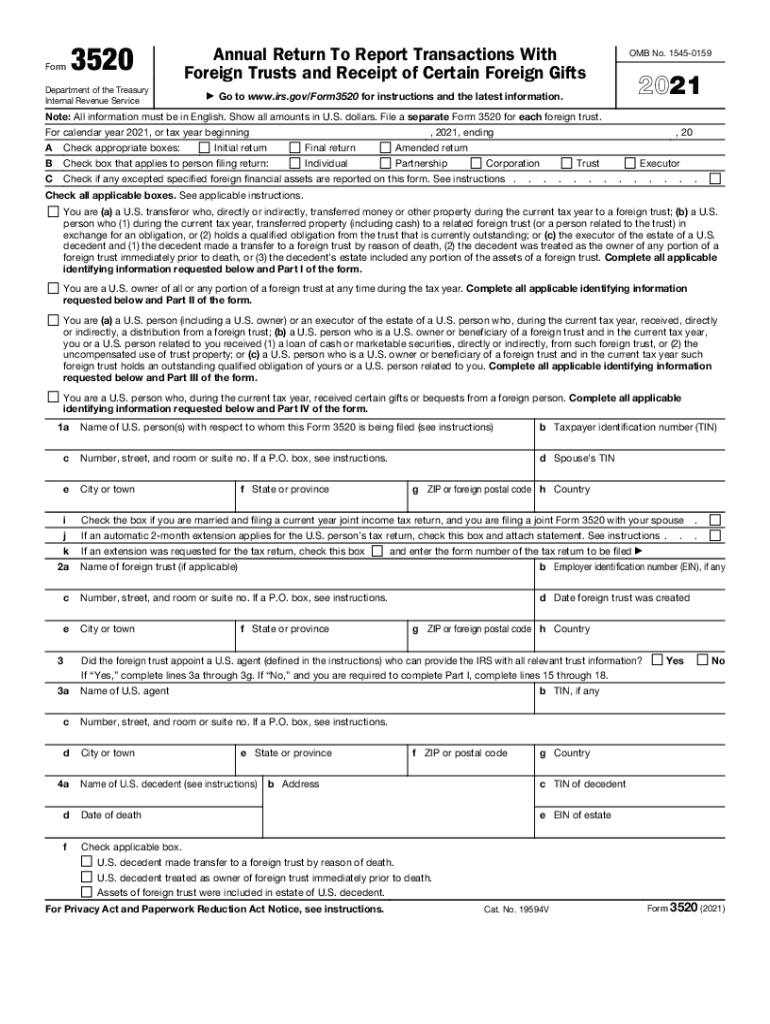

Form 3520 Part Iv - The fifth and final component of the form 3520 (entitled part iv “u.s. Recipients of gifts or bequests received during the current. Our esteemed international tax panelist will discuss who is required to file, avoiding penalties for non and incomplete. Enter a brief description of the property and fair market value of the. Complete the identifying information on page 1 of the form and part iv. Certain transactions with foreign trusts. Decedents) file form 3520 to report: Persons (and executors of estates of u.s. Yes, you will report the property also in form 3520 part iv. Part i is relatively straightforward, and requires personal identifying information from the filer.

Complete the identifying information on page 1 of the form and part iv. Persons (and executors of estates of u.s. Enter a brief description of the property and fair market value of the. Recipients of gifts or bequests received during the current. See the instructions for part iv. Part i is relatively straightforward, and requires personal identifying information from the filer. The fifth and final component of the form 3520 (entitled part iv “u.s. You may be required to file financial. Part iv is for the actual reporting of the gift (s). Yes, you will report the property also in form 3520 part iv.

Recipients of gifts or bequests received during the current. The fifth and final component of the form 3520 (entitled part iv “u.s. Our esteemed international tax panelist will discuss who is required to file, avoiding penalties for non and incomplete. Part i is relatively straightforward, and requires personal identifying information from the filer. Complete the identifying information on page 1 of the form and part iv. Yes, you will report the property also in form 3520 part iv. See the instructions for part iv. Certain transactions with foreign trusts. Persons (and executors of estates of u.s. Enter a brief description of the property and fair market value of the.

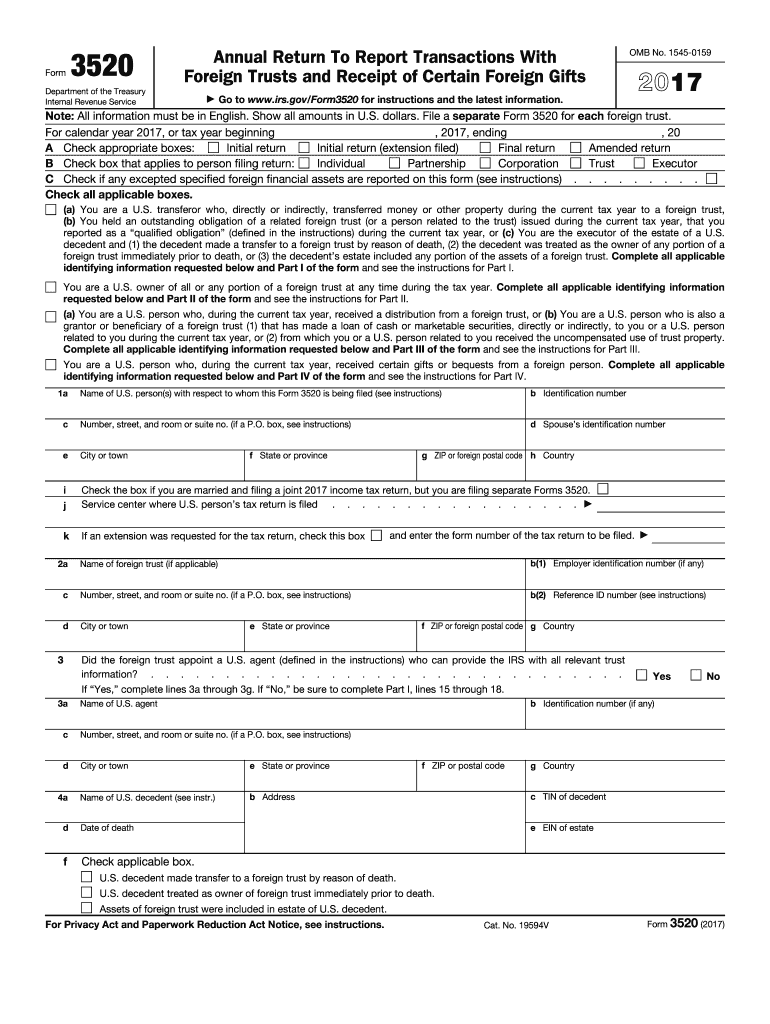

Form 3520 Blank Sample to Fill out Online in PDF

Part i is relatively straightforward, and requires personal identifying information from the filer. Recipients of gifts or bequests received during the current. Decedents) file form 3520 to report: Certain transactions with foreign trusts. See the instructions for part iv.

IRS Form 3520 in a Nutshell SF Tax Counsel

Persons (and executors of estates of u.s. Complete the identifying information on page 1 of the form and part iv. See the instructions for part iv. Recipients of gifts or bequests received during the current. Yes, you will report the property also in form 3520 part iv.

Form 3520 Examples and Guide to Filing fro Expats

See the instructions for part iv. You may be required to file financial. Certain transactions with foreign trusts. Our esteemed international tax panelist will discuss who is required to file, avoiding penalties for non and incomplete. Recipients of gifts or bequests received during the current.

