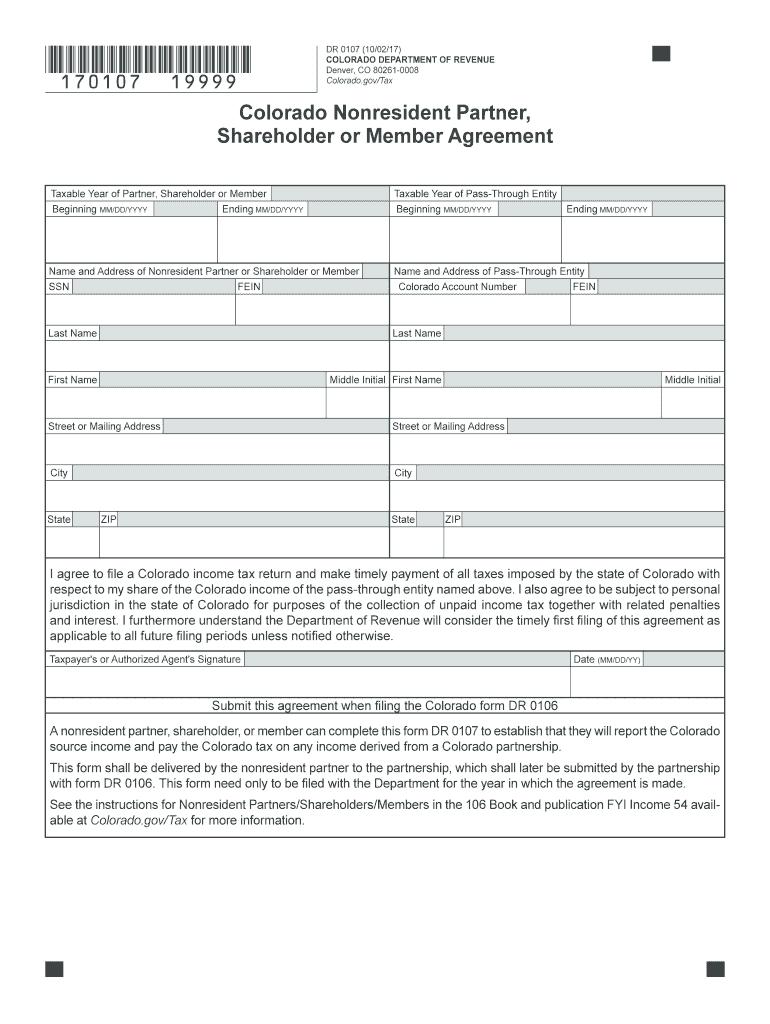

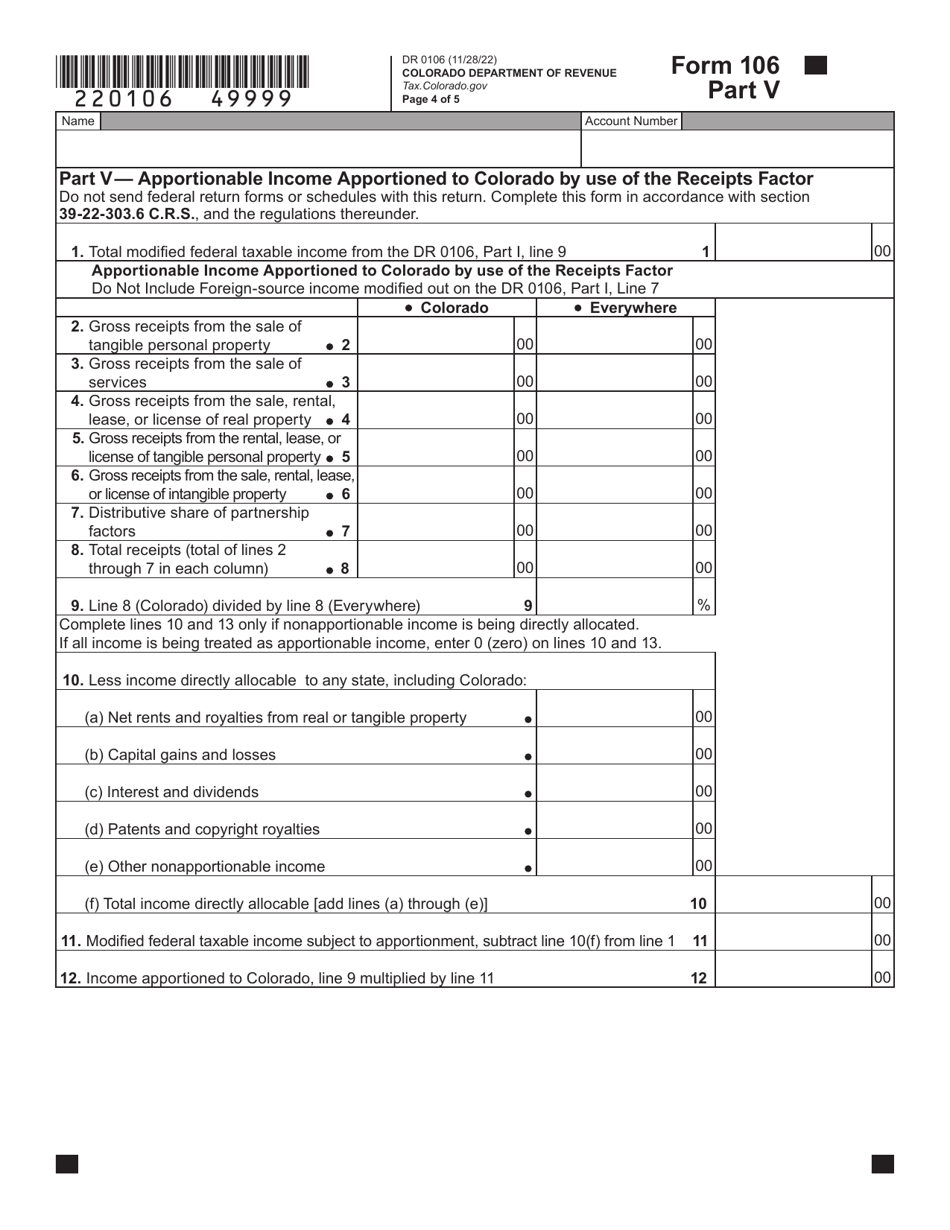

Colorado Form 106 Instructions - If line 23 is greater than line. A nonresident partner or shareholder can complete this form dr 0107 to establish that they will report the colorado source income and pay the. Please read through this guide before. Navigate colorado form 106 with ease by understanding filing requirements, deadlines, and how to avoid common errors for. Federal partnership return of income must file a colorado form 106 if any of the partnership income is from colorado sources. Name of organization (match page 1) c a n or f e i n (match page 1) 31. 106 book instructions this filing guide will assist you with completing your colorado income tax return.

106 book instructions this filing guide will assist you with completing your colorado income tax return. Federal partnership return of income must file a colorado form 106 if any of the partnership income is from colorado sources. Name of organization (match page 1) c a n or f e i n (match page 1) 31. A nonresident partner or shareholder can complete this form dr 0107 to establish that they will report the colorado source income and pay the. If line 23 is greater than line. Please read through this guide before. Navigate colorado form 106 with ease by understanding filing requirements, deadlines, and how to avoid common errors for.

A nonresident partner or shareholder can complete this form dr 0107 to establish that they will report the colorado source income and pay the. If line 23 is greater than line. 106 book instructions this filing guide will assist you with completing your colorado income tax return. Navigate colorado form 106 with ease by understanding filing requirements, deadlines, and how to avoid common errors for. Please read through this guide before. Federal partnership return of income must file a colorado form 106 if any of the partnership income is from colorado sources. Name of organization (match page 1) c a n or f e i n (match page 1) 31.

Colorado Form 106 (Partnership / SCorporation PassThrough Entities

Federal partnership return of income must file a colorado form 106 if any of the partnership income is from colorado sources. A nonresident partner or shareholder can complete this form dr 0107 to establish that they will report the colorado source income and pay the. Please read through this guide before. Navigate colorado form 106 with ease by understanding filing.

Dr 0106k Fill out & sign online DocHub

A nonresident partner or shareholder can complete this form dr 0107 to establish that they will report the colorado source income and pay the. Name of organization (match page 1) c a n or f e i n (match page 1) 31. Please read through this guide before. Navigate colorado form 106 with ease by understanding filing requirements, deadlines, and.

