Employeewashington State Exempt Employee Laws - To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. Both washington and federal labor laws require a minimum salary for exempt employees. The federal standard is $455 per.

Both washington and federal labor laws require a minimum salary for exempt employees. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. The federal standard is $455 per.

To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. The federal standard is $455 per. Both washington and federal labor laws require a minimum salary for exempt employees.

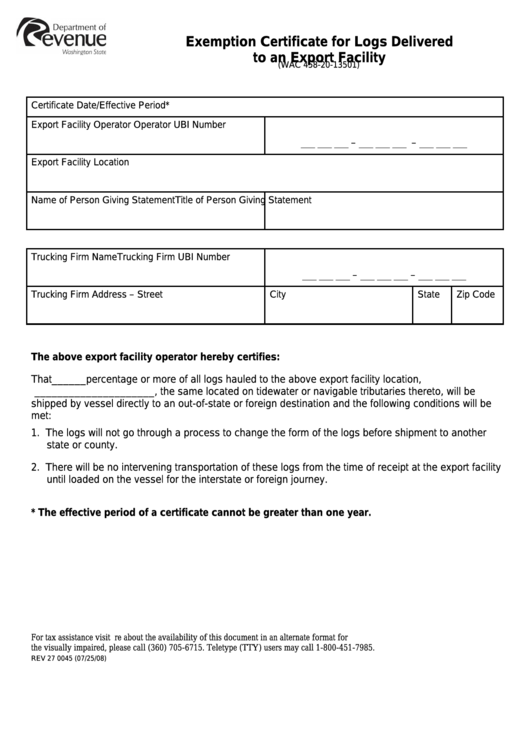

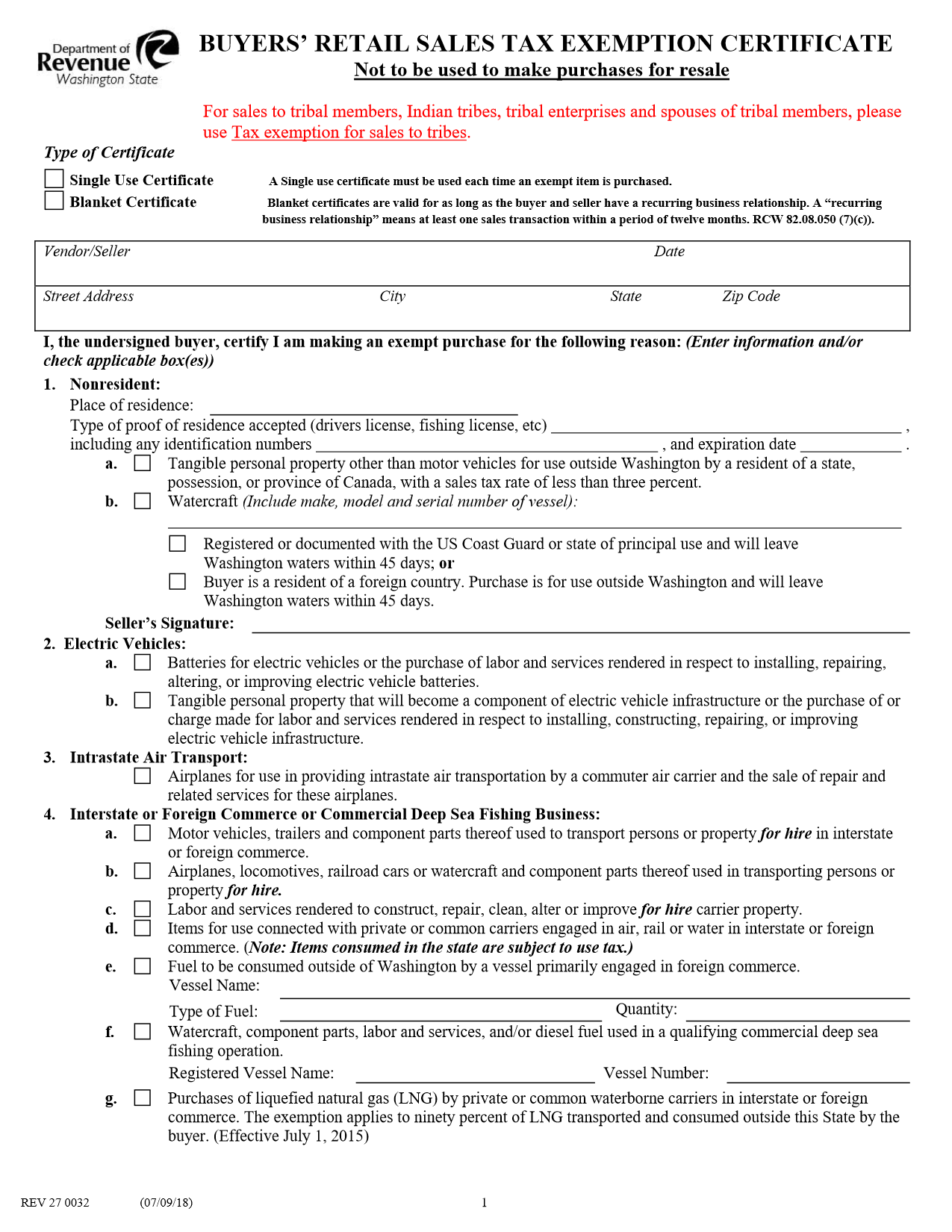

Washington State Certificate Of Exemption Form

The federal standard is $455 per. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. Both washington and federal labor laws require a minimum salary for exempt employees.

What Is an Exempt Employee? AIHR HR Glossary

Both washington and federal labor laws require a minimum salary for exempt employees. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. The federal standard is $455 per.

What Is an Exempt Employee? Definition, Requirements, Pros & Cons

Both washington and federal labor laws require a minimum salary for exempt employees. The federal standard is $455 per. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,.

Washington State Federal Tax Exempt Form

To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. Both washington and federal labor laws require a minimum salary for exempt employees. The federal standard is $455 per.

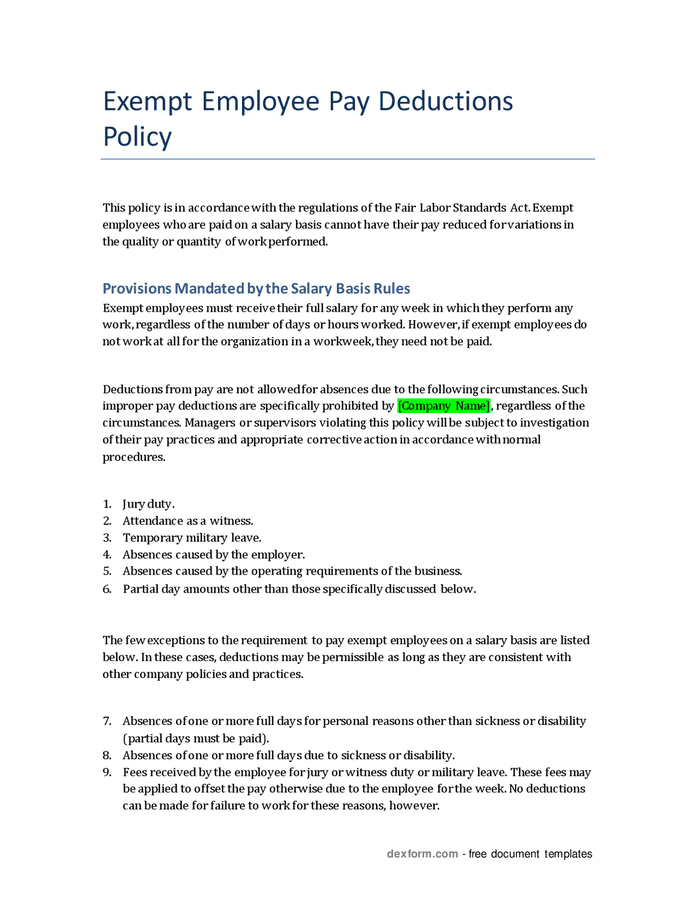

Exempt employee pay deductions policy in Word and Pdf formats

The federal standard is $455 per. Both washington and federal labor laws require a minimum salary for exempt employees. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,.

2024 Exempt Employee Salaries Benny Kaitlin

The federal standard is $455 per. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. Both washington and federal labor laws require a minimum salary for exempt employees.

Exempt Employee Salary Threshold 2024 Vinni Romonda

To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. The federal standard is $455 per. Both washington and federal labor laws require a minimum salary for exempt employees.

What Is an Exempt Employee? AIHR HR Glossary

To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. The federal standard is $455 per. Both washington and federal labor laws require a minimum salary for exempt employees.

What is an Exempt Employee in Washington State? HireQuotient

To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. Both washington and federal labor laws require a minimum salary for exempt employees. The federal standard is $455 per.

Exempt Employee California 2024 Midge Susette

The federal standard is $455 per. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,. Both washington and federal labor laws require a minimum salary for exempt employees.

Both Washington And Federal Labor Laws Require A Minimum Salary For Exempt Employees.

The federal standard is $455 per. To qualify as an exempt employee under this section, an employee must be compensated on a salary or fee basis, exclusive of board, lodging,.