Do You Have To Pay Social Security On 1099 - Do i also pay for state and federal taxes all the. Income you earn on a 1099 is not subject to tax withholding, including the social security insurance tax. However, this doesn't mean you don't have to. In 2024, however, if your wages are $100,000, and you have $69,600 in net earnings from a business, you don’t pay dual social security taxes on.

Income you earn on a 1099 is not subject to tax withholding, including the social security insurance tax. Do i also pay for state and federal taxes all the. In 2024, however, if your wages are $100,000, and you have $69,600 in net earnings from a business, you don’t pay dual social security taxes on. However, this doesn't mean you don't have to.

However, this doesn't mean you don't have to. In 2024, however, if your wages are $100,000, and you have $69,600 in net earnings from a business, you don’t pay dual social security taxes on. Do i also pay for state and federal taxes all the. Income you earn on a 1099 is not subject to tax withholding, including the social security insurance tax.

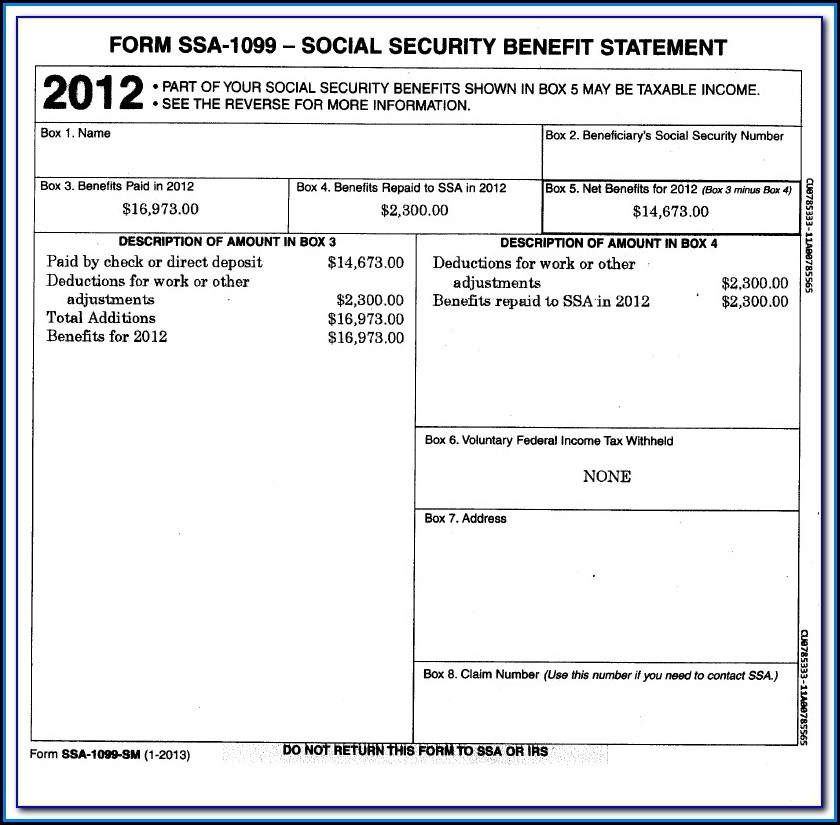

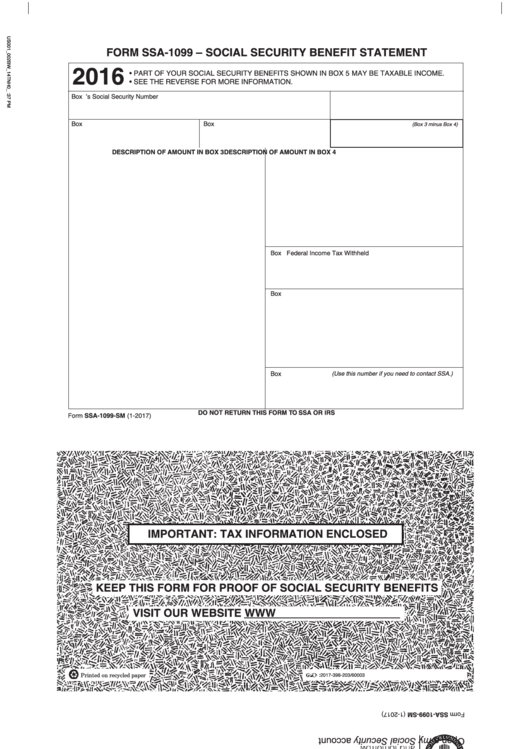

Get Social Security 1099 Form Form Resume Examples o7Y3xWwVBN

In 2024, however, if your wages are $100,000, and you have $69,600 in net earnings from a business, you don’t pay dual social security taxes on. Income you earn on a 1099 is not subject to tax withholding, including the social security insurance tax. However, this doesn't mean you don't have to. Do i also pay for state and federal.

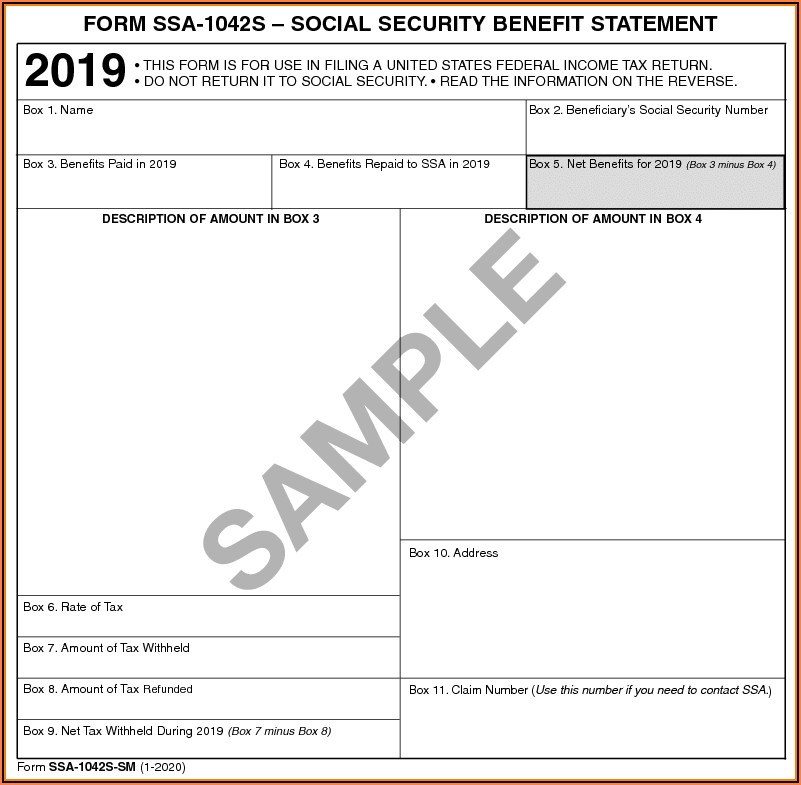

Social Security 1099 Form Pdf Form Resume Examples qb1VND61R2

In 2024, however, if your wages are $100,000, and you have $69,600 in net earnings from a business, you don’t pay dual social security taxes on. Do i also pay for state and federal taxes all the. However, this doesn't mean you don't have to. Income you earn on a 1099 is not subject to tax withholding, including the social.