2014 Form CO DoR 106 Fill Online, Printable, Fillable, Blank pdfFiller

A nonresident partner or shareholder can complete this form dr 0107 to establish that they will report the colorado source income and pay the. 106 book instructions this filing guide will assist you with completing your colorado income tax return. If line 23 is greater than line. Federal partnership return of income must file a colorado form 106 if any.

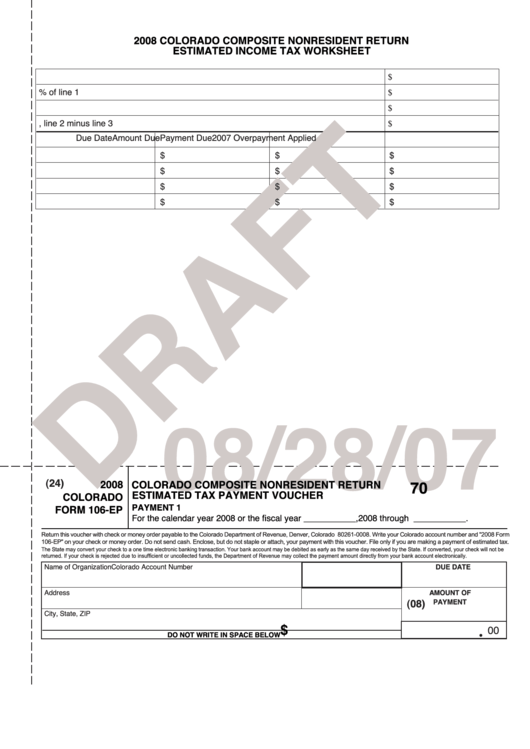

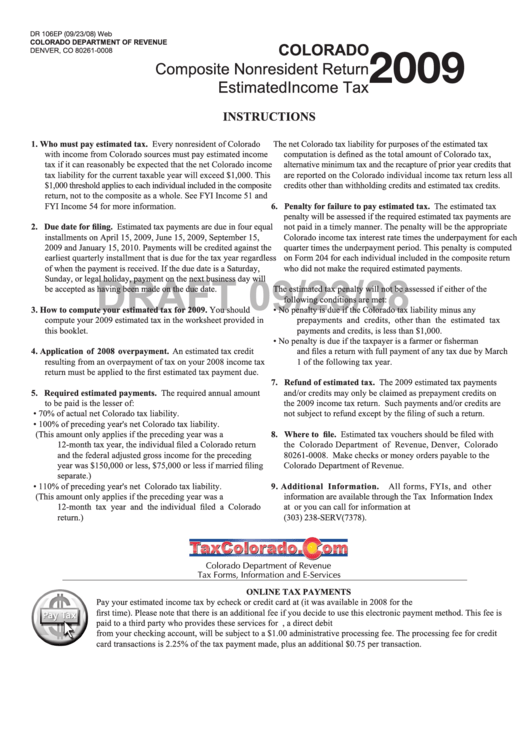

Colorado Form 106Ep Draft Colorado Composite Nonresident Return

Navigate colorado form 106 with ease by understanding filing requirements, deadlines, and how to avoid common errors for. A nonresident partner or shareholder can complete this form dr 0107 to establish that they will report the colorado source income and pay the. Name of organization (match page 1) c a n or f e i n (match page 1) 31..

DD Form 106 DoD Issuances Program Coordination Initiation (Sample

Federal partnership return of income must file a colorado form 106 if any of the partnership income is from colorado sources. A nonresident partner or shareholder can complete this form dr 0107 to establish that they will report the colorado source income and pay the. Navigate colorado form 106 with ease by understanding filing requirements, deadlines, and how to avoid.

Form Cdcr 106 A ≡ Fill Out Printable PDF Forms Online

If line 23 is greater than line. A nonresident partner or shareholder can complete this form dr 0107 to establish that they will report the colorado source income and pay the. Federal partnership return of income must file a colorado form 106 if any of the partnership income is from colorado sources. 106 book instructions this filing guide will assist.

Form 106 (DR0106) 2022 Fill Out, Sign Online and Download Fillable

If line 23 is greater than line. Federal partnership return of income must file a colorado form 106 if any of the partnership income is from colorado sources. Name of organization (match page 1) c a n or f e i n (match page 1) 31. Please read through this guide before. 106 book instructions this filing guide will assist.

