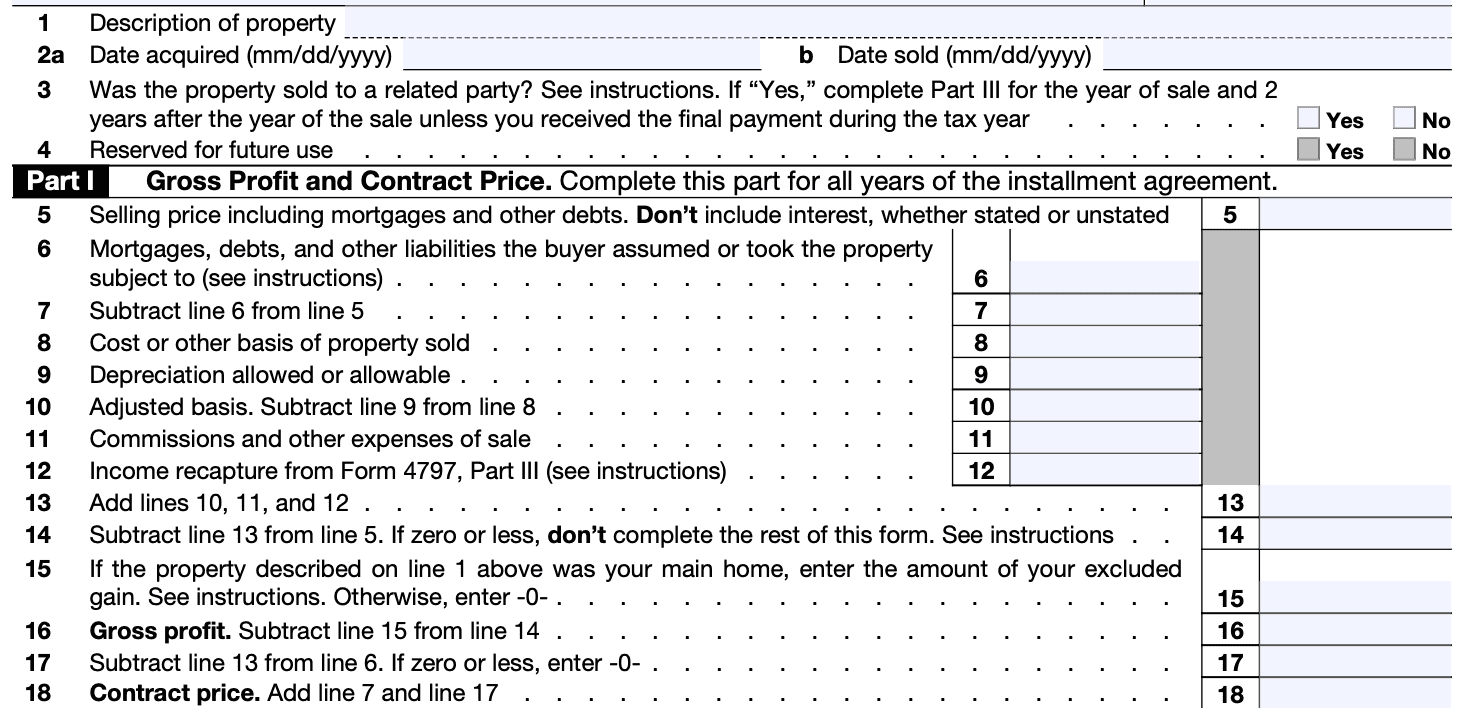

Deferred Obligation Form 6252 K 1 - The description is deferred obligation. Information about form 6252, installment sale income, including recent updates, related forms and instructions on how to file. If i add in that. The form is used to report the sale in the year it. The deferred tax liability on the installment note obligation is $10 million ($50 million × 20%), assuming the transaction is taxed using the. Beginning in tax year 2019, the 6252 part 1 needs to be completed for each year the installment agreement is active. What i have in box 17 is the actual deferred obligation amount still owed to me from the sale of a company in 2021. Use form 6252 to report income from an installment sale under the installment method. Purpose of form use form 6252 to report an installment sale under the installment method. File form 6252 for the year of the disposition.

