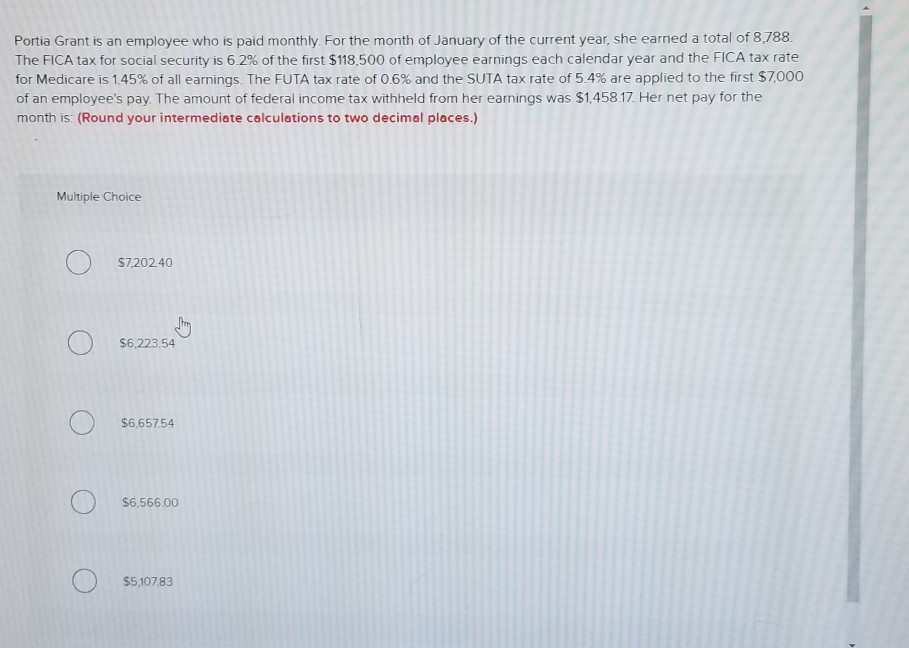

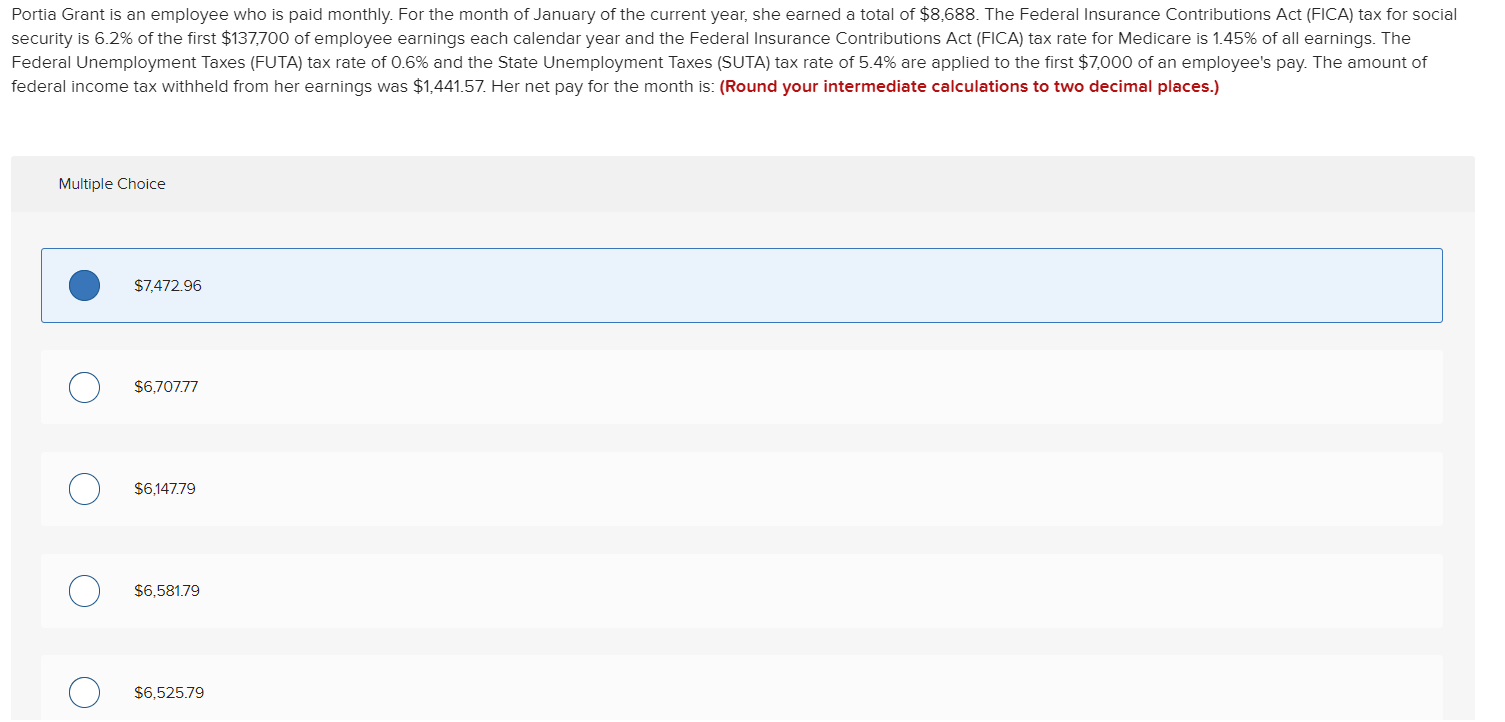

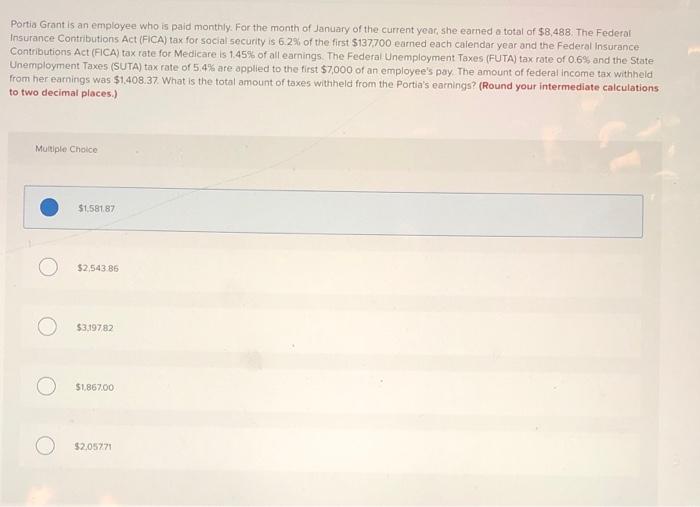

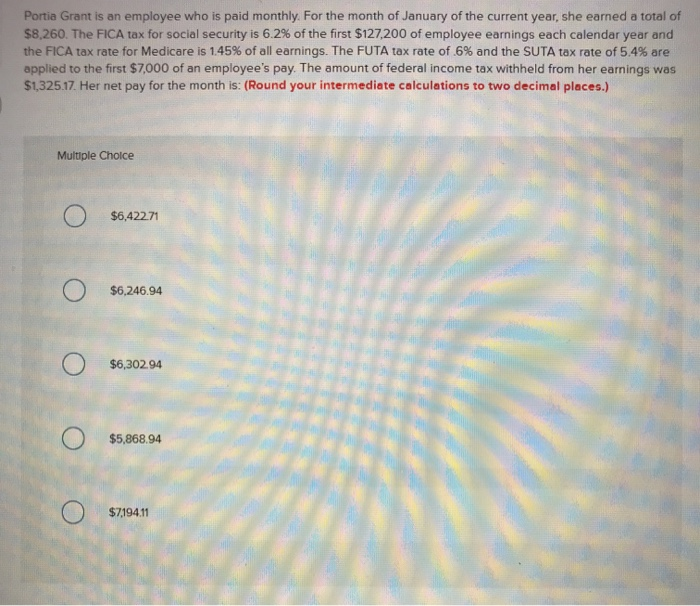

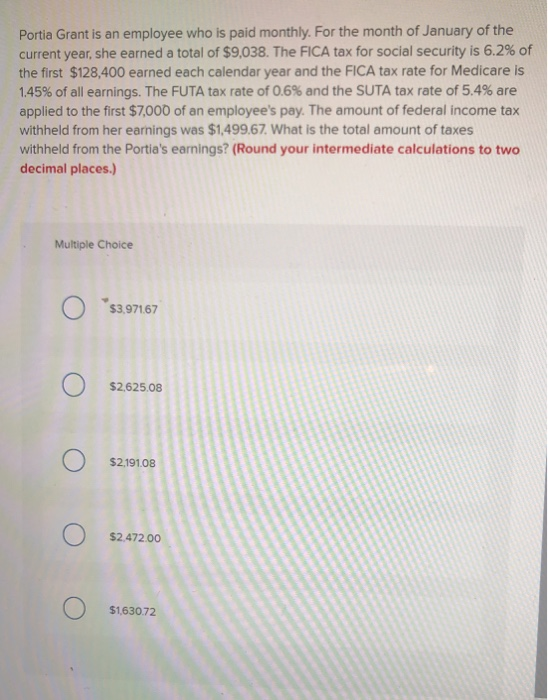

Employeeportia Grant Is An Employee Who Is Paid Monthly - First, we calculate the fica taxes for. Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of $8,438. For the month of january of the current year, she earned a total of $8,638. For the month of january of the current year, she earned a total of 8,538. The fica tax for social. Since portia's monthly earnings of $8,338 are more than. Portia grant is an employee who is paid monthly. To calculate portia's net pay for the month, we need to subtract all the taxes from her gross earnings. The suta tax rate of 5.4% is applied to the first $7,000 of an employee's pay.

For the month of january of the current year, she earned a total of $8,638. For the month of january of the current year, she earned a total of $8,438. Portia grant is an employee who is paid monthly. Calculate fica taxes first, we. First, we calculate the fica taxes for. The fica tax for social. Portia grant is an employee who is paid monthly. To calculate portia's net pay for the month, we need to subtract all the taxes from her gross earnings. To calculate portia grant's net pay for the month, we need to subtract all the taxes from her gross pay. Since portia's monthly earnings of $8,338 are more than.

To calculate portia's net pay for the month, we need to subtract all the taxes from her gross earnings. To calculate portia grant's net pay for the month, we need to subtract all the taxes from her gross pay. The suta tax rate of 5.4% is applied to the first $7,000 of an employee's pay. For the month of january of the current year, she earned a total of 8,538. For the month of january of the current year, she earned a total of $8,438. The fica tax for social. Since portia's monthly earnings of $8,338 are more than. Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of $8,638. For the month of january of the current year, she earned a total of $8,260.

Solved Portia Grant is an employee who is paid monthly For

For the month of january of the current year, she earned a total of $8,638. Portia grant is an employee who is paid monthly. To calculate portia's net pay for the month, we need to subtract all the taxes from her gross earnings. For the month of january of the current year, she earned a total of $8,260. To calculate.

Member Success Valerie A. Grant Published in the Journal of the Grant

First, we calculate the fica taxes for. To calculate portia grant's net pay for the month, we need to subtract all the taxes from her gross pay. For the month of january of the current year, she earned a total of $8,260. Portia grant is an employee who is paid monthly. The fica tax for social.

Employee Benefits Slide Employee Management Kit Presentation

The fica tax for social. Portia grant is an employee who is paid monthly. Portia grant is an employee who is paid monthly. Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of 8,538.

Solved Portia Grant is an employee who is paid monthly. For

The fica tax for social. Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of $8,438. Since portia's monthly earnings of $8,338 are more than. To calculate portia's net pay for the month, we need to subtract all the taxes from her gross earnings.

