Can A 1099 Employee Collect Unemployment In Texas - 1099 workers don’t pay into the unemployment insurance system. If your business has employees, you are subject to the texas unemployment compensation act (tuca). Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or partially unemployed. You may be liable to pay. Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if.

1099 workers don’t pay into the unemployment insurance system. Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or partially unemployed. Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if. You may be liable to pay. If your business has employees, you are subject to the texas unemployment compensation act (tuca).

Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or partially unemployed. 1099 workers don’t pay into the unemployment insurance system. Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if. You may be liable to pay. If your business has employees, you are subject to the texas unemployment compensation act (tuca).

Can a seasonal employee collect unemployment? Zippia

If your business has employees, you are subject to the texas unemployment compensation act (tuca). Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or partially unemployed. 1099 workers don’t pay into the unemployment insurance system. You may be liable to pay. Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect.

Can a 1099 Collect Unemployment? got1099

If your business has employees, you are subject to the texas unemployment compensation act (tuca). You may be liable to pay. Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or partially unemployed. Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if. 1099 workers don’t pay into the unemployment.

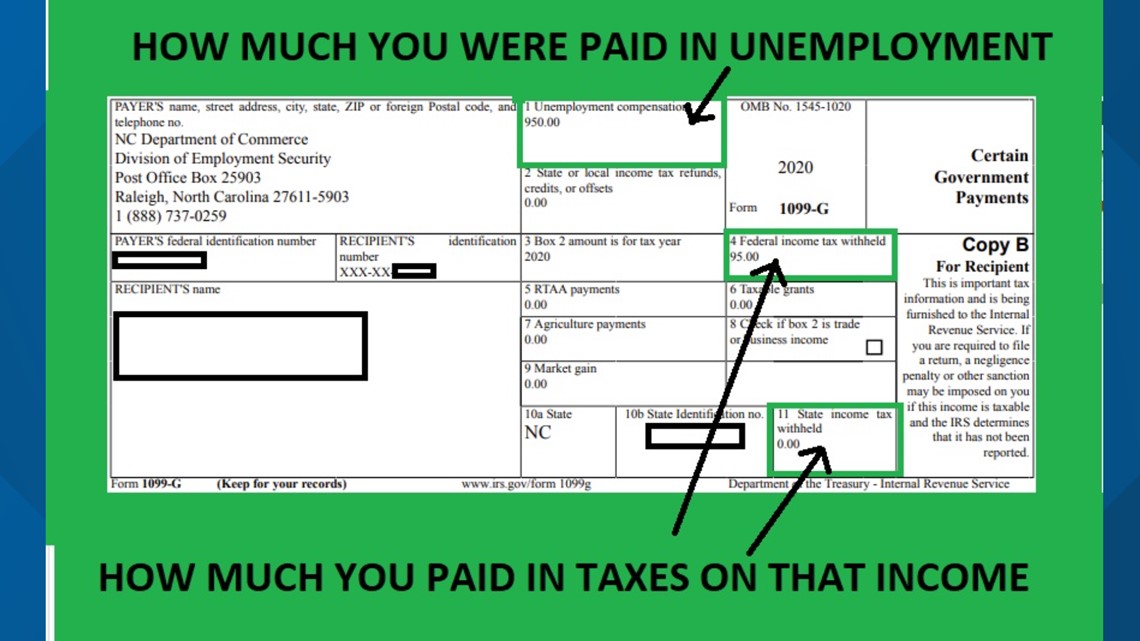

What You Need to Know About Unemployment Form 1099G National

Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or partially unemployed. 1099 workers don’t pay into the unemployment insurance system. Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if. You may be liable to pay. If your business has employees, you are subject to the texas unemployment compensation.

How to Get Your 1099 From Unemployment A Comprehensive Guide The

1099 workers don’t pay into the unemployment insurance system. Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if. If your business has employees, you are subject to the texas unemployment compensation act (tuca). Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or partially unemployed. You may be liable.

Can a 1099 employee collect unemployment? Zippia

Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if. Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or partially unemployed. You may be liable to pay. 1099 workers don’t pay into the unemployment insurance system. If your business has employees, you are subject to the texas unemployment compensation.

Can a Temp Employee Collect Unemployment?

If your business has employees, you are subject to the texas unemployment compensation act (tuca). You may be liable to pay. Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if. 1099 workers don’t pay into the unemployment insurance system. Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or.

Il unemployment tax form 1099 g jerywee

1099 workers don’t pay into the unemployment insurance system. Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if. If your business has employees, you are subject to the texas unemployment compensation act (tuca). Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or partially unemployed. You may be liable.

1099 Employee

You may be liable to pay. 1099 workers don’t pay into the unemployment insurance system. Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if. If your business has employees, you are subject to the texas unemployment compensation act (tuca). Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or.

Can a 1099 Collect Unemployment? got1099

1099 workers don’t pay into the unemployment insurance system. Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if. Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or partially unemployed. If your business has employees, you are subject to the texas unemployment compensation act (tuca). You may be liable.

What Is a 1099 Employee? Ramsey

Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or partially unemployed. You may be liable to pay. Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if. If your business has employees, you are subject to the texas unemployment compensation act (tuca). 1099 workers don’t pay into the unemployment.

If Your Business Has Employees, You Are Subject To The Texas Unemployment Compensation Act (Tuca).

Unemployment benefits provide temporary, partial income replacement for qualified individuals who are unemployed or partially unemployed. 1099 workers don’t pay into the unemployment insurance system. Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if. You may be liable to pay.