Purpose of form use form 6252 to report an installment sale under the installment method. The deferred tax liability on the installment note obligation is $10 million ($50 million × 20%), assuming the transaction is taxed using the. Information about form 6252, installment sale income, including recent updates, related forms and instructions on how to file. Beginning in tax year 2019, the 6252 part 1 needs to be completed for each year the installment agreement is active. What i have in box 17 is the actual deferred obligation amount still owed to me from the sale of a company in 2021. The description is deferred obligation. File form 6252 for the year of the disposition. Use form 6252 to report income from an installment sale under the installment method. The form is used to report the sale in the year it. If i add in that.

Beginning in tax year 2019, the 6252 part 1 needs to be completed for each year the installment agreement is active. The form is used to report the sale in the year it. Information about form 6252, installment sale income, including recent updates, related forms and instructions on how to file. What i have in box 17 is the actual deferred obligation amount still owed to me from the sale of a company in 2021. File form 6252 for the year of the disposition. Use form 6252 to report income from an installment sale under the installment method. The description is deferred obligation. If i add in that. Purpose of form use form 6252 to report an installment sale under the installment method. The deferred tax liability on the installment note obligation is $10 million ($50 million × 20%), assuming the transaction is taxed using the.

Form 6252Installment Sale

Information about form 6252, installment sale income, including recent updates, related forms and instructions on how to file. The description is deferred obligation. Beginning in tax year 2019, the 6252 part 1 needs to be completed for each year the installment agreement is active. What i have in box 17 is the actual deferred obligation amount still owed to me.

