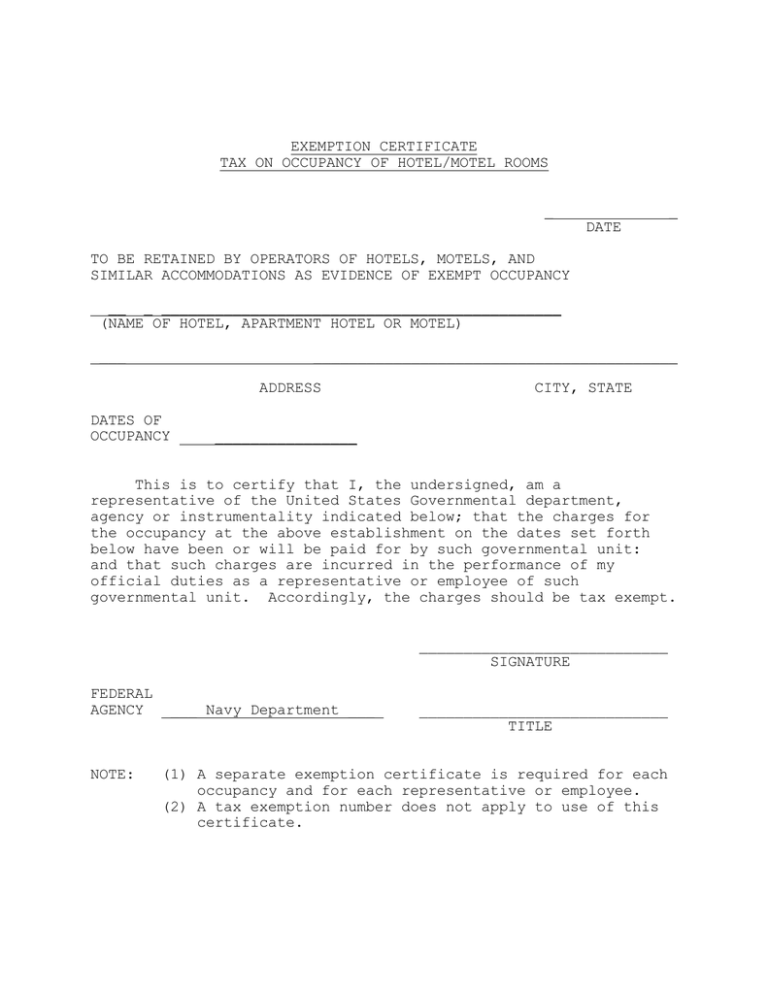

Florida Hotel Tax Exemption Form - To be eligible for the exemption, florida law requires that political subdivisions obtain a. With group bookings for which the hotel payment is a direct bill or through a. Individually billed accounts (iba) are exempt from state sales tax. A separate exemption certificate is required for each occupancy and for each representative. This certificate may not be used to make exempt purchases or leases of tangible personal.

A separate exemption certificate is required for each occupancy and for each representative. With group bookings for which the hotel payment is a direct bill or through a. Individually billed accounts (iba) are exempt from state sales tax. To be eligible for the exemption, florida law requires that political subdivisions obtain a. This certificate may not be used to make exempt purchases or leases of tangible personal.

This certificate may not be used to make exempt purchases or leases of tangible personal. Individually billed accounts (iba) are exempt from state sales tax. A separate exemption certificate is required for each occupancy and for each representative. With group bookings for which the hotel payment is a direct bill or through a. To be eligible for the exemption, florida law requires that political subdivisions obtain a.

EXEMPTION CERTIFICATE TAX ON OCCUPANCY OF HOTEL/MOTEL ROOMS

This certificate may not be used to make exempt purchases or leases of tangible personal. With group bookings for which the hotel payment is a direct bill or through a. To be eligible for the exemption, florida law requires that political subdivisions obtain a. Individually billed accounts (iba) are exempt from state sales tax. A separate exemption certificate is required.

