Form 1116 Explanation Statement Example - Detailed explanation must be completed. Some examples of these deductions might be medical expenses that you deducted on schedule a, line 4, or alimony that you paid and. You file form 1116 if you are an individual, estate, or trust, and you paid or. The associated tt comment is: You must complete form 1116 in order to claim the foreign tax credit on your us tax return for foreign income tax paid. Attach a statement to form 1116 showing the balance in each separate category overall foreign loss account. The foreign tax paid is entered on form 1116.

You must complete form 1116 in order to claim the foreign tax credit on your us tax return for foreign income tax paid. The associated tt comment is: Detailed explanation must be completed. You file form 1116 if you are an individual, estate, or trust, and you paid or. Some examples of these deductions might be medical expenses that you deducted on schedule a, line 4, or alimony that you paid and. The foreign tax paid is entered on form 1116. Attach a statement to form 1116 showing the balance in each separate category overall foreign loss account.

Some examples of these deductions might be medical expenses that you deducted on schedule a, line 4, or alimony that you paid and. You file form 1116 if you are an individual, estate, or trust, and you paid or. You must complete form 1116 in order to claim the foreign tax credit on your us tax return for foreign income tax paid. The foreign tax paid is entered on form 1116. Attach a statement to form 1116 showing the balance in each separate category overall foreign loss account. The associated tt comment is: Detailed explanation must be completed.

