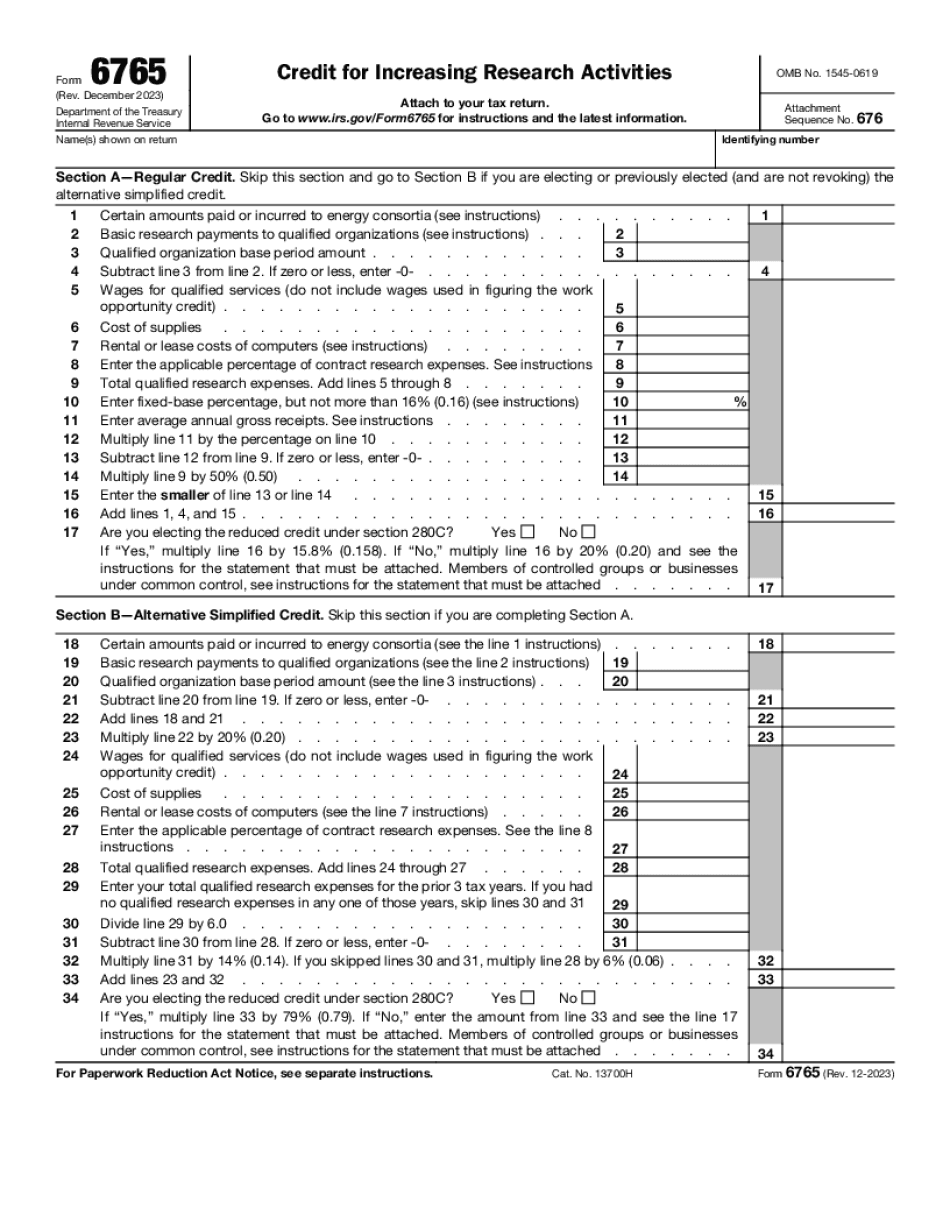

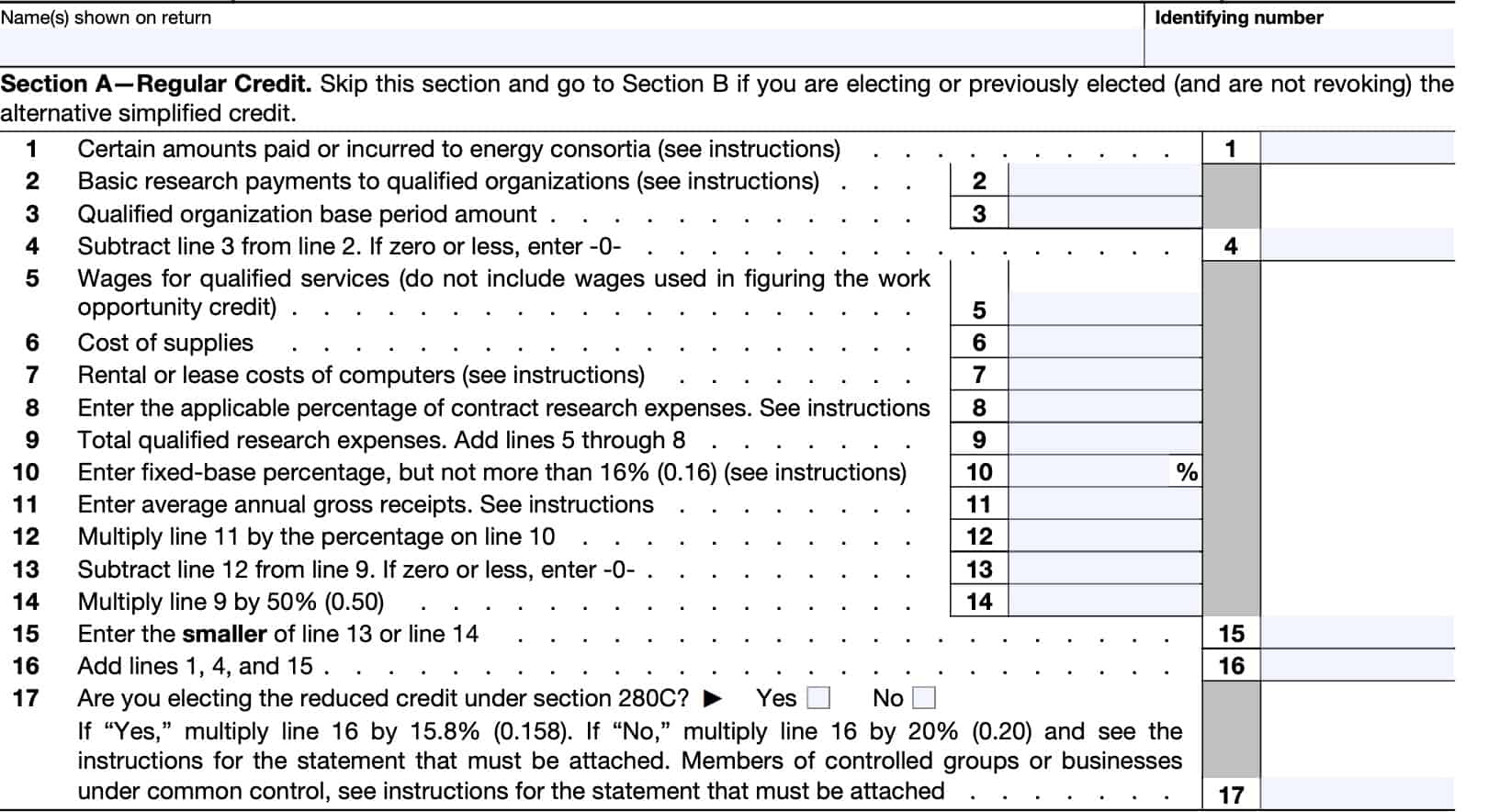

Form 6765 Instructions 2021 - Irs form 6765 is used to claim r&d tax credits for eligible business research expenses. Information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file. Businesses can claim the r&d credit by filing irs form 6765, credit for increasing research activities. Your path to r&d tax credits. Quick guide to form 6765: Use form 6765 to figure and claim. What is form 6765, and why would i need it? As part of the process, they need to identify qualifying expenses and provide. Use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as. Form 6765 is used to calculate and claim the r&d tax credits you are entitled to for increasing research and experimentation.

Information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file. Use form 6765 to figure and claim. Use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as. What is form 6765, and why would i need it? Your path to r&d tax credits. Quick guide to form 6765: Irs form 6765 is used to claim r&d tax credits for eligible business research expenses. Form 6765 is used to calculate and claim the r&d tax credits you are entitled to for increasing research and experimentation. Businesses can claim the r&d credit by filing irs form 6765, credit for increasing research activities. As part of the process, they need to identify qualifying expenses and provide.

Form 6765 is used to calculate and claim the r&d tax credits you are entitled to for increasing research and experimentation. Businesses can claim the r&d credit by filing irs form 6765, credit for increasing research activities. Irs form 6765 is used to claim r&d tax credits for eligible business research expenses. Your path to r&d tax credits. Use form 6765 to figure and claim. Information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file. Use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as. What is form 6765, and why would i need it? As part of the process, they need to identify qualifying expenses and provide. Quick guide to form 6765:

