Can I File Form 5329 By Itself - If the individual doesn't have to file a 2023 income tax return, they should complete and file form 5329 by itself at the time and place. If you haven't filed your 2020 tax return then you can use turbotax. Can i file form 5329 on its own? Form 5329 can be filed by itself. The excess contributions plus earnings attributable to the excess contributions need to. Find out who must file,. No, you cannot file only form 5329.

If you haven't filed your 2020 tax return then you can use turbotax. The excess contributions plus earnings attributable to the excess contributions need to. Form 5329 can be filed by itself. Find out who must file,. If the individual doesn't have to file a 2023 income tax return, they should complete and file form 5329 by itself at the time and place. Can i file form 5329 on its own? No, you cannot file only form 5329.

If you haven't filed your 2020 tax return then you can use turbotax. If the individual doesn't have to file a 2023 income tax return, they should complete and file form 5329 by itself at the time and place. The excess contributions plus earnings attributable to the excess contributions need to. Form 5329 can be filed by itself. No, you cannot file only form 5329. Find out who must file,. Can i file form 5329 on its own?

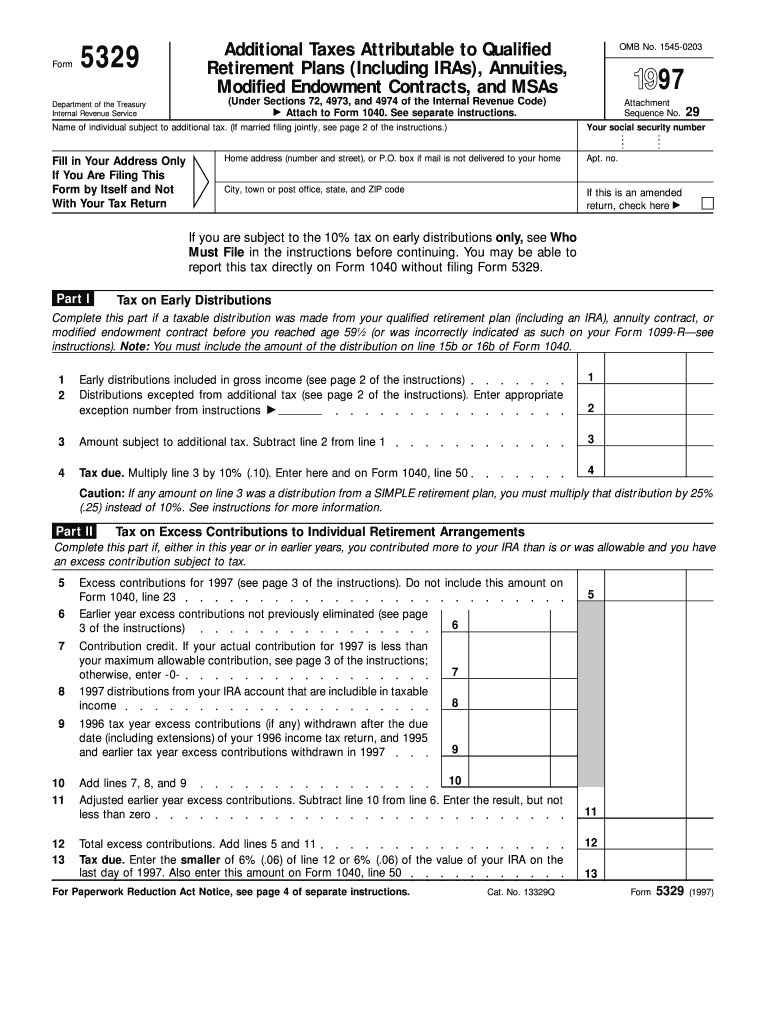

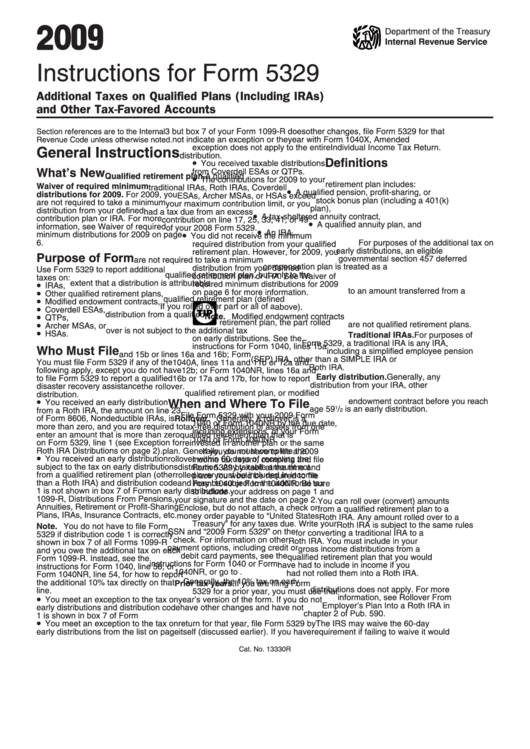

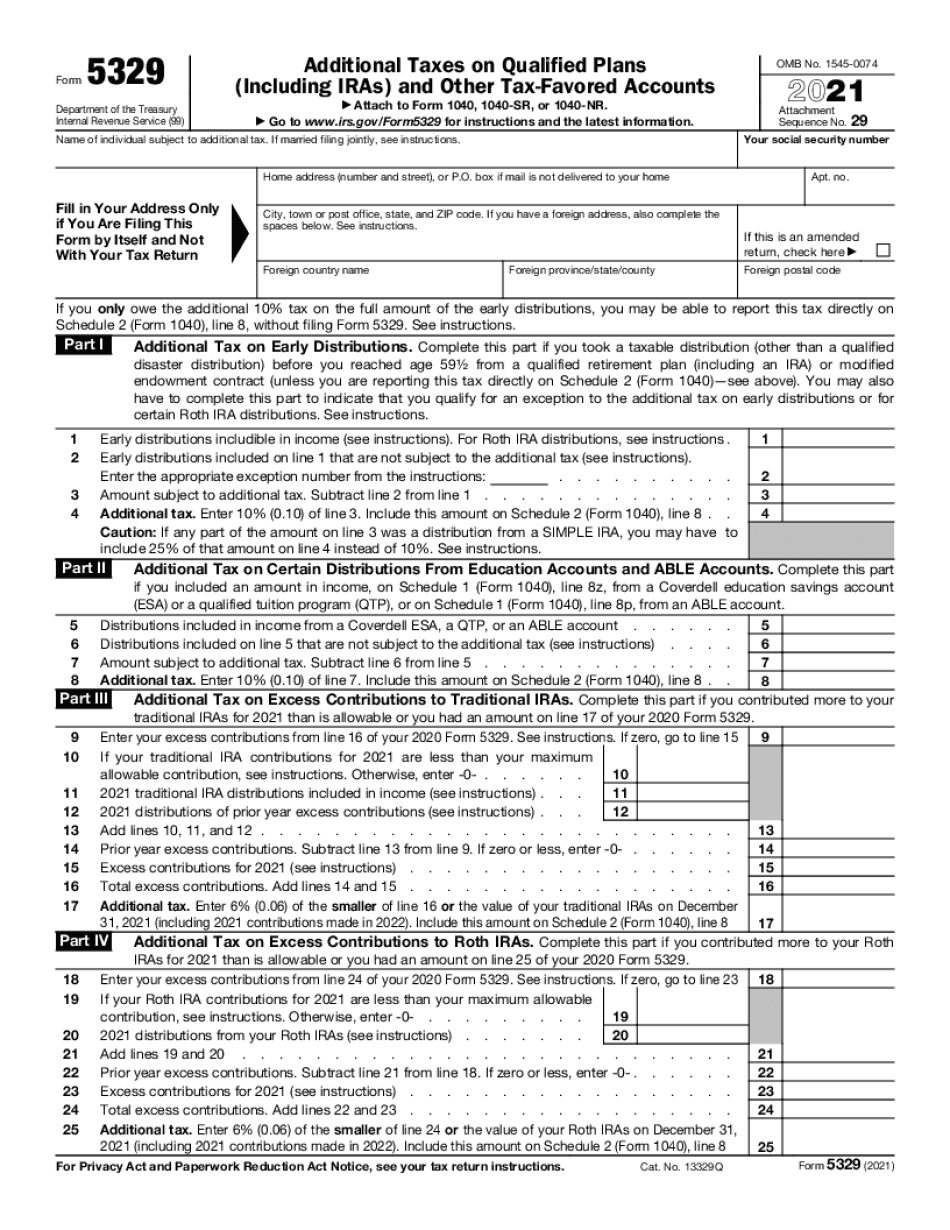

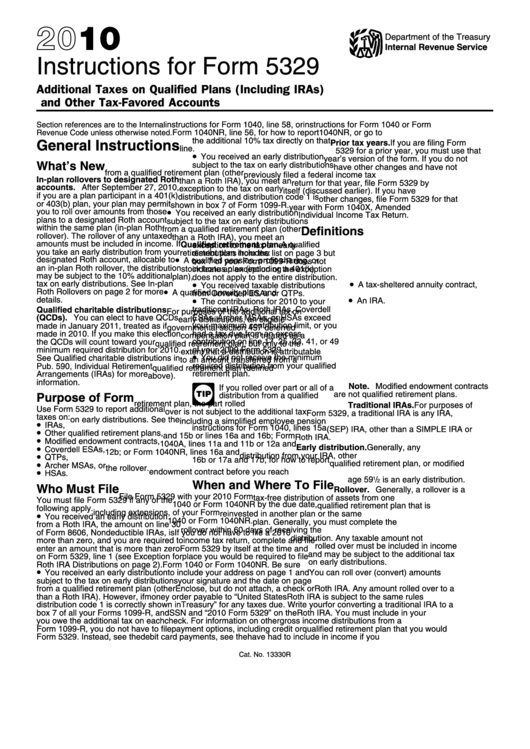

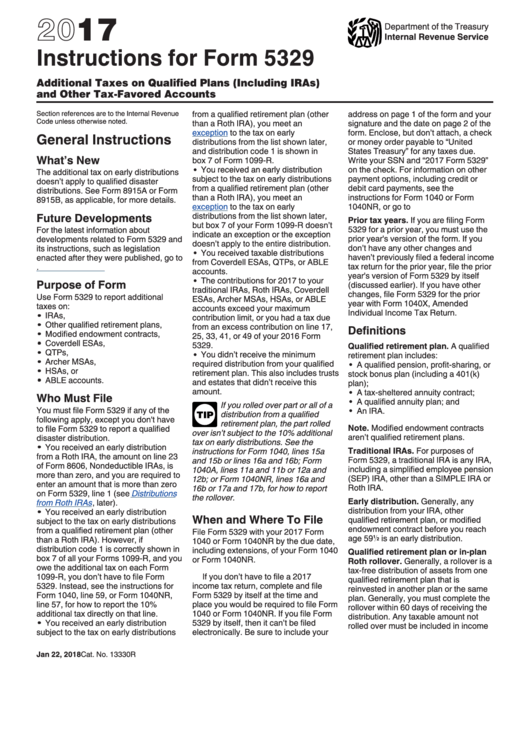

Instructions For Form 5329 Additional Taxes On Qualified Plans

Form 5329 can be filed by itself. If the individual doesn't have to file a 2023 income tax return, they should complete and file form 5329 by itself at the time and place. Find out who must file,. If you haven't filed your 2020 tax return then you can use turbotax. The excess contributions plus earnings attributable to the excess.

How to Add Watermark To Form 5329

