Form 3514 Business Code - It could refer to a small business,. If you claim the california eitc even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years. Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information about your qualifying children, if. Principal business activity codes activities. It requires information about your income, qualifying. List first the largest in terms of gross unrelated related services, rather than selecting a code. Use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if. This business code can be found on any of your business activities not only on a schedule c. This form is used to claim the california eitc and other tax credits for taxable year 2023.

It requires information about your income, qualifying. Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information about your qualifying children, if. List first the largest in terms of gross unrelated related services, rather than selecting a code. Principal business activity codes activities. Use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if. It could refer to a small business,. This business code can be found on any of your business activities not only on a schedule c. If you claim the california eitc even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years. This form is used to claim the california eitc and other tax credits for taxable year 2023.

This business code can be found on any of your business activities not only on a schedule c. Principal business activity codes activities. This form is used to claim the california eitc and other tax credits for taxable year 2023. It could refer to a small business,. Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information about your qualifying children, if. It requires information about your income, qualifying. Use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if. If you claim the california eitc even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years. List first the largest in terms of gross unrelated related services, rather than selecting a code.

Fill Free fillable 2016 Instructions for Form FTB 3514 (California

This form is used to claim the california eitc and other tax credits for taxable year 2023. It requires information about your income, qualifying. This business code can be found on any of your business activities not only on a schedule c. If you claim the california eitc even though you know you are not eligible, you may not be.

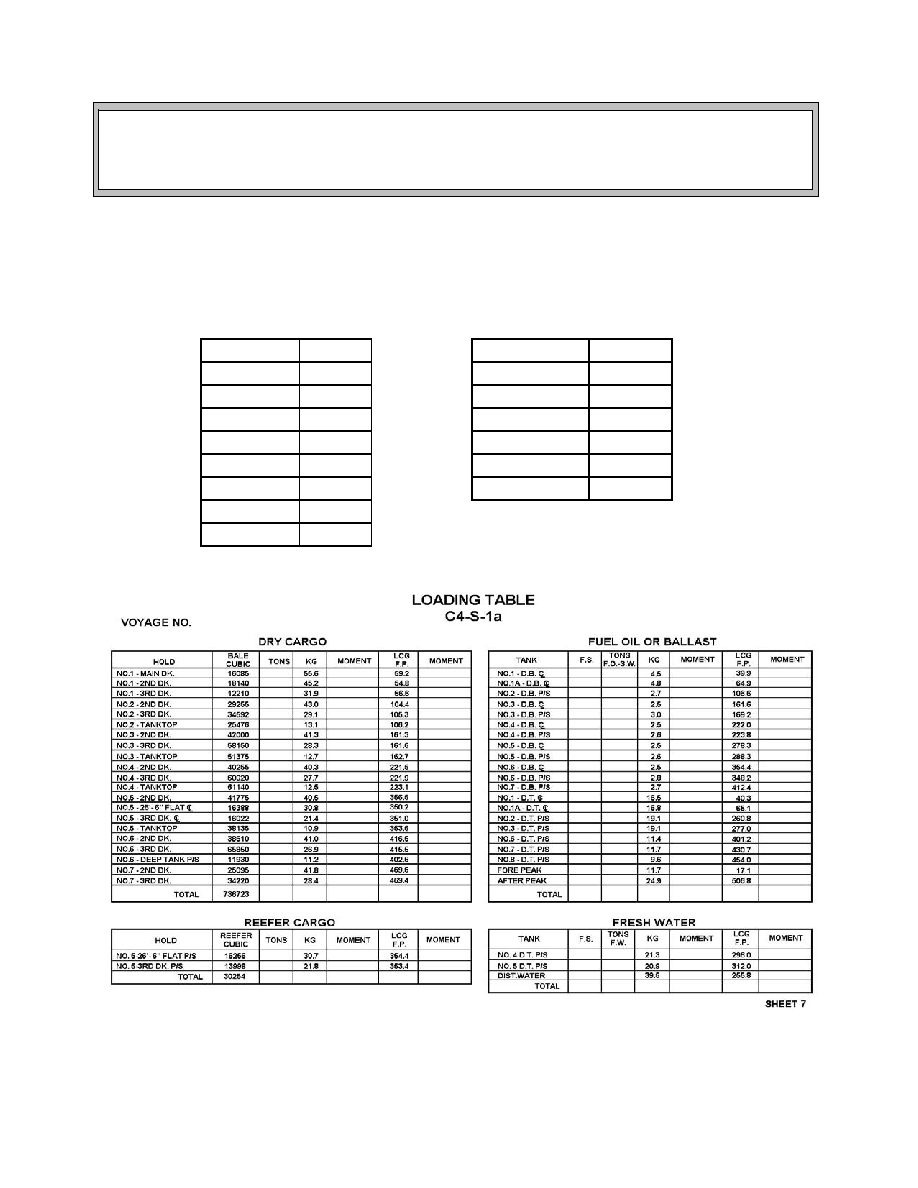

Page 1

Principal business activity codes activities. This business code can be found on any of your business activities not only on a schedule c. Use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if. If you claim the california eitc even though you know you are not eligible,.

