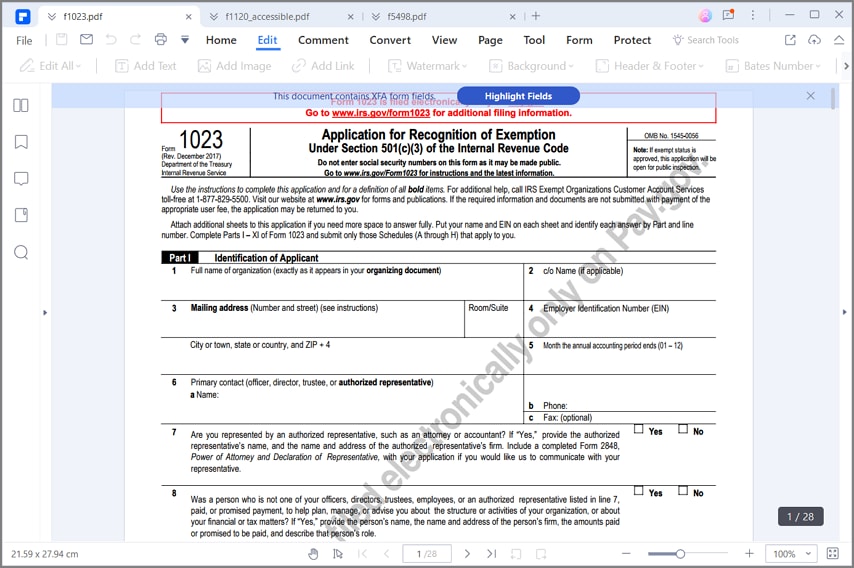

Fillable Form 1023 - Use the instructions to complete this application and for a definition of all bold items. How can i get a copy of form 1023? Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. December 2017) department of the treasury internal revenue service application for recognition of exemption under section. For additional help, call irs exempt organizations customer.

Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. How can i get a copy of form 1023? Use the instructions to complete this application and for a definition of all bold items. For additional help, call irs exempt organizations customer. December 2017) department of the treasury internal revenue service application for recognition of exemption under section.

Use the instructions to complete this application and for a definition of all bold items. December 2017) department of the treasury internal revenue service application for recognition of exemption under section. How can i get a copy of form 1023? For additional help, call irs exempt organizations customer. Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form.

