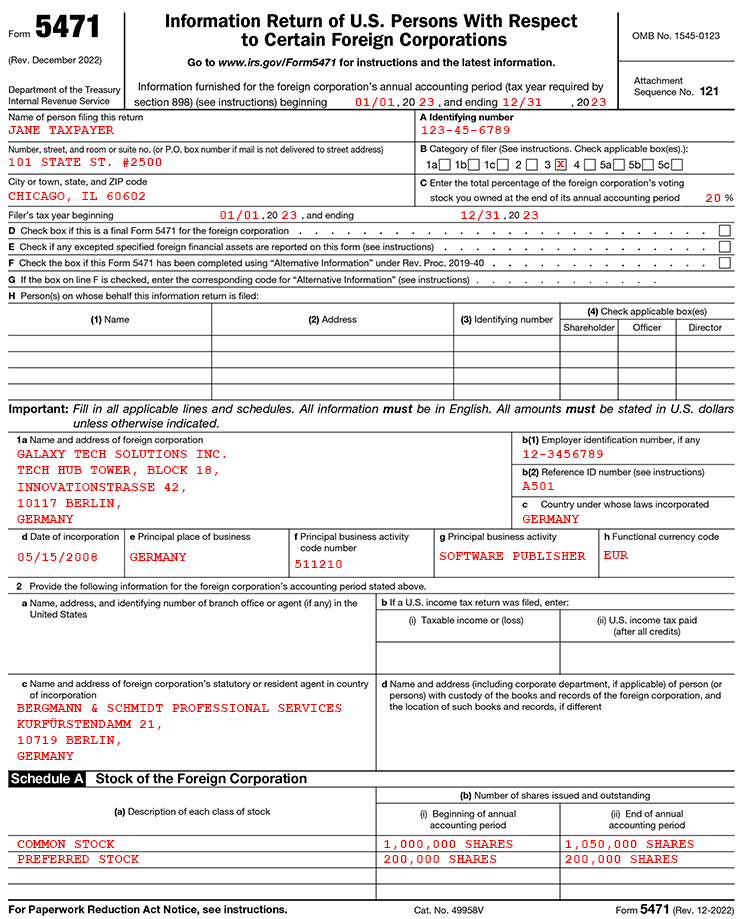

Form 5471 Worksheet A - For tax year 2022, affected form 5471 filers entered “xx” on form 5471, schedule g, line 14, if the answer to question 22 of the table in the. Unlike the fbar or form 8938,. Persons with respect to certain foreign corporations, including recent updates, related. Information about form 5471, information return of u.s. Person has an ownership or interest in a foreign corporation, they may be required to file form 5471. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa).

Unlike the fbar or form 8938,. Information about form 5471, information return of u.s. For tax year 2022, affected form 5471 filers entered “xx” on form 5471, schedule g, line 14, if the answer to question 22 of the table in the. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Person has an ownership or interest in a foreign corporation, they may be required to file form 5471. Persons with respect to certain foreign corporations, including recent updates, related.

Unlike the fbar or form 8938,. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Information about form 5471, information return of u.s. Persons with respect to certain foreign corporations, including recent updates, related. For tax year 2022, affected form 5471 filers entered “xx” on form 5471, schedule g, line 14, if the answer to question 22 of the table in the. Person has an ownership or interest in a foreign corporation, they may be required to file form 5471.

5471 Worksheets A

Information about form 5471, information return of u.s. Unlike the fbar or form 8938,. Persons with respect to certain foreign corporations, including recent updates, related. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Person has an ownership or interest in a foreign.

Form 5471 2023 2024

Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Person has an ownership or interest in a foreign corporation, they may be required to file form 5471. Persons with respect to certain foreign corporations, including recent updates, related. Unlike the fbar or form.

Form 5471 Worksheet A Pdf

Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Unlike the fbar or form 8938,. Information about form 5471, information return of u.s. Person has an ownership or interest in a foreign corporation, they may be required to file form 5471. Persons with.

Form 5471 Worksheet A Printable Word Searches

Persons with respect to certain foreign corporations, including recent updates, related. Person has an ownership or interest in a foreign corporation, they may be required to file form 5471. Information about form 5471, information return of u.s. For tax year 2022, affected form 5471 filers entered “xx” on form 5471, schedule g, line 14, if the answer to question 22.

Form 5471 Worksheet A

Person has an ownership or interest in a foreign corporation, they may be required to file form 5471. Information about form 5471, information return of u.s. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Persons with respect to certain foreign corporations, including.

Editable IRS Form 5471 2018 2019 Create A Digital Sample in PDF

For tax year 2022, affected form 5471 filers entered “xx” on form 5471, schedule g, line 14, if the answer to question 22 of the table in the. Information about form 5471, information return of u.s. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of.

Form 5471 Sch I Worksheet A

Persons with respect to certain foreign corporations, including recent updates, related. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Information about form 5471, information return of u.s. Unlike the fbar or form 8938,. For tax year 2022, affected form 5471 filers entered.

Form 5471 Overview Who, What, and How Gordon Law Group

Unlike the fbar or form 8938,. Information about form 5471, information return of u.s. Persons with respect to certain foreign corporations, including recent updates, related. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). For tax year 2022, affected form 5471 filers entered.

5471 Worksheet A Filing Form 5471 Everything You Need To Kn

Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Information about form 5471, information return of u.s. For tax year 2022, affected form 5471 filers entered “xx” on form 5471, schedule g, line 14, if the answer to question 22 of the table.

Form 5471 Worksheet A Printable Calendars AT A GLANCE

Unlike the fbar or form 8938,. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Information about form 5471, information return of u.s. For tax year 2022, affected form 5471 filers entered “xx” on form 5471, schedule g, line 14, if the answer.

Person Has An Ownership Or Interest In A Foreign Corporation, They May Be Required To File Form 5471.

Persons with respect to certain foreign corporations, including recent updates, related. Information about form 5471, information return of u.s. For tax year 2022, affected form 5471 filers entered “xx” on form 5471, schedule g, line 14, if the answer to question 22 of the table in the. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa).