Form 3520 Instructions 2022 - Persons (and executors of estates of u.s. If you have to file form 3520 this year (annual return to report transactions. Persons (and executors of estates of u.s. Decedents) file form 3520 to report: Decedents) file form 3520 with the irs to. Form 3520 is not included with your tax return, it is mailed separately to the address.

Decedents) file form 3520 to report: If you have to file form 3520 this year (annual return to report transactions. Form 3520 is not included with your tax return, it is mailed separately to the address. Decedents) file form 3520 with the irs to. Persons (and executors of estates of u.s. Persons (and executors of estates of u.s.

Decedents) file form 3520 to report: Persons (and executors of estates of u.s. If you have to file form 3520 this year (annual return to report transactions. Persons (and executors of estates of u.s. Decedents) file form 3520 with the irs to. Form 3520 is not included with your tax return, it is mailed separately to the address.

form 3520a instructions 2019 2020 Fill Online, Printable, Fillable

Form 3520 is not included with your tax return, it is mailed separately to the address. If you have to file form 3520 this year (annual return to report transactions. Persons (and executors of estates of u.s. Persons (and executors of estates of u.s. Decedents) file form 3520 to report:

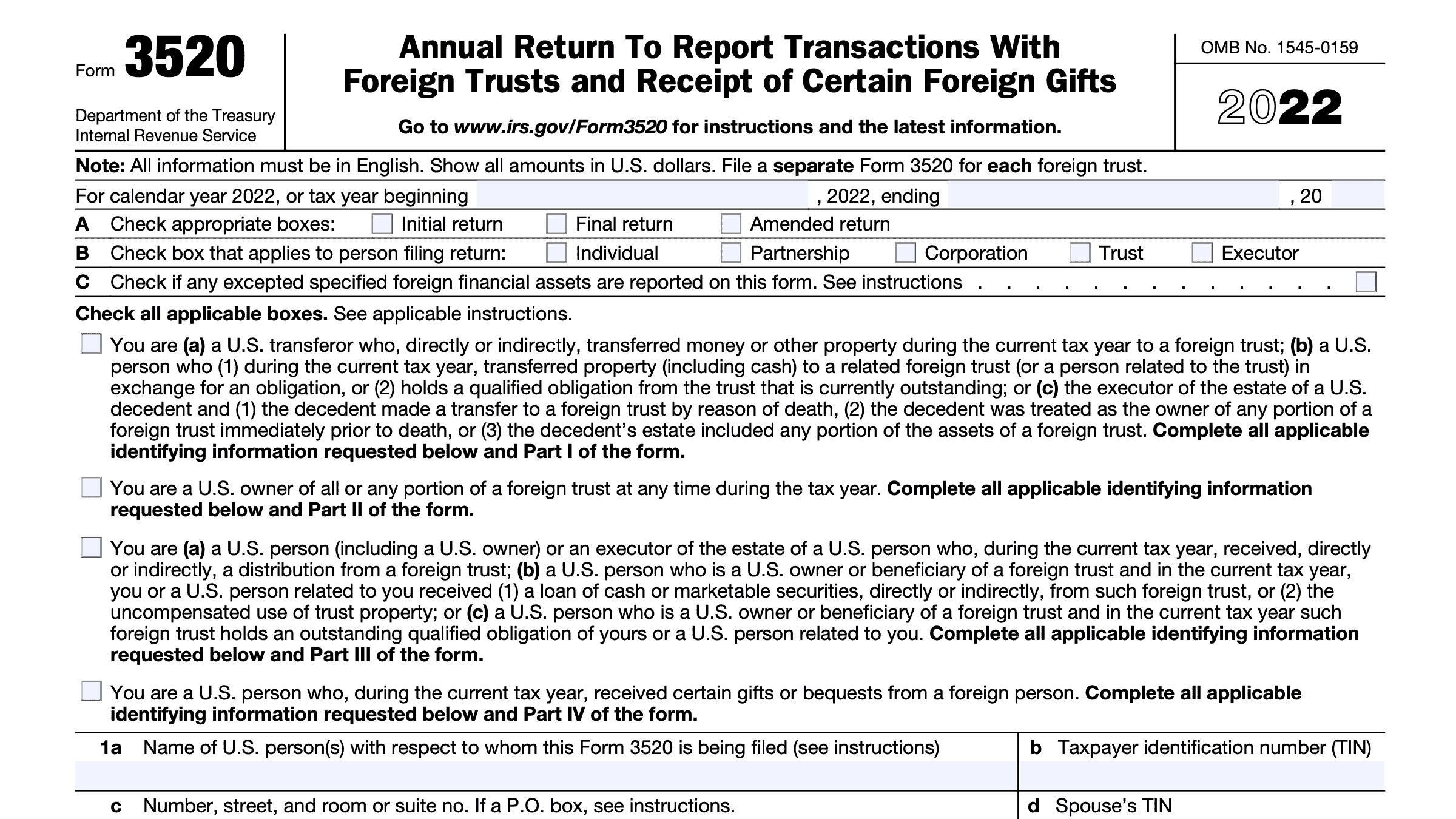

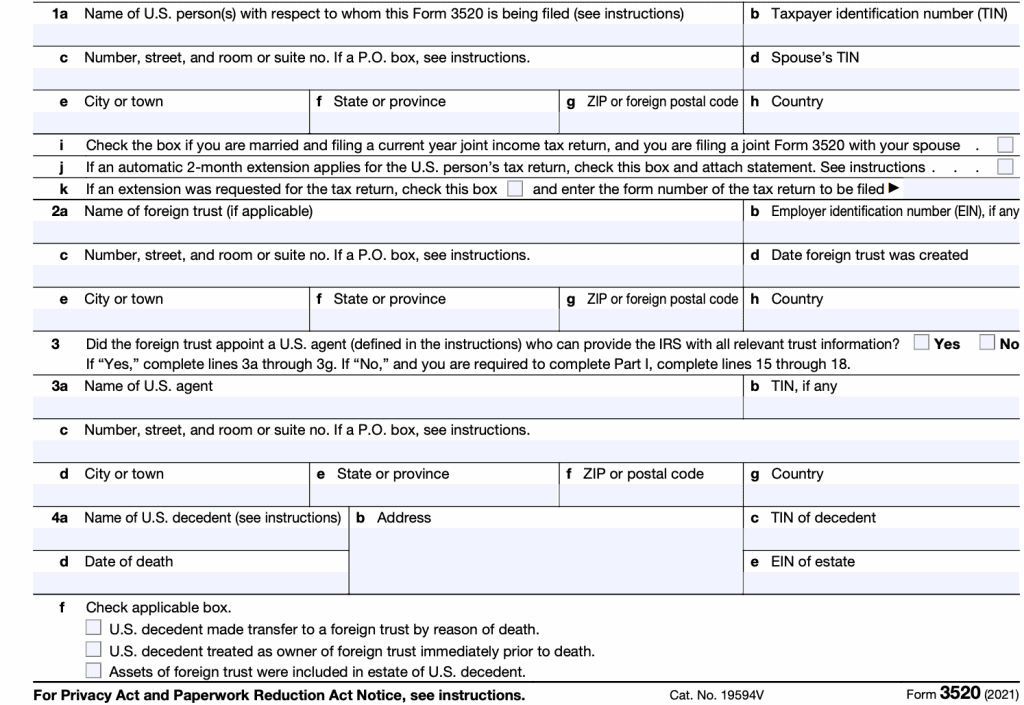

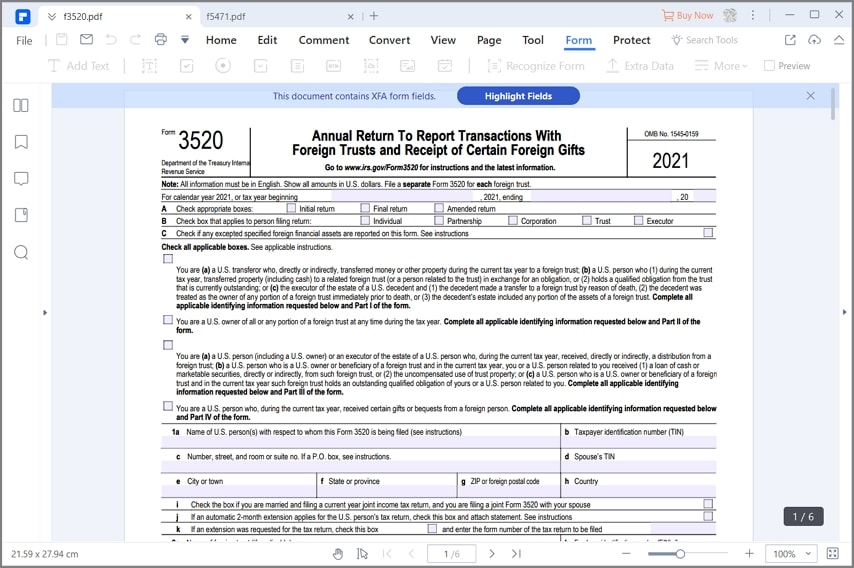

Fillable Online Form 3520 instructions 2021 pdf. Form 3520 instructions

If you have to file form 3520 this year (annual return to report transactions. Form 3520 is not included with your tax return, it is mailed separately to the address. Persons (and executors of estates of u.s. Decedents) file form 3520 to report: Decedents) file form 3520 with the irs to.