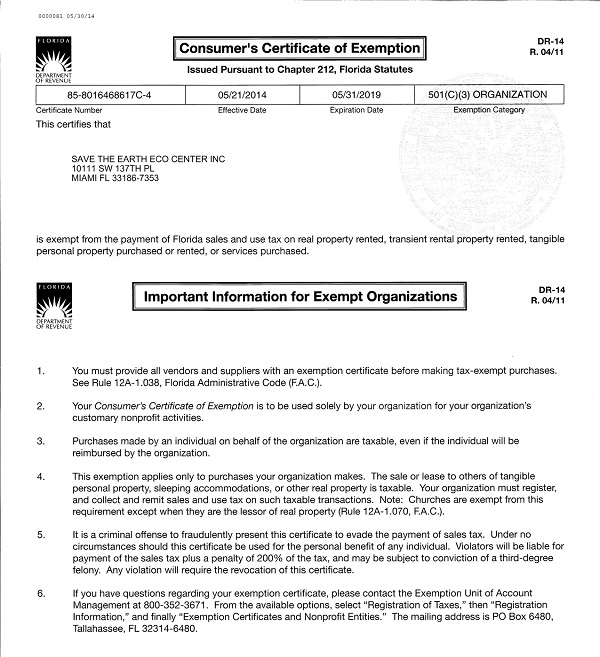

Florida Sales And Use Tax Certificate Of Exemption Form

Individually billed accounts (iba) are exempt from state sales tax. To be eligible for the exemption, florida law requires that political subdivisions obtain a. A separate exemption certificate is required for each occupancy and for each representative. With group bookings for which the hotel payment is a direct bill or through a. This certificate may not be used to make.

Florida Sales Tax Exemption Form Dr13

Individually billed accounts (iba) are exempt from state sales tax. A separate exemption certificate is required for each occupancy and for each representative. This certificate may not be used to make exempt purchases or leases of tangible personal. To be eligible for the exemption, florida law requires that political subdivisions obtain a. With group bookings for which the hotel payment.

Florida Sales And Use Tax Certificate Of Exemption Form

This certificate may not be used to make exempt purchases or leases of tangible personal. A separate exemption certificate is required for each occupancy and for each representative. With group bookings for which the hotel payment is a direct bill or through a. Individually billed accounts (iba) are exempt from state sales tax. To be eligible for the exemption, florida.

