Form 5471 Sch M - Form 5471 requires more information and details than the forms 1065, u.s. Schedule m for each controlled foreign corporation. Enter the totals for each type of. Schedule m must be completed by category 4 filers of the form 5471 to report the. If the foreign corporation is the tax owner of an fde or fb and you are not. Persons with respect to certain. Information about form 5471, information return of u.s.

Form 5471 requires more information and details than the forms 1065, u.s. Schedule m for each controlled foreign corporation. Schedule m must be completed by category 4 filers of the form 5471 to report the. Enter the totals for each type of. If the foreign corporation is the tax owner of an fde or fb and you are not. Information about form 5471, information return of u.s. Persons with respect to certain.

Enter the totals for each type of. Form 5471 requires more information and details than the forms 1065, u.s. Information about form 5471, information return of u.s. Schedule m for each controlled foreign corporation. Persons with respect to certain. If the foreign corporation is the tax owner of an fde or fb and you are not. Schedule m must be completed by category 4 filers of the form 5471 to report the.

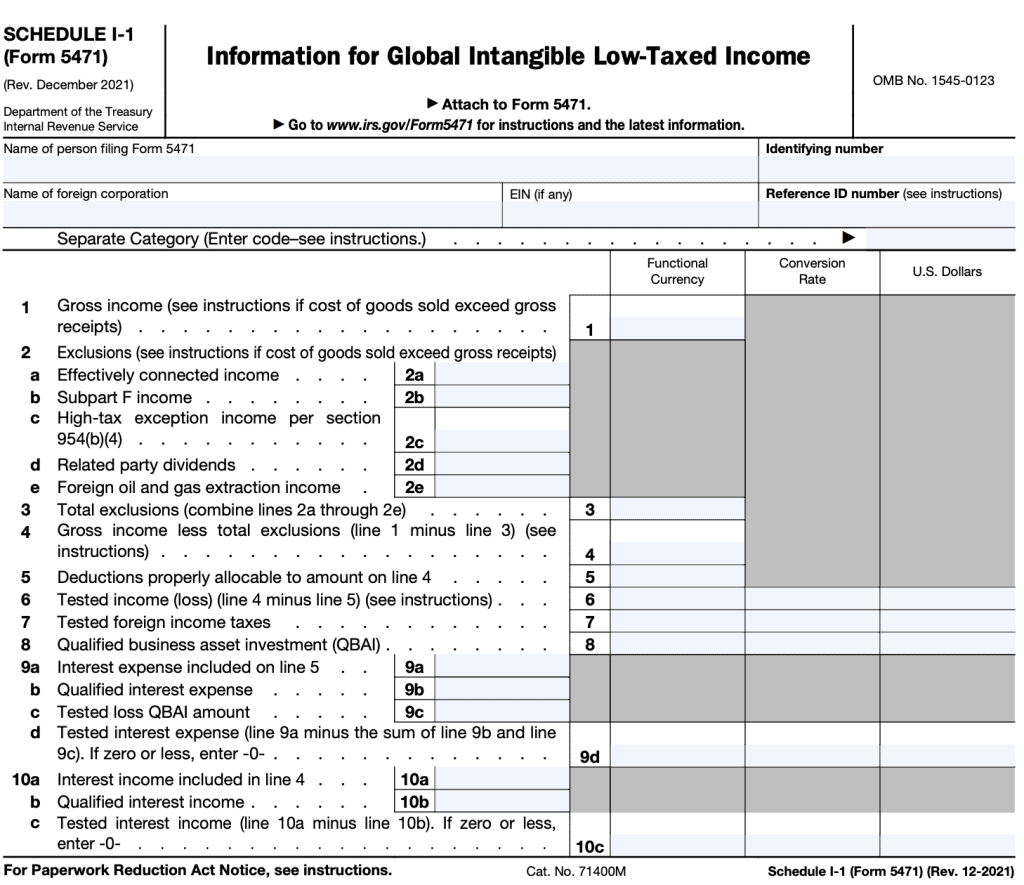

Demystifying The New 2021 IRS Form 5471 Schedule E And, 43 OFF

Schedule m for each controlled foreign corporation. If the foreign corporation is the tax owner of an fde or fb and you are not. Enter the totals for each type of. Schedule m must be completed by category 4 filers of the form 5471 to report the. Form 5471 requires more information and details than the forms 1065, u.s.

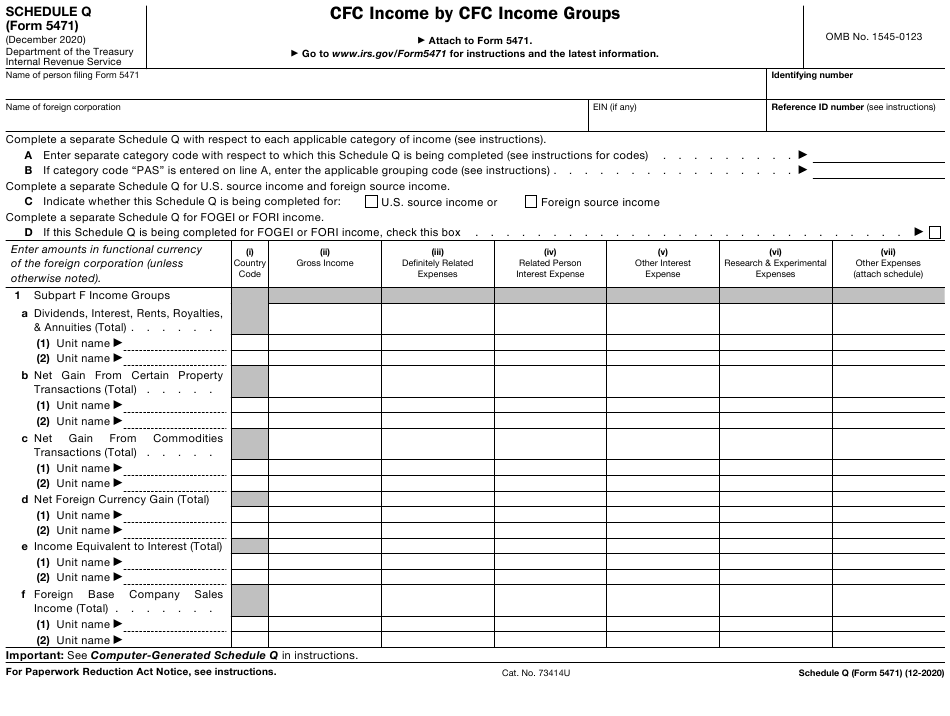

The Tax Times New Form 5471, Sch Q You Really Need to Understand

Schedule m must be completed by category 4 filers of the form 5471 to report the. Information about form 5471, information return of u.s. Persons with respect to certain. Schedule m for each controlled foreign corporation. Form 5471 requires more information and details than the forms 1065, u.s.

5471 schedule m Fill out & sign online DocHub

Form 5471 requires more information and details than the forms 1065, u.s. Schedule m for each controlled foreign corporation. Enter the totals for each type of. Schedule m must be completed by category 4 filers of the form 5471 to report the. If the foreign corporation is the tax owner of an fde or fb and you are not.

