax Withholding From Your Wages Or Salary In.

This certificate, de 4, is for california personal income tax withholding purposes only. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. The de 4 is used to compute the amount of. The de 4 is used to compute the amount.