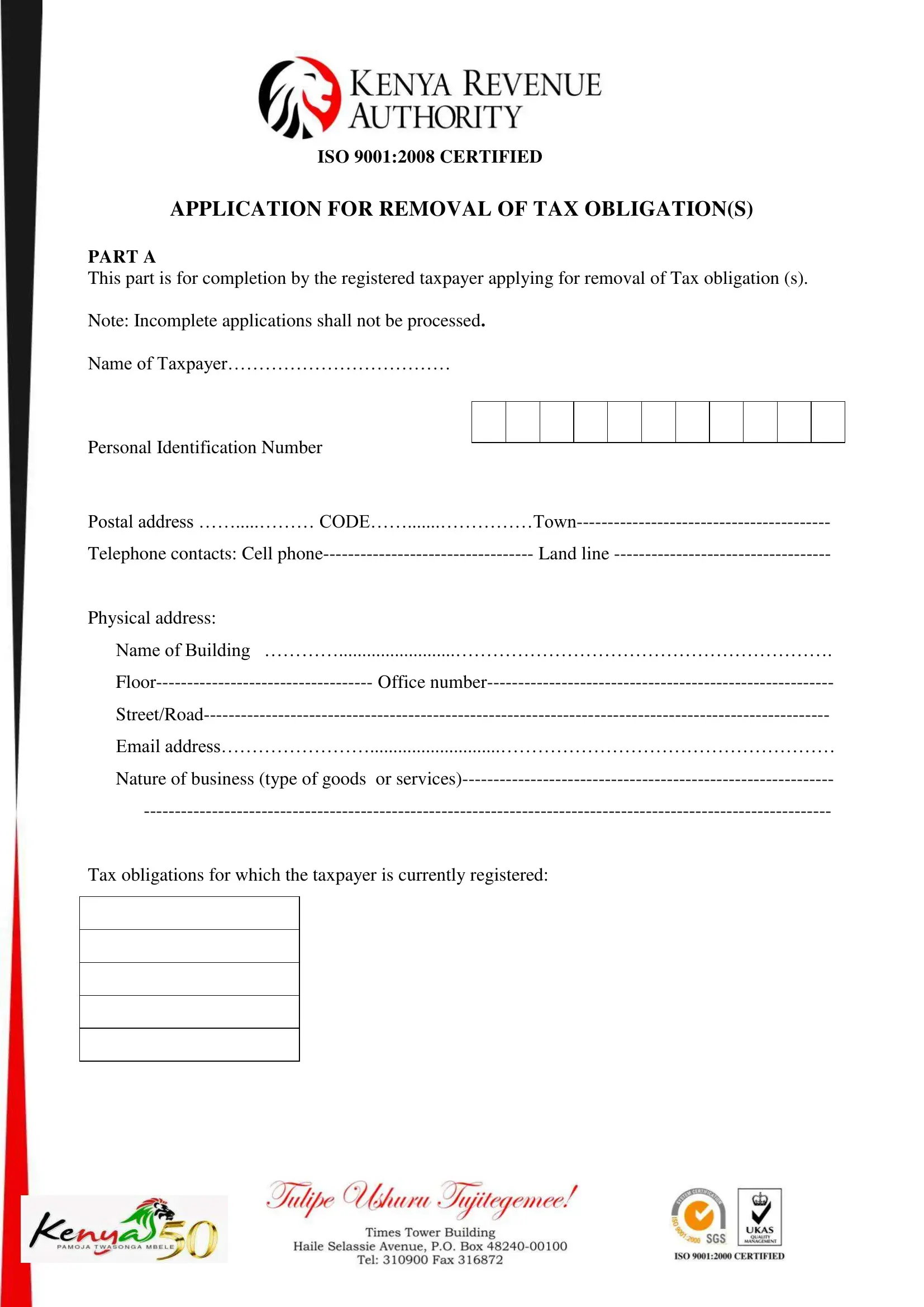

Kra Application Removal Tax Obligation PDF Form FormsPal

Use form 6252 to report income from an installment sale under the installment method. What i have in box 17 is the actual deferred obligation amount still owed to me from the sale of a company in 2021. The description is deferred obligation. If i add in that. The form is used to report the sale in the year it.

Form 6252

The description is deferred obligation. The form is used to report the sale in the year it. If i add in that. What i have in box 17 is the actual deferred obligation amount still owed to me from the sale of a company in 2021. Purpose of form use form 6252 to report an installment sale under the installment.

Form W2, box 12, code G & EE, reporting of SURS 457 deferred

Use form 6252 to report income from an installment sale under the installment method. The form is used to report the sale in the year it. If i add in that. What i have in box 17 is the actual deferred obligation amount still owed to me from the sale of a company in 2021. Information about form 6252, installment.

Form 6252 Installment Sale (2015) Free Download

Information about form 6252, installment sale income, including recent updates, related forms and instructions on how to file. If i add in that. The deferred tax liability on the installment note obligation is $10 million ($50 million × 20%), assuming the transaction is taxed using the. File form 6252 for the year of the disposition. The form is used to.

U.S. TREAS Form treasirs62521992

Information about form 6252, installment sale income, including recent updates, related forms and instructions on how to file. If i add in that. The description is deferred obligation. The form is used to report the sale in the year it. Beginning in tax year 2019, the 6252 part 1 needs to be completed for each year the installment agreement is.

IRS Form 6252 2018 2019 Fillable and Editable PDF Template

Use form 6252 to report income from an installment sale under the installment method. What i have in box 17 is the actual deferred obligation amount still owed to me from the sale of a company in 2021. The form is used to report the sale in the year it. The deferred tax liability on the installment note obligation is.

IRS Form 6252 Instructions Installment Sale

If i add in that. Use form 6252 to report income from an installment sale under the installment method. The description is deferred obligation. Beginning in tax year 2019, the 6252 part 1 needs to be completed for each year the installment agreement is active. The form is used to report the sale in the year it.

Form 6252 Installment Sale

Beginning in tax year 2019, the 6252 part 1 needs to be completed for each year the installment agreement is active. Information about form 6252, installment sale income, including recent updates, related forms and instructions on how to file. File form 6252 for the year of the disposition. If i add in that. What i have in box 17 is.

Form 6252 Installment Sale (2015) Free Download

Information about form 6252, installment sale income, including recent updates, related forms and instructions on how to file. If i add in that. Beginning in tax year 2019, the 6252 part 1 needs to be completed for each year the installment agreement is active. Purpose of form use form 6252 to report an installment sale under the installment method. The.

The Deferred Tax Liability On The Installment Note Obligation Is $10 Million ($50 Million × 20%), Assuming The Transaction Is Taxed Using The.

Beginning in tax year 2019, the 6252 part 1 needs to be completed for each year the installment agreement is active. Information about form 6252, installment sale income, including recent updates, related forms and instructions on how to file. File form 6252 for the year of the disposition. Use form 6252 to report income from an installment sale under the installment method.

Purpose Of Form Use Form 6252 To Report An Installment Sale Under The Installment Method.

What i have in box 17 is the actual deferred obligation amount still owed to me from the sale of a company in 2021. The description is deferred obligation. If i add in that. The form is used to report the sale in the year it.