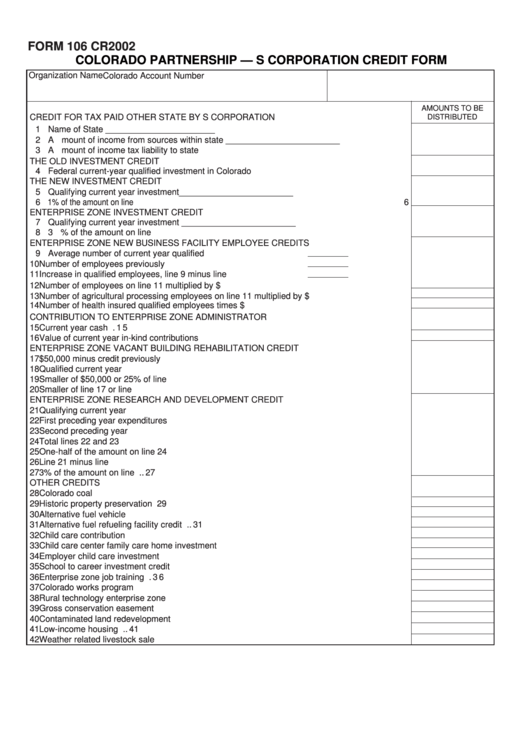

Form 106 Cr Colorado Partnership S Corporation Credit Form 2002

Federal partnership return of income must file a colorado form 106 if any of the partnership income is from colorado sources. If line 23 is greater than line. Please read through this guide before. 106 book instructions this filing guide will assist you with completing your colorado income tax return. A nonresident partner or shareholder can complete this form dr.

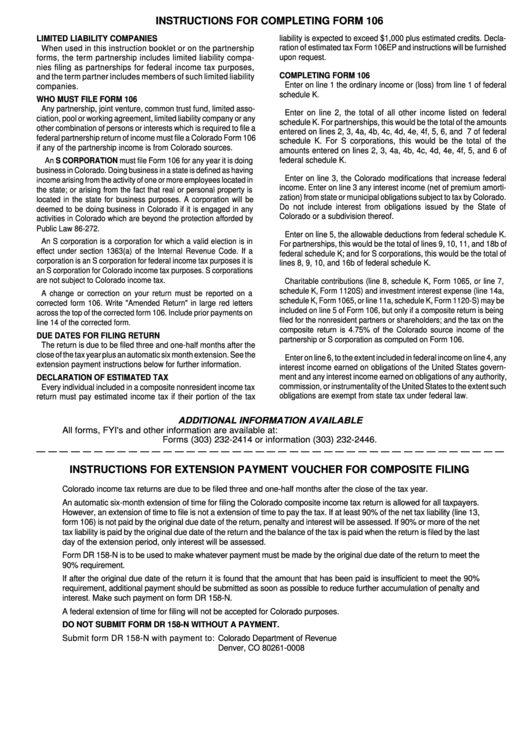

Instructions For Completing Form 106 Colorado printable pdf download

Please read through this guide before. Navigate colorado form 106 with ease by understanding filing requirements, deadlines, and how to avoid common errors for. 106 book instructions this filing guide will assist you with completing your colorado income tax return. If line 23 is greater than line. Name of organization (match page 1) c a n or f e i.

Form Dr 106Ep Draft Colorado Composite Nonresident Return Estimated

Please read through this guide before. Federal partnership return of income must file a colorado form 106 if any of the partnership income is from colorado sources. 106 book instructions this filing guide will assist you with completing your colorado income tax return. A nonresident partner or shareholder can complete this form dr 0107 to establish that they will report.

Federal Partnership Return Of Income Must File A Colorado Form 106 If Any Of The Partnership Income Is From Colorado Sources.

Please read through this guide before. Name of organization (match page 1) c a n or f e i n (match page 1) 31. A nonresident partner or shareholder can complete this form dr 0107 to establish that they will report the colorado source income and pay the. 106 book instructions this filing guide will assist you with completing your colorado income tax return.

Navigate Colorado Form 106 With Ease By Understanding Filing Requirements, Deadlines, And How To Avoid Common Errors For.

If line 23 is greater than line.