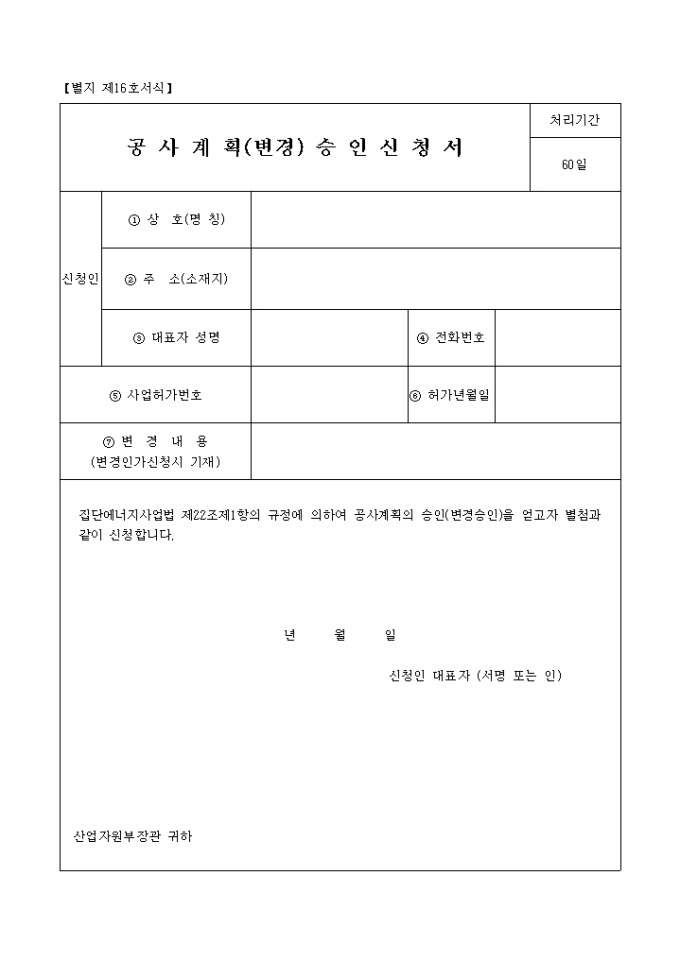

공사계획(변경) 승인신청서 샘플, 양식 다운로드

This business code can be found on any of your business activities not only on a schedule c. List first the largest in terms of gross unrelated related services, rather than selecting a code. Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information about your qualifying children, if. If you claim.

