Employeeis The Employee Retention Credit Taxable Income - The employee retention credit is a refundable tax credit for qualifying employee wages, and. Is the employee retention credit taxable income?

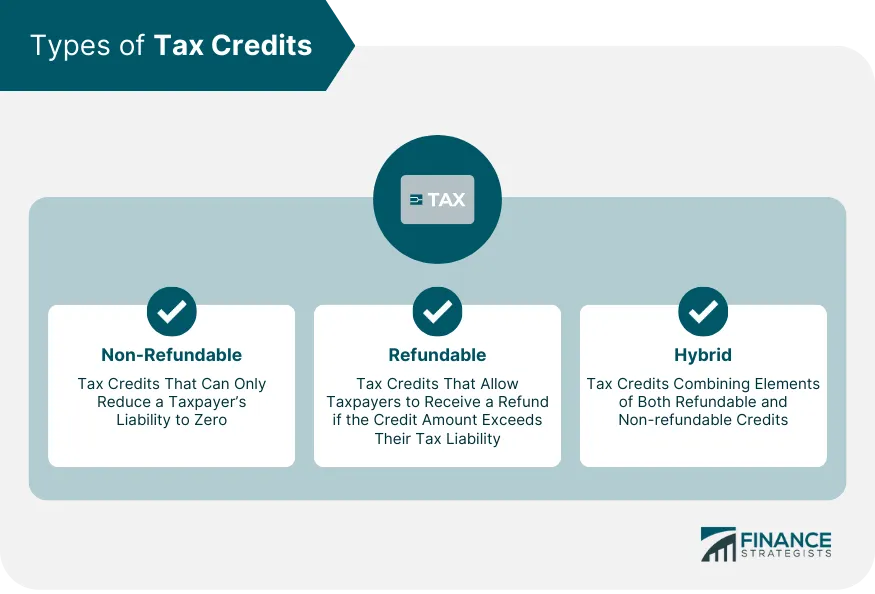

The employee retention credit is a refundable tax credit for qualifying employee wages, and. Is the employee retention credit taxable income?

The employee retention credit is a refundable tax credit for qualifying employee wages, and. Is the employee retention credit taxable income?

Is Employee Retention Credit (ERC) Taxable (updated March 2024

Is the employee retention credit taxable income? The employee retention credit is a refundable tax credit for qualifying employee wages, and.

Is Employee Retention Credit Taxable

Is the employee retention credit taxable income? The employee retention credit is a refundable tax credit for qualifying employee wages, and.

Is the Employee Retention Credit Taxable Fora Financial

The employee retention credit is a refundable tax credit for qualifying employee wages, and. Is the employee retention credit taxable income?

Is Employee Retention Credit (ERC) Taxable by Employee

The employee retention credit is a refundable tax credit for qualifying employee wages, and. Is the employee retention credit taxable income?

Is the Employee Retention Credit Taxable » TPG can help!

Is the employee retention credit taxable income? The employee retention credit is a refundable tax credit for qualifying employee wages, and.

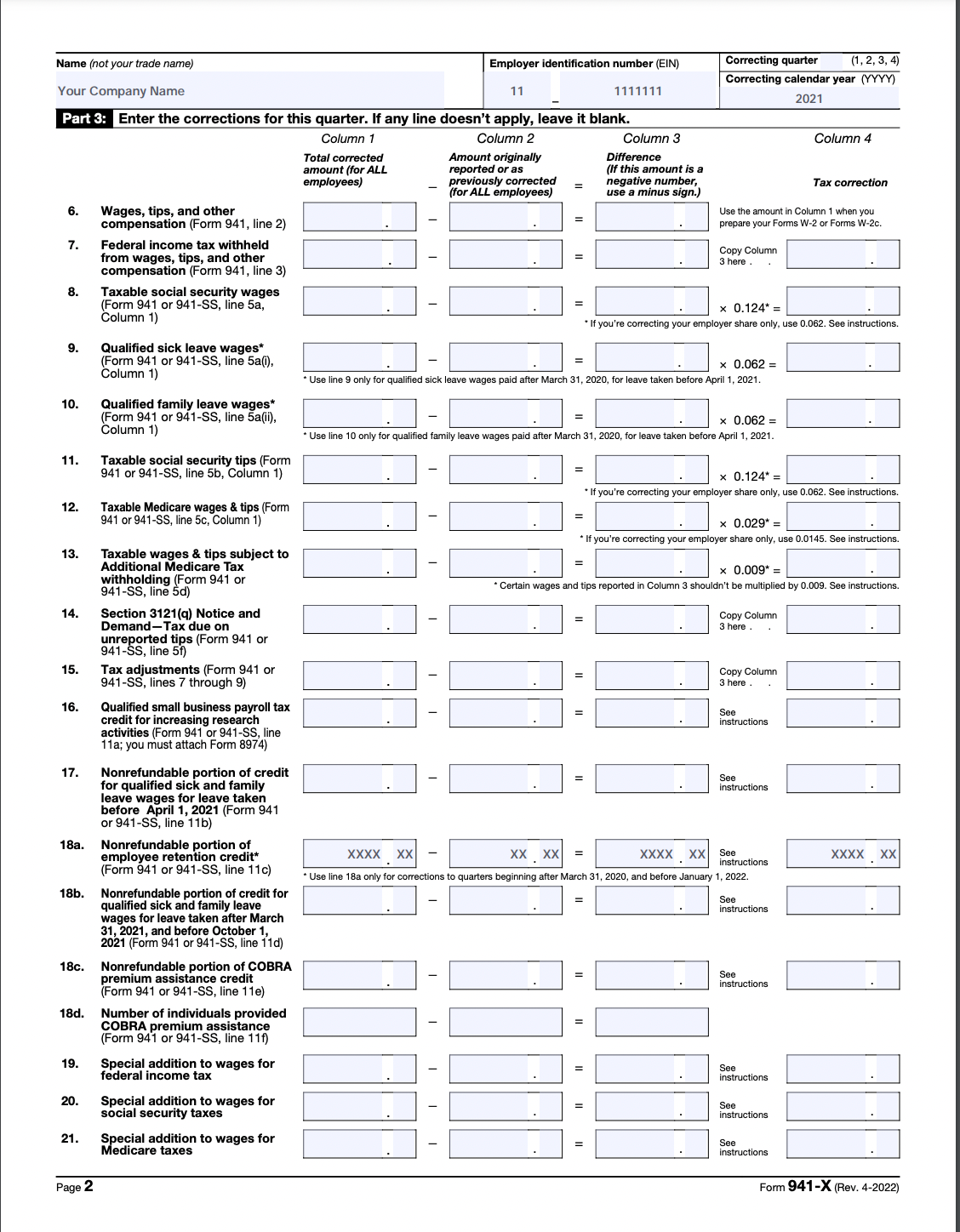

How ERTC Affects Your Tax Return Is Employee Retention Credit

Is the employee retention credit taxable income? The employee retention credit is a refundable tax credit for qualifying employee wages, and.

Is the employee retention credit 2023 taxable Leia aqui Do you

Is the employee retention credit taxable income? The employee retention credit is a refundable tax credit for qualifying employee wages, and.

How ERTC Affects Your Tax Return Is Employee Retention Credit

Is the employee retention credit taxable income? The employee retention credit is a refundable tax credit for qualifying employee wages, and.

ERC Tax Is the Employee Retention Credit Taxable

Is the employee retention credit taxable income? The employee retention credit is a refundable tax credit for qualifying employee wages, and.

The Employee Retention Credit Is A Refundable Tax Credit For Qualifying Employee Wages, And.

Is the employee retention credit taxable income?