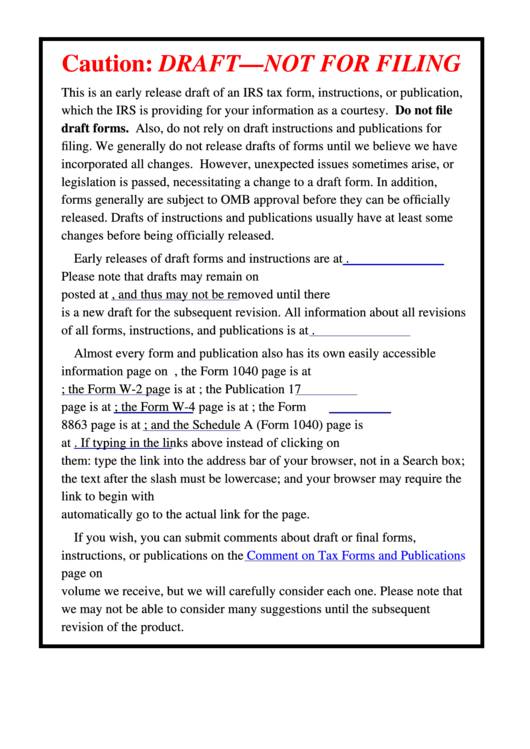

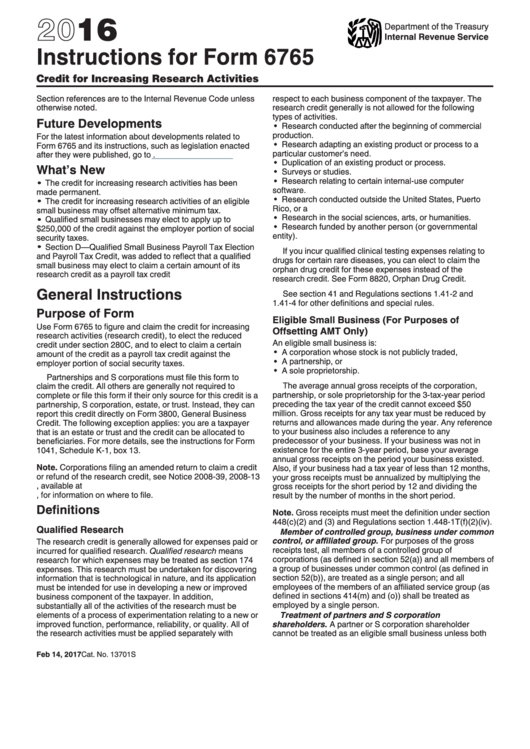

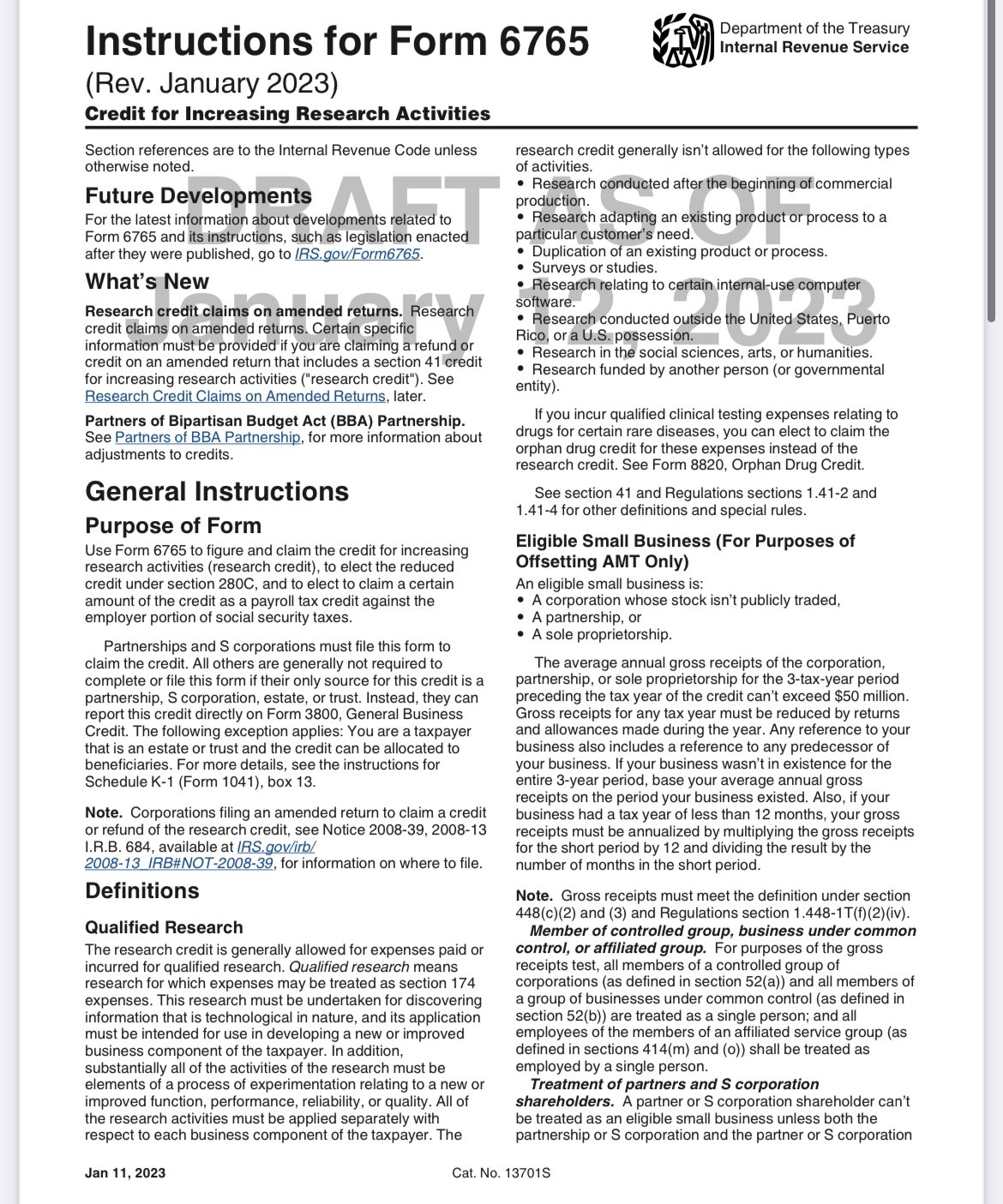

Instructions For Form 6765 (Draft) Credit For Increasing Research

Form 6765 is used to calculate and claim the r&d tax credits you are entitled to for increasing research and experimentation. Use form 6765 to figure and claim. Information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file. What is form 6765, and why would i need it? Quick guide.

Top 19 Irs Form 6765 Templates free to download in PDF format

What is form 6765, and why would i need it? Your path to r&d tax credits. Quick guide to form 6765: Information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file. Businesses can claim the r&d credit by filing irs form 6765, credit for increasing research activities.

2024 Form 6765 Fill Out Digital PDF Sample

Your path to r&d tax credits. As part of the process, they need to identify qualifying expenses and provide. Quick guide to form 6765: Irs form 6765 is used to claim r&d tax credits for eligible business research expenses. What is form 6765, and why would i need it?

Form 6765 Instructions 2023 Printable Forms Free Online

Quick guide to form 6765: Use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as. Form 6765 is used to calculate and claim the r&d tax credits you are entitled to for increasing research and experimentation. Your.

IRS Form 6765 2023 Draft Instructions Explained Cherry Bekaert

Quick guide to form 6765: Your path to r&d tax credits. Information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file. Use form 6765 to figure and claim. Form 6765 is used to calculate and claim the r&d tax credits you are entitled to for increasing research and experimentation.

Form 6765 Credit for Increasing Research Activities (2014) Free Download

Information about form 6765, credit for increasing research activities, including recent updates, related forms and instructions on how to file. As part of the process, they need to identify qualifying expenses and provide. Form 6765 is used to calculate and claim the r&d tax credits you are entitled to for increasing research and experimentation. Use form 6765 to figure and.

