Form 1116 Foreign Tax Credit Example - You must complete form 1116 in order to claim the foreign tax credit on your us tax return for foreign income tax paid. If you claim the foreign tax credit based on foreign taxes accrued instead of foreign taxes paid, your foreign tax credit and u.s. To help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately.

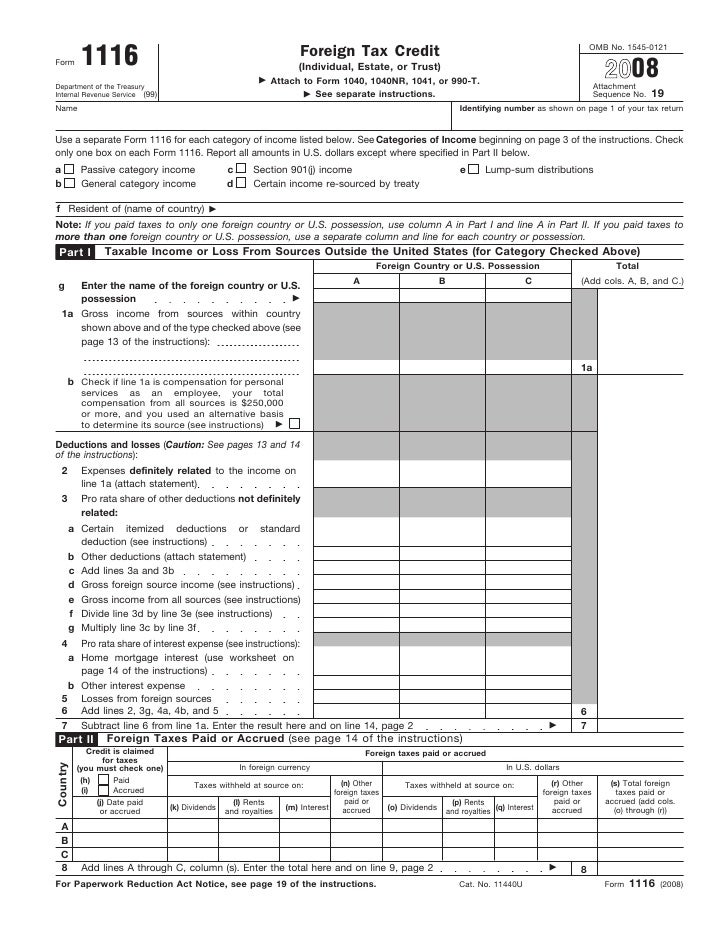

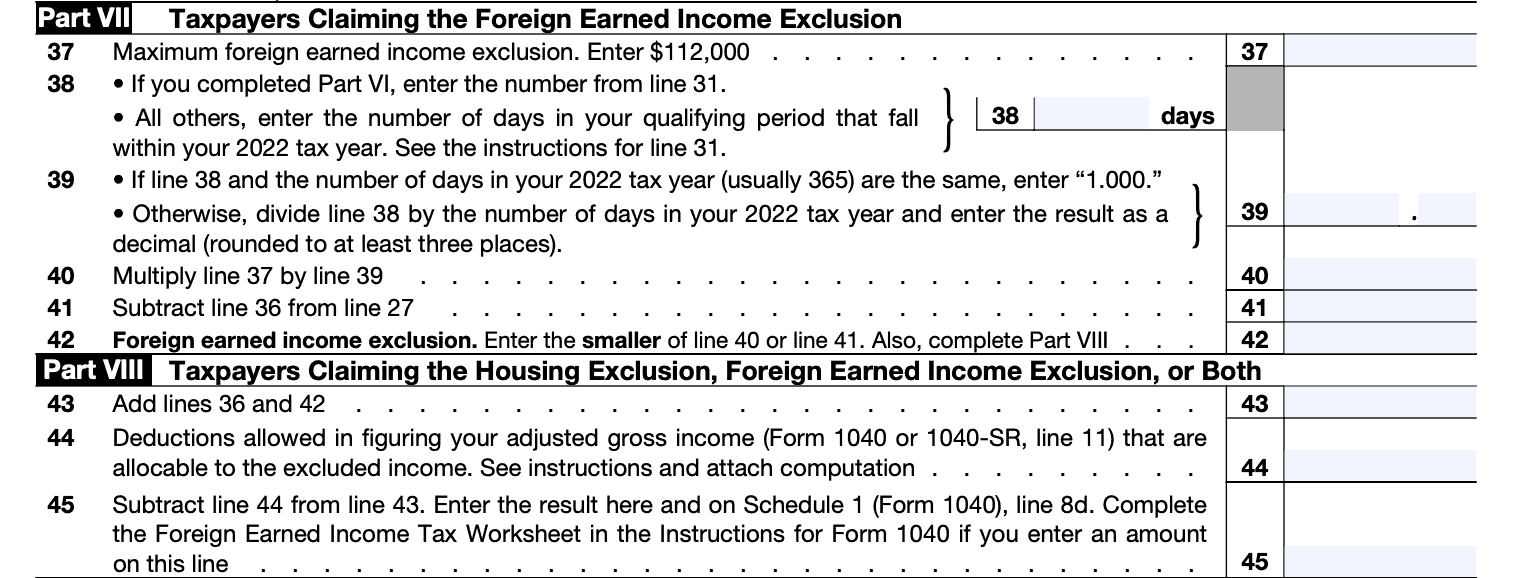

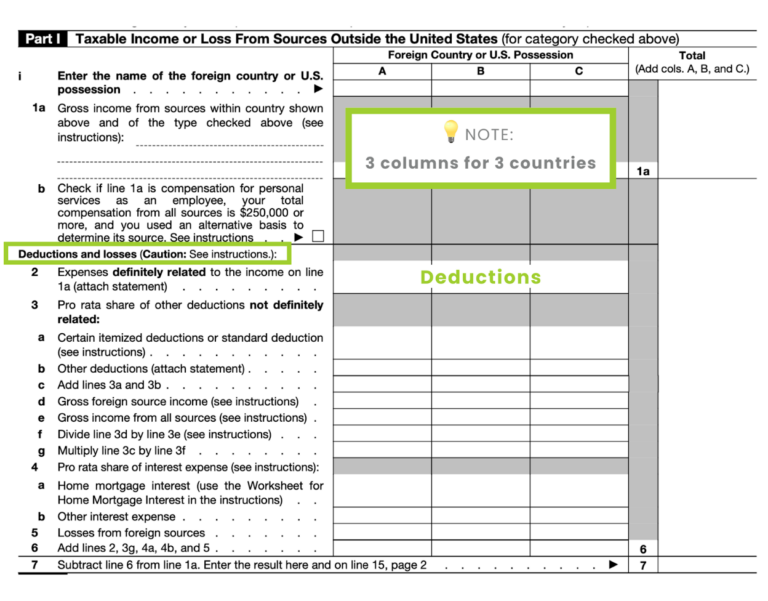

You must complete form 1116 in order to claim the foreign tax credit on your us tax return for foreign income tax paid. If you claim the foreign tax credit based on foreign taxes accrued instead of foreign taxes paid, your foreign tax credit and u.s. To help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately.

If you claim the foreign tax credit based on foreign taxes accrued instead of foreign taxes paid, your foreign tax credit and u.s. To help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately. You must complete form 1116 in order to claim the foreign tax credit on your us tax return for foreign income tax paid.

Filing Form 1116 Foreign Tax Credit (With Examples) TaxConnections

To help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately. If you claim the foreign tax credit based on foreign taxes accrued instead of foreign taxes paid, your foreign tax credit and u.s. You must complete form 1116 in order to claim the foreign tax credit on.

Form 1116Foreign Tax Credit

You must complete form 1116 in order to claim the foreign tax credit on your us tax return for foreign income tax paid. To help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately. If you claim the foreign tax credit based on foreign taxes accrued instead of.

