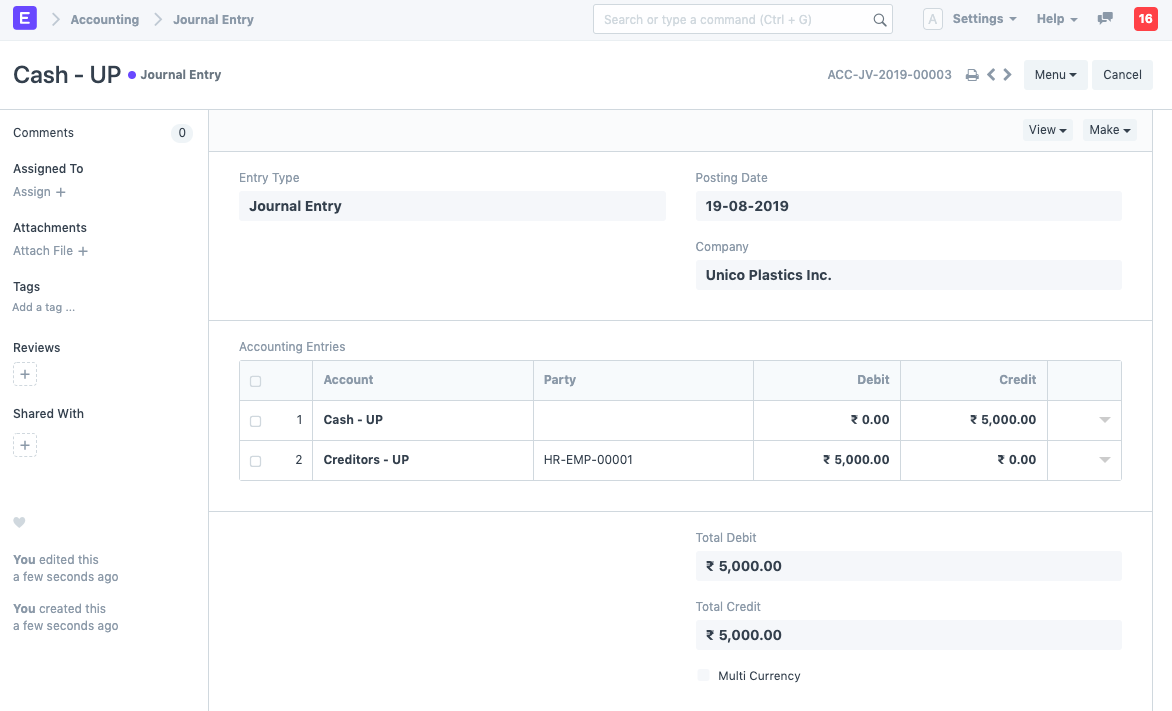

Employee Advance Account - Advance to employees can be recorded under any of the account heads as deemed suitable by the business. As such, it is recorded as a current asset in the company's balance sheet. How do i record an advance to an employee and the deduction? These account heads are most likely to be: In other words, the company is the. These loans are extended with. Learn how to pay an advance to your employees in quickbooks online payroll and quickbooks desktop payroll. A cash advance to an employee is usually a temporary loan by a company to an employee. If you need to loan your employees money in a pinch, you can give. There may not be a.

These account heads are most likely to be: A cash advance to an employee is usually a temporary loan by a company to an employee. Advance to employees can be recorded under any of the account heads as deemed suitable by the business. If you need to loan your employees money in a pinch, you can give. These loans are extended with. As such, it is recorded as a current asset in the company's balance sheet. Learn how to pay an advance to your employees in quickbooks online payroll and quickbooks desktop payroll. There may not be a. In other words, the company is the. How do i record an advance to an employee and the deduction?

In other words, the company is the. These loans are extended with. These account heads are most likely to be: If you need to loan your employees money in a pinch, you can give. As such, it is recorded as a current asset in the company's balance sheet. There may not be a. Learn how to pay an advance to your employees in quickbooks online payroll and quickbooks desktop payroll. Advance to employees can be recorded under any of the account heads as deemed suitable by the business. How do i record an advance to an employee and the deduction? A cash advance to an employee is usually a temporary loan by a company to an employee.

