Form 1118 Schedule L - Use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or us. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each applicable separate category, the. Schedule l (form 1118) serves to identify and report foreign tax redeterminations that affect a taxpayer's u.s.

Schedule l (form 1118) serves to identify and report foreign tax redeterminations that affect a taxpayer's u.s. Use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or us. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each applicable separate category, the.

Schedule l (form 1118) serves to identify and report foreign tax redeterminations that affect a taxpayer's u.s. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each applicable separate category, the. Use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or us.

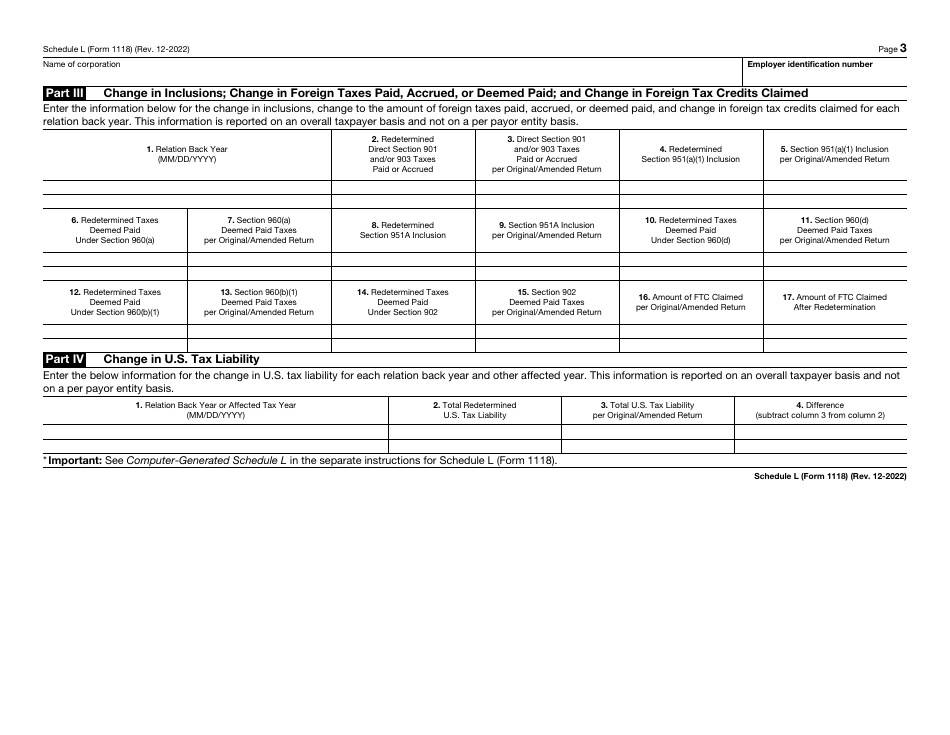

IRS Form 1118 Schedule L Fill Out, Sign Online and Download Fillable

Schedule l (form 1118) serves to identify and report foreign tax redeterminations that affect a taxpayer's u.s. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each applicable separate category, the. Use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries.

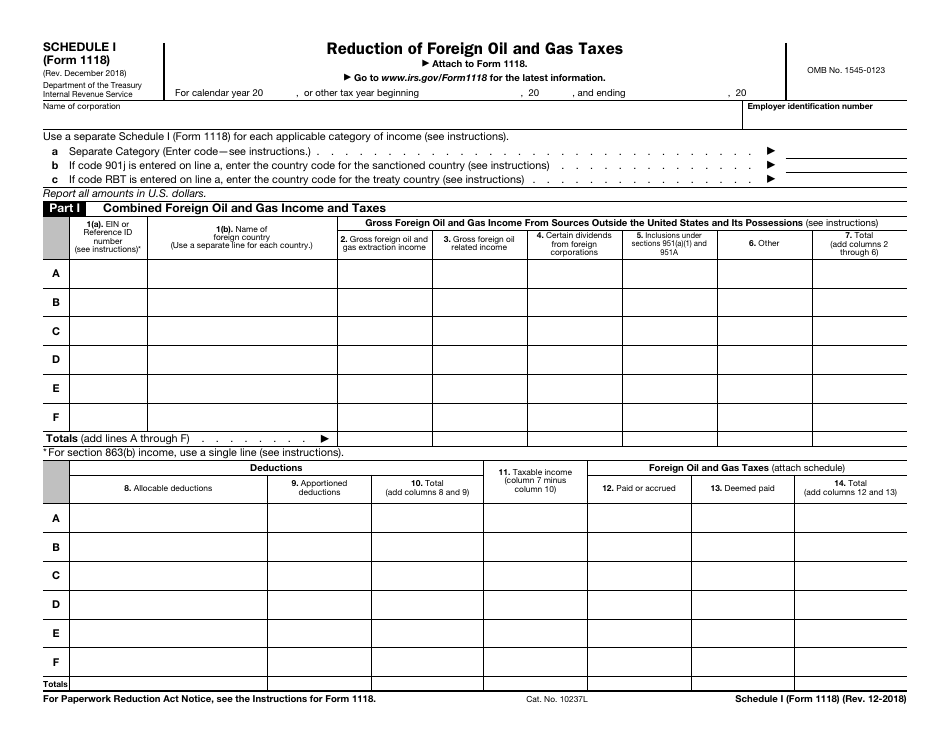

IRS Form 1118 Schedule I Fill Out, Sign Online and Download Fillable

Use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or us. Schedule l (form 1118) serves to identify and report foreign tax redeterminations that affect a taxpayer's u.s. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each applicable separate.