IRS Form 1116 Foreign Tax Credit With An Example 1040, 54 OFF

You must complete form 1116 in order to claim the foreign tax credit on your us tax return for foreign income tax paid. To help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately. If you claim the foreign tax credit based on foreign taxes accrued instead of.

Form 1116 Instructions for Expats Claiming the Foreign Tax Credit

You must complete form 1116 in order to claim the foreign tax credit on your us tax return for foreign income tax paid. If you claim the foreign tax credit based on foreign taxes accrued instead of foreign taxes paid, your foreign tax credit and u.s. To help these taxpayers, you must determine which taxes and types of foreign income.

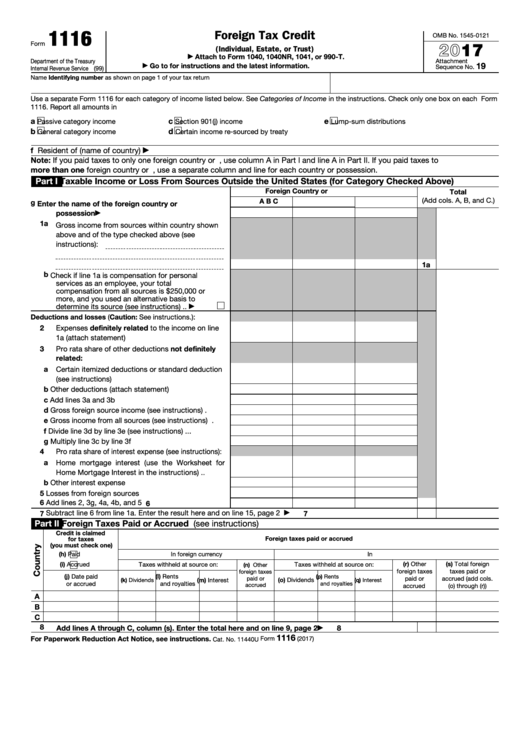

Fillable Form 1116 Foreign Tax Credit 2017 printable pdf download

If you claim the foreign tax credit based on foreign taxes accrued instead of foreign taxes paid, your foreign tax credit and u.s. You must complete form 1116 in order to claim the foreign tax credit on your us tax return for foreign income tax paid. To help these taxpayers, you must determine which taxes and types of foreign income.

Foreign Tax Credit Your Guide to the Form 1116 SDG Accountant

To help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately. You must complete form 1116 in order to claim the foreign tax credit on your us tax return for foreign income tax paid. If you claim the foreign tax credit based on foreign taxes accrued instead of.

Form 1116 Instructions for Expats Claiming the Foreign Tax Credit

You must complete form 1116 in order to claim the foreign tax credit on your us tax return for foreign income tax paid. To help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately. If you claim the foreign tax credit based on foreign taxes accrued instead of.

IRS Form 1116 Foreign Tax Credit With An Example 1040, 54 OFF

To help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately. If you claim the foreign tax credit based on foreign taxes accrued instead of foreign taxes paid, your foreign tax credit and u.s. You must complete form 1116 in order to claim the foreign tax credit on.

Form 1116Foreign Tax Credit

To help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately. If you claim the foreign tax credit based on foreign taxes accrued instead of foreign taxes paid, your foreign tax credit and u.s. You must complete form 1116 in order to claim the foreign tax credit on.

Filing Form 1116 Foreign Tax Credit (With Examples) TaxConnections

To help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately. If you claim the foreign tax credit based on foreign taxes accrued instead of foreign taxes paid, your foreign tax credit and u.s. You must complete form 1116 in order to claim the foreign tax credit on.

You Must Complete Form 1116 In Order To Claim The Foreign Tax Credit On Your Us Tax Return For Foreign Income Tax Paid.

To help these taxpayers, you must determine which taxes and types of foreign income are eligible for the foreign tax credit and accurately. If you claim the foreign tax credit based on foreign taxes accrued instead of foreign taxes paid, your foreign tax credit and u.s.