Find out who must file,. Can i file form 5329 on its own? If the individual doesn't have to file a 2023 income tax return, they should complete and file form 5329 by itself at the time and place. The excess contributions plus earnings attributable to the excess contributions need to. If you haven't filed your 2020 tax return then.

Form 5329 Example Return (2025) IRS Form 5329 What It Is, How to

No, you cannot file only form 5329. Find out who must file,. Form 5329 can be filed by itself. The excess contributions plus earnings attributable to the excess contributions need to. Can i file form 5329 on its own?

Instructions For Form 5329 2010 printable pdf download

No, you cannot file only form 5329. If you haven't filed your 2020 tax return then you can use turbotax. Can i file form 5329 on its own? If the individual doesn't have to file a 2023 income tax return, they should complete and file form 5329 by itself at the time and place. Form 5329 can be filed by.

Top 19 Form 5329 Templates free to download in PDF format

If the individual doesn't have to file a 2023 income tax return, they should complete and file form 5329 by itself at the time and place. Find out who must file,. If you haven't filed your 2020 tax return then you can use turbotax. Form 5329 can be filed by itself. The excess contributions plus earnings attributable to the excess.

2012 Instructions for Form 5329

If the individual doesn't have to file a 2023 income tax return, they should complete and file form 5329 by itself at the time and place. Can i file form 5329 on its own? Find out who must file,. No, you cannot file only form 5329. The excess contributions plus earnings attributable to the excess contributions need to.

Form 5329 Additional Taxes on Qualified Plans and Other TaxFavored

Form 5329 can be filed by itself. If you haven't filed your 2020 tax return then you can use turbotax. Can i file form 5329 on its own? If the individual doesn't have to file a 2023 income tax return, they should complete and file form 5329 by itself at the time and place. The excess contributions plus earnings attributable.

IRS Form 5329 [For Retirement Savings And More] Tax Relief Center

If the individual doesn't have to file a 2023 income tax return, they should complete and file form 5329 by itself at the time and place. Form 5329 can be filed by itself. The excess contributions plus earnings attributable to the excess contributions need to. Can i file form 5329 on its own? Find out who must file,.

Form 5329 Line 2 at gencolbyblog Blog

Can i file form 5329 on its own? If the individual doesn't have to file a 2023 income tax return, they should complete and file form 5329 by itself at the time and place. Form 5329 can be filed by itself. Find out who must file,. The excess contributions plus earnings attributable to the excess contributions need to.

Form 5329 Additional Taxes on Qualified Plans and Other TaxFavored

The excess contributions plus earnings attributable to the excess contributions need to. If the individual doesn't have to file a 2023 income tax return, they should complete and file form 5329 by itself at the time and place. No, you cannot file only form 5329. If you haven't filed your 2020 tax return then you can use turbotax. Find out.

If You Haven't Filed Your 2020 Tax Return Then You Can Use Turbotax.

Can i file form 5329 on its own? No, you cannot file only form 5329. Find out who must file,. If the individual doesn't have to file a 2023 income tax return, they should complete and file form 5329 by itself at the time and place.

Form 5329 Can Be Filed By Itself.

The excess contributions plus earnings attributable to the excess contributions need to.

![IRS Form 5329 [For Retirement Savings And More] Tax Relief Center](https://help.taxreliefcenter.org/wp-content/uploads/2019/07/TRC-PIN-IRS-Form-5329-683x1024.png)