Depop Tax Form - This has nothing to do with the new law,. Depop partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. If you made more than $400 in 2022 as a self employed individual (meaning depop), you have to report your income in a federal tax return. To report capital gains, you’ll need to file form 8949 and schedule d. We’ve put together some faqs to help you learn more about 1099s, and how to use stripe. Depop sellers may have to pay taxes on their sales.

We’ve put together some faqs to help you learn more about 1099s, and how to use stripe. Depop partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. This has nothing to do with the new law,. Depop sellers may have to pay taxes on their sales. If you made more than $400 in 2022 as a self employed individual (meaning depop), you have to report your income in a federal tax return. To report capital gains, you’ll need to file form 8949 and schedule d.

We’ve put together some faqs to help you learn more about 1099s, and how to use stripe. This has nothing to do with the new law,. If you made more than $400 in 2022 as a self employed individual (meaning depop), you have to report your income in a federal tax return. Depop sellers may have to pay taxes on their sales. To report capital gains, you’ll need to file form 8949 and schedule d. Depop partners with stripe to file 1099 tax forms that summarize your earnings or sales activities.

Depop Review Is It Actually A Trustworthy Site?

Depop sellers may have to pay taxes on their sales. If you made more than $400 in 2022 as a self employed individual (meaning depop), you have to report your income in a federal tax return. We’ve put together some faqs to help you learn more about 1099s, and how to use stripe. To report capital gains, you’ll need to.

Depop Desktop App for Mac, Windows (PC), Linux WebCatalog

To report capital gains, you’ll need to file form 8949 and schedule d. If you made more than $400 in 2022 as a self employed individual (meaning depop), you have to report your income in a federal tax return. This has nothing to do with the new law,. Depop partners with stripe to file 1099 tax forms that summarize your.

What Is Depop? Everything You Need to Know About the Resale App

If you made more than $400 in 2022 as a self employed individual (meaning depop), you have to report your income in a federal tax return. Depop sellers may have to pay taxes on their sales. To report capital gains, you’ll need to file form 8949 and schedule d. Depop partners with stripe to file 1099 tax forms that summarize.

Depop Review Is Depop Legit?

If you made more than $400 in 2022 as a self employed individual (meaning depop), you have to report your income in a federal tax return. Depop sellers may have to pay taxes on their sales. To report capital gains, you’ll need to file form 8949 and schedule d. This has nothing to do with the new law,. Depop partners.

Prints Depop

This has nothing to do with the new law,. If you made more than $400 in 2022 as a self employed individual (meaning depop), you have to report your income in a federal tax return. Depop partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. We’ve put together some faqs to help you learn.