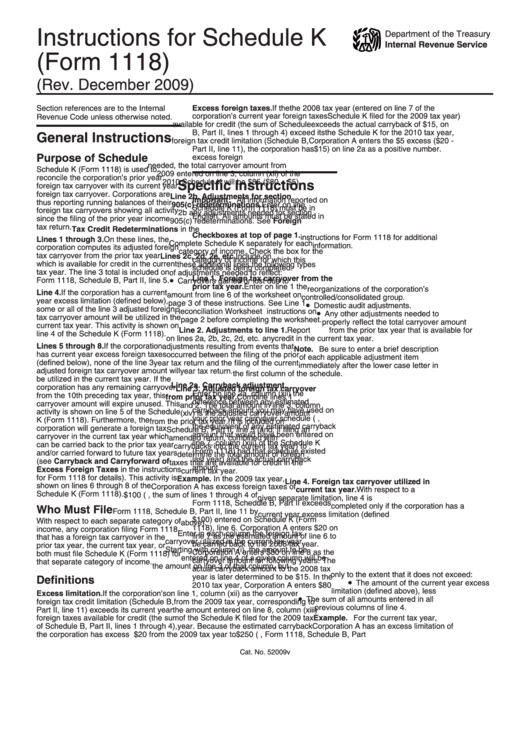

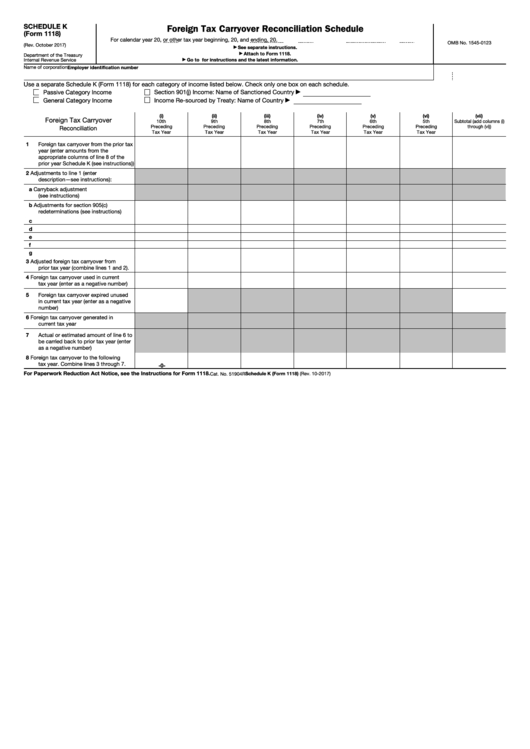

Instructions For Schedule K (Form 1118) printable pdf download

Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each applicable separate category, the. Use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or us. Schedule l (form 1118) serves to identify and report foreign tax redeterminations that affect a.

Form 1118 (Schedule K) Foreign Tax Carryover Reconciliation Schedule

Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each applicable separate category, the. Use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or us. Schedule l (form 1118) serves to identify and report foreign tax redeterminations that affect a.

Schedule L (Form 1118) Fill and sign online with Lumin

Use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or us. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each applicable separate category, the. Schedule l (form 1118) serves to identify and report foreign tax redeterminations that affect a.

