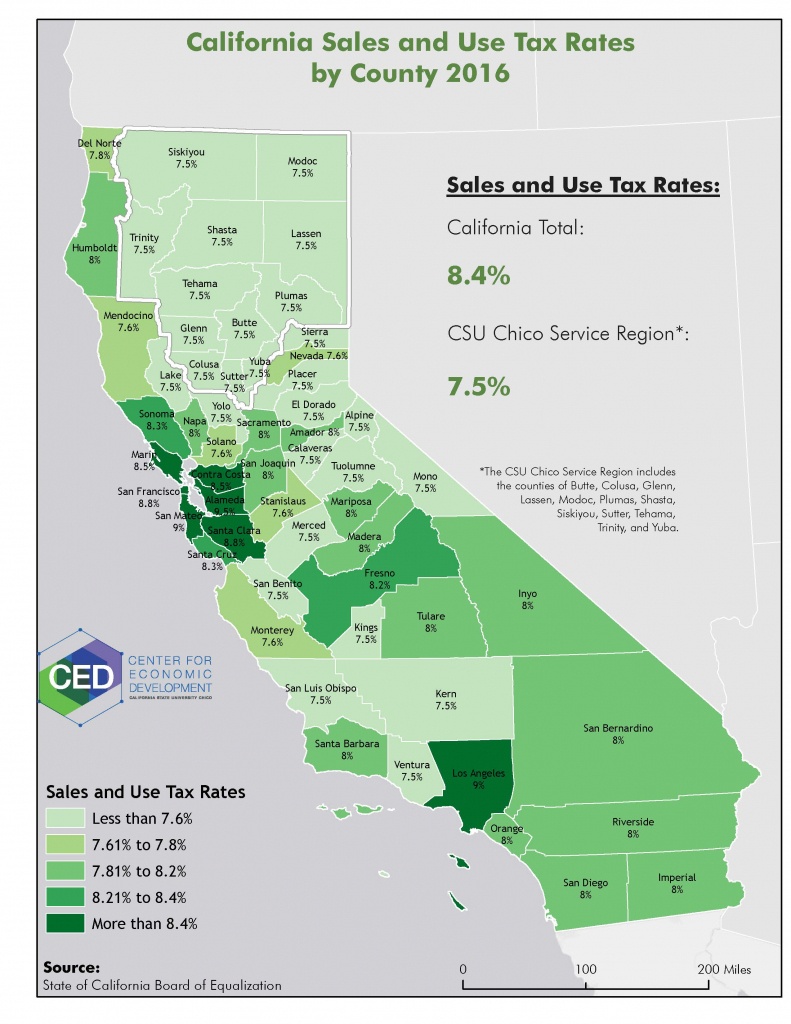

Carson Ca Sales Tax - The sales tax rate in carson, california is 10.25%. This figure is the sum of the rates together on the state, county, city, and special levels. This is the total of state, county, and city sales tax rates. Carson sales tax rate is 10.25%. The total sales tax rate in carson comprises the california state tax, the sales tax for los angeles county, and. The combined sales tax rate for carson, california is 10.25%. The 10.25% sales tax rate in carson consists of 6% california state sales tax, 0.25% los angeles county sales tax, 0.75% carson tax and 3.25%. The december 2020 total local sales tax rate was 9.500%. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The minimum combined 2025 sales tax rate for carson, california is 10.25%.

The 10.25% sales tax rate in carson consists of 6% california state sales tax, 0.25% los angeles county sales tax, 0.75% carson tax and 3.25%. This figure is the sum of the rates together on the state, county, city, and special levels. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The sales tax rate in carson, california is 10.25%. The current total local sales tax rate in carson, ca is 10.250%. The combined sales tax rate for carson, california is 10.25%. The current sales tax rate in carson, ca is 9.5%. The minimum combined 2025 sales tax rate for carson, california is 10.25%. Your total sales tax rate is the sum of the california state tax (6.25%), the los angeles. This is the total of state, county, and city sales tax rates.

Click for sales tax rates, carson sales tax calculator, and printable sales tax table from. This figure is the sum of the rates together on the state, county, city, and special levels. The current total local sales tax rate in carson, ca is 10.250%. This is the total of state, county, and city sales tax rates. The sales tax rate in carson, california is 10.25%. The december 2020 total local sales tax rate was 9.500%. The current sales tax rate in carson, ca is 9.5%. The minimum combined 2025 sales tax rate for carson, california is 10.25%. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The 10.25% sales tax rate in carson consists of 6% california state sales tax, 0.25% los angeles county sales tax, 0.75% carson tax and 3.25%.

Carson CA Coastal Capital

The 10.25% sales tax rate in carson consists of 6% california state sales tax, 0.25% los angeles county sales tax, 0.75% carson tax and 3.25%. The minimum combined 2025 sales tax rate for carson, california is 10.25%. The current sales tax rate in carson, ca is 9.5%. The sales tax rate in carson, california is 10.25%. The combined sales tax.