Solved Portia Grant is an employee who is paid monthly. For

For the month of january of the current year, she earned a total of $8,260. Since portia's monthly earnings of $8,338 are more than. Portia grant is an employee who is paid monthly. The fica tax for social. For the month of january of the current year, she earned a total of $8,638.

Solved Portia Grant Is an employee who Is paid monthly. For

Calculate fica taxes first, we. The suta tax rate of 5.4% is applied to the first $7,000 of an employee's pay. Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of $8,638. Since portia's monthly earnings of $8,338 are more than.

Solved Portia Grant is an employee who is paid monthly. For

Calculate fica taxes first, we. For the month of january of the current year, she earned a total of $8,638. Portia grant is an employee who is paid monthly. The suta tax rate of 5.4% is applied to the first $7,000 of an employee's pay. For the month of january of the current year, she earned a total of 8,538.

Solved Portia Grant is an employee who is paid monthly. For

Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of $8,438. Calculate fica taxes first, we. The suta tax rate of 5.4% is applied to the first $7,000 of an employee's pay. The fica tax for social.

Mark III Employee Benefits City of Lynchburg Employee Benefits Page

Portia grant is an employee who is paid monthly. The suta tax rate of 5.4% is applied to the first $7,000 of an employee's pay. First, we calculate the fica taxes for. Calculate fica taxes first, we. The fica tax for social.

