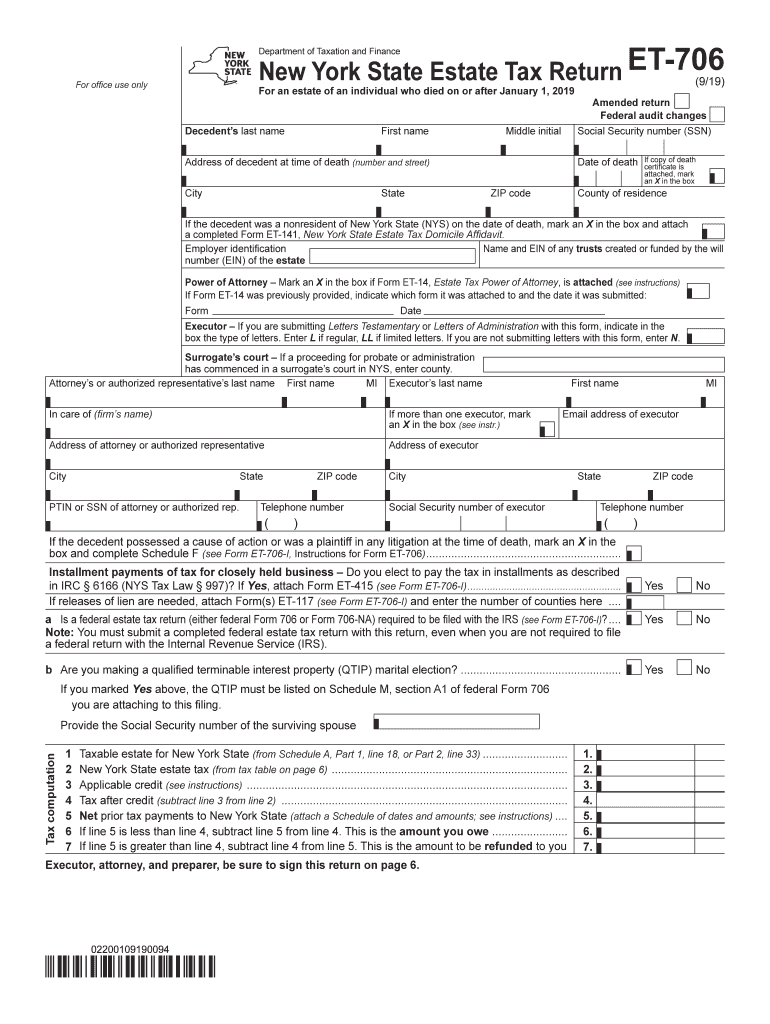

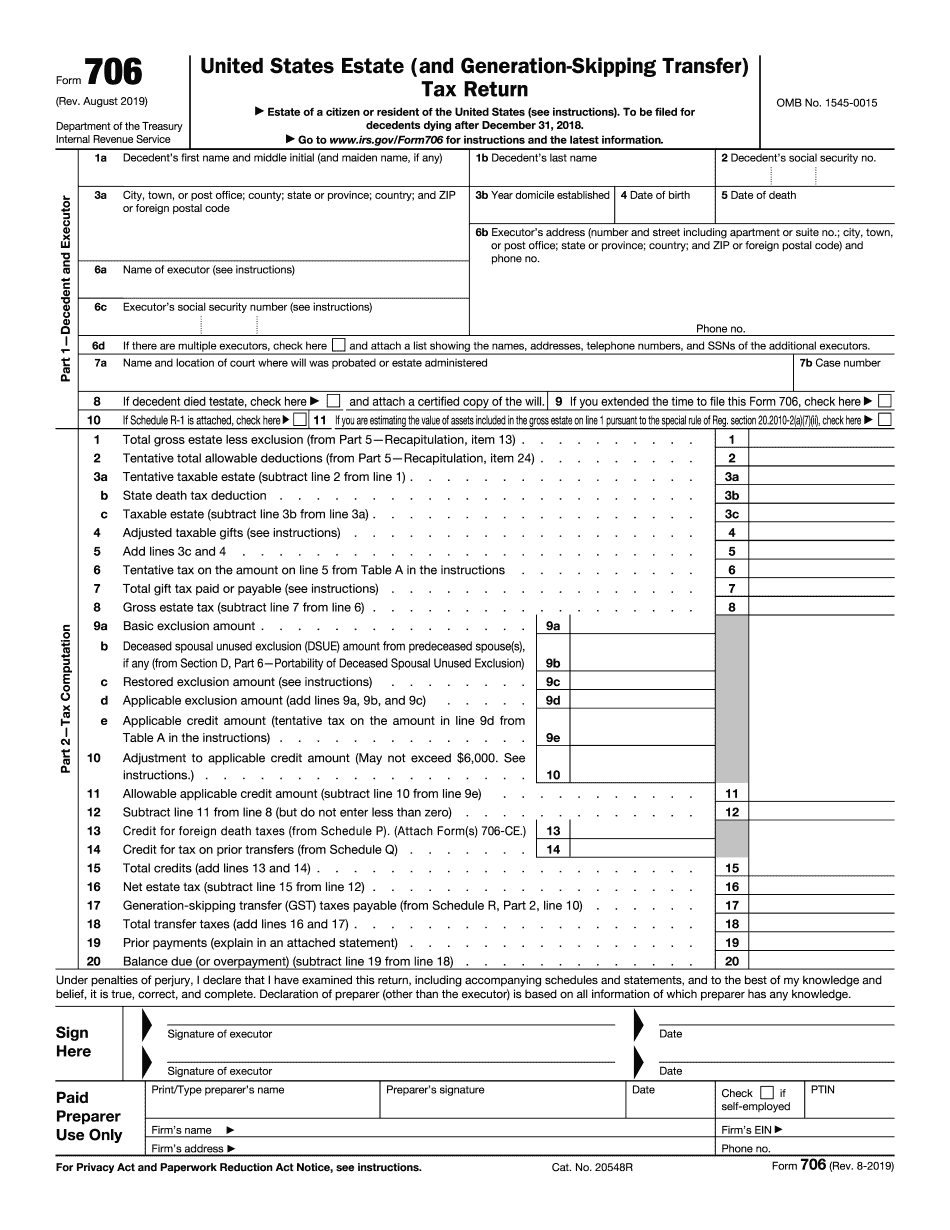

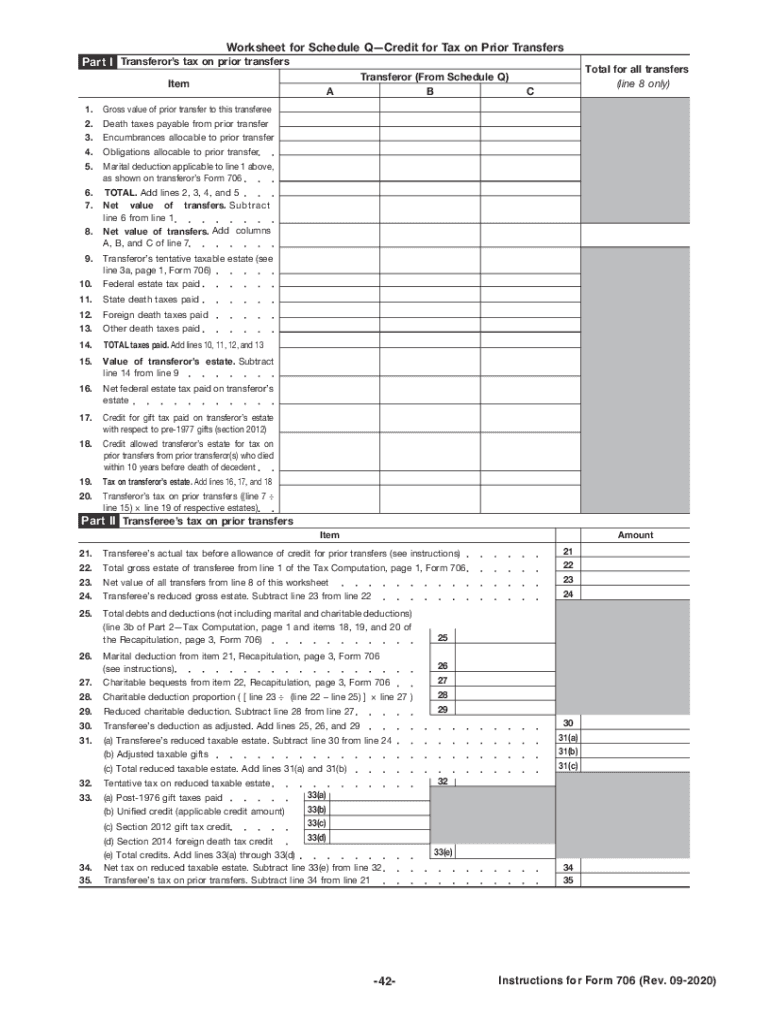

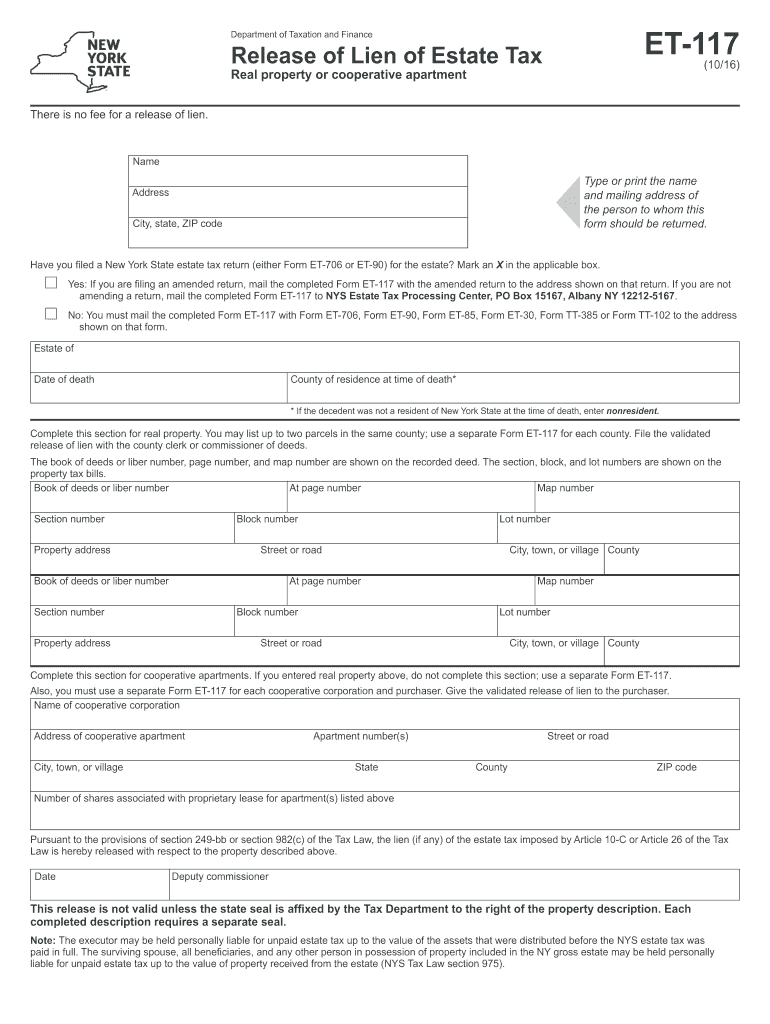

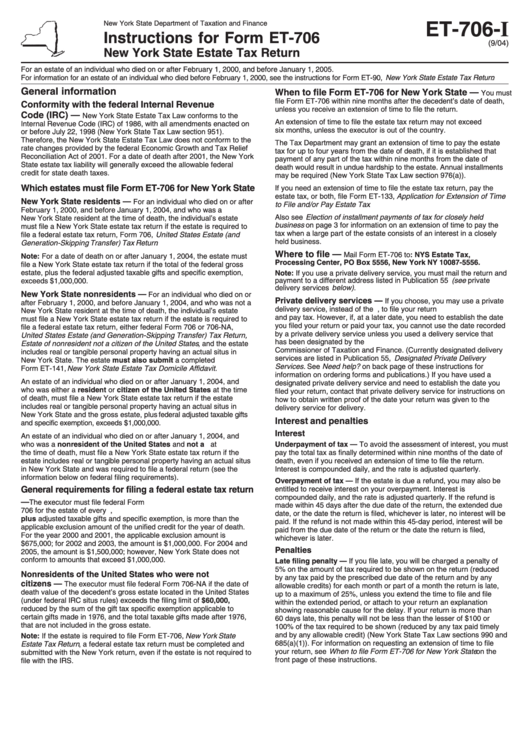

Et 706 Form - Estate tax return to determine the correct new york state estate tax. New york state estate tax returns (form et 706) must also be filed within nine months of the decedent's death. If more time is needed, an. The estate of every individual who was a resident of new york state at the time of death must file a new york state estate tax return if the estate is. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips.