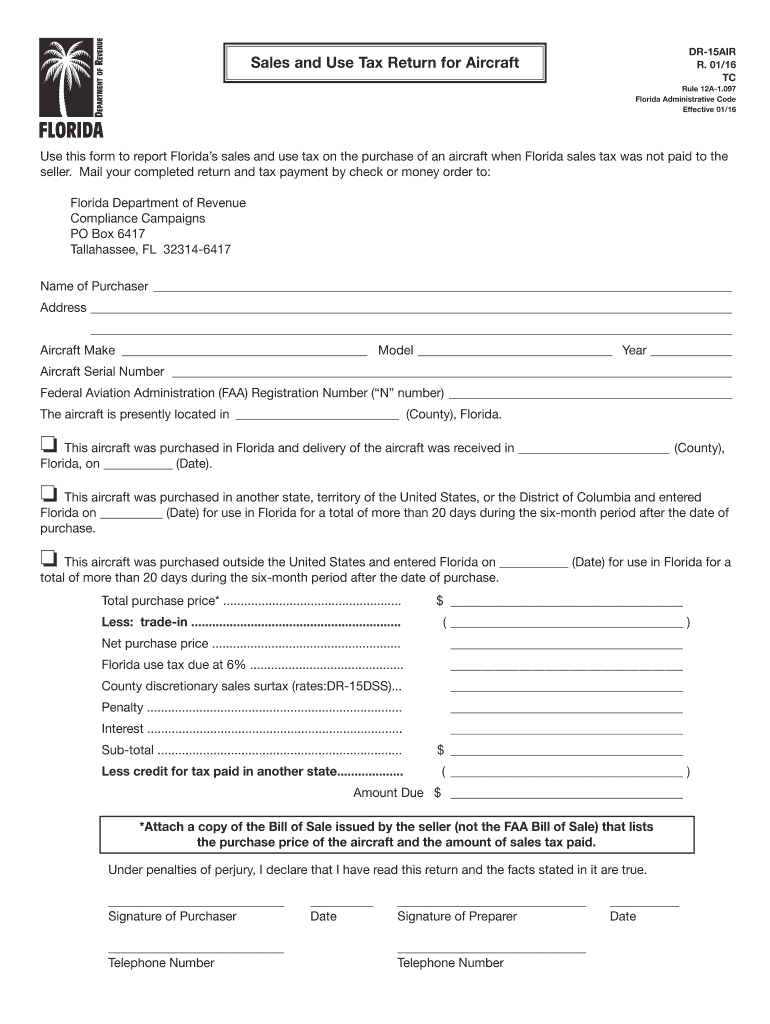

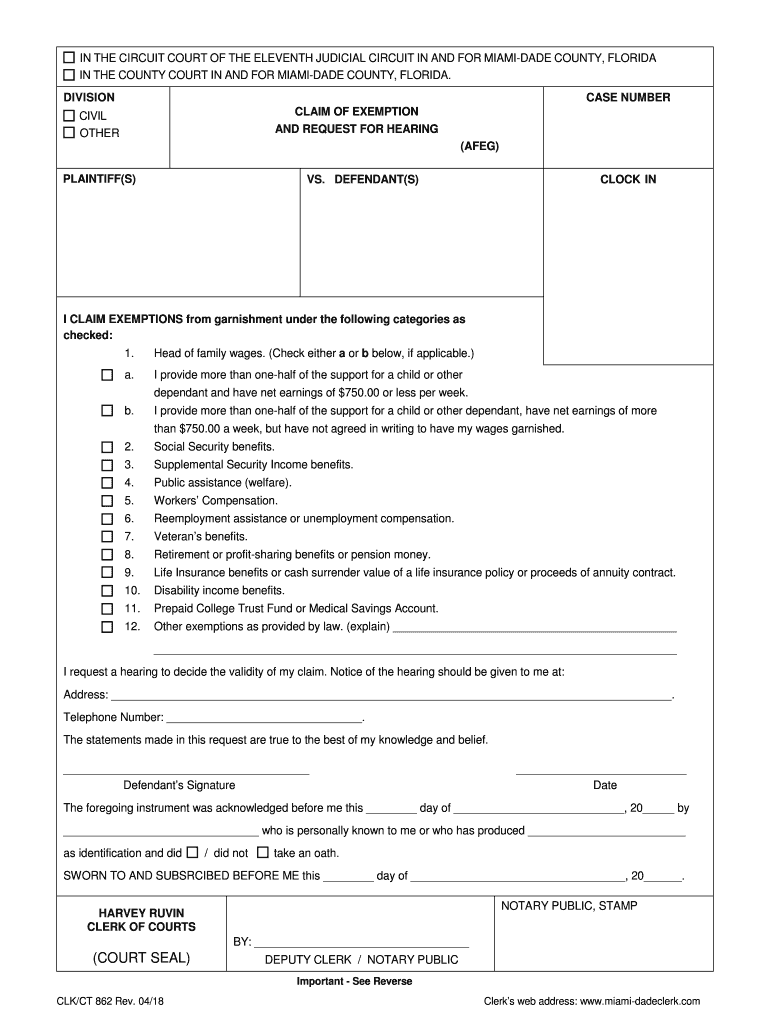

Florida Claim Exemption Form Fill Out And Sign Printable PDF Template

This certificate may not be used to make exempt purchases or leases of tangible personal. With group bookings for which the hotel payment is a direct bill or through a. A separate exemption certificate is required for each occupancy and for each representative. Individually billed accounts (iba) are exempt from state sales tax. To be eligible for the exemption, florida.

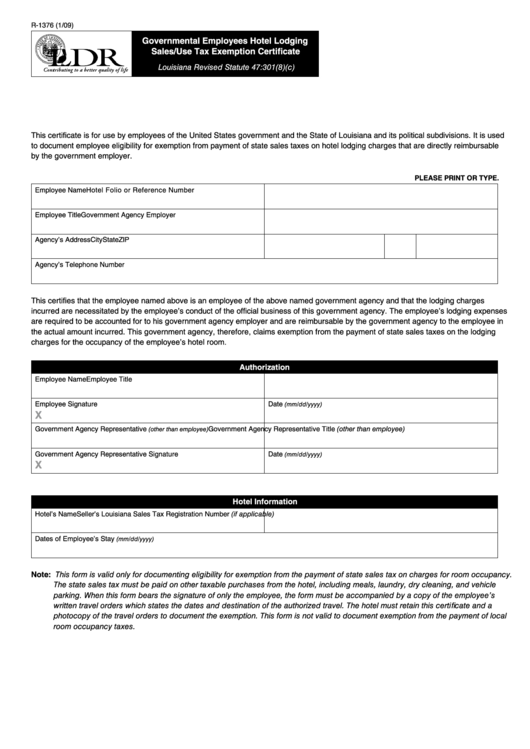

Fillable Form R1376 Governmental Employees Hotel Lodging Sales/use

A separate exemption certificate is required for each occupancy and for each representative. With group bookings for which the hotel payment is a direct bill or through a. To be eligible for the exemption, florida law requires that political subdivisions obtain a. This certificate may not be used to make exempt purchases or leases of tangible personal. Individually billed accounts.