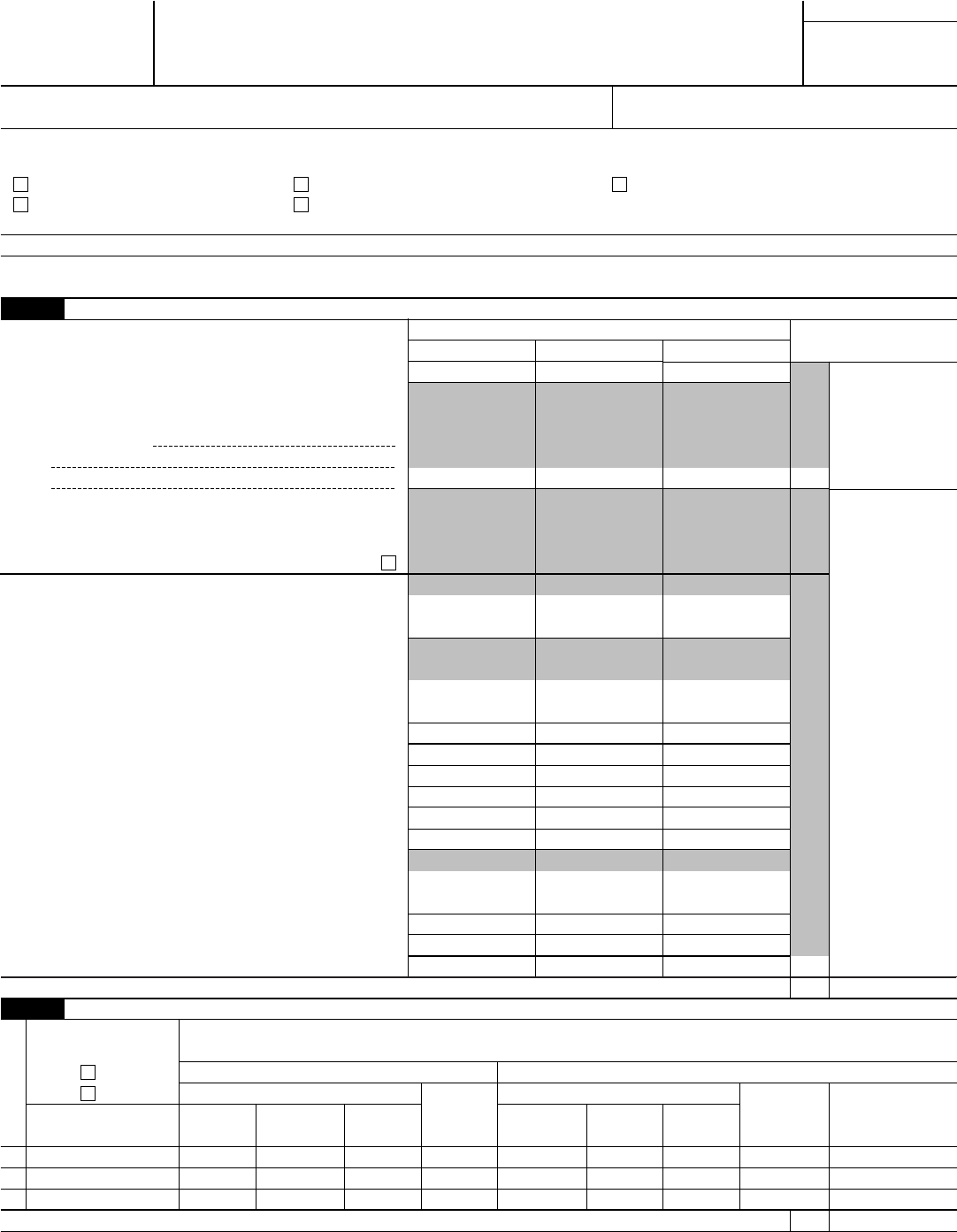

Form 1116 Edit, Fill, Sign Online Handypdf

Detailed explanation must be completed. You file form 1116 if you are an individual, estate, or trust, and you paid or. The associated tt comment is: Attach a statement to form 1116 showing the balance in each separate category overall foreign loss account. The foreign tax paid is entered on form 1116.

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

The foreign tax paid is entered on form 1116. Some examples of these deductions might be medical expenses that you deducted on schedule a, line 4, or alimony that you paid and. The associated tt comment is: You file form 1116 if you are an individual, estate, or trust, and you paid or. Attach a statement to form 1116 showing.