If more time is needed, an. New york state estate tax returns (form et 706) must also be filed within nine months of the decedent's death. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. Estate tax return to determine the correct new york state estate tax. The estate of every individual who was a resident of new york state at the time of death must file a new york state estate tax return if the estate is.

Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. The estate of every individual who was a resident of new york state at the time of death must file a new york state estate tax return if the estate is. Estate tax return to determine the correct new york state estate tax. If more time is needed, an. New york state estate tax returns (form et 706) must also be filed within nine months of the decedent's death.

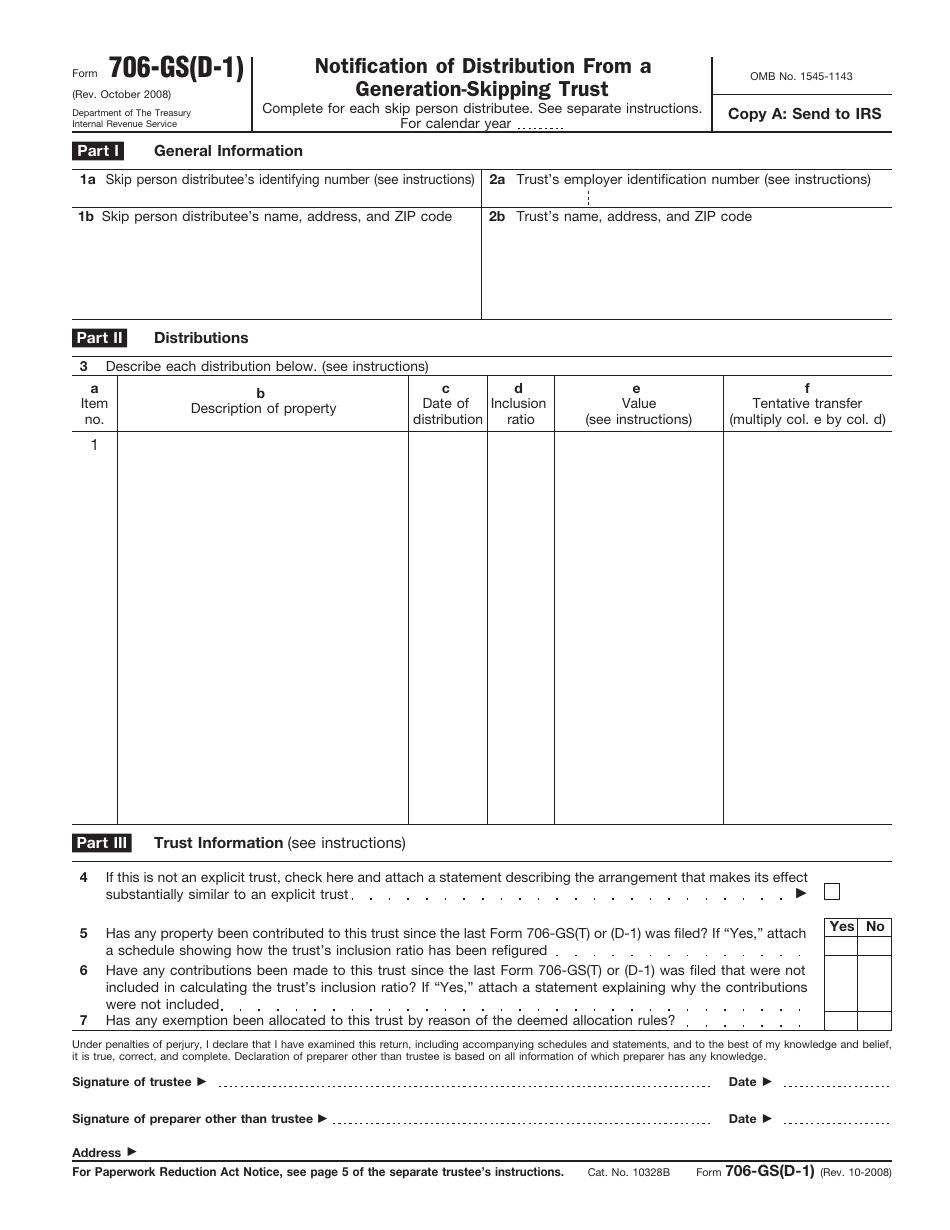

Form 706 Fillable Online Printable Forms Free Online

New york state estate tax returns (form et 706) must also be filed within nine months of the decedent's death. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. If more time is needed, an. The estate of every individual who was a resident.

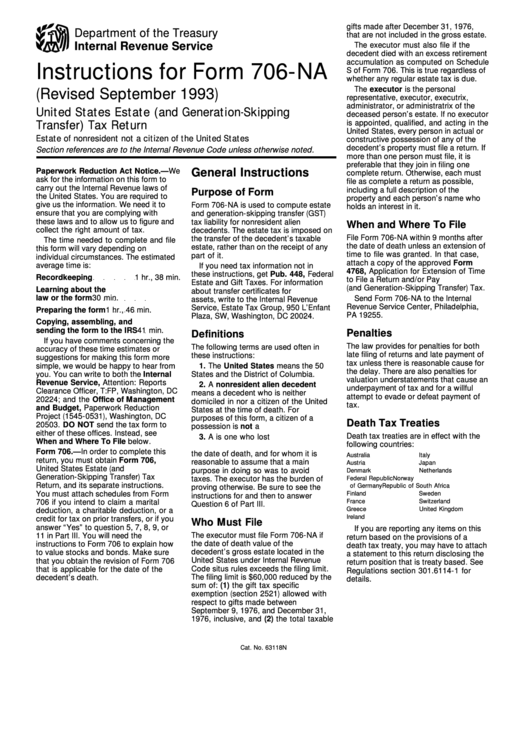

Form 706 Na Instructions

If more time is needed, an. New york state estate tax returns (form et 706) must also be filed within nine months of the decedent's death. Estate tax return to determine the correct new york state estate tax. The estate of every individual who was a resident of new york state at the time of death must file a new.

Form 706NA United States Estate Tax Return (2013) Free Download

If more time is needed, an. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. Estate tax return to determine the correct new york state estate tax. The estate of every individual who was a resident of new york state at the time of.

20192024 Form NY DTF ET706 Fill Online, Printable, Fillable, Blank

New york state estate tax returns (form et 706) must also be filed within nine months of the decedent's death. If more time is needed, an. The estate of every individual who was a resident of new york state at the time of death must file a new york state estate tax return if the estate is. Form 706 is.

Et 706 fill in form 2012 Fill out & sign online DocHub

Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. New york state estate tax returns (form et 706) must also be filed within nine months of the decedent's death. If more time is needed, an. Estate tax return to determine the correct new york.

Form 706 Fillable Tax Return Templates in PDF

Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. The estate of every individual who was a resident of new york state at the time of death must file a new york state estate tax return if the estate is. Estate tax return to.

Form 706 instructions Fill out & sign online DocHub

If more time is needed, an. The estate of every individual who was a resident of new york state at the time of death must file a new york state estate tax return if the estate is. Estate tax return to determine the correct new york state estate tax. Form 706 is used to figure the estate tax imposed by.

Et 706 instructions 2016 form Fill out & sign online DocHub

If more time is needed, an. The estate of every individual who was a resident of new york state at the time of death must file a new york state estate tax return if the estate is. New york state estate tax returns (form et 706) must also be filed within nine months of the decedent's death. Estate tax return.

Et 20162024 Form Fill Out and Sign Printable PDF Template airSlate

The estate of every individual who was a resident of new york state at the time of death must file a new york state estate tax return if the estate is. New york state estate tax returns (form et 706) must also be filed within nine months of the decedent's death. Form 706 is used to figure the estate tax.

Instructions For Form Et706 New York State Estate Tax Return

Estate tax return to determine the correct new york state estate tax. New york state estate tax returns (form et 706) must also be filed within nine months of the decedent's death. If more time is needed, an. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13.

Form 706 Is Used To Figure The Estate Tax Imposed By Chapter 11, And Compute The Gst Tax Imposed By Chapter 13 On Direct Skips.

The estate of every individual who was a resident of new york state at the time of death must file a new york state estate tax return if the estate is. New york state estate tax returns (form et 706) must also be filed within nine months of the decedent's death. If more time is needed, an. Estate tax return to determine the correct new york state estate tax.