Form 5500 Instructions 2022 - This form is required to be filed under section 6058(a) of the internal revenue code. Quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2022 form. 2022 instructions for schedule mb (form 5500) multiemployer defined benefit plan and certain money purchase plan actuarial information. It covers who must file,. Access resources and official guidance for plan reporting and compliance. Under the computerized erisa filing acceptance system (efast2), you must electronically file your 2022 form 5500. This document provides detailed instructions for completing the form 5500 annual return/report of employee benefit plan. Certain foreign retirement plans are also required to file. File your form 5500 series with ease. The form 5500 version selection tool can help.

It covers who must file,. Quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2022 form. This document provides detailed instructions for completing the form 5500 annual return/report of employee benefit plan. Under the computerized erisa filing acceptance system (efast2), you must electronically file your 2022 form 5500. 2022 instructions for schedule mb (form 5500) multiemployer defined benefit plan and certain money purchase plan actuarial information. This form is required to be filed under section 6058(a) of the internal revenue code. The form 5500 version selection tool can help. Certain foreign retirement plans are also required to file. Access resources and official guidance for plan reporting and compliance. File your form 5500 series with ease.

Certain foreign retirement plans are also required to file. Access resources and official guidance for plan reporting and compliance. 2022 instructions for schedule mb (form 5500) multiemployer defined benefit plan and certain money purchase plan actuarial information. The form 5500 version selection tool can help. This form is required to be filed under section 6058(a) of the internal revenue code. File your form 5500 series with ease. It covers who must file,. This document provides detailed instructions for completing the form 5500 annual return/report of employee benefit plan. Under the computerized erisa filing acceptance system (efast2), you must electronically file your 2022 form 5500. Quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2022 form.

Understanding the Form 5500 for Defined Contribution Plans Fidelity

This document provides detailed instructions for completing the form 5500 annual return/report of employee benefit plan. Quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2022 form. File your form 5500 series with ease. It covers who must file,. Access resources and official guidance for plan reporting and compliance.