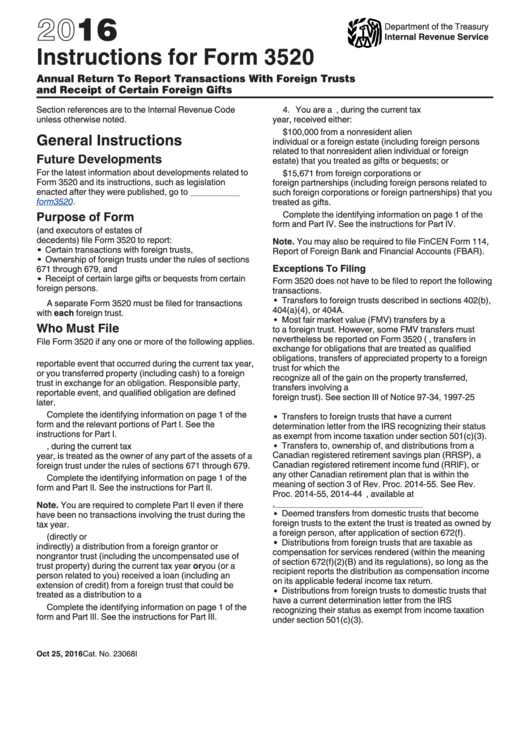

Instructions For Form 3520 Annual Return To Report Transactions With

Form 3520 is not included with your tax return, it is mailed separately to the address. Decedents) file form 3520 to report: If you have to file form 3520 this year (annual return to report transactions. Persons (and executors of estates of u.s. Persons (and executors of estates of u.s.

Fillable Online 2020 Instructions for Form FTB 3520PIT Fax Email Print

If you have to file form 3520 this year (annual return to report transactions. Decedents) file form 3520 to report: Decedents) file form 3520 with the irs to. Persons (and executors of estates of u.s. Persons (and executors of estates of u.s.

Form 3520 Instructions 2023 Printable Forms Free Online

Decedents) file form 3520 with the irs to. Persons (and executors of estates of u.s. Persons (and executors of estates of u.s. Form 3520 is not included with your tax return, it is mailed separately to the address. If you have to file form 3520 this year (annual return to report transactions.

IRS Form 3520Reporting Transactions With Foreign Trusts

Persons (and executors of estates of u.s. Decedents) file form 3520 with the irs to. If you have to file form 3520 this year (annual return to report transactions. Persons (and executors of estates of u.s. Form 3520 is not included with your tax return, it is mailed separately to the address.

IRS Form 3520 in a Nutshell SF Tax Counsel

If you have to file form 3520 this year (annual return to report transactions. Decedents) file form 3520 to report: Decedents) file form 3520 with the irs to. Form 3520 is not included with your tax return, it is mailed separately to the address. Persons (and executors of estates of u.s.

Adjustable rate note template Fill out & sign online DocHub

Persons (and executors of estates of u.s. Decedents) file form 3520 to report: Form 3520 is not included with your tax return, it is mailed separately to the address. Decedents) file form 3520 with the irs to. Persons (and executors of estates of u.s.

Instructions For Form 3520 (Rev. December 2023) PDF Tax In

Decedents) file form 3520 with the irs to. Persons (and executors of estates of u.s. Decedents) file form 3520 to report: Form 3520 is not included with your tax return, it is mailed separately to the address. If you have to file form 3520 this year (annual return to report transactions.

Form 3520 Instructions 2023 Printable Forms Free Online

If you have to file form 3520 this year (annual return to report transactions. Form 3520 is not included with your tax return, it is mailed separately to the address. Decedents) file form 3520 with the irs to. Decedents) file form 3520 to report: Persons (and executors of estates of u.s.

Persons (And Executors Of Estates Of U.s.

If you have to file form 3520 this year (annual return to report transactions. Decedents) file form 3520 with the irs to. Decedents) file form 3520 to report: Persons (and executors of estates of u.s.