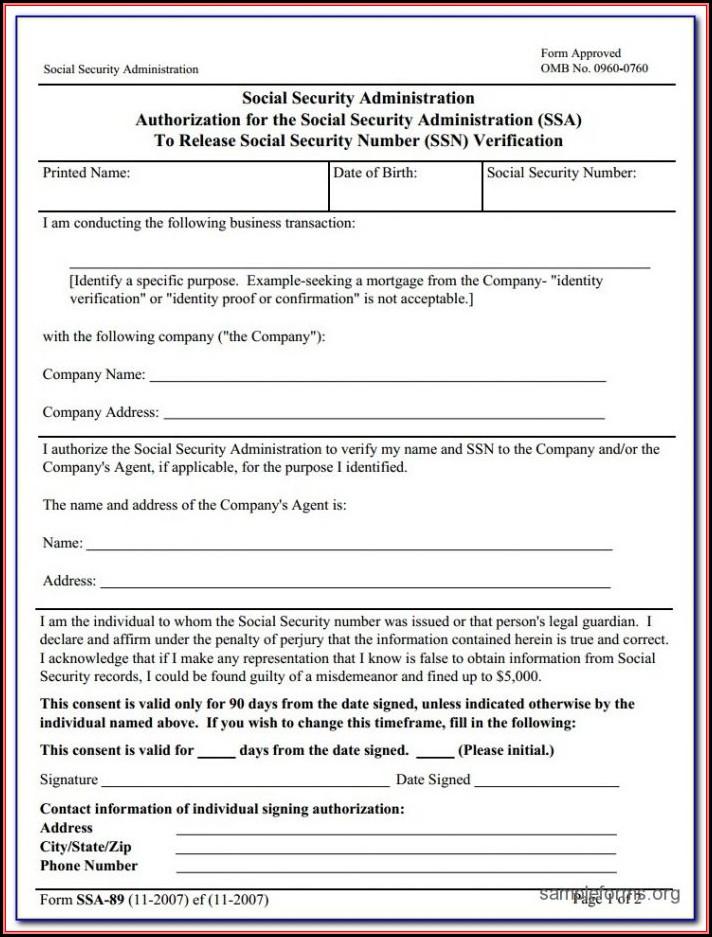

Social Security Form 1099 R Form Resume Examples 1ZV8a77323

Income you earn on a 1099 is not subject to tax withholding, including the social security insurance tax. Do i also pay for state and federal taxes all the. However, this doesn't mean you don't have to. In 2024, however, if your wages are $100,000, and you have $69,600 in net earnings from a business, you don’t pay dual social.