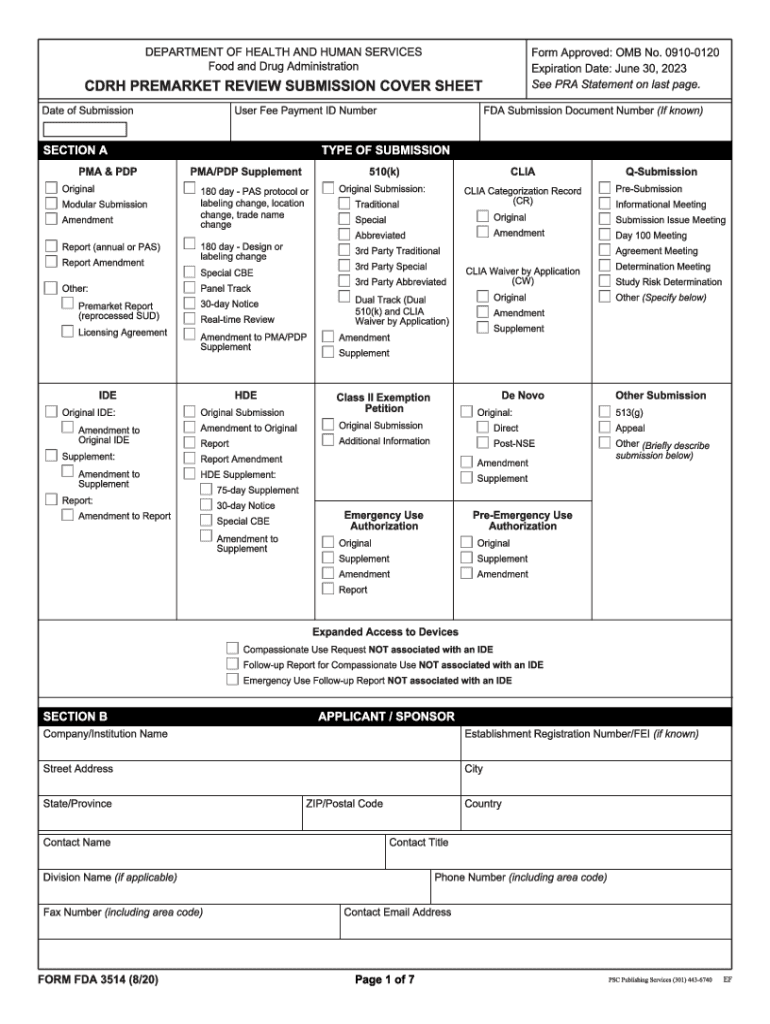

FDA Form 3514 PDF PDF Food And Drug Administration Federal Food

It could refer to a small business,. This form is used to claim the california eitc and other tax credits for taxable year 2023. List first the largest in terms of gross unrelated related services, rather than selecting a code. Principal business activity codes activities. This business code can be found on any of your business activities not only on.

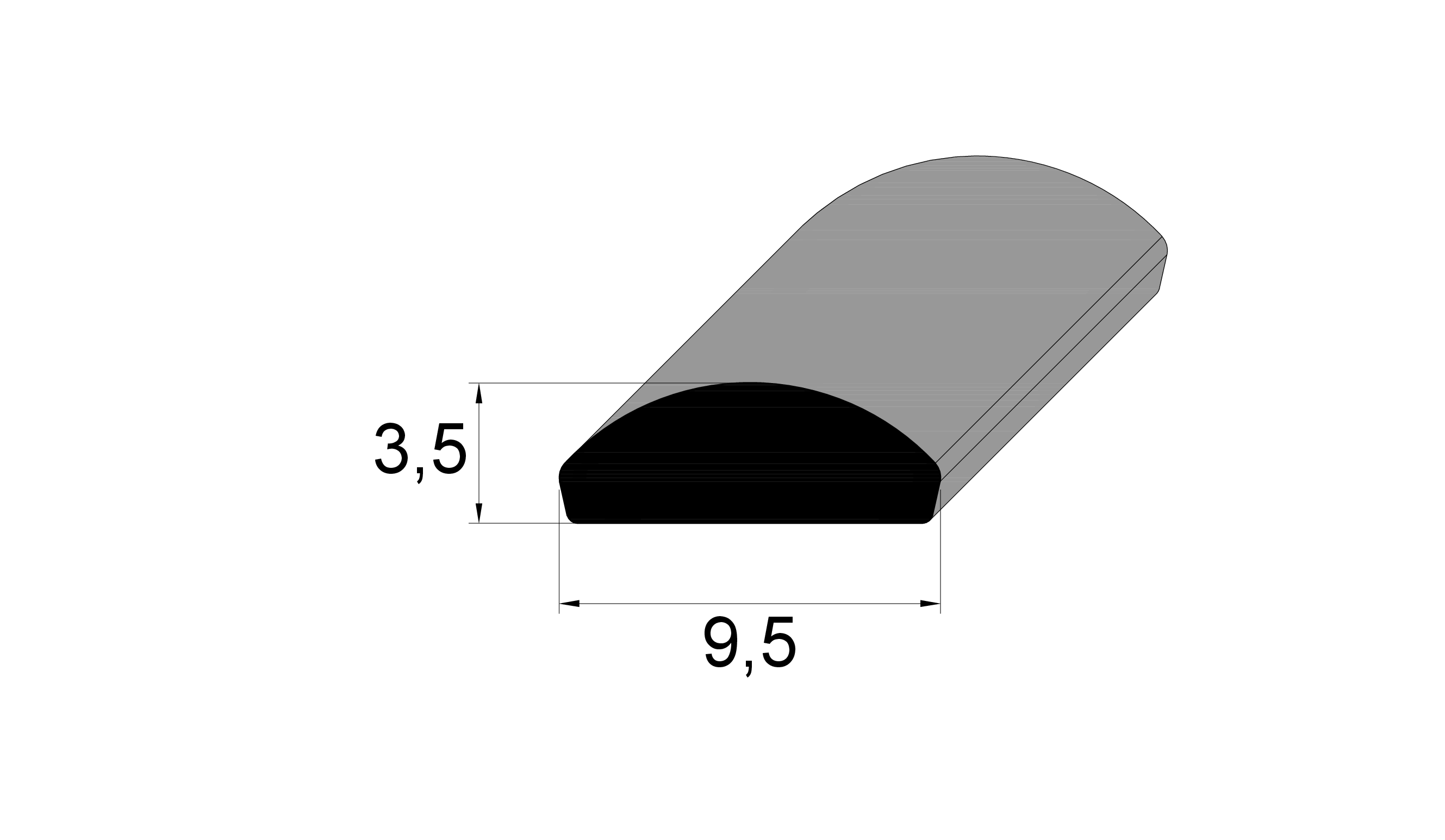

IBC 3514 IBC Borrachas

It could refer to a small business,. It requires information about your income, qualifying. If you claim the california eitc even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years. Principal business activity codes activities. This business code can be found on any of your business activities not.