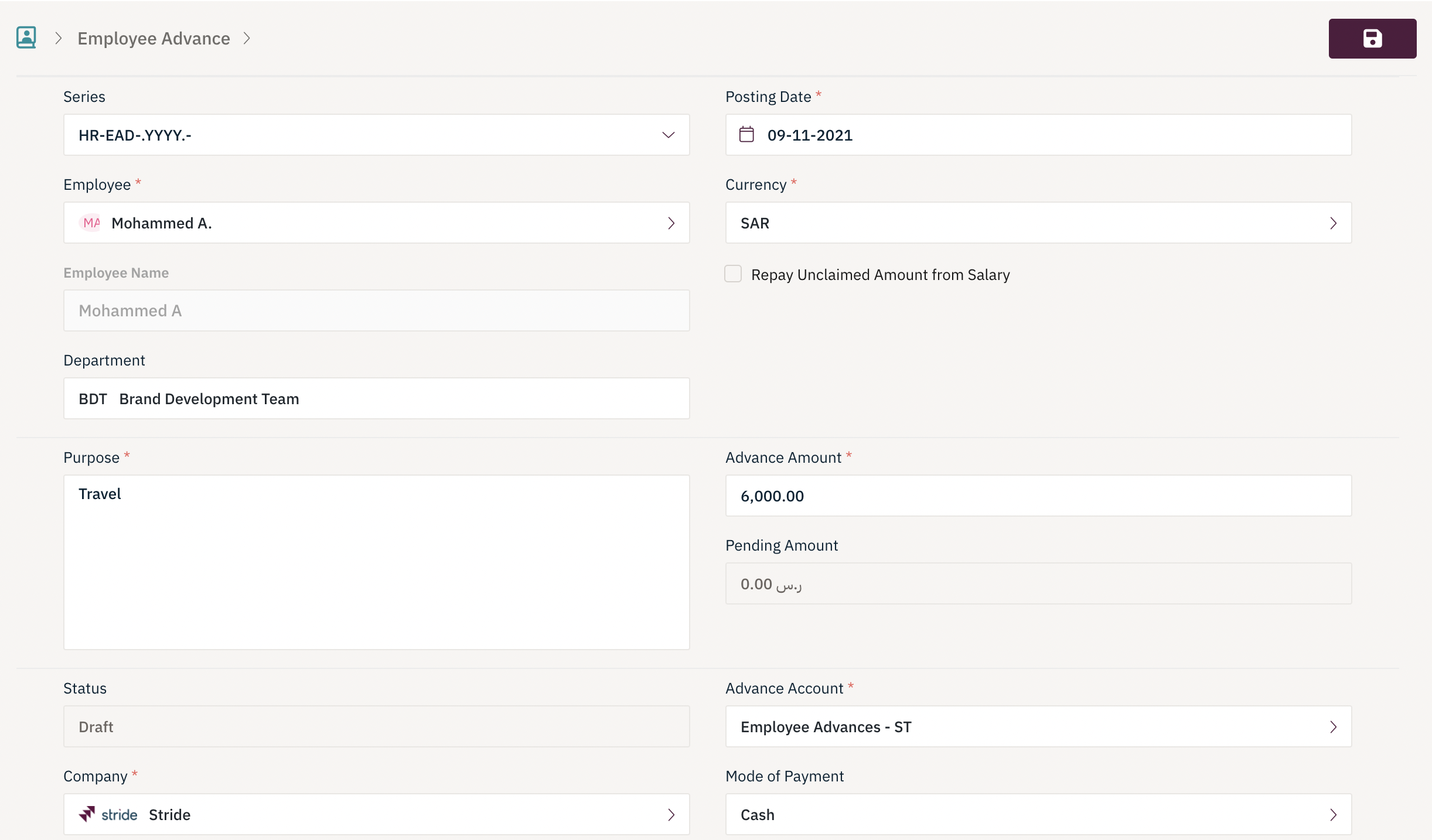

Employee Advance

How do i record an advance to an employee and the deduction? If you need to loan your employees money in a pinch, you can give. These loans are extended with. There may not be a. Learn how to pay an advance to your employees in quickbooks online payroll and quickbooks desktop payroll.

