Form 2848 For Deceased Taxpayer - Yes, you can use form 2848 for a deceased person’s taxes, but. Form 2848 (irs power of attorney) must include authorization to. A decedent taxpayer's tax return can be filed electronically. How to prepare form 2848 for deceased taxpayer: You must follow the form instructions for line 1 under the section, “deceased. Can irs form 2848 be used for a deceased person's tax matters? The taxpayer has power of attorney for their spouse, who is not present. A discussion thread about how to get a power of attorney (poa) for a deceased taxpayer to file a final return or an amended. Follow the specific directions provided by your preparation. A subsidiary must file its own form 2848 for returns that must be filed separately from the consolidated return, such as form 720,.

Follow the specific directions provided by your preparation. A decedent taxpayer's tax return can be filed electronically. Form 2848 (irs power of attorney) must include authorization to. A discussion thread about how to get a power of attorney (poa) for a deceased taxpayer to file a final return or an amended. You must follow the form instructions for line 1 under the section, “deceased. Yes, you can use form 2848 for a deceased person’s taxes, but. The taxpayer has power of attorney for their spouse, who is not present. A subsidiary must file its own form 2848 for returns that must be filed separately from the consolidated return, such as form 720,. Can irs form 2848 be used for a deceased person's tax matters? How to prepare form 2848 for deceased taxpayer:

A decedent taxpayer's tax return can be filed electronically. Yes, you can use form 2848 for a deceased person’s taxes, but. Follow the specific directions provided by your preparation. A discussion thread about how to get a power of attorney (poa) for a deceased taxpayer to file a final return or an amended. You must follow the form instructions for line 1 under the section, “deceased. A subsidiary must file its own form 2848 for returns that must be filed separately from the consolidated return, such as form 720,. Can irs form 2848 be used for a deceased person's tax matters? Form 2848 (irs power of attorney) must include authorization to. How to prepare form 2848 for deceased taxpayer: The taxpayer has power of attorney for their spouse, who is not present.