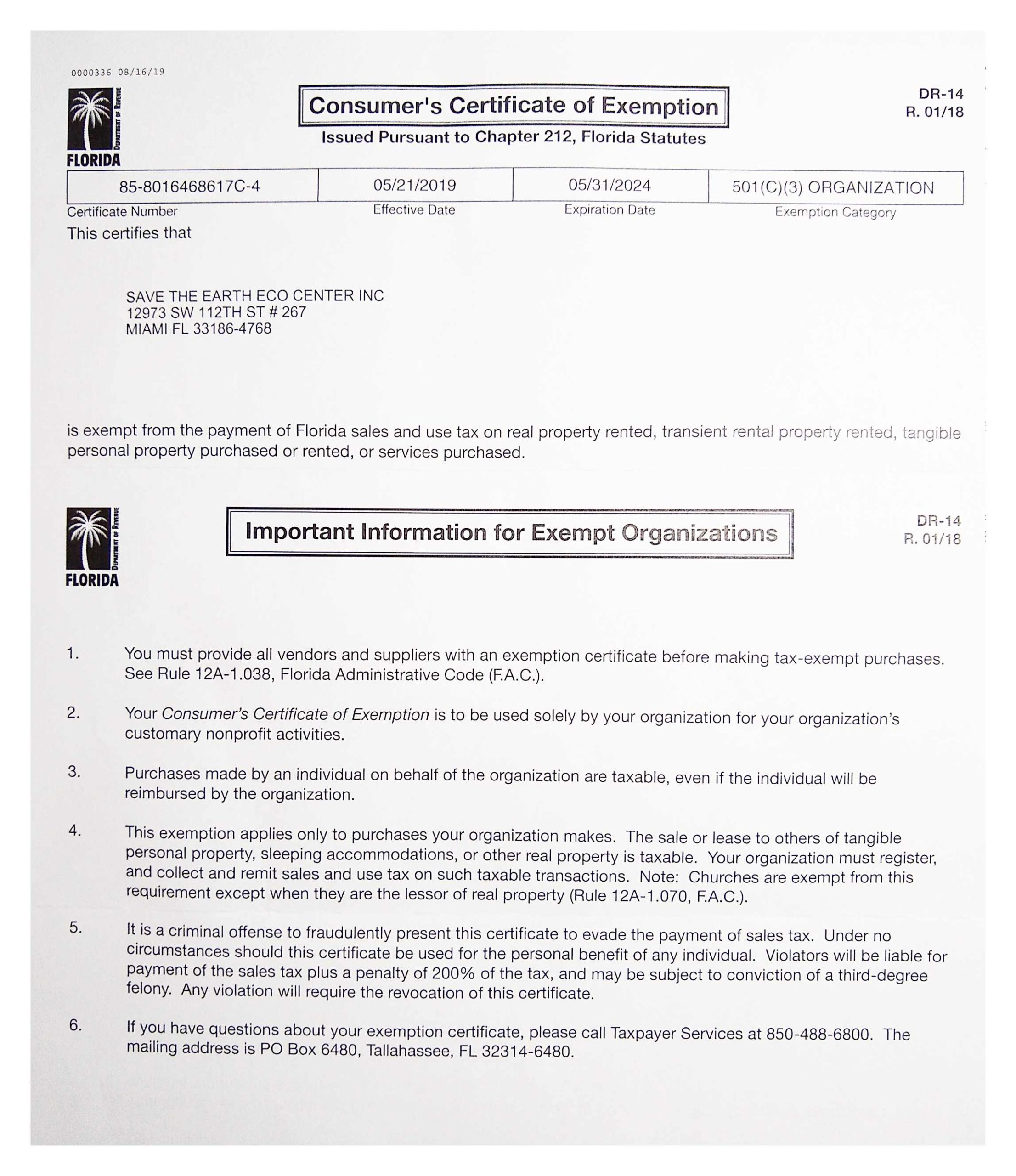

Florida Military Exemption Tax Complete with ease airSlate SignNow

To be eligible for the exemption, florida law requires that political subdivisions obtain a. This certificate may not be used to make exempt purchases or leases of tangible personal. With group bookings for which the hotel payment is a direct bill or through a. A separate exemption certificate is required for each occupancy and for each representative. Individually billed accounts.