Employee Advance

In other words, the company is the. These account heads are most likely to be: How do i record an advance to an employee and the deduction? A cash advance to an employee is usually a temporary loan by a company to an employee. These loans are extended with.

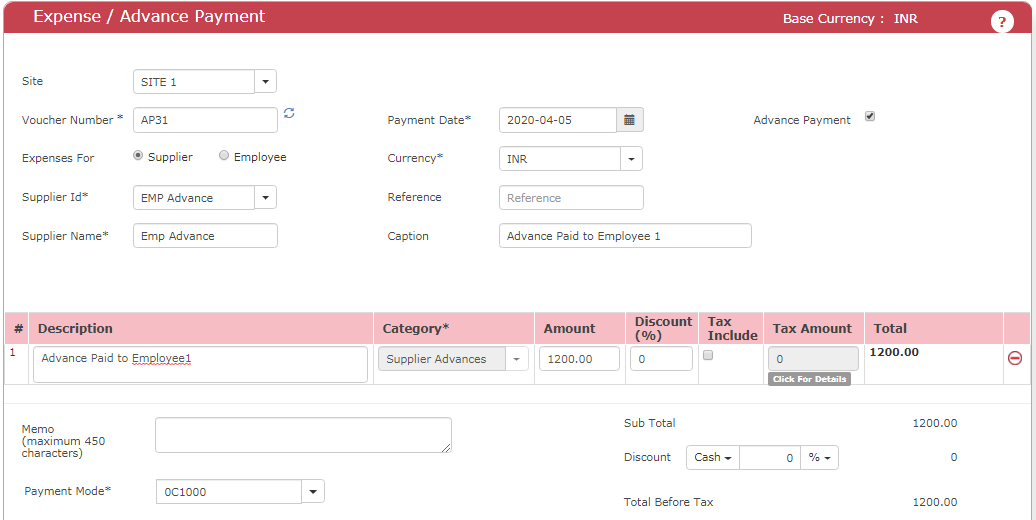

Employee Advance SuperSuite

In other words, the company is the. If you need to loan your employees money in a pinch, you can give. Learn how to pay an advance to your employees in quickbooks online payroll and quickbooks desktop payroll. Advance to employees can be recorded under any of the account heads as deemed suitable by the business. There may not be.

