Employeeemployee Record Retention Guidelines 2022 - Records relating to employment taxes (fica and futa) and income tax withholdings must be retained for at least. Explore hr guidelines for retaining personnel. Employee recordkeeping requirements vary by type and business location. Any personnel or employment record made or kept by an employer, including requests for reasonable accommodation;

Any personnel or employment record made or kept by an employer, including requests for reasonable accommodation; Records relating to employment taxes (fica and futa) and income tax withholdings must be retained for at least. Employee recordkeeping requirements vary by type and business location. Explore hr guidelines for retaining personnel.

Records relating to employment taxes (fica and futa) and income tax withholdings must be retained for at least. Explore hr guidelines for retaining personnel. Employee recordkeeping requirements vary by type and business location. Any personnel or employment record made or kept by an employer, including requests for reasonable accommodation;

Infographic Federal Record Retention Periods First Healthcare Compliance

Explore hr guidelines for retaining personnel. Any personnel or employment record made or kept by an employer, including requests for reasonable accommodation; Records relating to employment taxes (fica and futa) and income tax withholdings must be retained for at least. Employee recordkeeping requirements vary by type and business location.

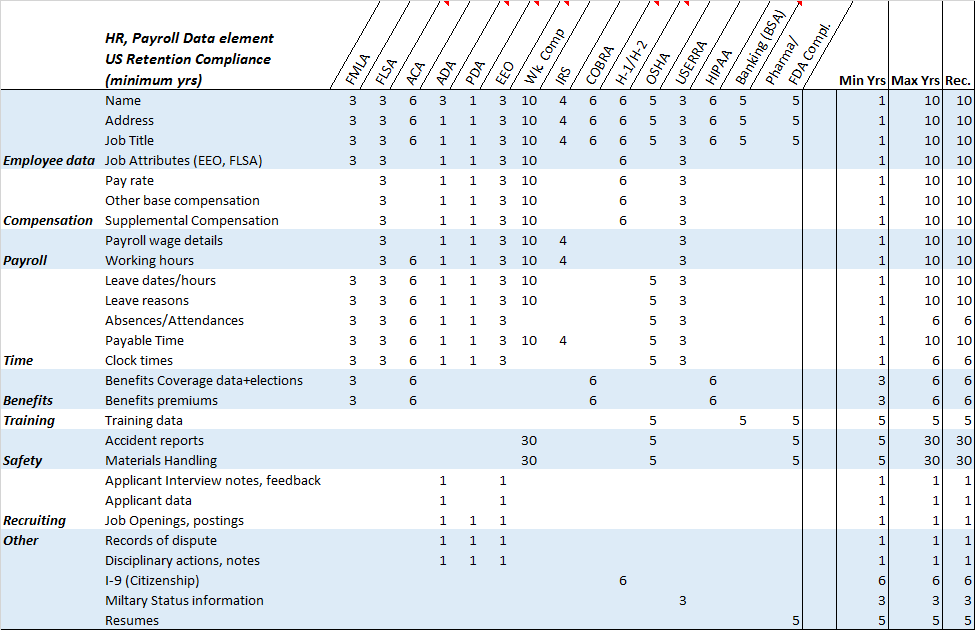

Udemy HR Compliance 101 RECORD+RETENTION+POLICY+CHECKLIST PDF

Explore hr guidelines for retaining personnel. Employee recordkeeping requirements vary by type and business location. Records relating to employment taxes (fica and futa) and income tax withholdings must be retained for at least. Any personnel or employment record made or kept by an employer, including requests for reasonable accommodation;