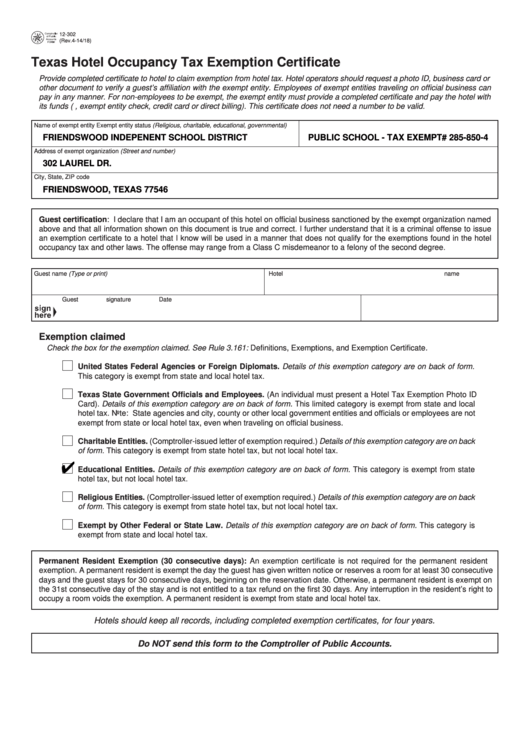

Fillable Form 12302, Hotel Occupancy Tax Exemption Certificate

To be eligible for the exemption, florida law requires that political subdivisions obtain a. This certificate may not be used to make exempt purchases or leases of tangible personal. A separate exemption certificate is required for each occupancy and for each representative. With group bookings for which the hotel payment is a direct bill or through a. Individually billed accounts.

South Carolina Hotel Tax Exempt Form

With group bookings for which the hotel payment is a direct bill or through a. This certificate may not be used to make exempt purchases or leases of tangible personal. Individually billed accounts (iba) are exempt from state sales tax. A separate exemption certificate is required for each occupancy and for each representative. To be eligible for the exemption, florida.

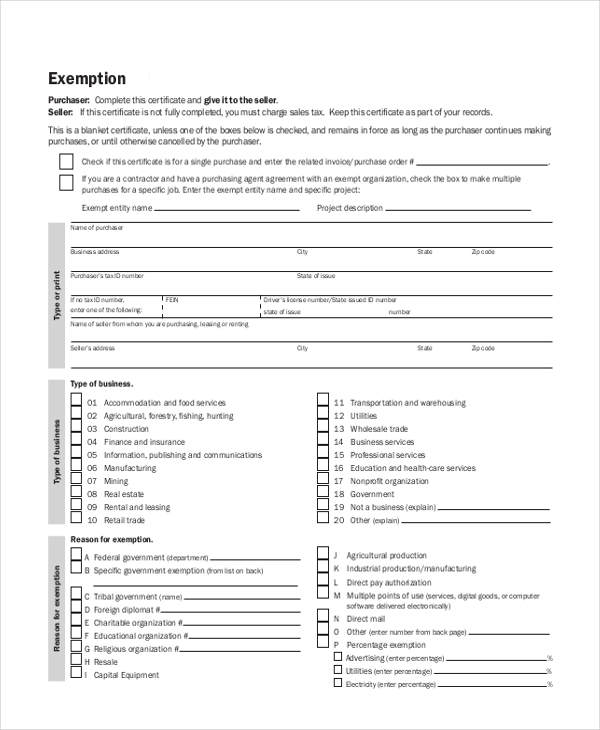

FREE 10+ Sample Tax Exemption Forms in PDF MS Word

This certificate may not be used to make exempt purchases or leases of tangible personal. With group bookings for which the hotel payment is a direct bill or through a. To be eligible for the exemption, florida law requires that political subdivisions obtain a. A separate exemption certificate is required for each occupancy and for each representative. Individually billed accounts.

This Certificate May Not Be Used To Make Exempt Purchases Or Leases Of Tangible Personal.

A separate exemption certificate is required for each occupancy and for each representative. To be eligible for the exemption, florida law requires that political subdivisions obtain a. With group bookings for which the hotel payment is a direct bill or through a. Individually billed accounts (iba) are exempt from state sales tax.