Eic Form 15112 - You should probably do that. Mail the signed form 15112 in the envelope provided. If any of the boxes in. To claim the earned income tax credit (eitc), you must qualify for the credit and file a federal tax return. If you are not eligible for. The irs cp27 notice informs taxpayers they may be eligible for the earned income credit (eic) but did not claim it on their. Sign and date form 15112; Often, the irs attaches form 15112 to the notice cp27 for you to fill out and return to them. You must file form 1040, u.s.

The irs cp27 notice informs taxpayers they may be eligible for the earned income credit (eic) but did not claim it on their. You should probably do that. Sign and date form 15112; Mail the signed form 15112 in the envelope provided. If you are not eligible for. You must file form 1040, u.s. Often, the irs attaches form 15112 to the notice cp27 for you to fill out and return to them. If any of the boxes in. To claim the earned income tax credit (eitc), you must qualify for the credit and file a federal tax return.

The irs cp27 notice informs taxpayers they may be eligible for the earned income credit (eic) but did not claim it on their. Often, the irs attaches form 15112 to the notice cp27 for you to fill out and return to them. You must file form 1040, u.s. If you are not eligible for. Sign and date form 15112; Mail the signed form 15112 in the envelope provided. If any of the boxes in. To claim the earned income tax credit (eitc), you must qualify for the credit and file a federal tax return. You should probably do that.

IRS Form 15112 walkthrough (Earned Credit CP27) YouTube

If any of the boxes in. If you are not eligible for. You must file form 1040, u.s. Mail the signed form 15112 in the envelope provided. Sign and date form 15112;

Fillable Online Form 15112 instructions Fax Email Print pdfFiller

You should probably do that. The irs cp27 notice informs taxpayers they may be eligible for the earned income credit (eic) but did not claim it on their. Sign and date form 15112; Mail the signed form 15112 in the envelope provided. You must file form 1040, u.s.