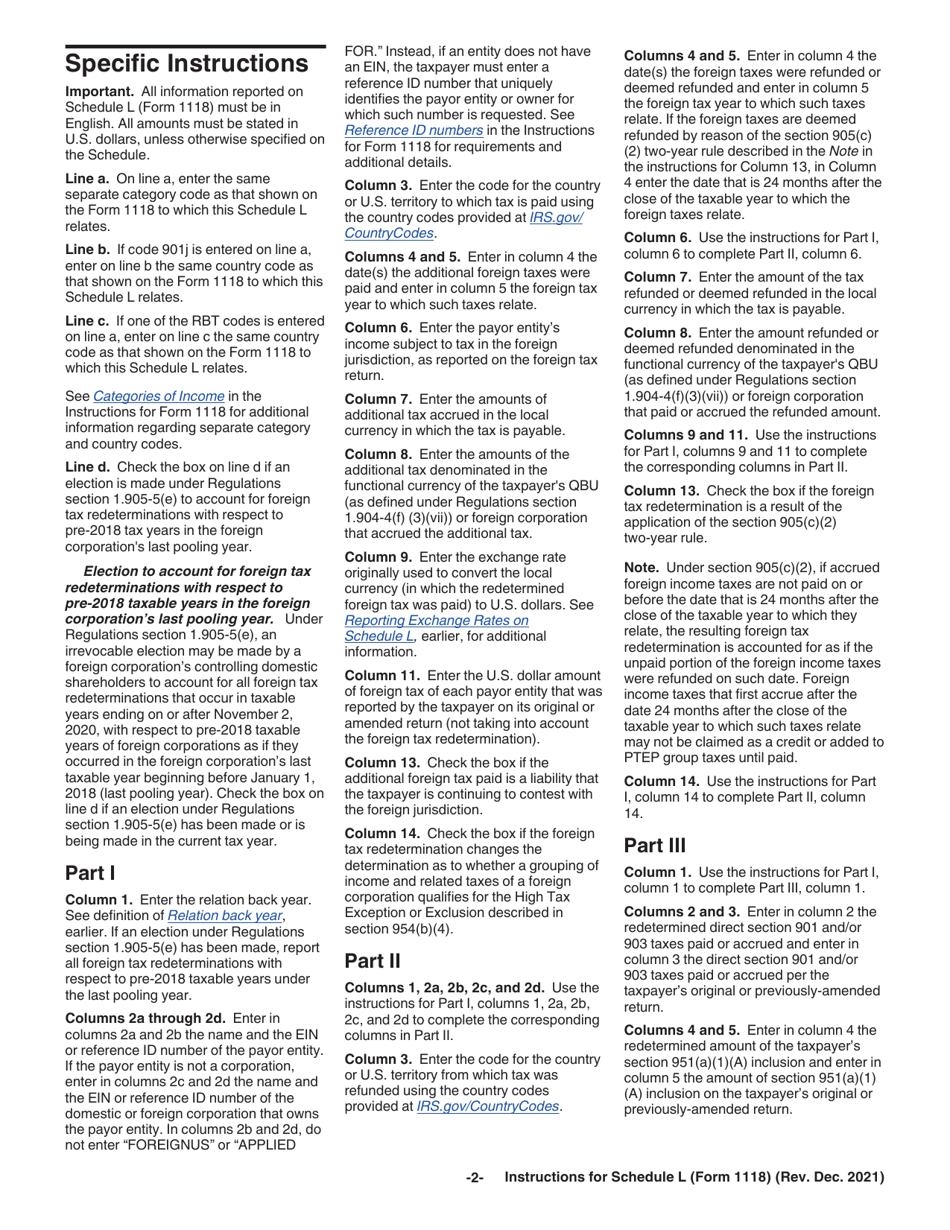

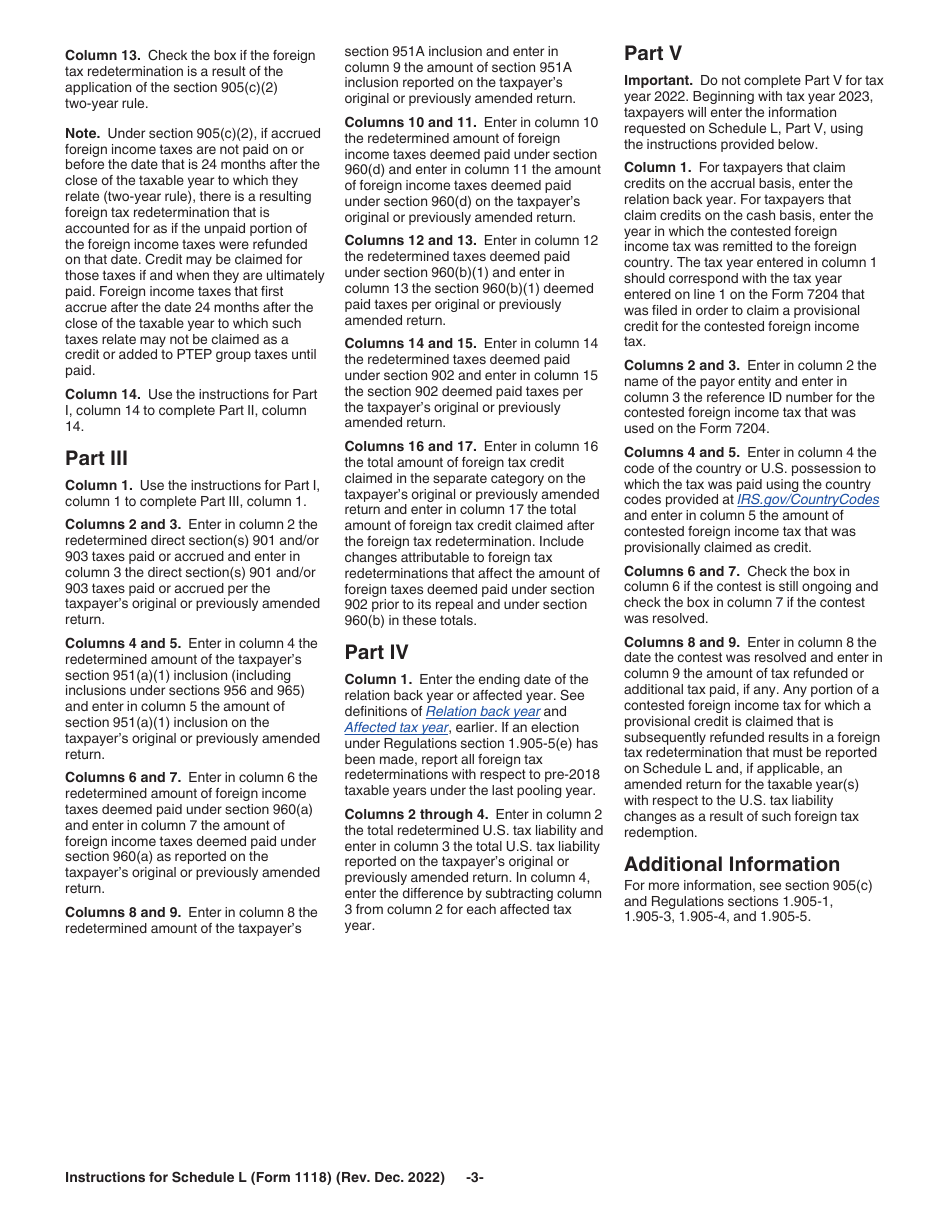

Download Instructions for IRS Form 1118 Schedule L Foreign Tax

Use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or us. Schedule l (form 1118) serves to identify and report foreign tax redeterminations that affect a taxpayer's u.s. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each applicable separate.

Schedule L (Form 1118) Fill and sign online with Lumin

Use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or us. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each applicable separate category, the. Schedule l (form 1118) serves to identify and report foreign tax redeterminations that affect a.

Top 26 Form 1118 Templates free to download in PDF format

Use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or us. Schedule l (form 1118) serves to identify and report foreign tax redeterminations that affect a taxpayer's u.s. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each applicable separate.