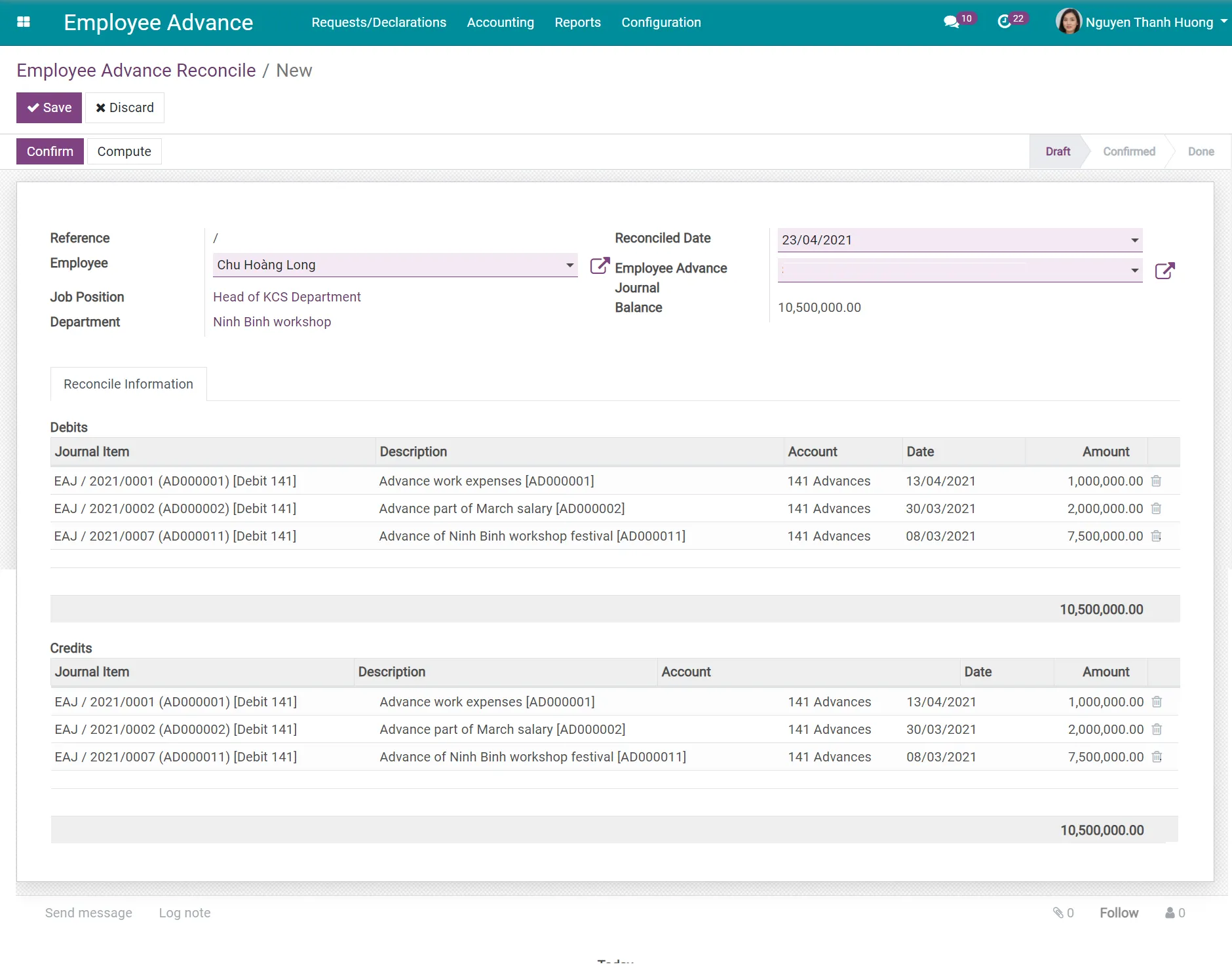

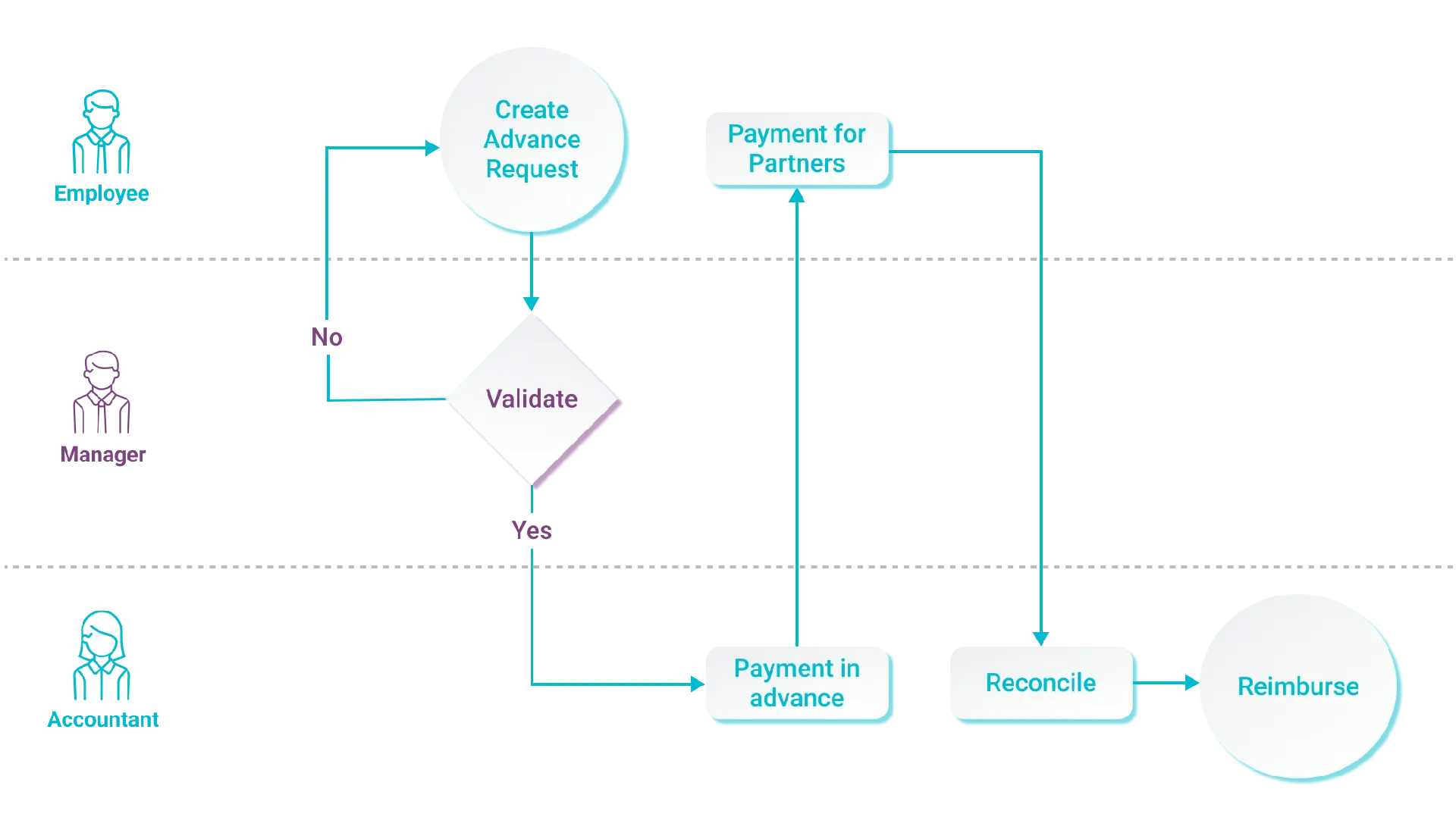

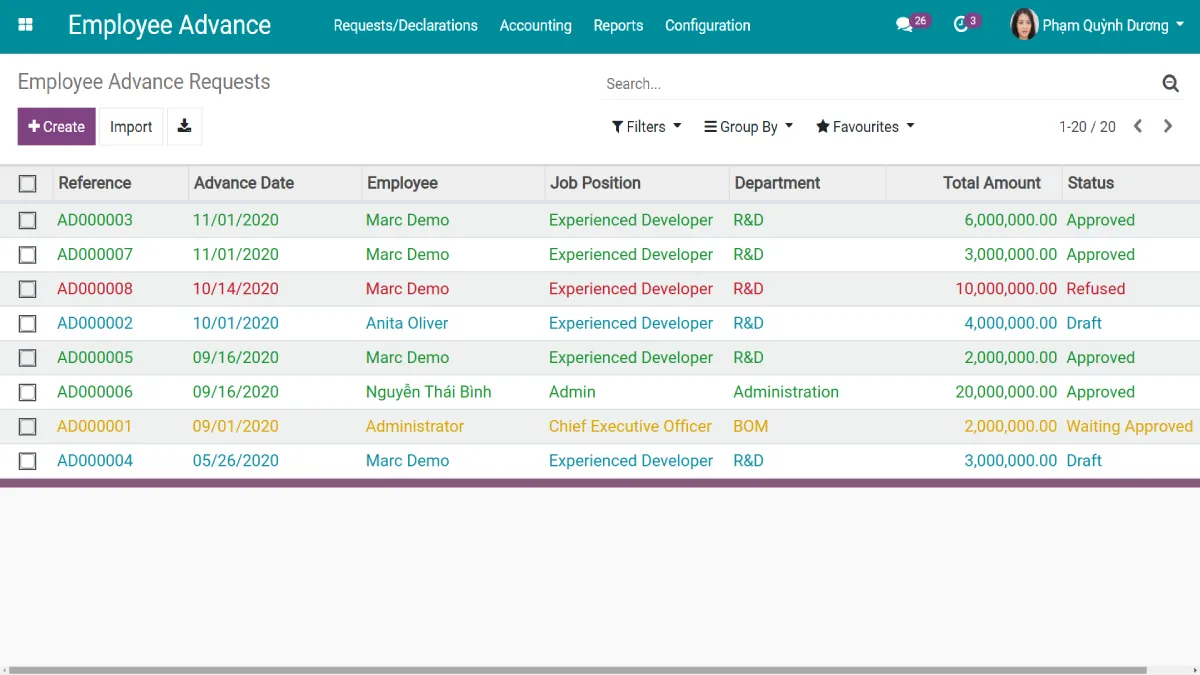

Employee Advance Management Application Viindoo EOS

In other words, the company is the. As such, it is recorded as a current asset in the company's balance sheet. If you need to loan your employees money in a pinch, you can give. How do i record an advance to an employee and the deduction? These loans are extended with.

