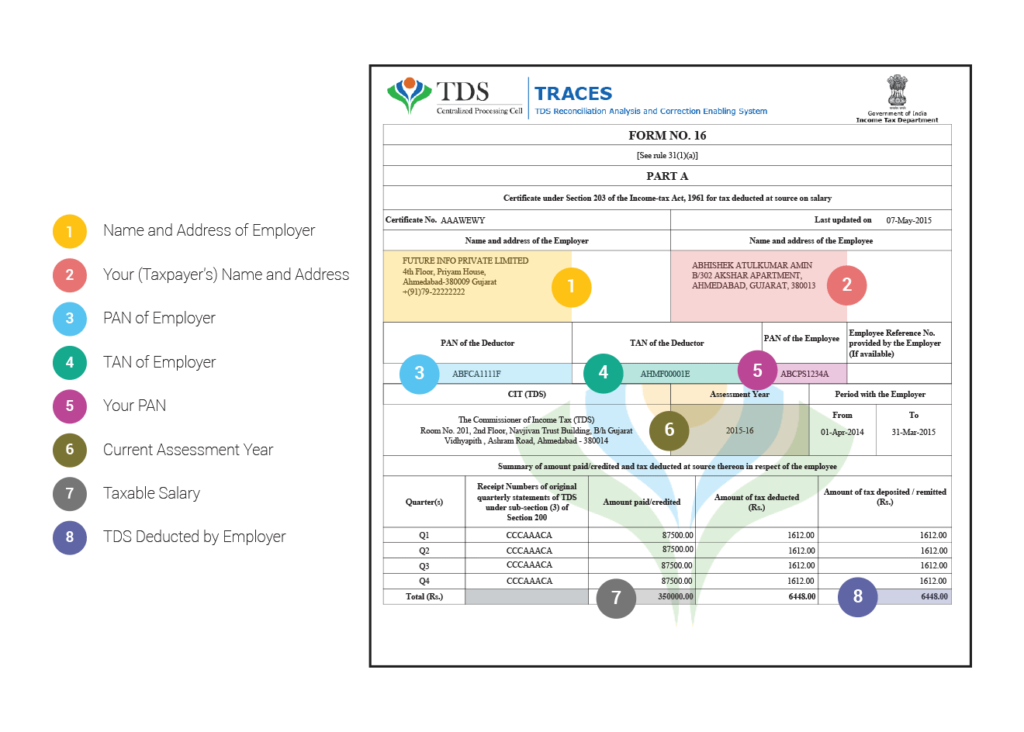

Form 16A Tds Certificate - Understand their issuance, verification, and legal. It is issued by the employer. In case of invalid pan or if the pan is not reported in tds statement, form 16 will not be generated. Learn about form 16 and form 16a, essential tds certificates in india. Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Tds certificate is generated in traces on the basis of details provided by deductor in the quarterly tds return. Form 16 is a tds certificate that shows the salary earned and the tds deducted from your salary. Form 16 is generated only for valid pan. 29 rows form 16a is a certificate issued under section 203 of the income tax act, 1961, to the person who has deducted tax at.

Tds certificate is generated in traces on the basis of details provided by deductor in the quarterly tds return. It is issued by the employer. In case of invalid pan or if the pan is not reported in tds statement, form 16 will not be generated. Form 16 is a tds certificate that shows the salary earned and the tds deducted from your salary. Learn about form 16 and form 16a, essential tds certificates in india. Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Understand their issuance, verification, and legal. Form 16 is generated only for valid pan. 29 rows form 16a is a certificate issued under section 203 of the income tax act, 1961, to the person who has deducted tax at.

Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Form 16 is generated only for valid pan. Understand their issuance, verification, and legal. In case of invalid pan or if the pan is not reported in tds statement, form 16 will not be generated. Form 16 is a tds certificate that shows the salary earned and the tds deducted from your salary. Tds certificate is generated in traces on the basis of details provided by deductor in the quarterly tds return. 29 rows form 16a is a certificate issued under section 203 of the income tax act, 1961, to the person who has deducted tax at. It is issued by the employer. Learn about form 16 and form 16a, essential tds certificates in india.

Form 16a Tds Certificate

It is issued by the employer. Understand their issuance, verification, and legal. In case of invalid pan or if the pan is not reported in tds statement, form 16 will not be generated. Form 16 is a tds certificate that shows the salary earned and the tds deducted from your salary. Form 16/ 16a is the certificate of deduction of.

Form 16 TDS Certificate issued by Employer Learn by Quicko

Learn about form 16 and form 16a, essential tds certificates in india. Tds certificate is generated in traces on the basis of details provided by deductor in the quarterly tds return. Form 16 is a tds certificate that shows the salary earned and the tds deducted from your salary. In case of invalid pan or if the pan is not.

Form 16B Certificate of TDS on Sale of Property Learn by Quicko

Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Form 16 is generated only for valid pan. Form 16 is a tds certificate that shows the salary earned and the tds deducted from your salary. In case of invalid pan or if the.

TDS Certificate Form 16, 16A Process & Due Date TaxWinner

Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. It is issued by the employer. Learn about form 16 and form 16a, essential tds certificates in india. Tds certificate is generated in traces on the basis of details provided by deductor in the.

Form 16a Tds Certificate

Tds certificate is generated in traces on the basis of details provided by deductor in the quarterly tds return. Understand their issuance, verification, and legal. Form 16 is a tds certificate that shows the salary earned and the tds deducted from your salary. Learn about form 16 and form 16a, essential tds certificates in india. In case of invalid pan.

What is Form 16A? Understand TDS Certificate other than salary

Tds certificate is generated in traces on the basis of details provided by deductor in the quarterly tds return. 29 rows form 16a is a certificate issued under section 203 of the income tax act, 1961, to the person who has deducted tax at. Form 16 is a tds certificate that shows the salary earned and the tds deducted from.

TDS Certificate Form 16D Details Learn by Quicko

Understand their issuance, verification, and legal. Learn about form 16 and form 16a, essential tds certificates in india. In case of invalid pan or if the pan is not reported in tds statement, form 16 will not be generated. It is issued by the employer. Form 16/ 16a is the certificate of deduction of tax at source and issued on.

Form 16a Tds Certificate

Form 16 is generated only for valid pan. 29 rows form 16a is a certificate issued under section 203 of the income tax act, 1961, to the person who has deducted tax at. Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Understand.

TDS Certificate Form16 / Form 16A

It is issued by the employer. Understand their issuance, verification, and legal. Form 16 is a tds certificate that shows the salary earned and the tds deducted from your salary. 29 rows form 16a is a certificate issued under section 203 of the income tax act, 1961, to the person who has deducted tax at. Form 16 is generated only.

TDS Certificate Form 16A Q 1 23 Download Free PDF Securities

In case of invalid pan or if the pan is not reported in tds statement, form 16 will not be generated. Form 16 is generated only for valid pan. Form 16 is a tds certificate that shows the salary earned and the tds deducted from your salary. Form 16/ 16a is the certificate of deduction of tax at source and.

29 Rows Form 16A Is A Certificate Issued Under Section 203 Of The Income Tax Act, 1961, To The Person Who Has Deducted Tax At.

Understand their issuance, verification, and legal. Form 16 is a tds certificate that shows the salary earned and the tds deducted from your salary. Form 16 is generated only for valid pan. Tds certificate is generated in traces on the basis of details provided by deductor in the quarterly tds return.

In Case Of Invalid Pan Or If The Pan Is Not Reported In Tds Statement, Form 16 Will Not Be Generated.

It is issued by the employer. Form 16/ 16a is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. Learn about form 16 and form 16a, essential tds certificates in india.