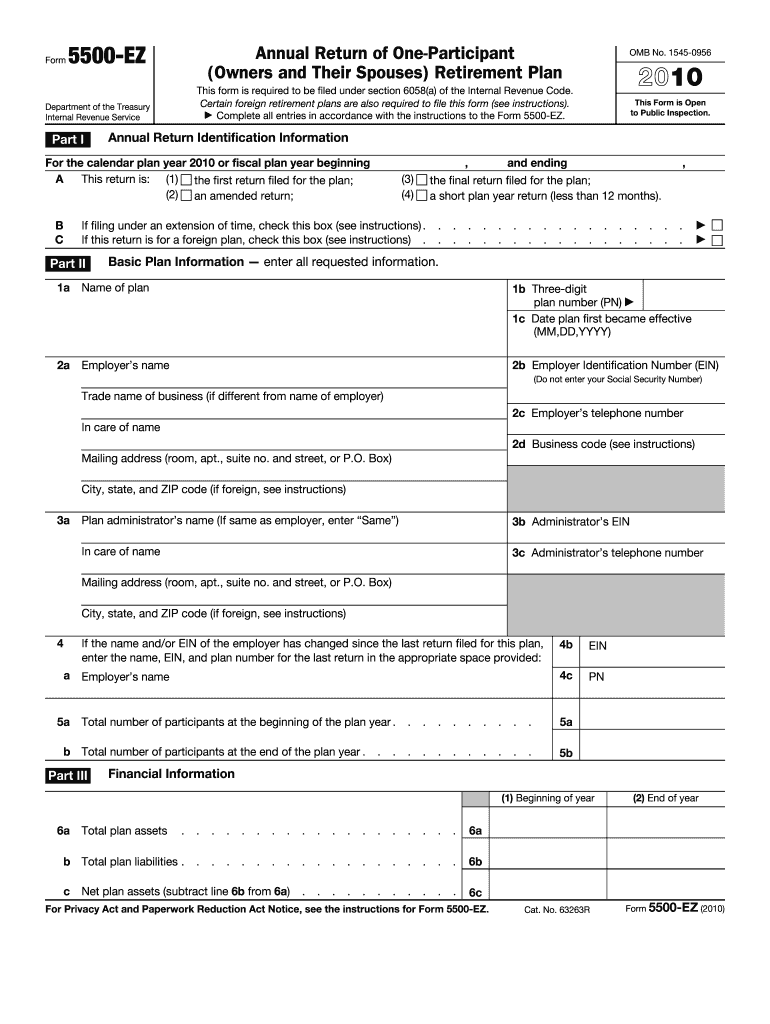

How to Rotate Form Instructions 5500EZ

2022 instructions for schedule mb (form 5500) multiemployer defined benefit plan and certain money purchase plan actuarial information. File your form 5500 series with ease. The form 5500 version selection tool can help. Access resources and official guidance for plan reporting and compliance. Quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report.