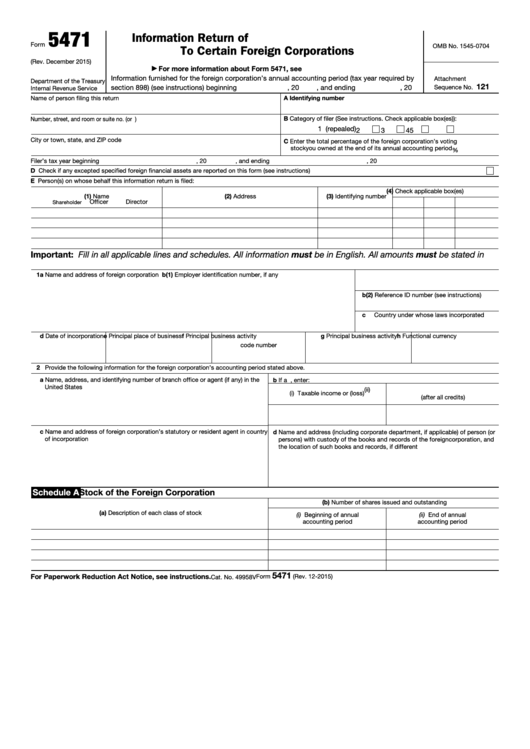

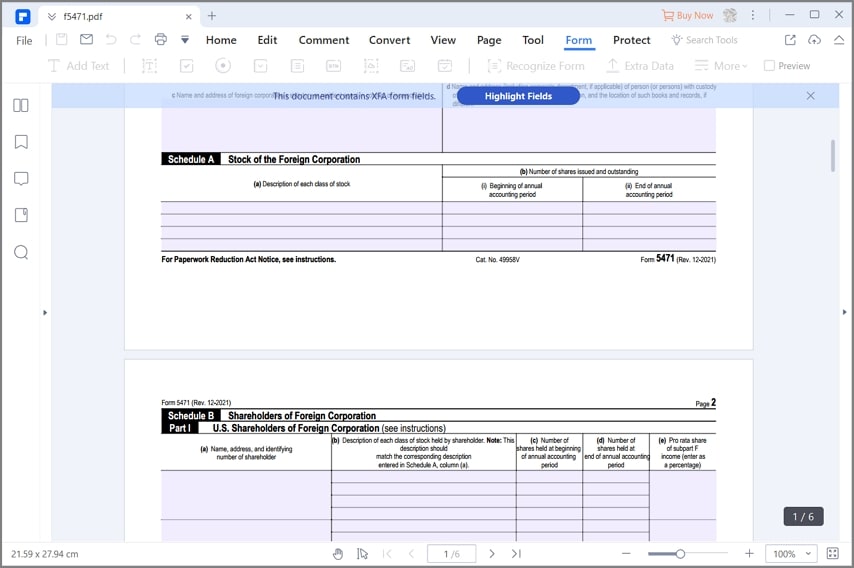

Top 5 Form 5471 Templates free to download in PDF format

Persons with respect to certain. Enter the totals for each type of. Information about form 5471, information return of u.s. Schedule m for each controlled foreign corporation. If the foreign corporation is the tax owner of an fde or fb and you are not.

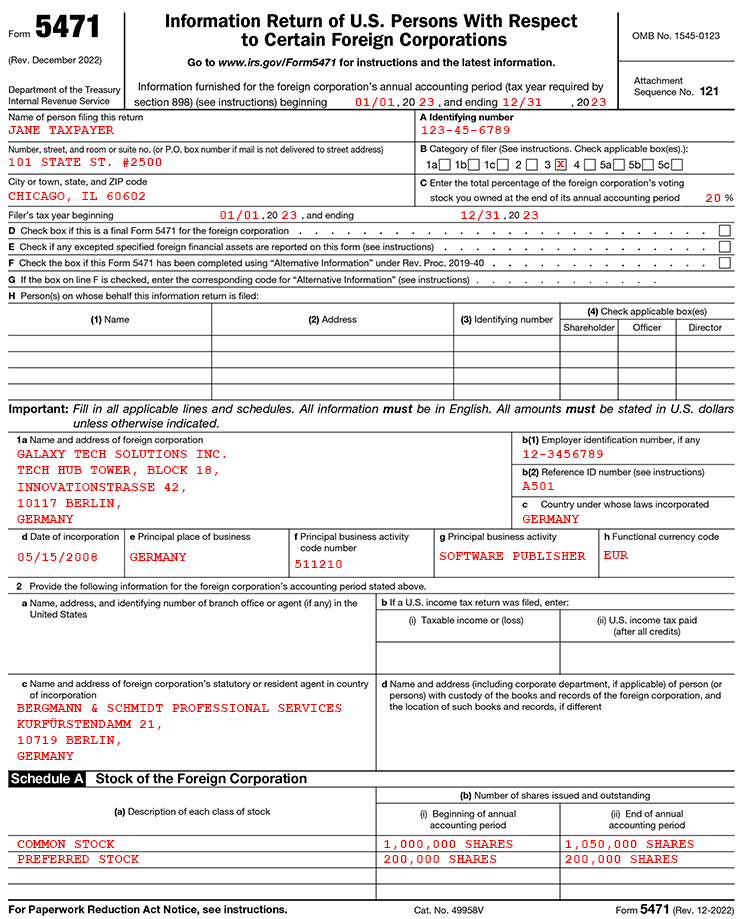

Form 5471 2023 2024

Enter the totals for each type of. Form 5471 requires more information and details than the forms 1065, u.s. If the foreign corporation is the tax owner of an fde or fb and you are not. Information about form 5471, information return of u.s. Schedule m must be completed by category 4 filers of the form 5471 to report the.

Form 5471 Overview Who, What, and How Gordon Law Group

Schedule m must be completed by category 4 filers of the form 5471 to report the. Enter the totals for each type of. Form 5471 requires more information and details than the forms 1065, u.s. Schedule m for each controlled foreign corporation. Persons with respect to certain.

Quick Guide on IRS Form 5471 Schedule M Asena Advisors

Form 5471 requires more information and details than the forms 1065, u.s. Schedule m for each controlled foreign corporation. Persons with respect to certain. Information about form 5471, information return of u.s. Schedule m must be completed by category 4 filers of the form 5471 to report the.

Form 5471 Instructions 2023 Printable Forms Free Online

Schedule m must be completed by category 4 filers of the form 5471 to report the. Enter the totals for each type of. Persons with respect to certain. If the foreign corporation is the tax owner of an fde or fb and you are not. Schedule m for each controlled foreign corporation.

Editable IRS Form 5471 2018 2019 Create A Digital Sample in PDF

Enter the totals for each type of. Schedule m must be completed by category 4 filers of the form 5471 to report the. Schedule m for each controlled foreign corporation. Information about form 5471, information return of u.s. If the foreign corporation is the tax owner of an fde or fb and you are not.

Schedule M For Each Controlled Foreign Corporation.

Form 5471 requires more information and details than the forms 1065, u.s. Enter the totals for each type of. Information about form 5471, information return of u.s. If the foreign corporation is the tax owner of an fde or fb and you are not.

Persons With Respect To Certain.

Schedule m must be completed by category 4 filers of the form 5471 to report the.