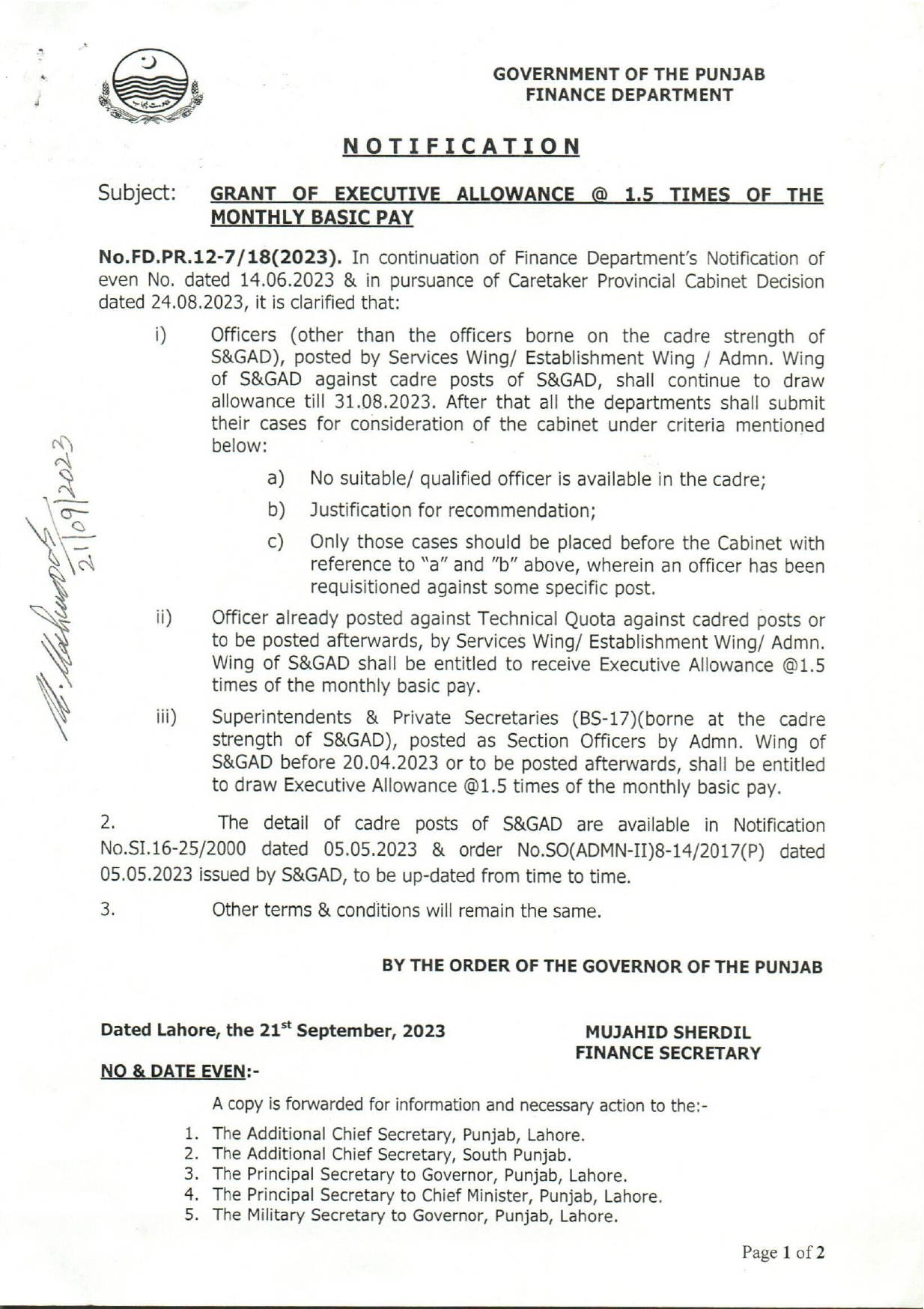

GRANT OF EXECUTIVE ALLOWANCE 1.5 TIMES OF THE MONTHLY BASIC PAY

Portia grant is an employee who is paid monthly. Portia grant is an employee who is paid monthly. Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of $8,638. The fica tax for social.

To Calculate Portia's Net Pay For The Month, We Need To Subtract All The Taxes From Her Gross Earnings.

Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of $8,260. For the month of january of the current year, she earned a total of 8,538. The fica tax for social.

Portia Grant Is An Employee Who Is Paid Monthly.

Since portia's monthly earnings of $8,338 are more than. Portia grant is an employee who is paid monthly. For the month of january of the current year, she earned a total of $8,638. For the month of january of the current year, she earned a total of $8,438.

To Calculate Portia Grant's Net Pay For The Month, We Need To Subtract All The Taxes From Her Gross Pay.

The suta tax rate of 5.4% is applied to the first $7,000 of an employee's pay. Calculate fica taxes first, we. First, we calculate the fica taxes for. Portia grant is an employee who is paid monthly.