HRMS Mobile App Employee Advance account value missing error on

How do i record an advance to an employee and the deduction? Learn how to pay an advance to your employees in quickbooks online payroll and quickbooks desktop payroll. In other words, the company is the. Advance to employees can be recorded under any of the account heads as deemed suitable by the business. There may not be a.

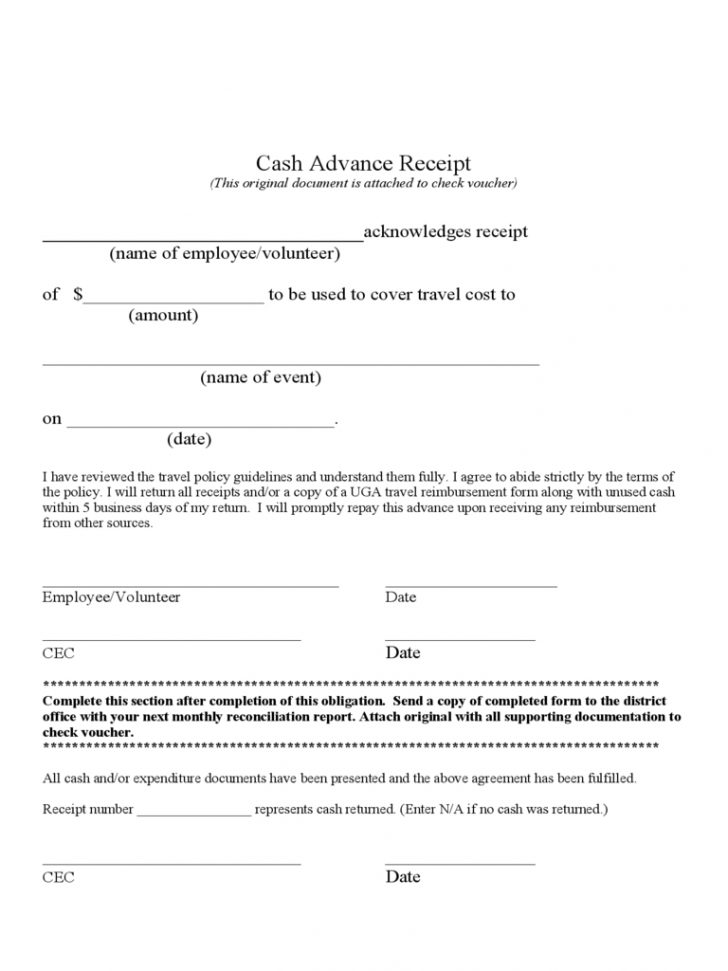

Browse Our Image of Employee Payroll Advance Template Payroll

These loans are extended with. There may not be a. A cash advance to an employee is usually a temporary loan by a company to an employee. Advance to employees can be recorded under any of the account heads as deemed suitable by the business. In other words, the company is the.