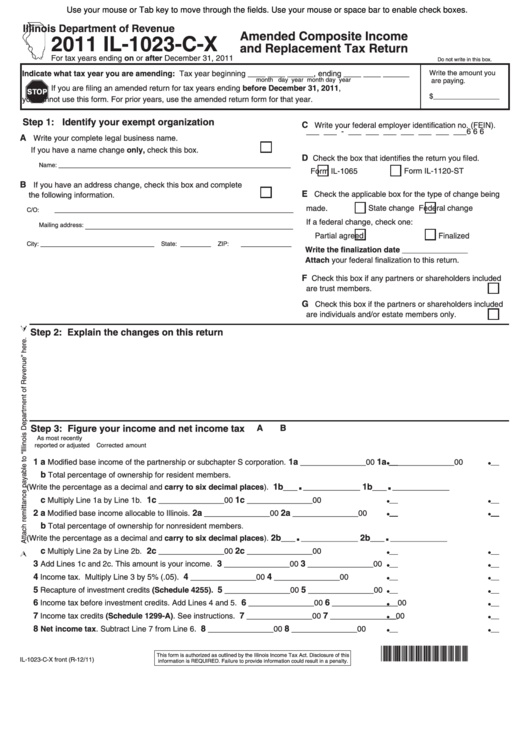

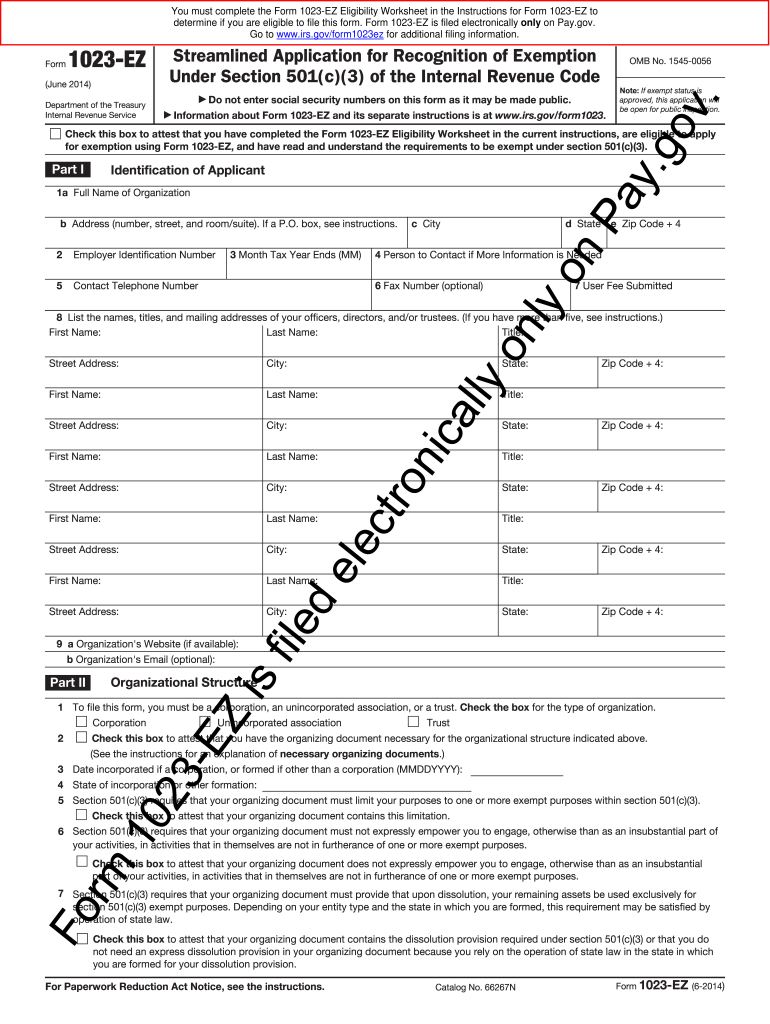

Fillable Form 1023 Ez Printable Forms Free Online

Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. How can i get a copy of form 1023? For additional help, call irs exempt organizations customer. Use the instructions to complete this application and for a definition of all bold items. December 2017) department of the treasury internal revenue service application.