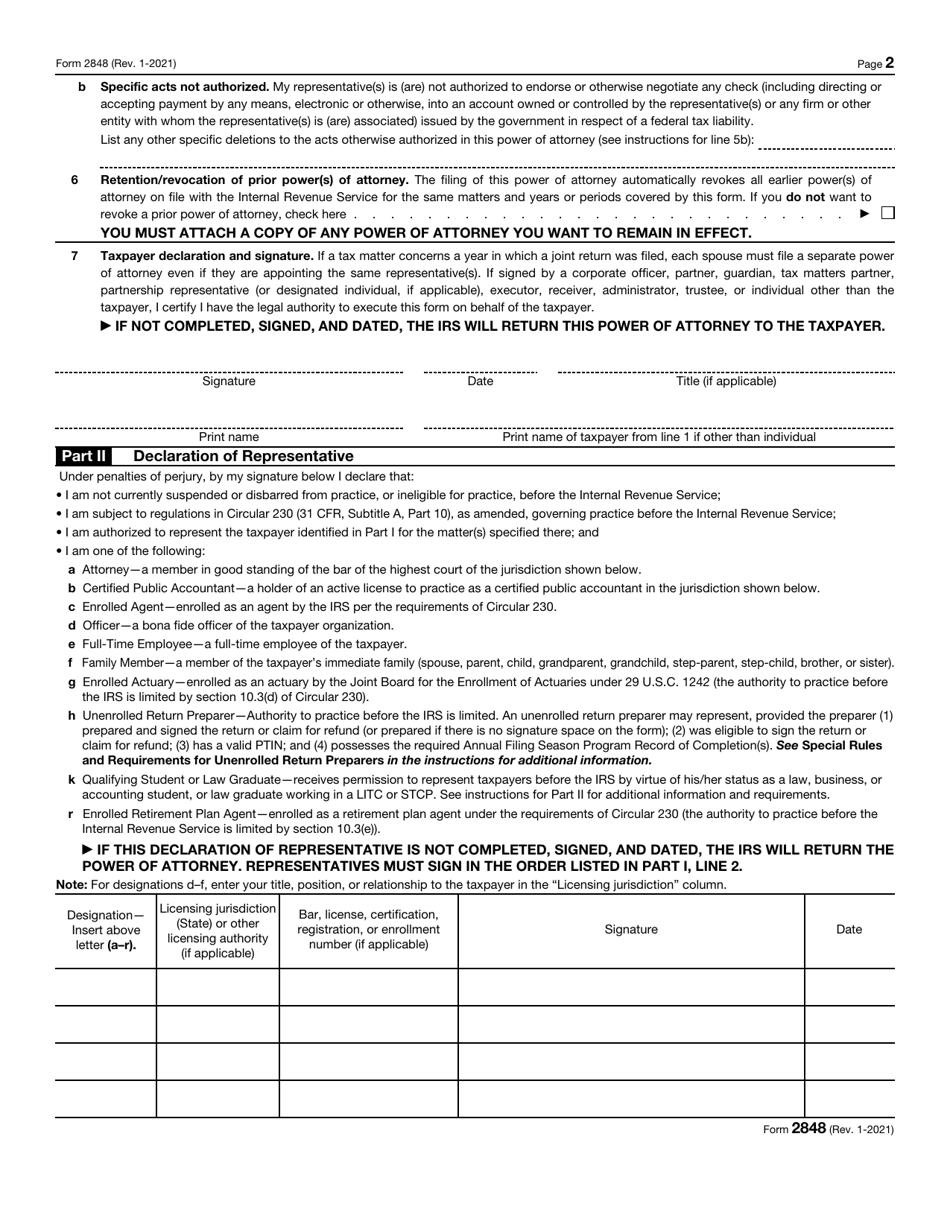

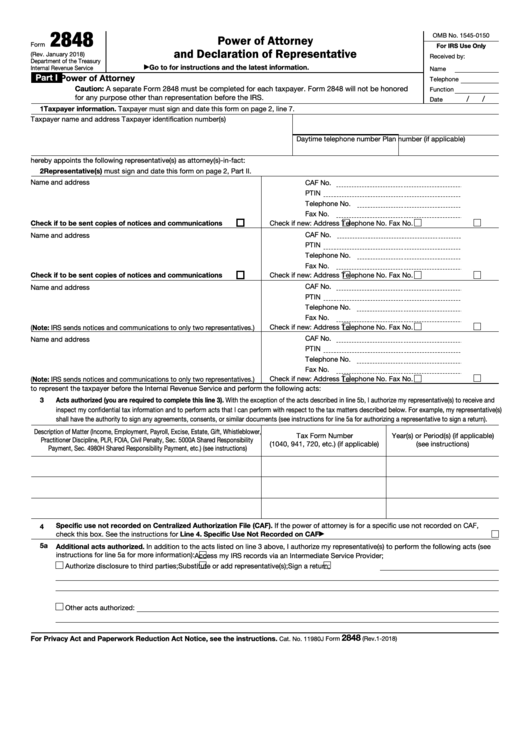

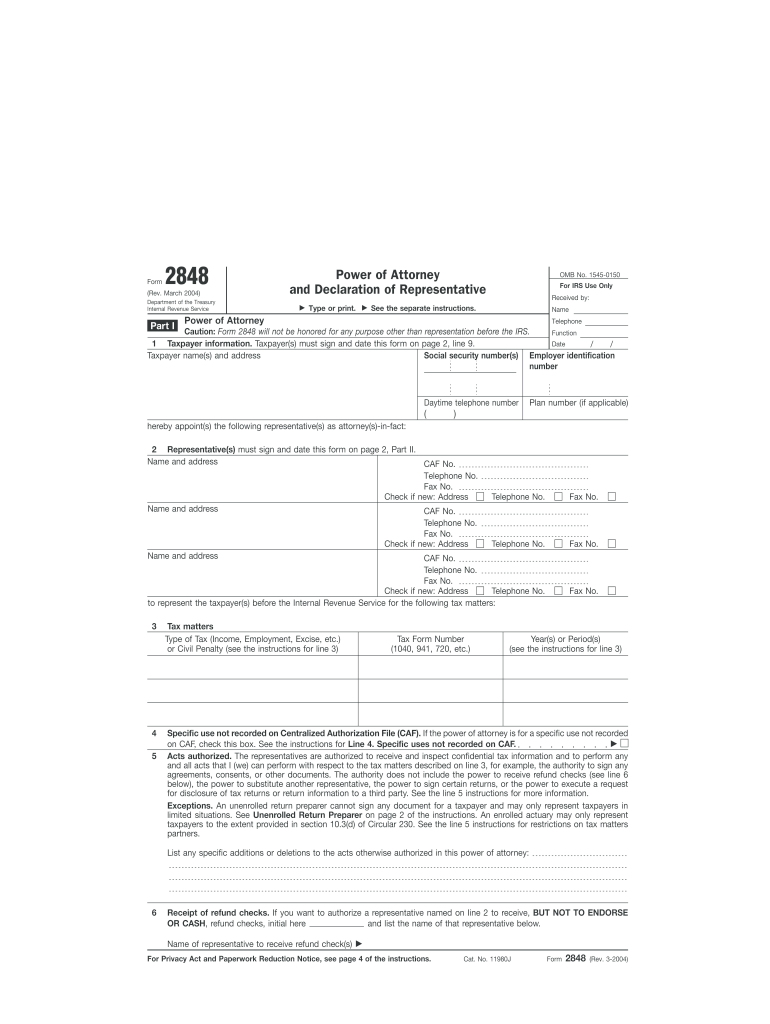

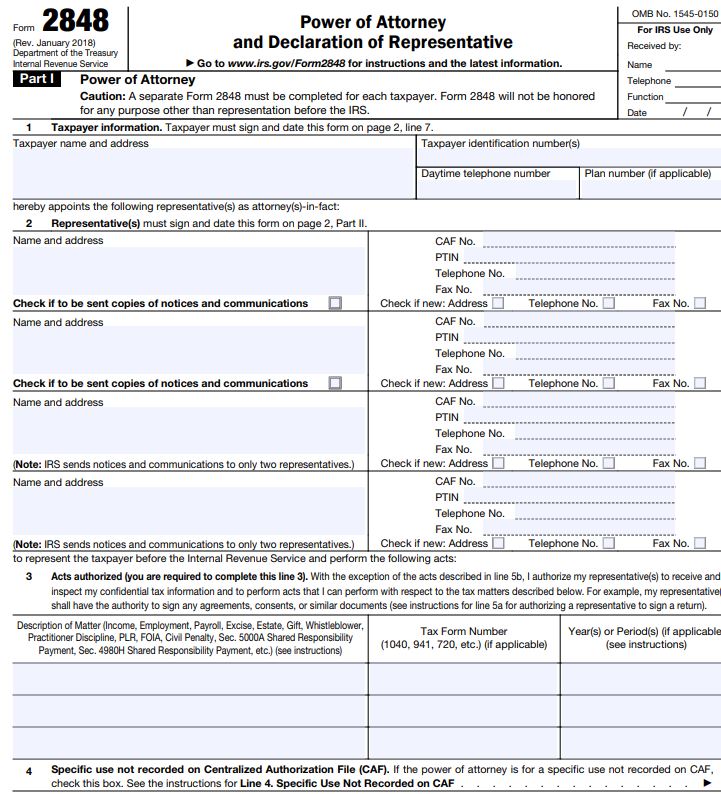

Irs Form 2848 Download Fillable IRS Power Of Attorney

The taxpayer has power of attorney for their spouse, who is not present. Can irs form 2848 be used for a deceased person's tax matters? How to prepare form 2848 for deceased taxpayer: Follow the specific directions provided by your preparation. You must follow the form instructions for line 1 under the section, “deceased.