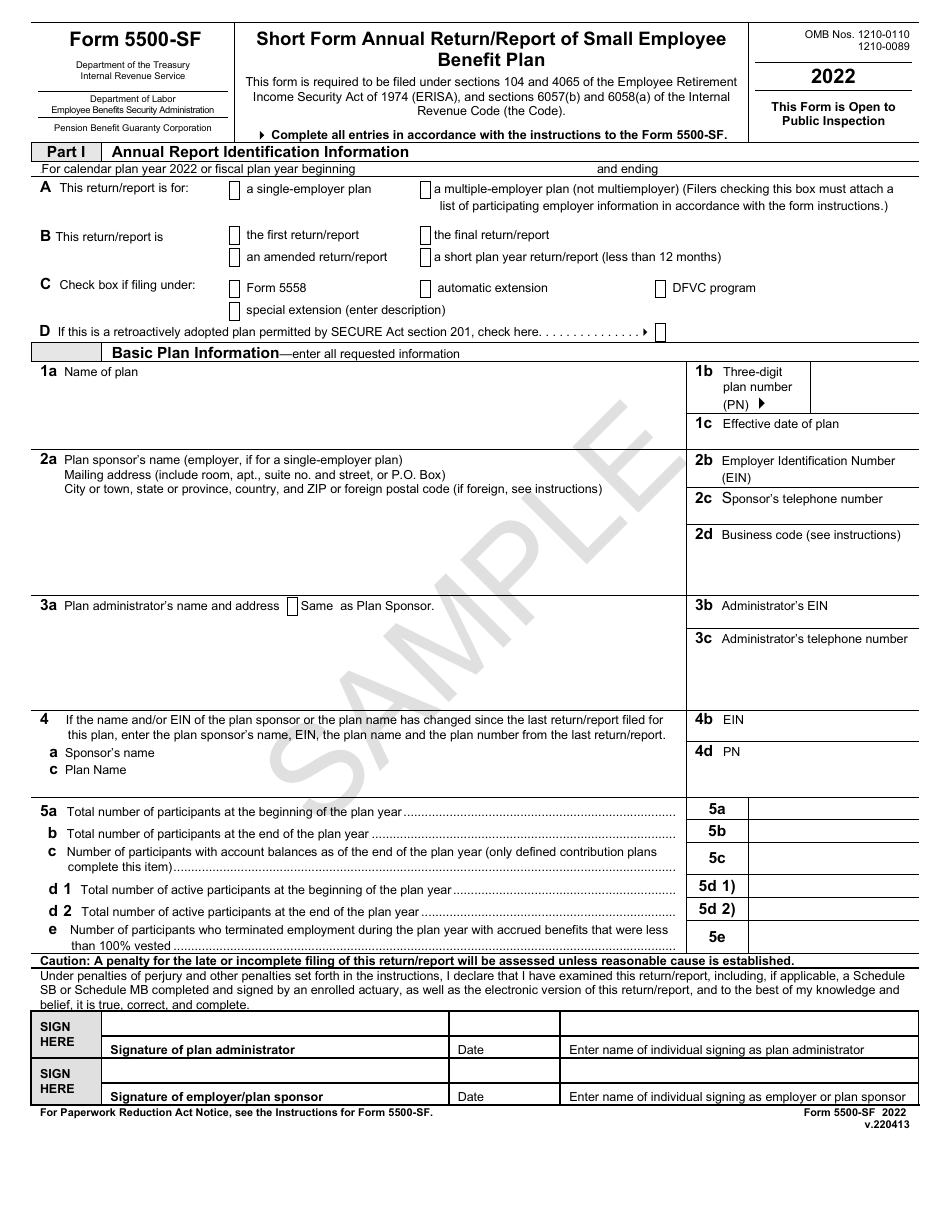

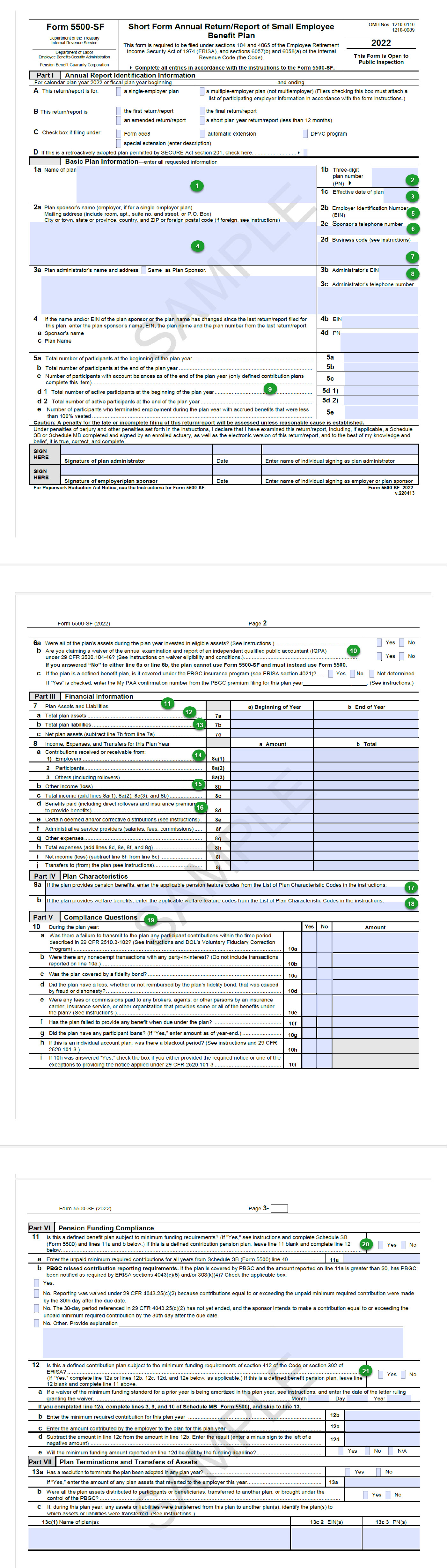

Fillable Online 2022 Form 5500SF Instructions Fax Email Print pdfFiller

2022 instructions for schedule mb (form 5500) multiemployer defined benefit plan and certain money purchase plan actuarial information. Quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2022 form. This form is required to be filed under section 6058(a) of the internal revenue code. Under the computerized erisa filing.

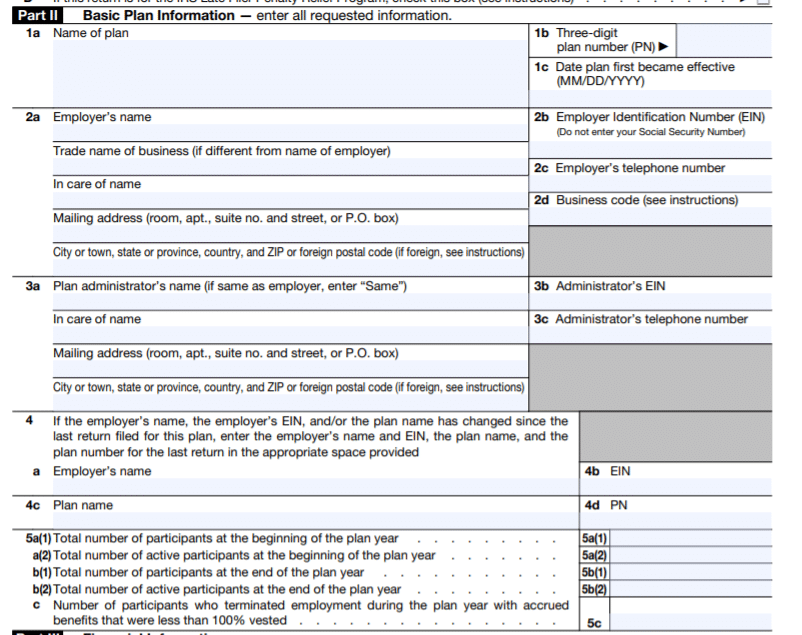

Fillable Online Form 5500 Instructions Fax Email Print pdfFiller

It covers who must file,. This document provides detailed instructions for completing the form 5500 annual return/report of employee benefit plan. Access resources and official guidance for plan reporting and compliance. The form 5500 version selection tool can help. This form is required to be filed under section 6058(a) of the internal revenue code.

Form 5500 Definition, Instructions, Types, & How to File

Under the computerized erisa filing acceptance system (efast2), you must electronically file your 2022 form 5500. The form 5500 version selection tool can help. File your form 5500 series with ease. Access resources and official guidance for plan reporting and compliance. Quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of.

Form 5500 Instructions 2024 Nolie Carmencita

2022 instructions for schedule mb (form 5500) multiemployer defined benefit plan and certain money purchase plan actuarial information. It covers who must file,. Access resources and official guidance for plan reporting and compliance. File your form 5500 series with ease. Quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the.

Form 5500 Ssa Report Fillable Printable Forms Free Online

Certain foreign retirement plans are also required to file. Under the computerized erisa filing acceptance system (efast2), you must electronically file your 2022 form 5500. This form is required to be filed under section 6058(a) of the internal revenue code. 2022 instructions for schedule mb (form 5500) multiemployer defined benefit plan and certain money purchase plan actuarial information. It covers.

2023 Form 5500 Ez Instructions Printable Forms Free Online

Quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2022 form. It covers who must file,. This document provides detailed instructions for completing the form 5500 annual return/report of employee benefit plan. 2022 instructions for schedule mb (form 5500) multiemployer defined benefit plan and certain money purchase plan actuarial.

DOL Releases New Form 5500 Instructions Chief Investment Officer

It covers who must file,. File your form 5500 series with ease. Quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2022 form. This form is required to be filed under section 6058(a) of the internal revenue code. Under the computerized erisa filing acceptance system (efast2), you must electronically.

Form 5500 Instructions 2023 Printable Forms Free Online

The form 5500 version selection tool can help. It covers who must file,. File your form 5500 series with ease. Quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2022 form. This form is required to be filed under section 6058(a) of the internal revenue code.

File Your Form 5500 Series With Ease.

2022 instructions for schedule mb (form 5500) multiemployer defined benefit plan and certain money purchase plan actuarial information. Access resources and official guidance for plan reporting and compliance. Certain foreign retirement plans are also required to file. It covers who must file,.

This Form Is Required To Be Filed Under Section 6058(A) Of The Internal Revenue Code.

Under the computerized erisa filing acceptance system (efast2), you must electronically file your 2022 form 5500. This document provides detailed instructions for completing the form 5500 annual return/report of employee benefit plan. The form 5500 version selection tool can help. Quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2022 form.

.png?width=1800&height=974&name=Types_of_Form_5500_(2).png)