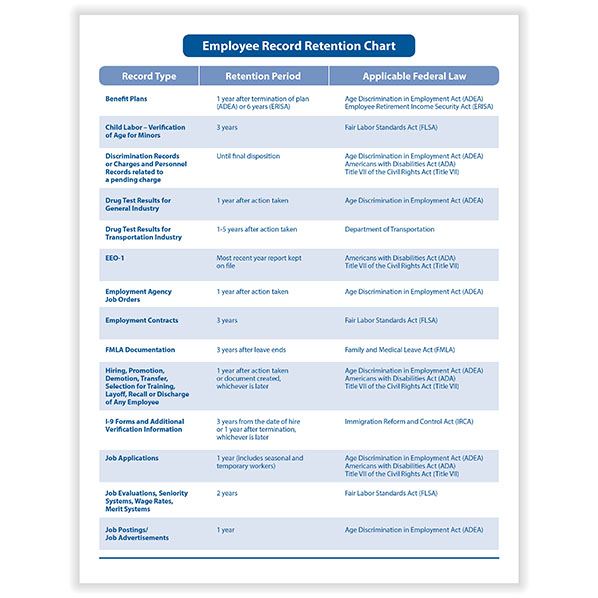

employee record retention chart Record management, retention, and

Explore hr guidelines for retaining personnel. Any personnel or employment record made or kept by an employer, including requests for reasonable accommodation; Records relating to employment taxes (fica and futa) and income tax withholdings must be retained for at least. Employee recordkeeping requirements vary by type and business location.

Hr Record Retention Guidelines 2024 Terry

Any personnel or employment record made or kept by an employer, including requests for reasonable accommodation; Records relating to employment taxes (fica and futa) and income tax withholdings must be retained for at least. Employee recordkeeping requirements vary by type and business location. Explore hr guidelines for retaining personnel.

Irs Business Record Retention Guidelines 2024 Mab Charlene

Records relating to employment taxes (fica and futa) and income tax withholdings must be retained for at least. Explore hr guidelines for retaining personnel. Any personnel or employment record made or kept by an employer, including requests for reasonable accommodation; Employee recordkeeping requirements vary by type and business location.

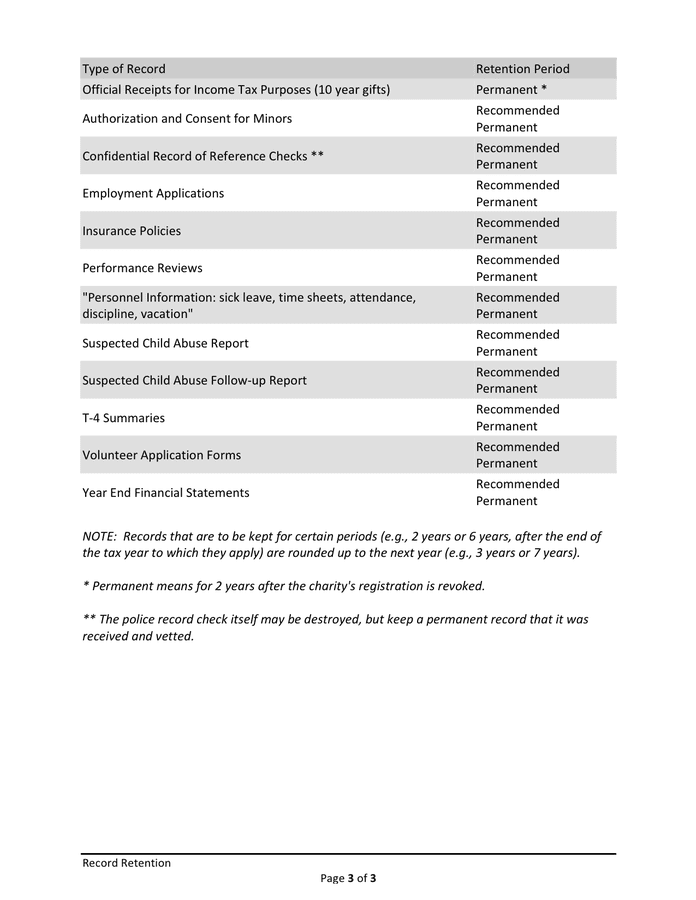

Record Retention Schedule Download Free PDF Thesis Business

Records relating to employment taxes (fica and futa) and income tax withholdings must be retained for at least. Employee recordkeeping requirements vary by type and business location. Any personnel or employment record made or kept by an employer, including requests for reasonable accommodation; Explore hr guidelines for retaining personnel.

Hr Record Retention Guidelines 2024 Terry

Employee recordkeeping requirements vary by type and business location. Records relating to employment taxes (fica and futa) and income tax withholdings must be retained for at least. Any personnel or employment record made or kept by an employer, including requests for reasonable accommodation; Explore hr guidelines for retaining personnel.