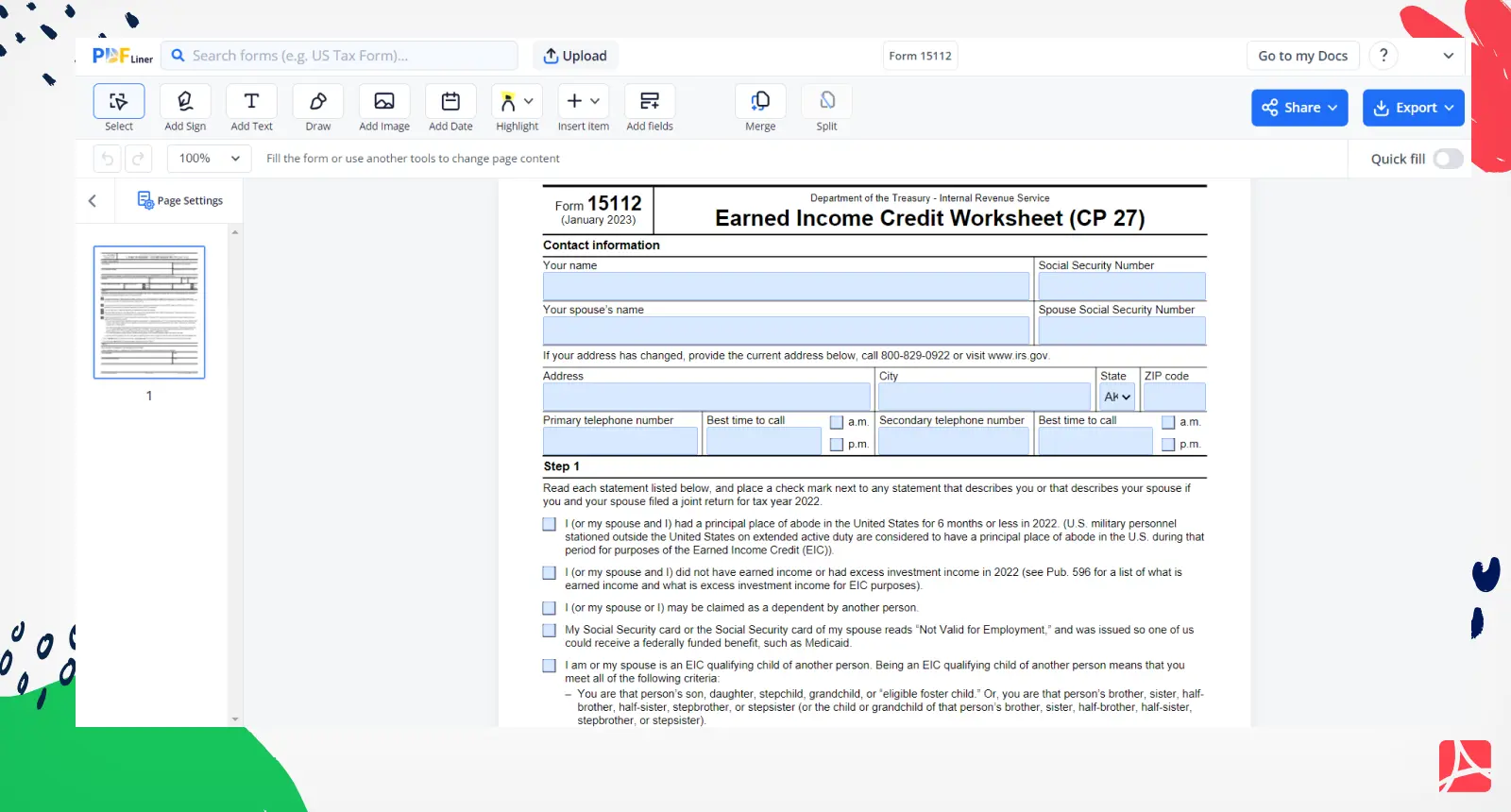

Fillable Form 15112, sign form online — PDFliner

You must file form 1040, u.s. Mail the signed form 15112 in the envelope provided. You should probably do that. Often, the irs attaches form 15112 to the notice cp27 for you to fill out and return to them. If you are not eligible for.

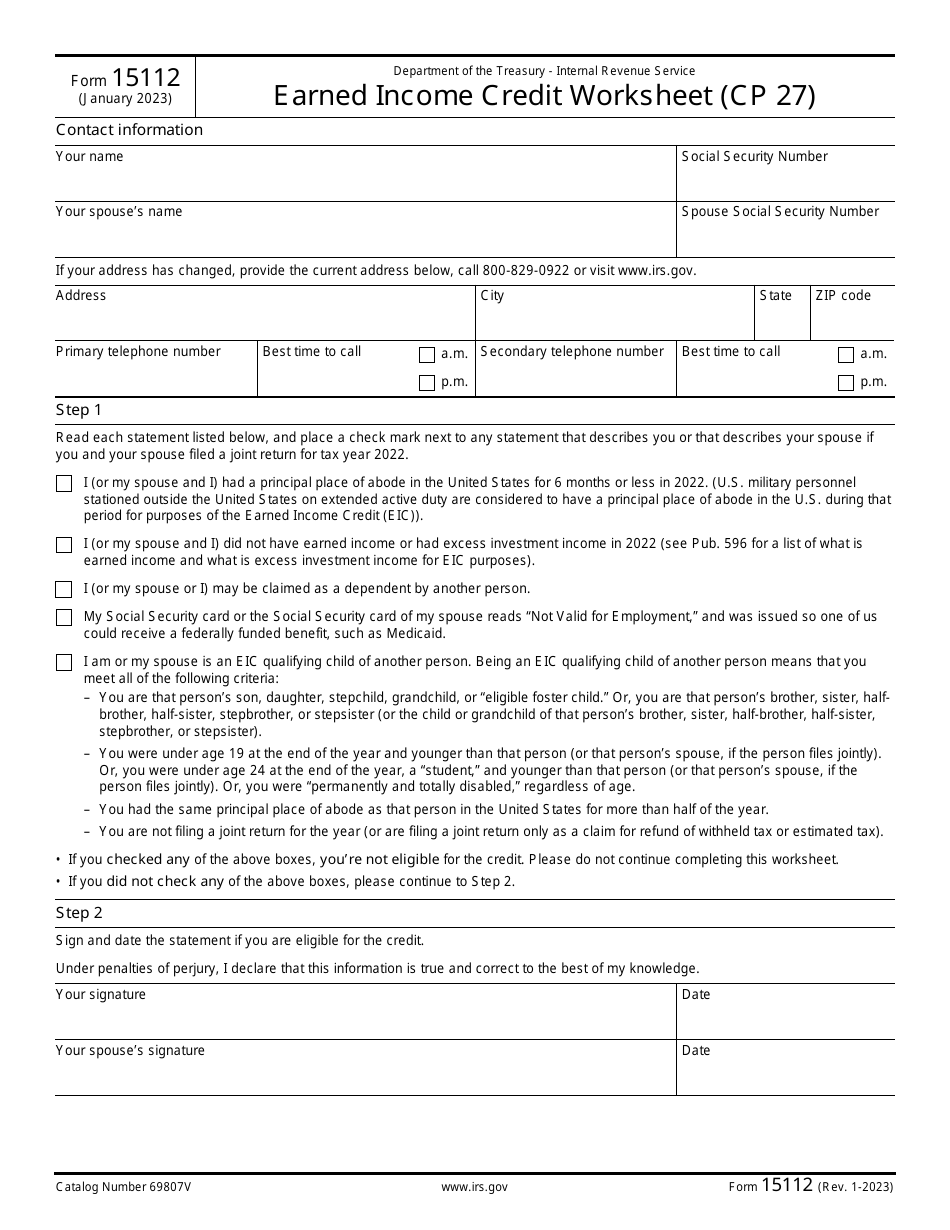

IRS Form 15112 Download Fillable PDF or Fill Online Earned

Sign and date form 15112; You should probably do that. Mail the signed form 15112 in the envelope provided. If you are not eligible for. The irs cp27 notice informs taxpayers they may be eligible for the earned income credit (eic) but did not claim it on their.

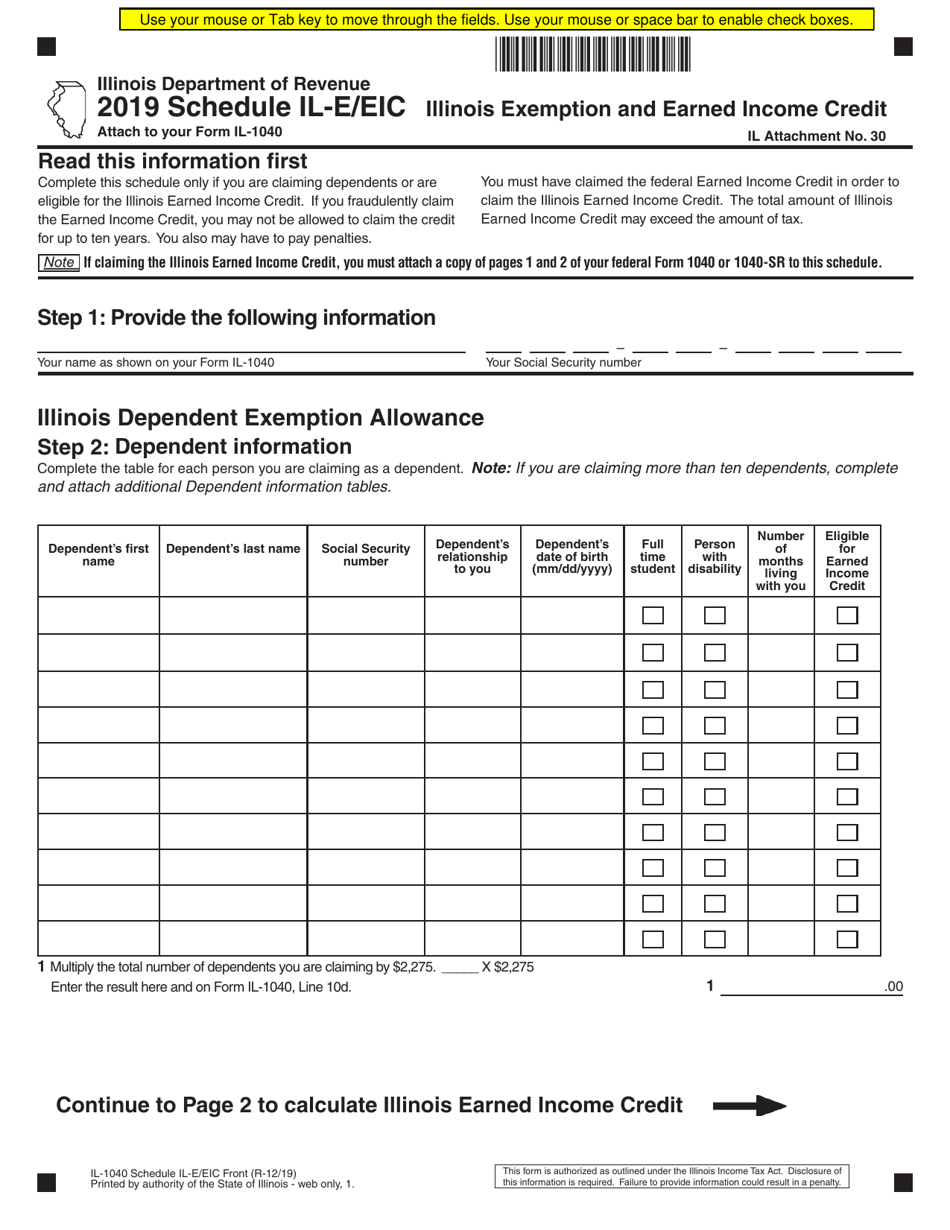

Form IL1040 Schedule ILE/EIC 2019 Fill Out, Sign Online and

If you are not eligible for. Sign and date form 15112; You must file form 1040, u.s. Mail the signed form 15112 in the envelope provided. If any of the boxes in.

Help Form 15112 EIC CP27 r/IRS

The irs cp27 notice informs taxpayers they may be eligible for the earned income credit (eic) but did not claim it on their. If any of the boxes in. You should probably do that. Sign and date form 15112; To claim the earned income tax credit (eitc), you must qualify for the credit and file a federal tax return.

IRS Form 15112 Instructions EIC Worksheet (CP27)

Often, the irs attaches form 15112 to the notice cp27 for you to fill out and return to them. Sign and date form 15112; If you are not eligible for. You must file form 1040, u.s. You should probably do that.

Earned Credit Table 2018 Pdf

You should probably do that. Often, the irs attaches form 15112 to the notice cp27 for you to fill out and return to them. If you are not eligible for. Sign and date form 15112; The irs cp27 notice informs taxpayers they may be eligible for the earned income credit (eic) but did not claim it on their.

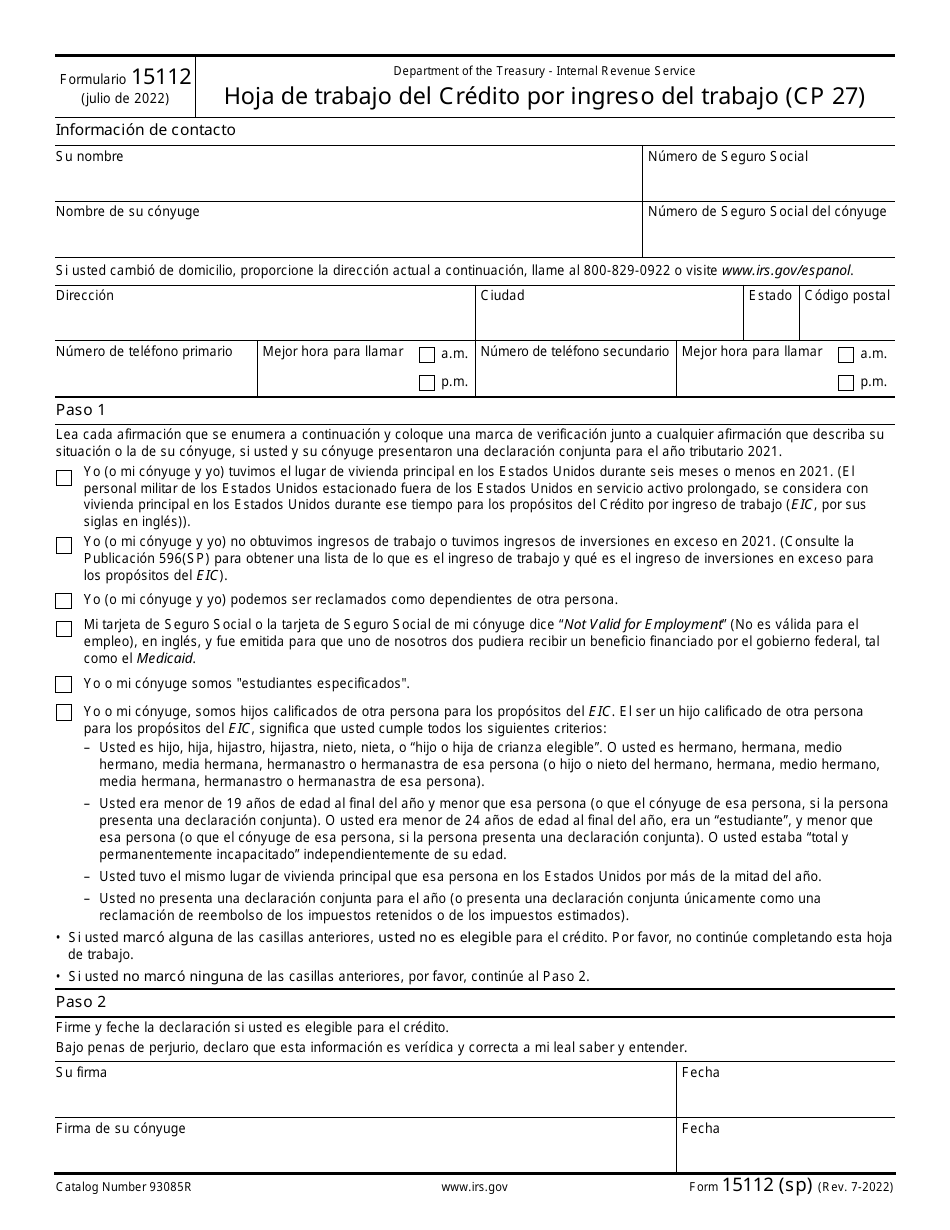

IRS Formulario 15112 Fill Out, Sign Online and Download Fillable PDF

If you are not eligible for. Mail the signed form 15112 in the envelope provided. To claim the earned income tax credit (eitc), you must qualify for the credit and file a federal tax return. The irs cp27 notice informs taxpayers they may be eligible for the earned income credit (eic) but did not claim it on their. Sign and.

If You Are Not Eligible For.

The irs cp27 notice informs taxpayers they may be eligible for the earned income credit (eic) but did not claim it on their. If any of the boxes in. To claim the earned income tax credit (eitc), you must qualify for the credit and file a federal tax return. You must file form 1040, u.s.

Mail The Signed Form 15112 In The Envelope Provided.

Often, the irs attaches form 15112 to the notice cp27 for you to fill out and return to them. You should probably do that. Sign and date form 15112;