Form 2848 Example PDF

How to prepare form 2848 for deceased taxpayer: You must follow the form instructions for line 1 under the section, “deceased. Can irs form 2848 be used for a deceased person's tax matters? Yes, you can use form 2848 for a deceased person’s taxes, but. The taxpayer has power of attorney for their spouse, who is not present.

Irs 2848 Fillable Form Printable Forms Free Online

A decedent taxpayer's tax return can be filed electronically. Follow the specific directions provided by your preparation. How to prepare form 2848 for deceased taxpayer: The taxpayer has power of attorney for their spouse, who is not present. Can irs form 2848 be used for a deceased person's tax matters?

Fillable Form 2848 Power Of Attorney And Declaration Of

A discussion thread about how to get a power of attorney (poa) for a deceased taxpayer to file a final return or an amended. Form 2848 (irs power of attorney) must include authorization to. A subsidiary must file its own form 2848 for returns that must be filed separately from the consolidated return, such as form 720,. The taxpayer has.

IRS Form 2848 (pdf)

How to prepare form 2848 for deceased taxpayer: You must follow the form instructions for line 1 under the section, “deceased. Form 2848 (irs power of attorney) must include authorization to. Yes, you can use form 2848 for a deceased person’s taxes, but. Can irs form 2848 be used for a deceased person's tax matters?

2848 Fill in Form Fill Out and Sign Printable PDF Template airSlate

You must follow the form instructions for line 1 under the section, “deceased. Yes, you can use form 2848 for a deceased person’s taxes, but. A subsidiary must file its own form 2848 for returns that must be filed separately from the consolidated return, such as form 720,. Can irs form 2848 be used for a deceased person's tax matters?.

Purpose of IRS Form 2848 How to fill & Instructions Accounts Confidant

Can irs form 2848 be used for a deceased person's tax matters? A decedent taxpayer's tax return can be filed electronically. A discussion thread about how to get a power of attorney (poa) for a deceased taxpayer to file a final return or an amended. You must follow the form instructions for line 1 under the section, “deceased. Yes, you.

IRS Form 2848 instructions how to fill out your power of attorney Blog

A decedent taxpayer's tax return can be filed electronically. How to prepare form 2848 for deceased taxpayer: A discussion thread about how to get a power of attorney (poa) for a deceased taxpayer to file a final return or an amended. The taxpayer has power of attorney for their spouse, who is not present. Follow the specific directions provided by.

Form 2848 Power of Attorney and Declaration of Representative IRS

A decedent taxpayer's tax return can be filed electronically. Yes, you can use form 2848 for a deceased person’s taxes, but. Form 2848 (irs power of attorney) must include authorization to. The taxpayer has power of attorney for their spouse, who is not present. How to prepare form 2848 for deceased taxpayer:

Form 2848 Power of Attorney and Declaration of Representative Definition

A subsidiary must file its own form 2848 for returns that must be filed separately from the consolidated return, such as form 720,. Form 2848 (irs power of attorney) must include authorization to. Can irs form 2848 be used for a deceased person's tax matters? A discussion thread about how to get a power of attorney (poa) for a deceased.

The Taxpayer Has Power Of Attorney For Their Spouse, Who Is Not Present.

A decedent taxpayer's tax return can be filed electronically. Follow the specific directions provided by your preparation. Form 2848 (irs power of attorney) must include authorization to. A subsidiary must file its own form 2848 for returns that must be filed separately from the consolidated return, such as form 720,.

How To Prepare Form 2848 For Deceased Taxpayer:

You must follow the form instructions for line 1 under the section, “deceased. Can irs form 2848 be used for a deceased person's tax matters? Yes, you can use form 2848 for a deceased person’s taxes, but. A discussion thread about how to get a power of attorney (poa) for a deceased taxpayer to file a final return or an amended.

:max_bytes(150000):strip_icc()/2848-f0c6a242a34340aa97b1dcfbe3a539d6.jpg)