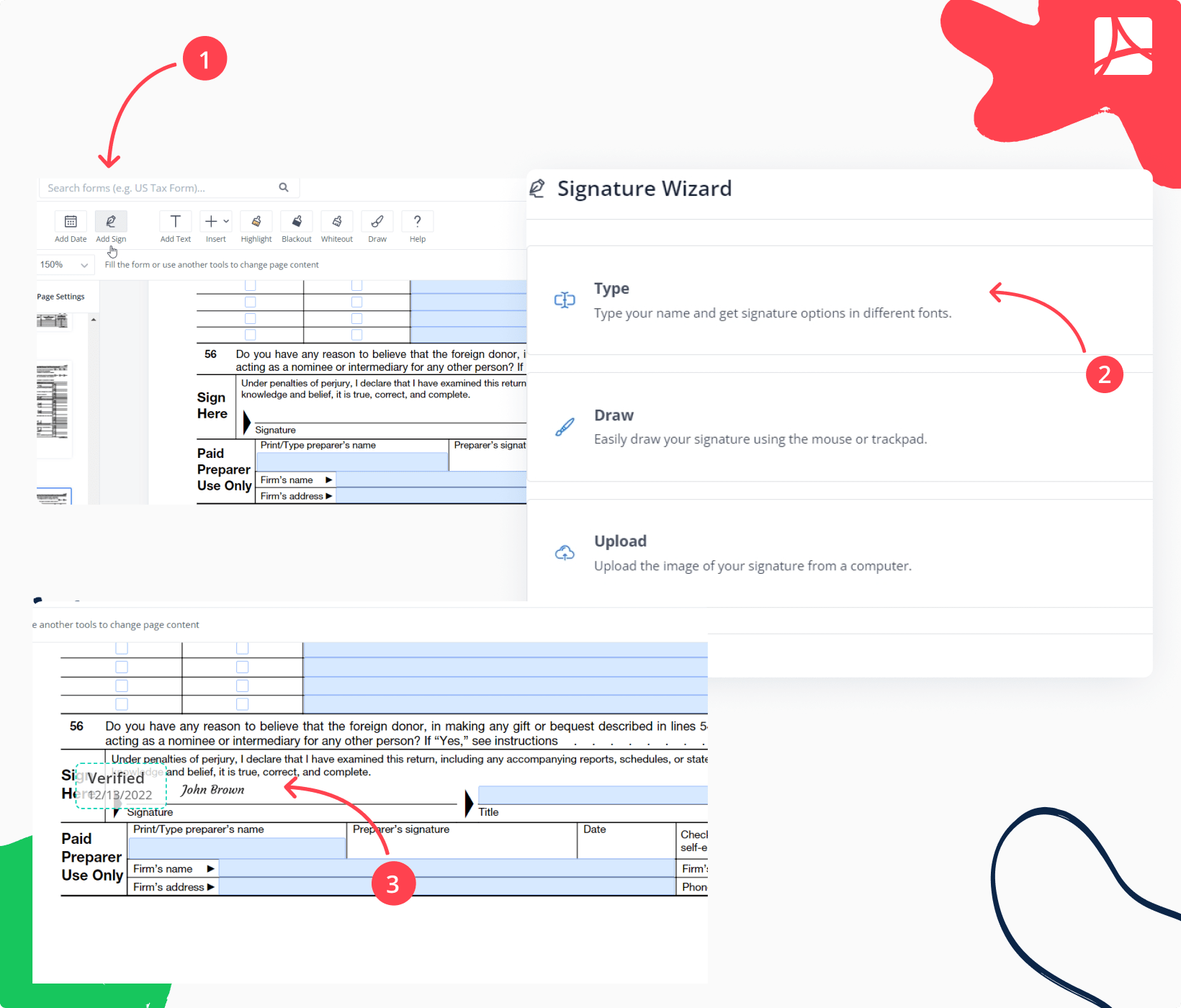

Form 3520 Fill out & sign online DocHub

Certain transactions with foreign trusts. You may be required to file financial. The fifth and final component of the form 3520 (entitled part iv “u.s. Recipients of gifts or bequests received during the current. Our esteemed international tax panelist will discuss who is required to file, avoiding penalties for non and incomplete.

IRS Form 3520A 2018 2019 Fill out and Edit Online PDF Template

Recipients of gifts or bequests received during the current. The fifth and final component of the form 3520 (entitled part iv “u.s. Enter a brief description of the property and fair market value of the. Our esteemed international tax panelist will discuss who is required to file, avoiding penalties for non and incomplete. See the instructions for part iv.

Form 3520 Instructions 2024 Helen Kristen

Our esteemed international tax panelist will discuss who is required to file, avoiding penalties for non and incomplete. Certain transactions with foreign trusts. See the instructions for part iv. Persons (and executors of estates of u.s. The fifth and final component of the form 3520 (entitled part iv “u.s.

IRS Form 3520 Annual Return To Report Transactions With Foreign Trust

Recipients of gifts or bequests received during the current. See the instructions for part iv. Certain transactions with foreign trusts. Complete the identifying information on page 1 of the form and part iv. Yes, you will report the property also in form 3520 part iv.

Form 3520 Fillable Printable Forms Free Online

Enter a brief description of the property and fair market value of the. Part i is relatively straightforward, and requires personal identifying information from the filer. Complete the identifying information on page 1 of the form and part iv. Yes, you will report the property also in form 3520 part iv. Certain transactions with foreign trusts.

3520 2017 Fill out & sign online DocHub

Decedents) file form 3520 to report: Enter a brief description of the property and fair market value of the. Complete the identifying information on page 1 of the form and part iv. Recipients of gifts or bequests received during the current. Certain transactions with foreign trusts.

3520 Fillable Form Printable Forms Free Online

See the instructions for part iv. Our esteemed international tax panelist will discuss who is required to file, avoiding penalties for non and incomplete. Part i is relatively straightforward, and requires personal identifying information from the filer. Decedents) file form 3520 to report: Part iv is for the actual reporting of the gift (s).

Our Esteemed International Tax Panelist Will Discuss Who Is Required To File, Avoiding Penalties For Non And Incomplete.

Certain transactions with foreign trusts. Part i is relatively straightforward, and requires personal identifying information from the filer. Part iv is for the actual reporting of the gift (s). Enter a brief description of the property and fair market value of the.

See The Instructions For Part Iv.

Complete the identifying information on page 1 of the form and part iv. Yes, you will report the property also in form 3520 part iv. Recipients of gifts or bequests received during the current. Persons (and executors of estates of u.s.

You May Be Required To File Financial.

Decedents) file form 3520 to report: The fifth and final component of the form 3520 (entitled part iv “u.s.