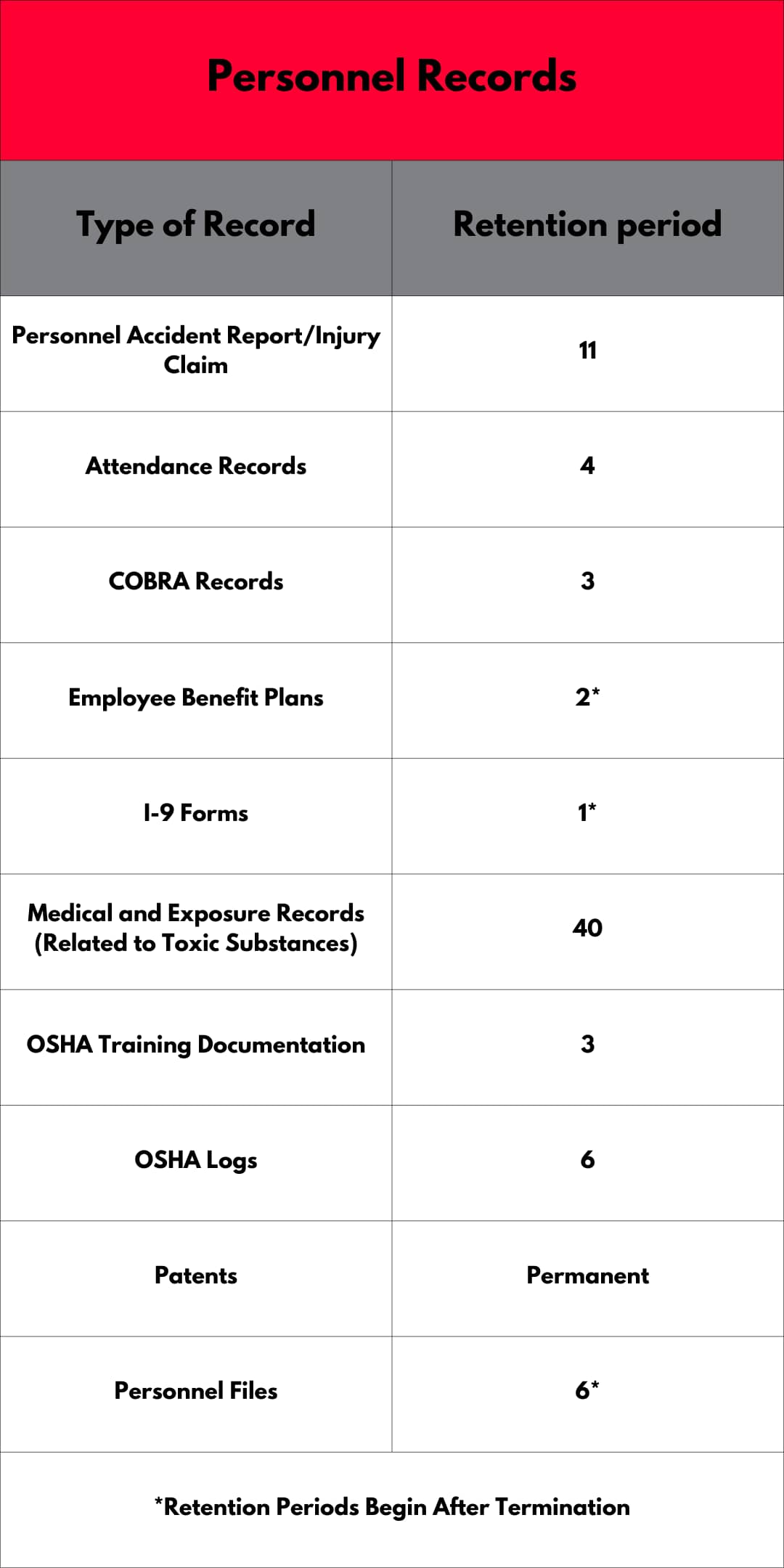

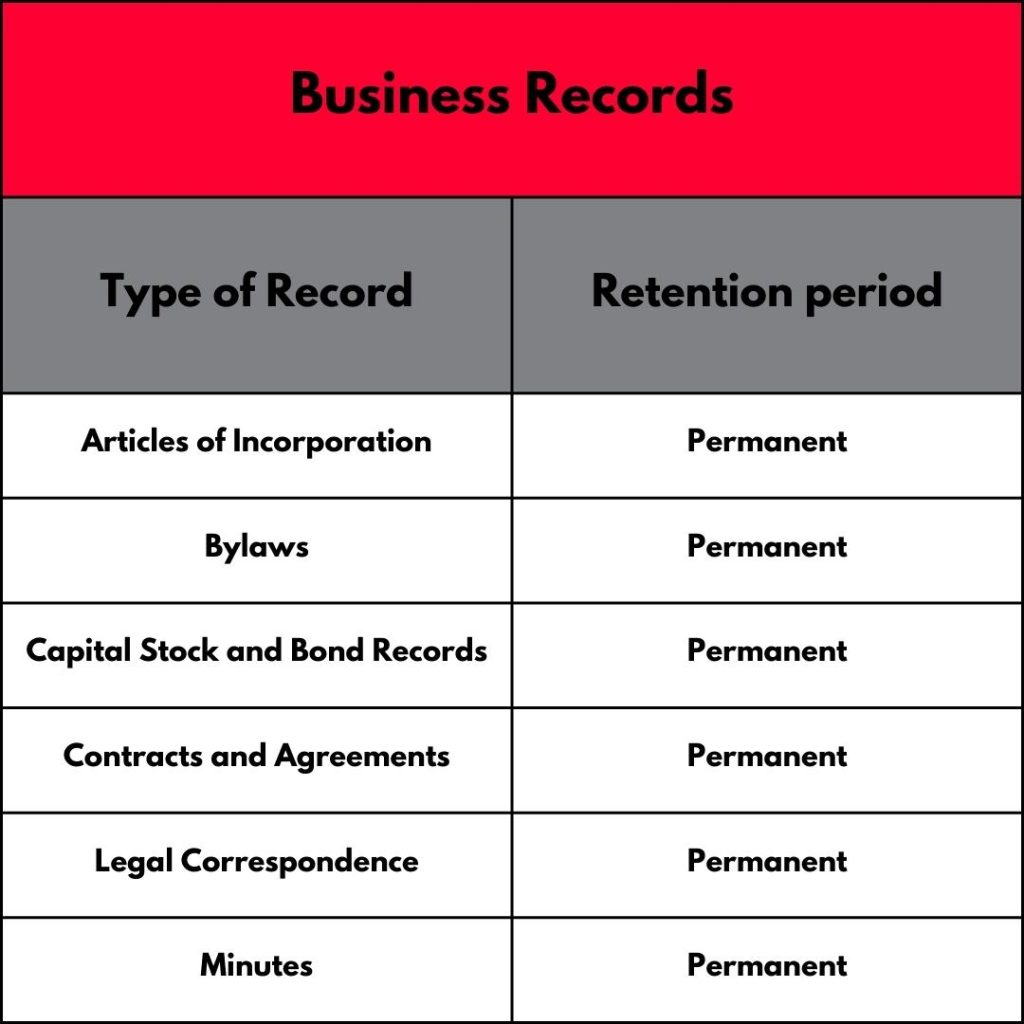

Business Record Retention Times & Schedules Shred Nations

Any personnel or employment record made or kept by an employer, including requests for reasonable accommodation; Explore hr guidelines for retaining personnel. Records relating to employment taxes (fica and futa) and income tax withholdings must be retained for at least. Employee recordkeeping requirements vary by type and business location.

Business record retention guidelines 2022 pdf Fill out & sign online

Explore hr guidelines for retaining personnel. Records relating to employment taxes (fica and futa) and income tax withholdings must be retained for at least. Employee recordkeeping requirements vary by type and business location. Any personnel or employment record made or kept by an employer, including requests for reasonable accommodation;

California Record Retention Laws 2024 Erika Jacinta

Any personnel or employment record made or kept by an employer, including requests for reasonable accommodation; Employee recordkeeping requirements vary by type and business location. Explore hr guidelines for retaining personnel. Records relating to employment taxes (fica and futa) and income tax withholdings must be retained for at least.

Explore Hr Guidelines For Retaining Personnel.

Any personnel or employment record made or kept by an employer, including requests for reasonable accommodation; Employee recordkeeping requirements vary by type and business location. Records relating to employment taxes (fica and futa) and income tax withholdings must be retained for at least.