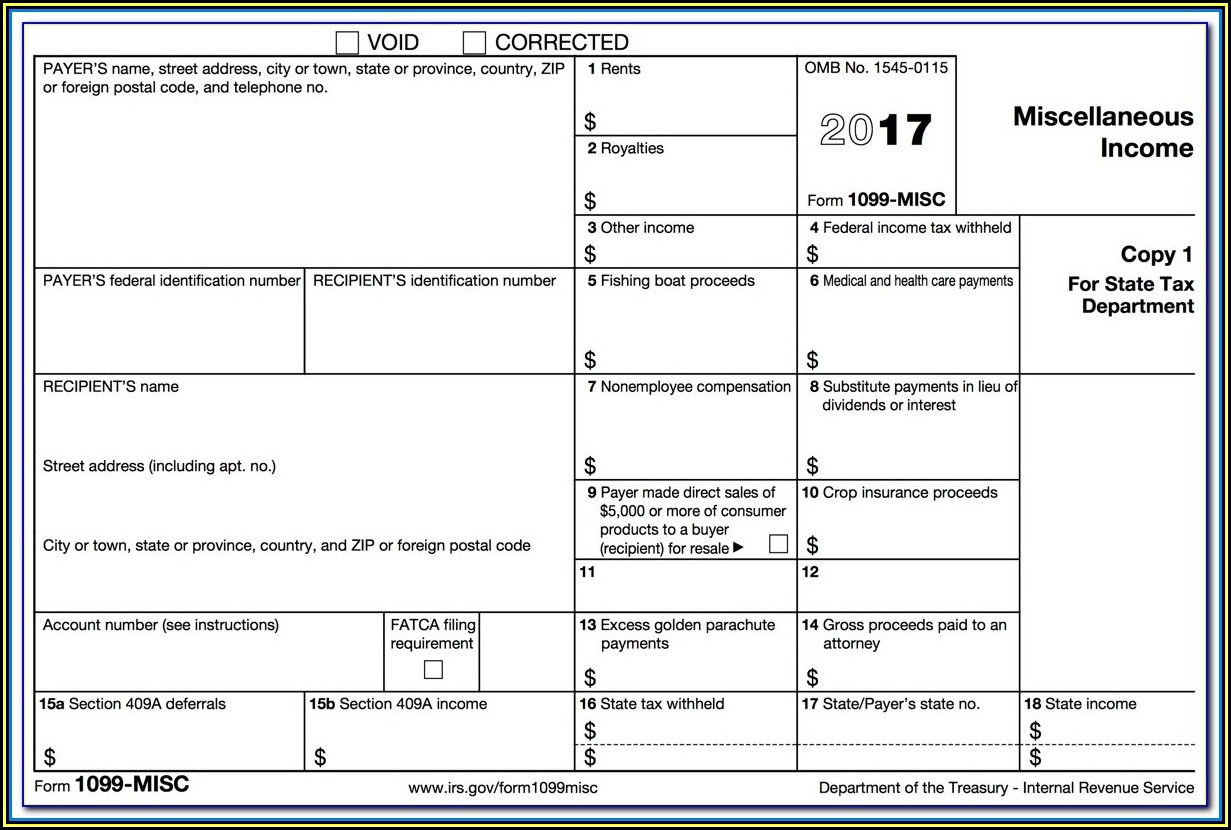

Social Security 1099 Form For Taxes Form Resume Examples 9x8rbNZ8dR

Do i also pay for state and federal taxes all the. However, this doesn't mean you don't have to. Income you earn on a 1099 is not subject to tax withholding, including the social security insurance tax. In 2024, however, if your wages are $100,000, and you have $69,600 in net earnings from a business, you don’t pay dual social.

Non Social Security 1099 Form Form Resume Examples 1ZV8gPEY3X

Income you earn on a 1099 is not subject to tax withholding, including the social security insurance tax. In 2024, however, if your wages are $100,000, and you have $69,600 in net earnings from a business, you don’t pay dual social security taxes on. Do i also pay for state and federal taxes all the. However, this doesn't mean you.

Social Security Administration (ssa) 1099 Form Form Resume Examples

Do i also pay for state and federal taxes all the. Income you earn on a 1099 is not subject to tax withholding, including the social security insurance tax. However, this doesn't mean you don't have to. In 2024, however, if your wages are $100,000, and you have $69,600 in net earnings from a business, you don’t pay dual social.

When Are Social Security 1099 Forms Mailed Form Resume Examples

Do i also pay for state and federal taxes all the. In 2024, however, if your wages are $100,000, and you have $69,600 in net earnings from a business, you don’t pay dual social security taxes on. However, this doesn't mean you don't have to. Income you earn on a 1099 is not subject to tax withholding, including the social.

Form Ssa1099 Social Security Benefit Statement Social Security

Income you earn on a 1099 is not subject to tax withholding, including the social security insurance tax. However, this doesn't mean you don't have to. Do i also pay for state and federal taxes all the. In 2024, however, if your wages are $100,000, and you have $69,600 in net earnings from a business, you don’t pay dual social.

Social Security Form 1099 Sm Form Resume Examples Kw9kJaM2JN

In 2024, however, if your wages are $100,000, and you have $69,600 in net earnings from a business, you don’t pay dual social security taxes on. However, this doesn't mean you don't have to. Income you earn on a 1099 is not subject to tax withholding, including the social security insurance tax. Do i also pay for state and federal.

Social Security 1099 Form Pdf Form Resume Examples qb1VND61R2

However, this doesn't mean you don't have to. In 2024, however, if your wages are $100,000, and you have $69,600 in net earnings from a business, you don’t pay dual social security taxes on. Do i also pay for state and federal taxes all the. Income you earn on a 1099 is not subject to tax withholding, including the social.

However, This Doesn't Mean You Don't Have To.

In 2024, however, if your wages are $100,000, and you have $69,600 in net earnings from a business, you don’t pay dual social security taxes on. Do i also pay for state and federal taxes all the. Income you earn on a 1099 is not subject to tax withholding, including the social security insurance tax.