Download Instructions for IRS Form 6765 Credit for Increasing Research

Irs form 6765 is used to claim r&d tax credits for eligible business research expenses. What is form 6765, and why would i need it? Use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as. Businesses can.

Form 6765 Instructions 2023 Printable Forms Free Online

Use form 6765 to figure and claim. As part of the process, they need to identify qualifying expenses and provide. Your path to r&d tax credits. Quick guide to form 6765: Irs form 6765 is used to claim r&d tax credits for eligible business research expenses.

IRS Form 6765 Instructions Tax Credit For Research Activities

Use form 6765 to figure and claim. As part of the process, they need to identify qualifying expenses and provide. Use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as. Your path to r&d tax credits. Information.

Fillable Form 6765 Printable Forms Free Online

Quick guide to form 6765: Use form 6765 to figure and claim. Use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain amount of the credit as. Your path to r&d tax credits. As part of the process, they need to identify.

Information About Form 6765, Credit For Increasing Research Activities, Including Recent Updates, Related Forms And Instructions On How To File.

Businesses can claim the r&d credit by filing irs form 6765, credit for increasing research activities. What is form 6765, and why would i need it? Your path to r&d tax credits. Irs form 6765 is used to claim r&d tax credits for eligible business research expenses.

Use Form 6765 To Figure And Claim The Credit For Increasing Research Activities, To Elect The Reduced Credit Under Section 280C, And To Elect To Claim A Certain Amount Of The Credit As.

Use form 6765 to figure and claim. As part of the process, they need to identify qualifying expenses and provide. Quick guide to form 6765: Form 6765 is used to calculate and claim the r&d tax credits you are entitled to for increasing research and experimentation.