Form 3514 Fill out & sign online DocHub

Principal business activity codes activities. Use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if. This business code can be found on any of your business activities not only on a schedule c. It could refer to a small business,. Use form ftb 3514 to determine whether.

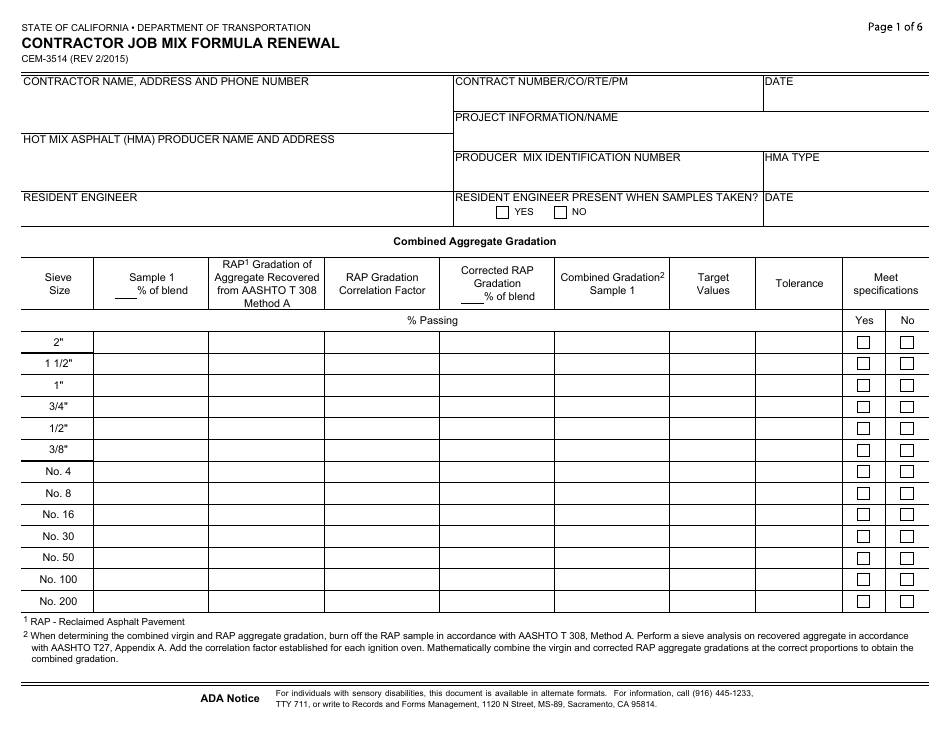

Form CEM3514 Download Fillable PDF or Fill Online Contractor Job Mix

Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information about your qualifying children, if. List first the largest in terms of gross unrelated related services, rather than selecting a code. If you claim the california eitc even though you know you are not eligible, you may not be allowed to take.

BEL_3514 CTFashionMag

If you claim the california eitc even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years. It could refer to a small business,. It requires information about your income, qualifying. Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information.

20202024 Form FDA 3514 Fill Online, Printable, Fillable, Blank pdfFiller

This business code can be found on any of your business activities not only on a schedule c. If you claim the california eitc even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years. Principal business activity codes activities. It requires information about your income, qualifying. This form.

Form 3514 Fill and Sign Printable Template Online US Legal Forms

If you claim the california eitc even though you know you are not eligible, you may not be allowed to take the credit for up to 10 years. Principal business activity codes activities. It requires information about your income, qualifying. This form is used to claim the california eitc and other tax credits for taxable year 2023. List first the.

This Form Is Used To Claim The California Eitc And Other Tax Credits For Taxable Year 2023.

Use form ftb 3514 to determine whether you qualify to claim the eitc and yctc credits, provide information about your qualifying children, if. Use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if. This business code can be found on any of your business activities not only on a schedule c. Principal business activity codes activities.

If You Claim The California Eitc Even Though You Know You Are Not Eligible, You May Not Be Allowed To Take The Credit For Up To 10 Years.

It could refer to a small business,. List first the largest in terms of gross unrelated related services, rather than selecting a code. It requires information about your income, qualifying.