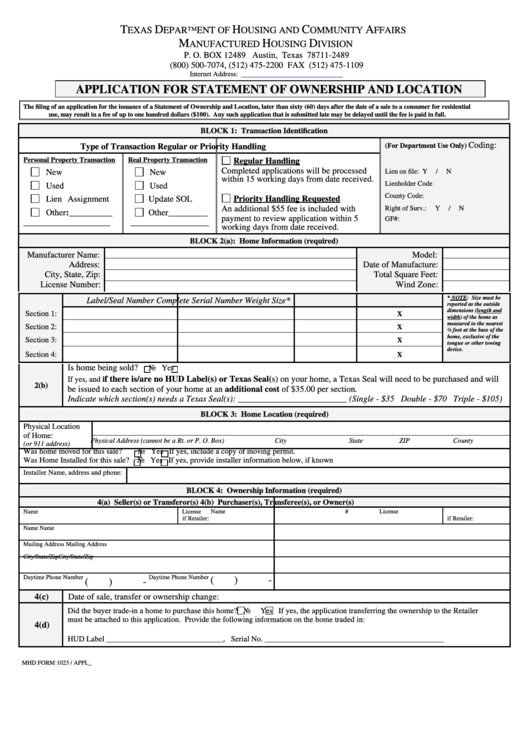

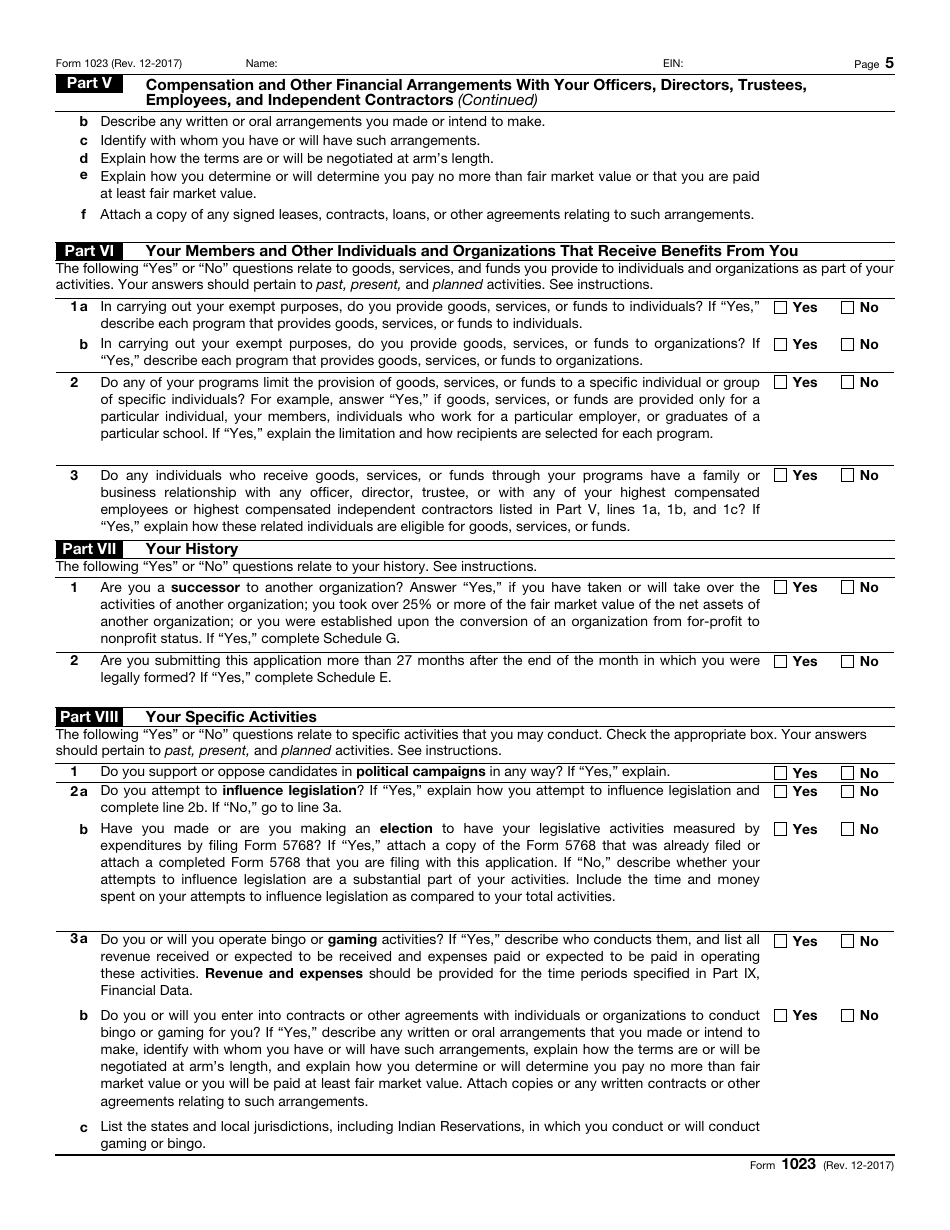

ICANN Application for Tax Exemption (U.S.) Page 8

How can i get a copy of form 1023? For additional help, call irs exempt organizations customer. December 2017) department of the treasury internal revenue service application for recognition of exemption under section. Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Use the instructions to complete this application and for.

Fillable Online Form 1023 fillable pdf. Form 1023 fillable pdf. How to

Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. How can i get a copy of form 1023? For additional help, call irs exempt organizations customer. Use the instructions to complete this application and for a definition of all bold items. December 2017) department of the treasury internal revenue service application.

Fillable Form 1023 Printable Forms Free Online

December 2017) department of the treasury internal revenue service application for recognition of exemption under section. For additional help, call irs exempt organizations customer. Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Use the instructions to complete this application and for a definition of all bold items. How can i.

Fillable Form 1023 Printable Forms Free Online

Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. December 2017) department of the treasury internal revenue service application for recognition of exemption under section. For additional help, call irs exempt organizations customer. Use the instructions to complete this application and for a definition of all bold items. How can i.

Fillable Form 1023 Ez Printable Forms Free Online

For additional help, call irs exempt organizations customer. Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Use the instructions to complete this application and for a definition of all bold items. How can i get a copy of form 1023? December 2017) department of the treasury internal revenue service application.

Form 1023 Fillable Pdf Printable Forms Free Online

For additional help, call irs exempt organizations customer. Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. How can i get a copy of form 1023? December 2017) department of the treasury internal revenue service application for recognition of exemption under section. Use the instructions to complete this application and for.

Form 1023 Edit, Fill, Sign Online Handypdf

For additional help, call irs exempt organizations customer. How can i get a copy of form 1023? Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. December 2017) department of the treasury internal revenue service application for recognition of exemption under section. Use the instructions to complete this application and for.

IRS Form 1023 Fill Out, Sign Online and Download Fillable PDF

For additional help, call irs exempt organizations customer. Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. December 2017) department of the treasury internal revenue service application for recognition of exemption under section. Use the instructions to complete this application and for a definition of all bold items. How can i.

Create Fillable IRS Form 1023 And Cope With Bureaucracy

For additional help, call irs exempt organizations customer. Use the instructions to complete this application and for a definition of all bold items. How can i get a copy of form 1023? Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. December 2017) department of the treasury internal revenue service application.

December 2017) Department Of The Treasury Internal Revenue Service Application For Recognition Of Exemption Under Section.

How can i get a copy of form 1023? Form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. For additional help, call irs exempt organizations customer. Use the instructions to complete this application and for a definition of all bold items.