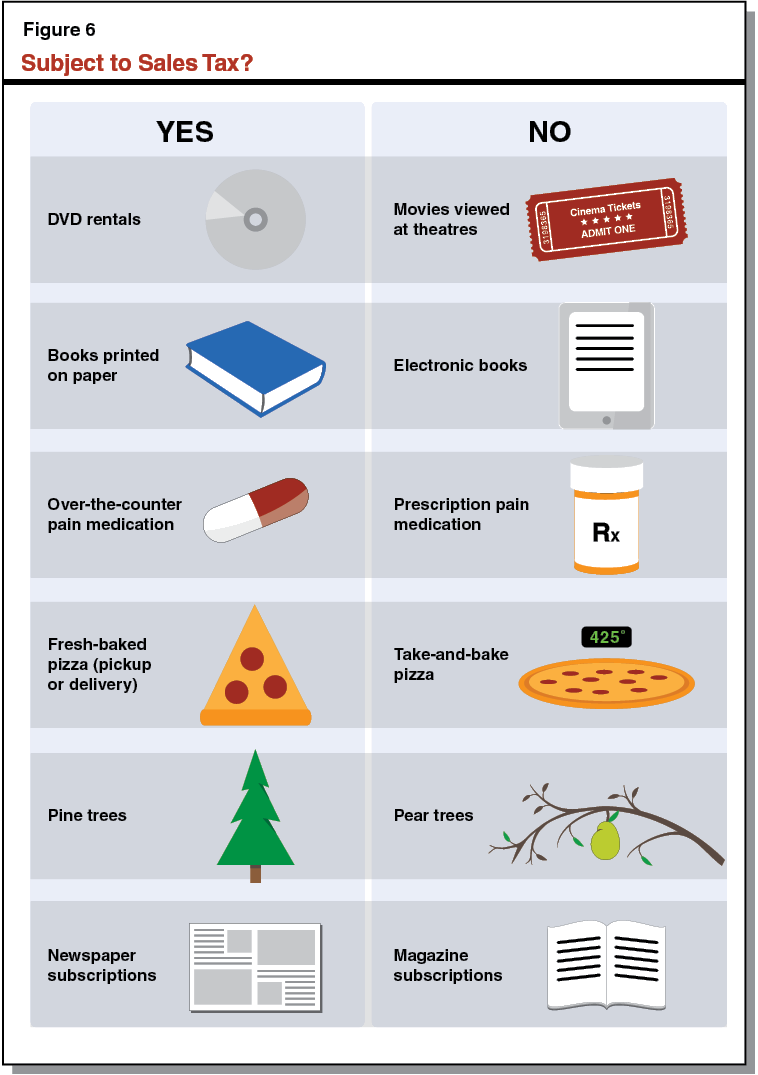

Understanding California’s Sales Tax

547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. Your total sales tax rate is the sum of the california state tax (6.25%), the los angeles. The current total local sales tax rate in carson, ca is 10.250%. This figure is the sum of the.

California Sales Tax Guide for Businesses

Carson sales tax rate is 10.25%. Click for sales tax rates, carson sales tax calculator, and printable sales tax table from. This figure is the sum of the rates together on the state, county, city, and special levels. The minimum combined 2025 sales tax rate for carson, california is 10.25%. The current total local sales tax rate in carson, ca.

20192024 Form CA Business Tax/Permit Application Carson Fill Online

The 10.25% sales tax rate in carson consists of 6% california state sales tax, 0.25% los angeles county sales tax, 0.75% carson tax and 3.25%. The minimum combined 2025 sales tax rate for carson, california is 10.25%. This figure is the sum of the rates together on the state, county, city, and special levels. Your total sales tax rate is.

How Much Is Ca Sales Tax 2024 Sukey Engracia

Click for sales tax rates, carson sales tax calculator, and printable sales tax table from. The sales tax rate in carson, california is 10.25%. This figure is the sum of the rates together on the state, county, city, and special levels. The current total local sales tax rate in carson, ca is 10.250%. This is the total of state, county,.

Sales Tax Carson City Nv 2016

The december 2020 total local sales tax rate was 9.500%. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The combined sales tax rate for carson, california is 10.25%. This is the total of state, county, and city sales tax rates. The minimum combined 2025.

Chevrolet of Carson in Carson, CA Kelley Blue Book

Carson sales tax rate is 10.25%. This figure is the sum of the rates together on the state, county, city, and special levels. The 10.25% sales tax rate in carson consists of 6% california state sales tax, 0.25% los angeles county sales tax, 0.75% carson tax and 3.25%. The current total local sales tax rate in carson, ca is 10.250%..

2024 State of The City City of Carson, CA

547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The minimum combined 2025 sales tax rate for carson, california is 10.25%. Your total sales tax rate is the sum of the california state tax (6.25%), the los angeles. The 10.25% sales tax rate in carson.

Understanding California’s Sales Tax

This is the total of state, county, and city sales tax rates. The december 2020 total local sales tax rate was 9.500%. The current sales tax rate in carson, ca is 9.5%. The sales tax rate in carson, california is 10.25%. This figure is the sum of the rates together on the state, county, city, and special levels.

City of Carson ICSC to the City of Carson

The december 2020 total local sales tax rate was 9.500%. This is the total of state, county, and city sales tax rates. The 10.25% sales tax rate in carson consists of 6% california state sales tax, 0.25% los angeles county sales tax, 0.75% carson tax and 3.25%. The total sales tax rate in carson comprises the california state tax, the.

Carson Sales Tax Rate Is 10.25%.

The current total local sales tax rate in carson, ca is 10.250%. The december 2020 total local sales tax rate was 9.500%. The total sales tax rate in carson comprises the california state tax, the sales tax for los angeles county, and. Click for sales tax rates, carson sales tax calculator, and printable sales tax table from.

547 Rows For A List Of Your Current And Historical Rates, Go To The California City & County Sales & Use Tax Rates Webpage.

Your total sales tax rate is the sum of the california state tax (6.25%), the los angeles. The minimum combined 2025 sales tax rate for carson, california is 10.25%. This is the total of state, county, and city sales tax rates. The sales tax rate in carson, california is 10.25%.

The 10.25% Sales Tax Rate In Carson Consists Of 6% California State Sales Tax, 0.25% Los Angeles County Sales Tax, 0.75% Carson Tax And 3.25%.

This figure is the sum of the rates together on the state, county, city, and special levels. The combined sales tax rate for carson, california is 10.25%. The current sales tax rate in carson, ca is 9.5%.