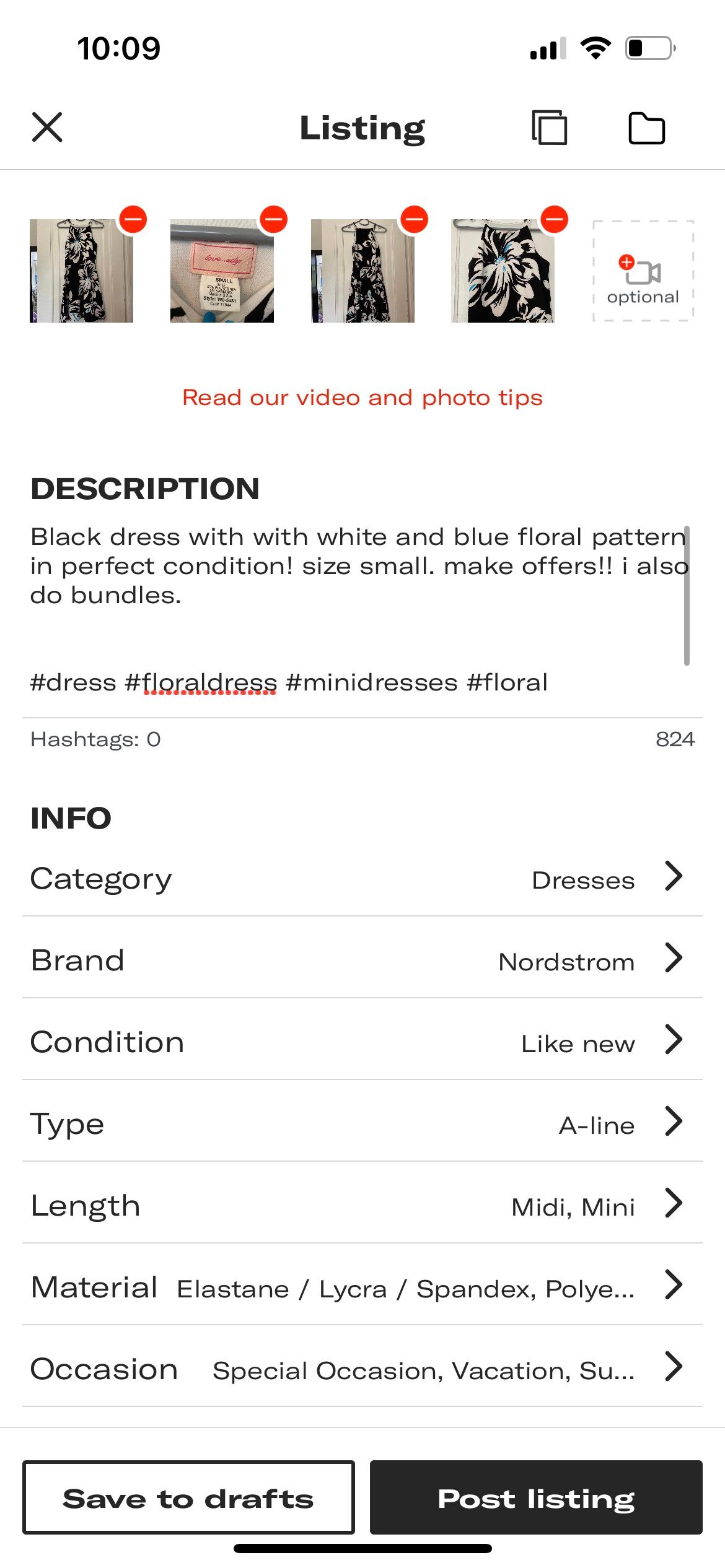

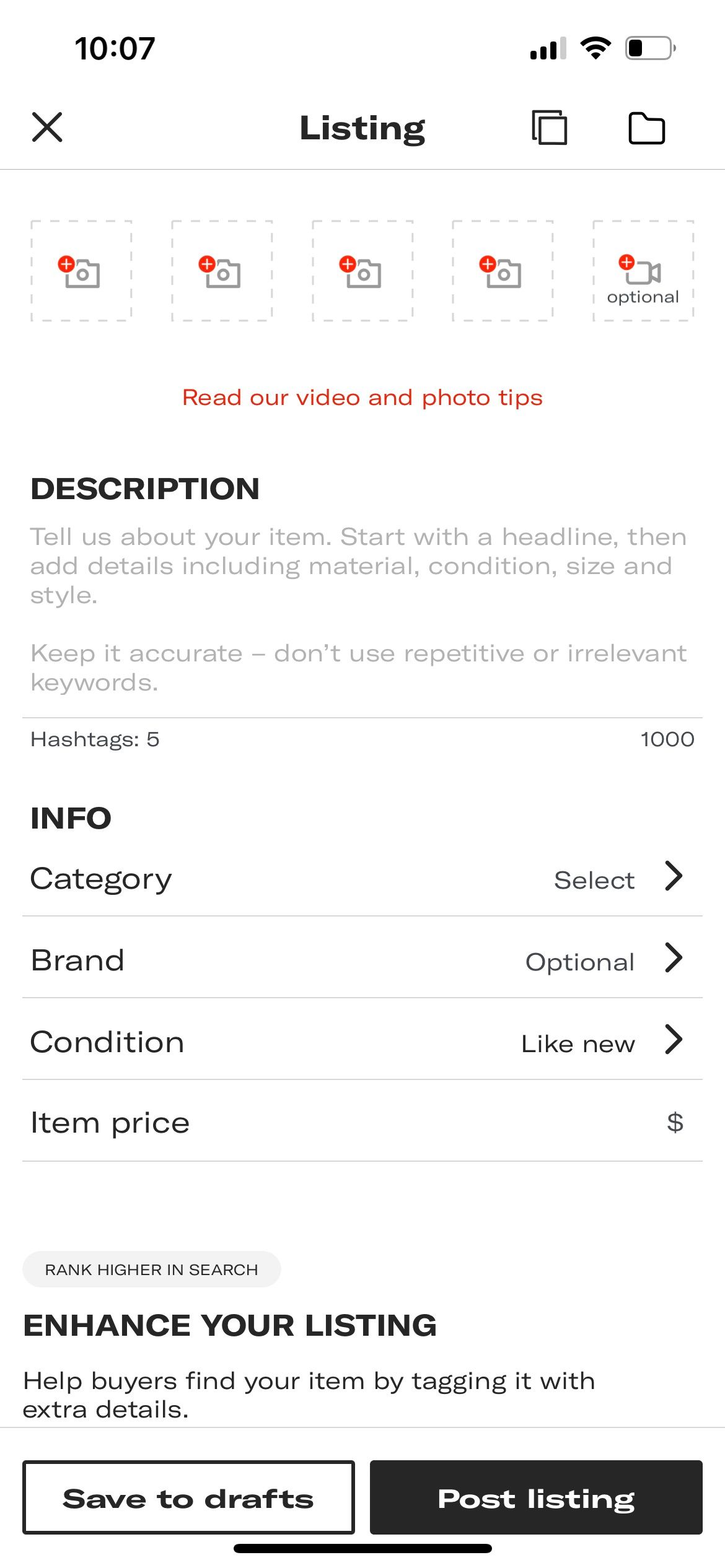

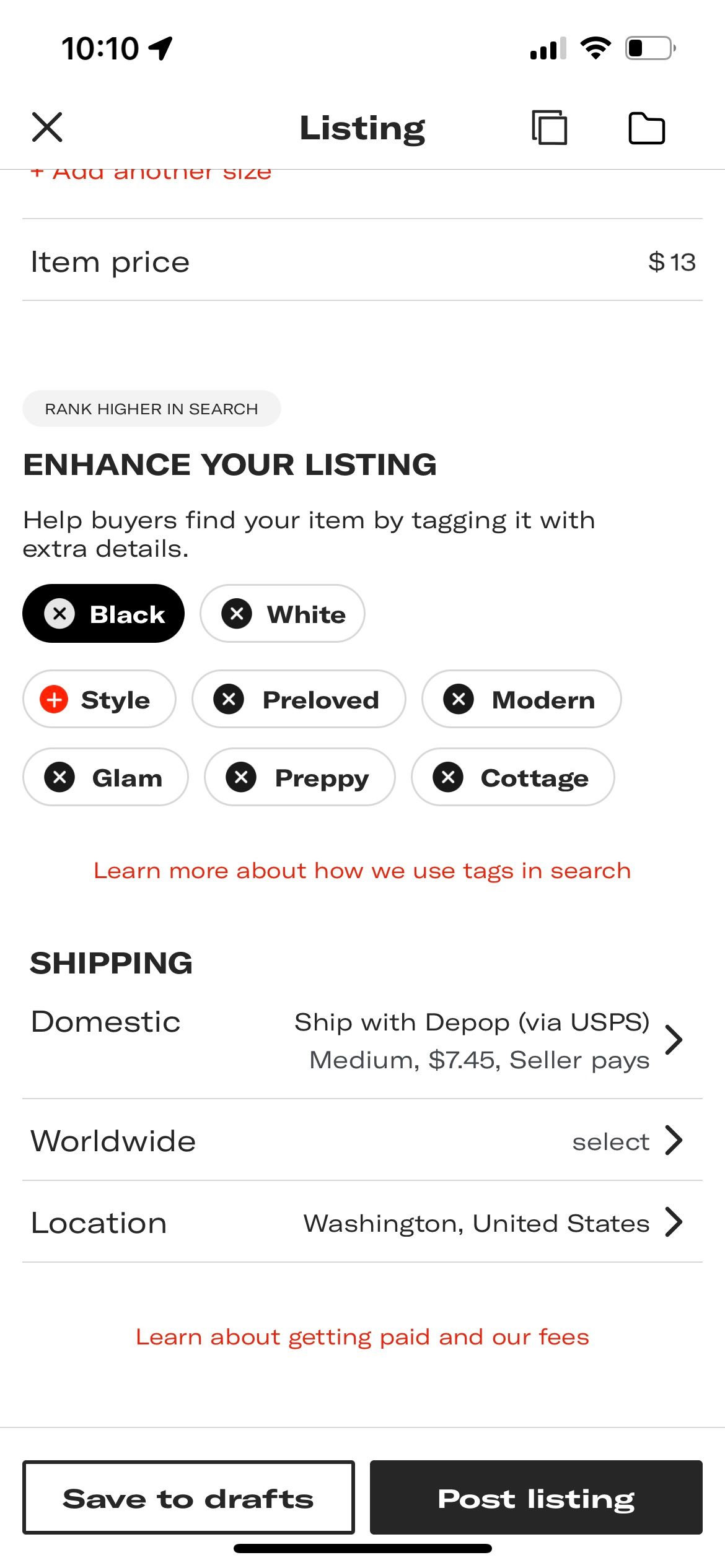

DepopCreatingaListing.jpeg

If you made more than $400 in 2022 as a self employed individual (meaning depop), you have to report your income in a federal tax return. To report capital gains, you’ll need to file form 8949 and schedule d. This has nothing to do with the new law,. We’ve put together some faqs to help you learn more about 1099s,.

Depop

If you made more than $400 in 2022 as a self employed individual (meaning depop), you have to report your income in a federal tax return. Depop partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. This has nothing to do with the new law,. To report capital gains, you’ll need to file form.

State Sales Tax what’s the deal? Depop Blog

This has nothing to do with the new law,. To report capital gains, you’ll need to file form 8949 and schedule d. Depop partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. We’ve put together some faqs to help you learn more about 1099s, and how to use stripe. Depop sellers may have to.

Depop

Depop sellers may have to pay taxes on their sales. We’ve put together some faqs to help you learn more about 1099s, and how to use stripe. This has nothing to do with the new law,. If you made more than $400 in 2022 as a self employed individual (meaning depop), you have to report your income in a federal.

What Is Depop? Everything You Need to Know About the Resale App

This has nothing to do with the new law,. Depop partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. If you made more than $400 in 2022 as a self employed individual (meaning depop), you have to report your income in a federal tax return. To report capital gains, you’ll need to file form.

This Has Nothing To Do With The New Law,.

If you made more than $400 in 2022 as a self employed individual (meaning depop), you have to report your income in a federal tax return. Depop sellers may have to pay taxes on their sales. Depop partners with stripe to file 1099 tax forms that summarize your earnings or sales activities. To report capital gains, you’ll need to file form 8949 and schedule d.