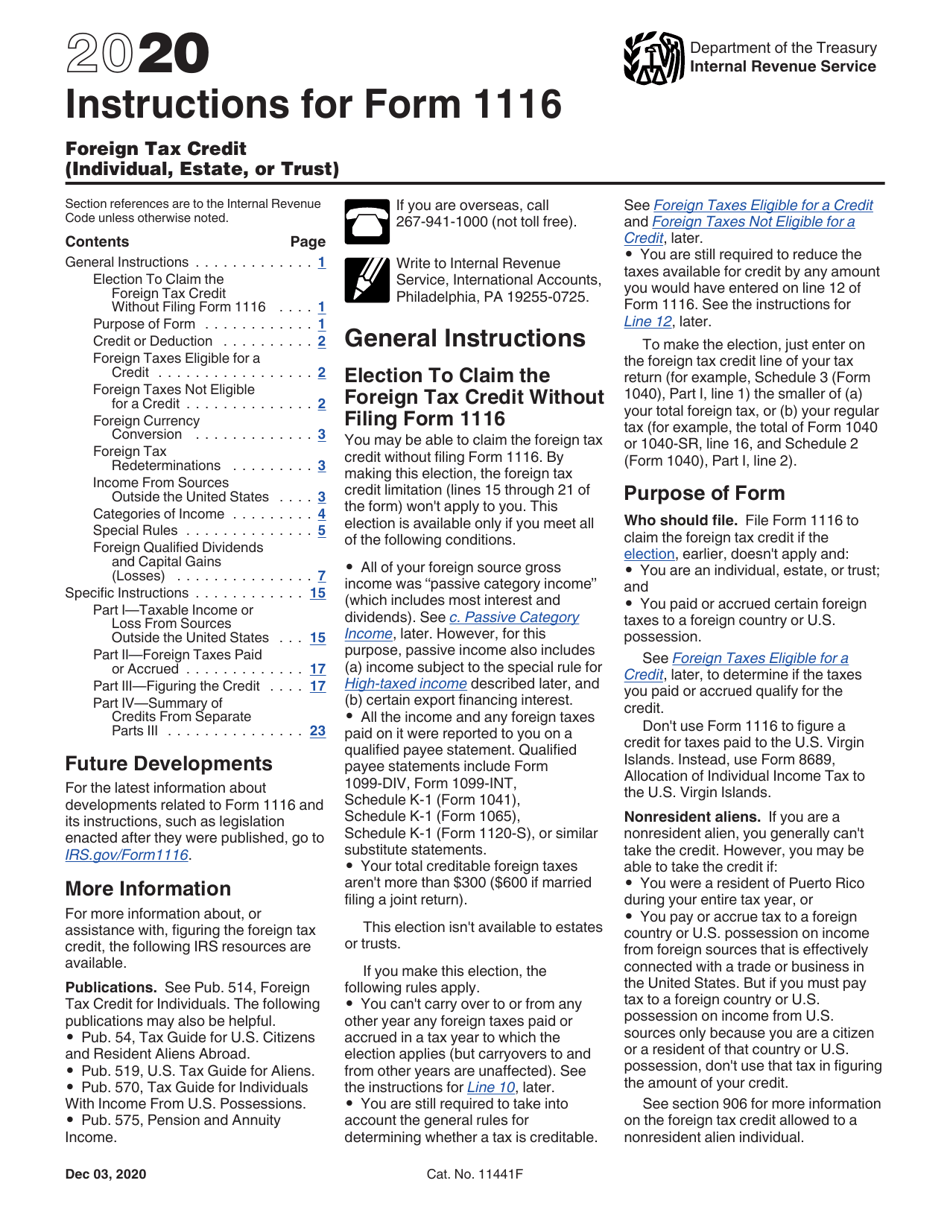

Form 1116 Explanation Statement What You Need to File

The associated tt comment is: Detailed explanation must be completed. You must complete form 1116 in order to claim the foreign tax credit on your us tax return for foreign income tax paid. You file form 1116 if you are an individual, estate, or trust, and you paid or. Some examples of these deductions might be medical expenses that you.

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

The associated tt comment is: Detailed explanation must be completed. You file form 1116 if you are an individual, estate, or trust, and you paid or. Some examples of these deductions might be medical expenses that you deducted on schedule a, line 4, or alimony that you paid and. You must complete form 1116 in order to claim the foreign.

Form 1116 2023 Printable Forms Free Online

Some examples of these deductions might be medical expenses that you deducted on schedule a, line 4, or alimony that you paid and. Detailed explanation must be completed. Attach a statement to form 1116 showing the balance in each separate category overall foreign loss account. The associated tt comment is: You file form 1116 if you are an individual, estate,.

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Detailed explanation must be completed. Some examples of these deductions might be medical expenses that you deducted on schedule a, line 4, or alimony that you paid and. You file form 1116 if you are an individual, estate, or trust, and you paid or. You must complete form 1116 in order to claim the foreign tax credit on your us.

Form 1116 Explanation Statement What You Need to File

Detailed explanation must be completed. You must complete form 1116 in order to claim the foreign tax credit on your us tax return for foreign income tax paid. The associated tt comment is: You file form 1116 if you are an individual, estate, or trust, and you paid or. The foreign tax paid is entered on form 1116.

Form 1116 Explanation Statement What You Need to File

Some examples of these deductions might be medical expenses that you deducted on schedule a, line 4, or alimony that you paid and. Attach a statement to form 1116 showing the balance in each separate category overall foreign loss account. Detailed explanation must be completed. The associated tt comment is: You file form 1116 if you are an individual, estate,.

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

You must complete form 1116 in order to claim the foreign tax credit on your us tax return for foreign income tax paid. The foreign tax paid is entered on form 1116. The associated tt comment is: Attach a statement to form 1116 showing the balance in each separate category overall foreign loss account. Some examples of these deductions might.

Irs Form 1116 Printable Printable Forms Free Online

Detailed explanation must be completed. Some examples of these deductions might be medical expenses that you deducted on schedule a, line 4, or alimony that you paid and. You file form 1116 if you are an individual, estate, or trust, and you paid or. Attach a statement to form 1116 showing the balance in each separate category overall foreign loss.

The Foreign Tax Paid Is Entered On Form 1116.

You must complete form 1116 in order to claim the foreign tax credit on your us tax return for foreign income tax paid. Detailed explanation must be completed. Attach a statement to form 1116 showing the balance in each separate category overall foreign loss account. You file form 1116 if you are an individual, estate, or trust, and you paid or.

Some Examples Of These Deductions Might Be Medical Expenses That You Deducted On Schedule A, Line 4, Or Alimony That You Paid And.

The associated tt comment is: