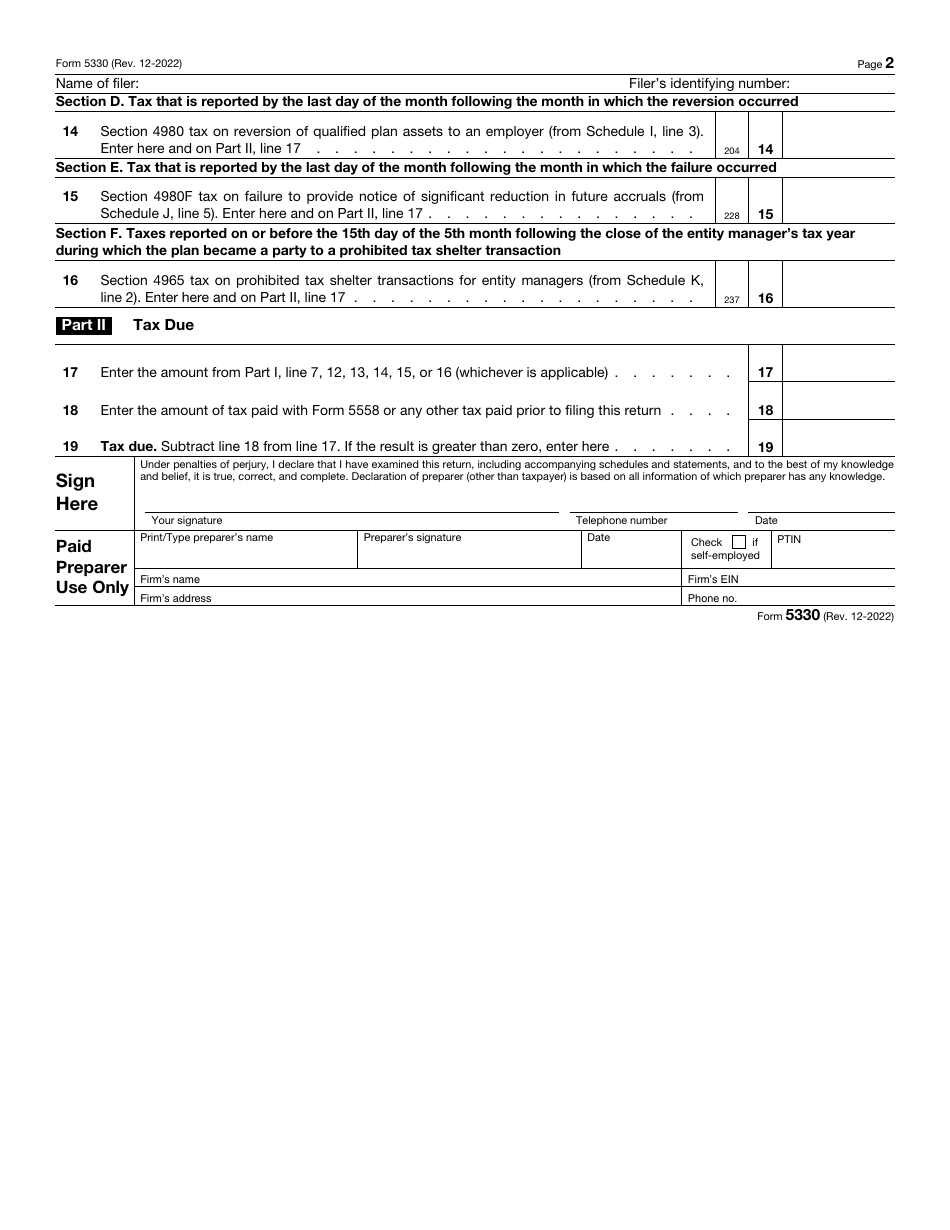

Form 5330 Late Contributions - In short, if the contributions are remitted to the plan within 180 calendar days, the excise tax on the lost earnings would be less. If you file late, you may attach a statement to form 5330 explaining the reasonable cause. Penalty for late payment of tax. As i said above, form 5330 for late contributions is a real pain. Yes, the fee seems high compared to the tax, but did you consider. Form 5330 is filed with the irs and used to report and pay excise taxes related to certain plan errors, such as for late plan.

Form 5330 is filed with the irs and used to report and pay excise taxes related to certain plan errors, such as for late plan. In short, if the contributions are remitted to the plan within 180 calendar days, the excise tax on the lost earnings would be less. Yes, the fee seems high compared to the tax, but did you consider. Penalty for late payment of tax. If you file late, you may attach a statement to form 5330 explaining the reasonable cause. As i said above, form 5330 for late contributions is a real pain.