Download Instructions for IRS Form 1118 Schedule L Foreign Tax

Use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or us. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each applicable separate category, the. Schedule l (form 1118) serves to identify and report foreign tax redeterminations that affect a.

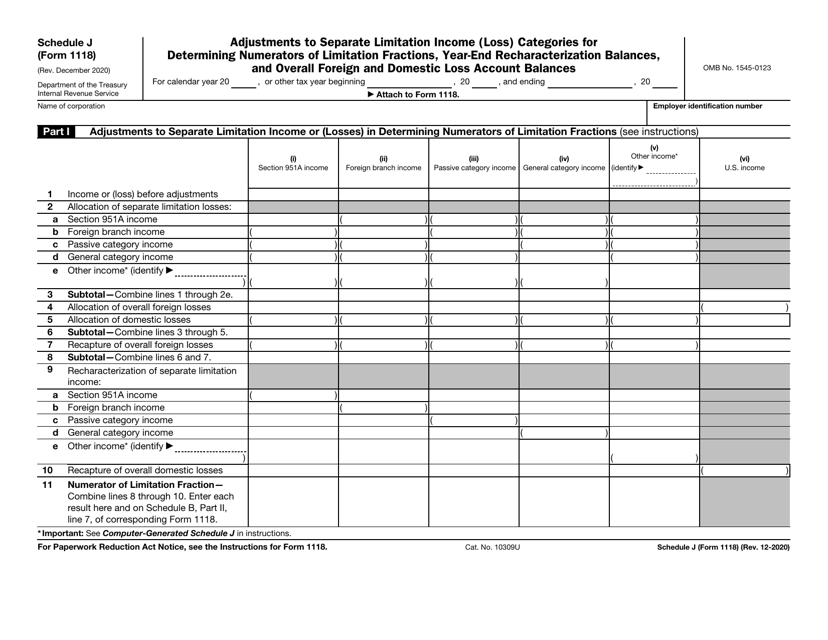

IRS Form 1118 Schedule J Download Fillable PDF or Fill Online

Schedule l (form 1118) serves to identify and report foreign tax redeterminations that affect a taxpayer's u.s. Use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or us. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each applicable separate.

Use Form 1118 To Compute A Corporation's Foreign Tax Credit For Certain Taxes Paid Or Accrued To Foreign Countries Or Us.

Schedule l (form 1118) serves to identify and report foreign tax redeterminations that affect a taxpayer's u.s. Schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each applicable separate category, the.