Employee Advance Management Software Viindoo EOS

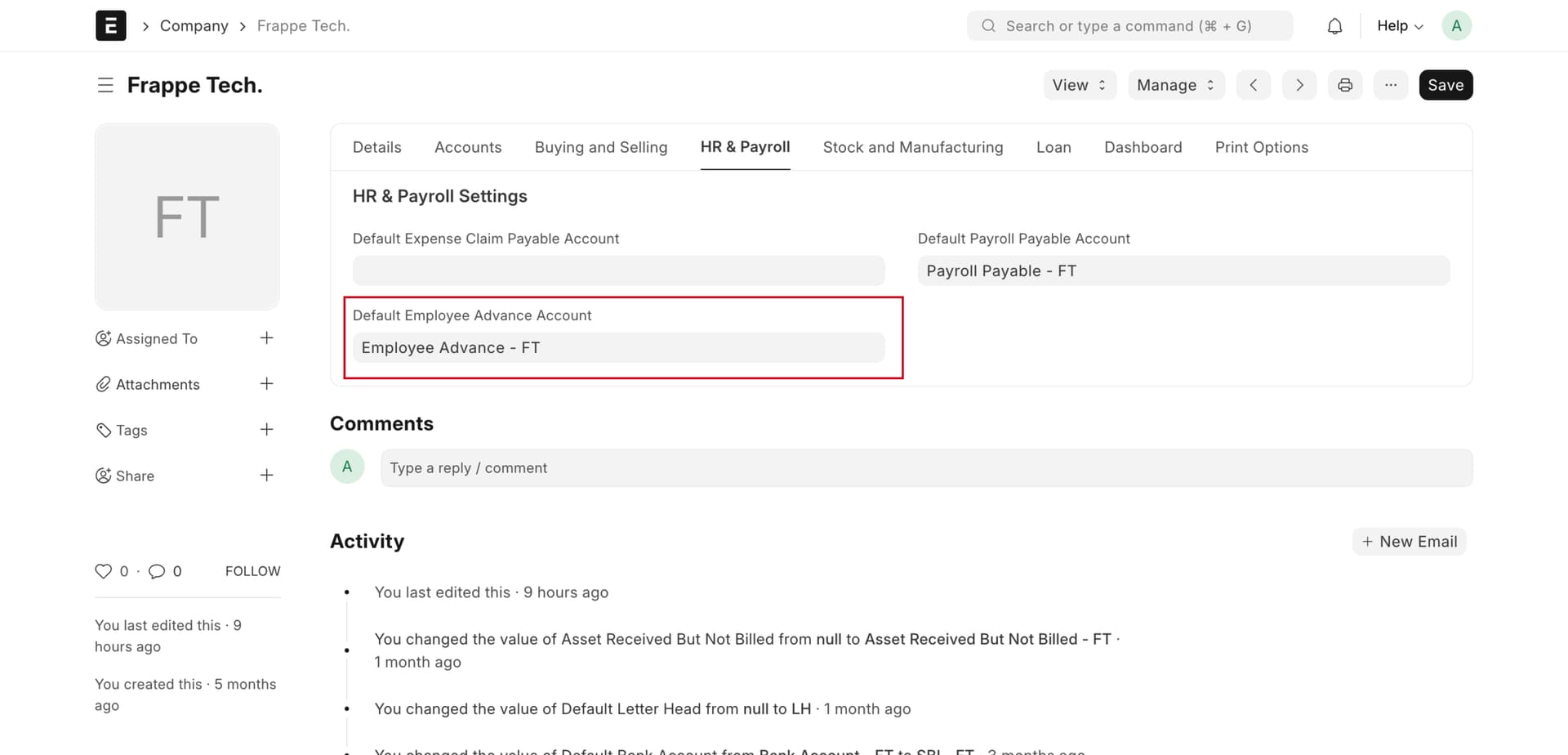

A cash advance to an employee is usually a temporary loan by a company to an employee. Learn how to pay an advance to your employees in quickbooks online payroll and quickbooks desktop payroll. These loans are extended with. Advance to employees can be recorded under any of the account heads as deemed suitable by the business. If you need.

How to do Employee Advance payments? ACTouch, manufacturing ERP

Learn how to pay an advance to your employees in quickbooks online payroll and quickbooks desktop payroll. If you need to loan your employees money in a pinch, you can give. Advance to employees can be recorded under any of the account heads as deemed suitable by the business. These account heads are most likely to be: There may not.

Employee Advance Management Application Viindoo

There may not be a. If you need to loan your employees money in a pinch, you can give. Advance to employees can be recorded under any of the account heads as deemed suitable by the business. In other words, the company is the. Learn how to pay an advance to your employees in quickbooks online payroll and quickbooks desktop.

In Other Words, The Company Is The.

As such, it is recorded as a current asset in the company's balance sheet. If you need to loan your employees money in a pinch, you can give. How do i record an advance to an employee and the deduction? These account heads are most likely to be:

Advance To Employees Can Be Recorded Under Any Of The Account Heads As Deemed Suitable By The Business.

These loans are extended with. Learn how to pay an advance to your employees in quickbooks online payroll and quickbooks desktop payroll. A cash advance to an employee is usually a temporary loan by a company to an employee. There may not be a.