Yes, the fee seems high compared to the tax, but did you consider. As i said above, form 5330 for late contributions is a real pain. If you file late, you may attach a statement to form 5330 explaining the reasonable cause. In short, if the contributions are remitted to the plan within 180 calendar days, the excise tax on the lost earnings would be less. Form 5330 is filed with the irs and used to report and pay excise taxes related to certain plan errors, such as for late plan. Penalty for late payment of tax.

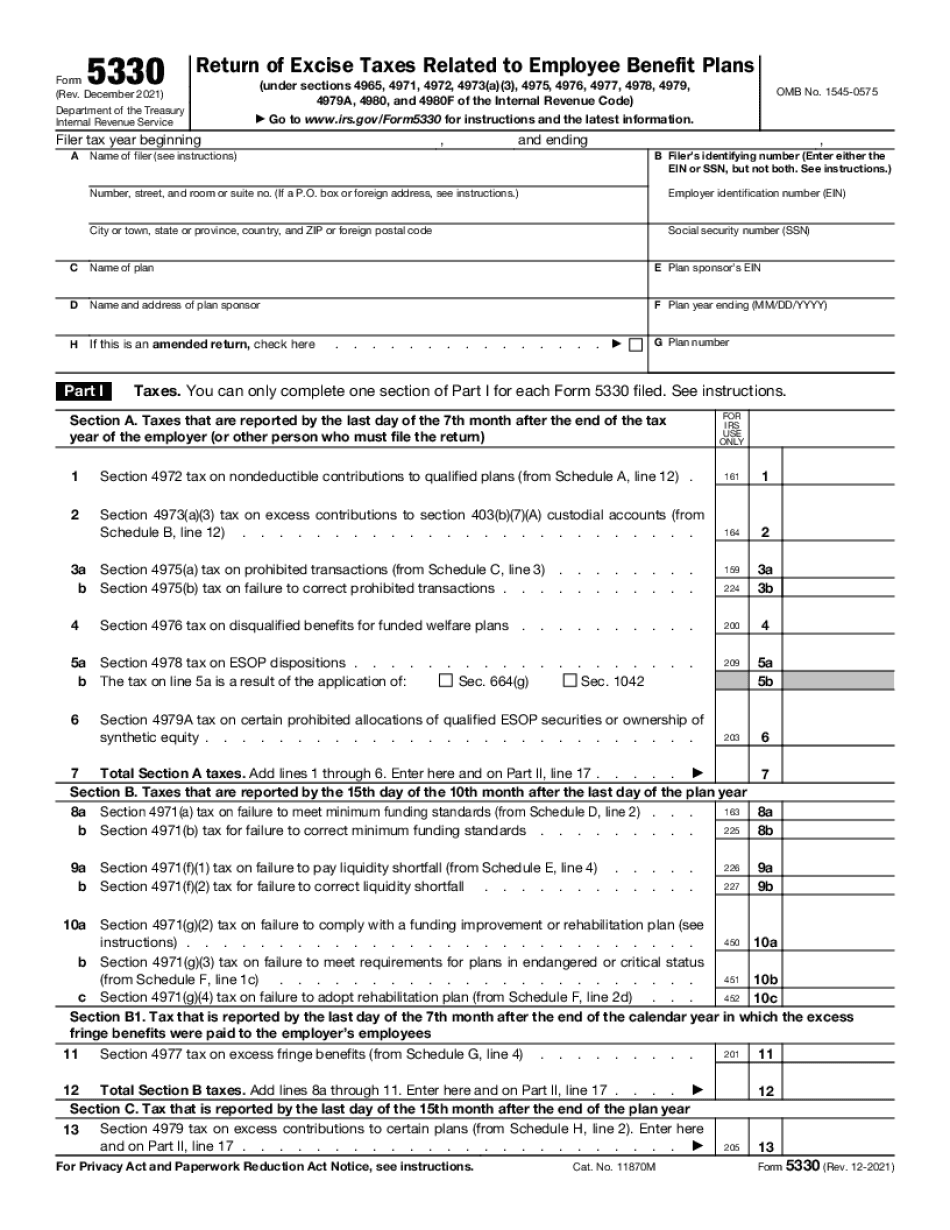

sample form 5330 for late contributions Fill Online, Printable

If you file late, you may attach a statement to form 5330 explaining the reasonable cause. As i said above, form 5330 for late contributions is a real pain. In short, if the contributions are remitted to the plan within 180 calendar days, the excise tax on the lost earnings would be less. Penalty for late payment of tax. Form.

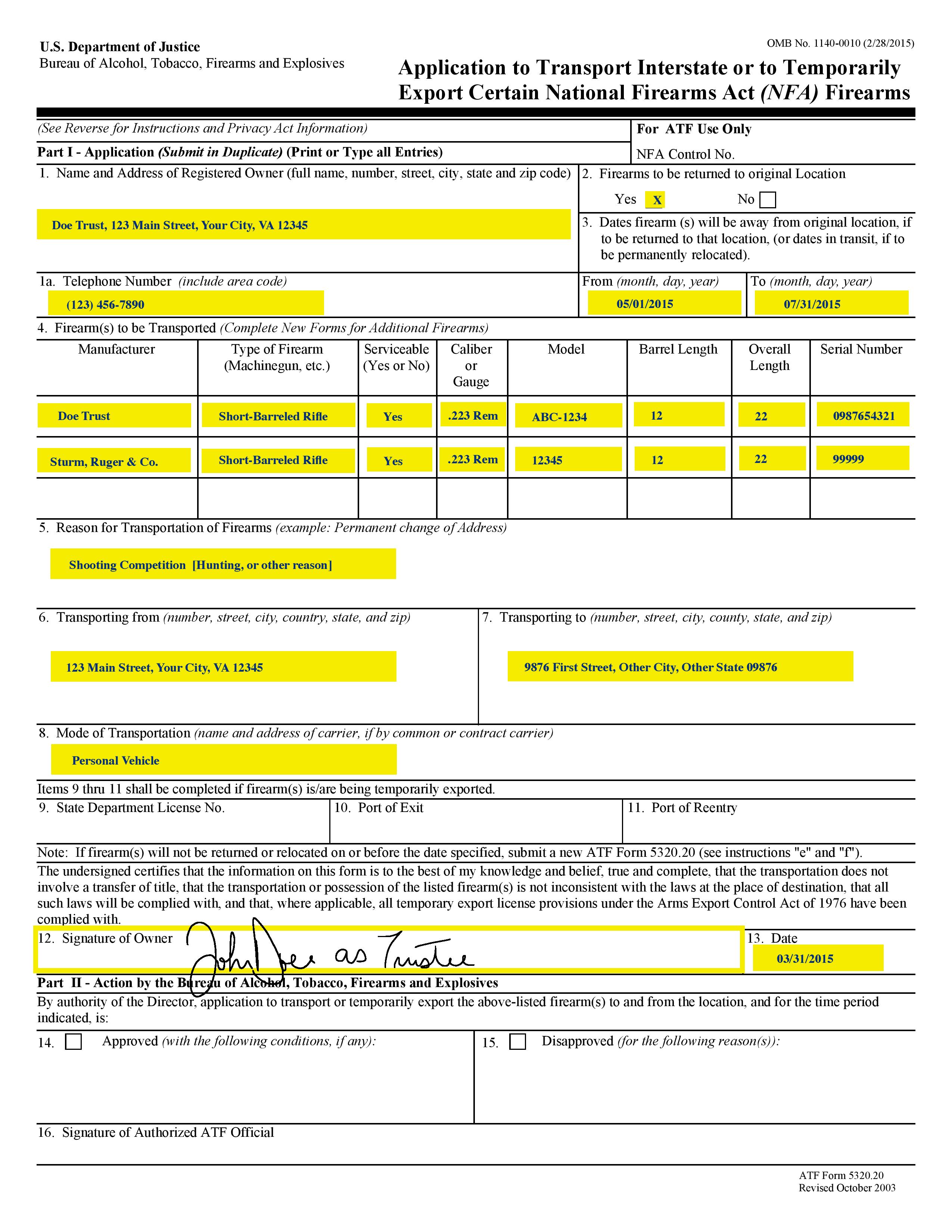

Printable Atf Form 5330 20 Printable Forms Free Online

Penalty for late payment of tax. In short, if the contributions are remitted to the plan within 180 calendar days, the excise tax on the lost earnings would be less. Form 5330 is filed with the irs and used to report and pay excise taxes related to certain plan errors, such as for late plan. As i said above, form.

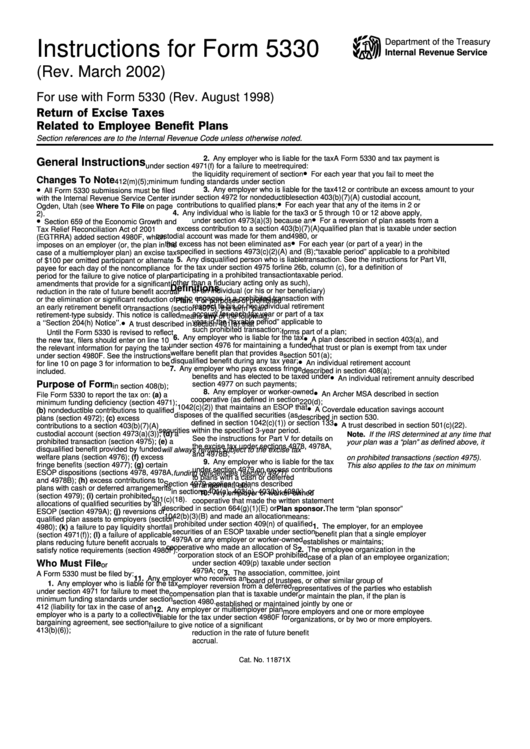

Instructions For Form 5330 printable pdf download

In short, if the contributions are remitted to the plan within 180 calendar days, the excise tax on the lost earnings would be less. As i said above, form 5330 for late contributions is a real pain. Yes, the fee seems high compared to the tax, but did you consider. Penalty for late payment of tax. If you file late,.

The Plain English Guide to Form 5330 ForUsAll Blog

Yes, the fee seems high compared to the tax, but did you consider. Form 5330 is filed with the irs and used to report and pay excise taxes related to certain plan errors, such as for late plan. As i said above, form 5330 for late contributions is a real pain. Penalty for late payment of tax. If you file.

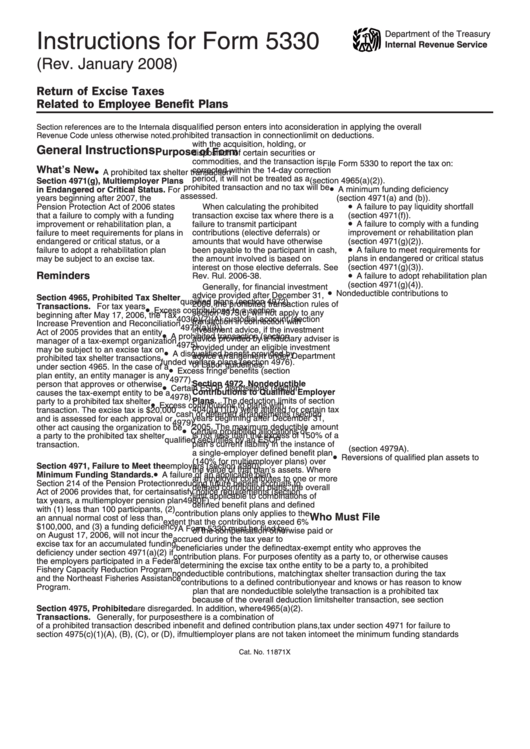

Instructions For Form 5330 Internal Revenue Service printable pdf

Form 5330 is filed with the irs and used to report and pay excise taxes related to certain plan errors, such as for late plan. In short, if the contributions are remitted to the plan within 180 calendar days, the excise tax on the lost earnings would be less. As i said above, form 5330 for late contributions is a.

Fill Free fillable Form 5330 2013 Return of Excise Taxes PDF form

If you file late, you may attach a statement to form 5330 explaining the reasonable cause. Form 5330 is filed with the irs and used to report and pay excise taxes related to certain plan errors, such as for late plan. In short, if the contributions are remitted to the plan within 180 calendar days, the excise tax on the.

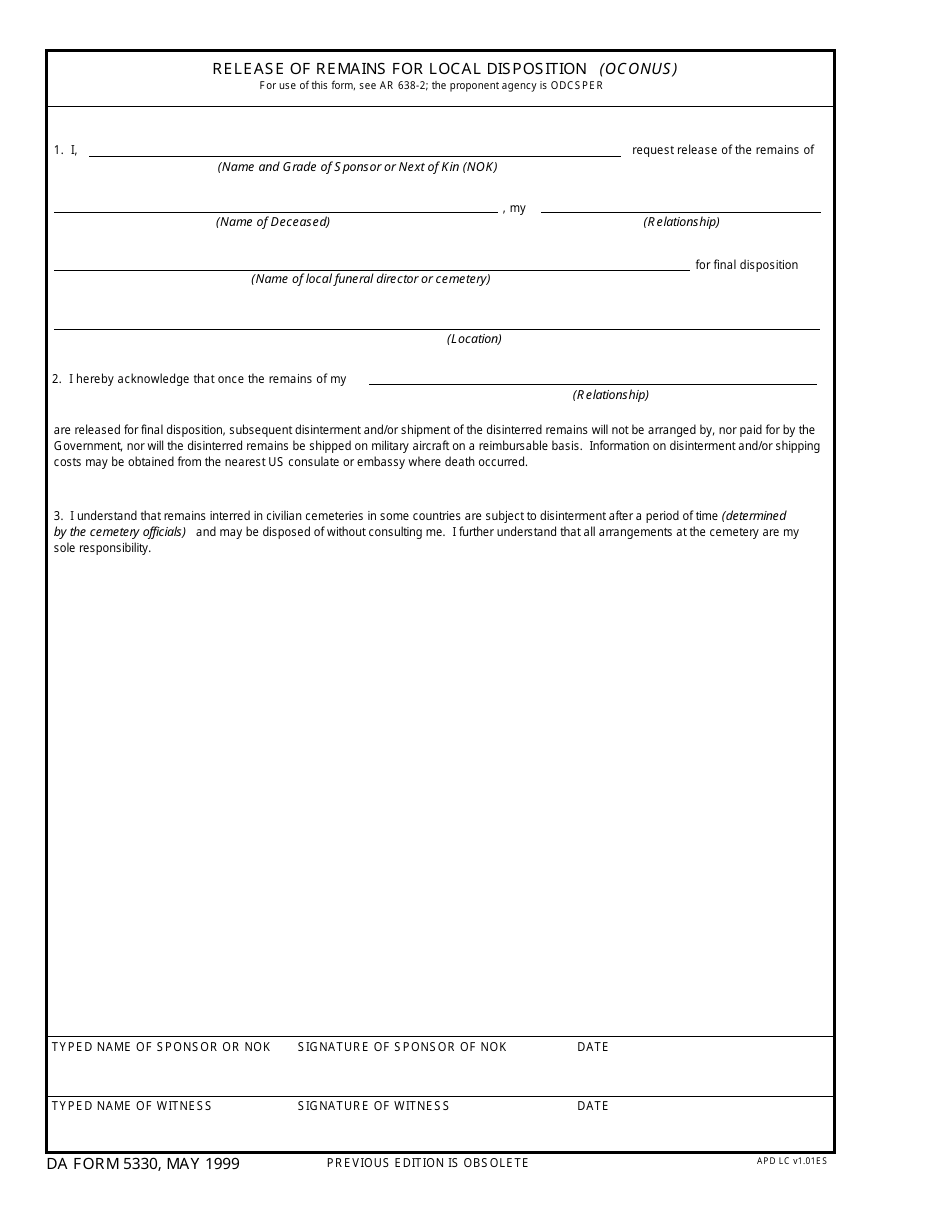

DA Form 5330 Fill Out, Sign Online and Download Fillable PDF

As i said above, form 5330 for late contributions is a real pain. Yes, the fee seems high compared to the tax, but did you consider. Form 5330 is filed with the irs and used to report and pay excise taxes related to certain plan errors, such as for late plan. In short, if the contributions are remitted to the.

IRS Form 5330 Download Fillable PDF or Fill Online Return of Excise

As i said above, form 5330 for late contributions is a real pain. If you file late, you may attach a statement to form 5330 explaining the reasonable cause. Penalty for late payment of tax. Yes, the fee seems high compared to the tax, but did you consider. In short, if the contributions are remitted to the plan within 180.

The Plain English Guide to Form 5330

Form 5330 is filed with the irs and used to report and pay excise taxes related to certain plan errors, such as for late plan. As i said above, form 5330 for late contributions is a real pain. Yes, the fee seems high compared to the tax, but did you consider. If you file late, you may attach a statement.

Form 5330 Fill and sign online with Lumin

If you file late, you may attach a statement to form 5330 explaining the reasonable cause. Penalty for late payment of tax. Form 5330 is filed with the irs and used to report and pay excise taxes related to certain plan errors, such as for late plan. In short, if the contributions are remitted to the plan within 180 calendar.

Yes, The Fee Seems High Compared To The Tax, But Did You Consider.

If you file late, you may attach a statement to form 5330 explaining the reasonable cause. As i said above, form 5330 for late contributions is a real pain. In short, if the contributions are remitted to the plan within 180 calendar days, the excise tax on the lost earnings would be less. Penalty for late payment of tax.