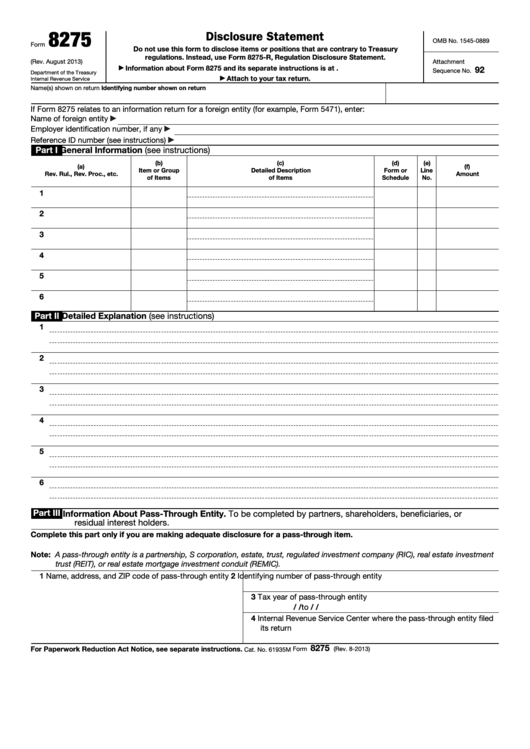

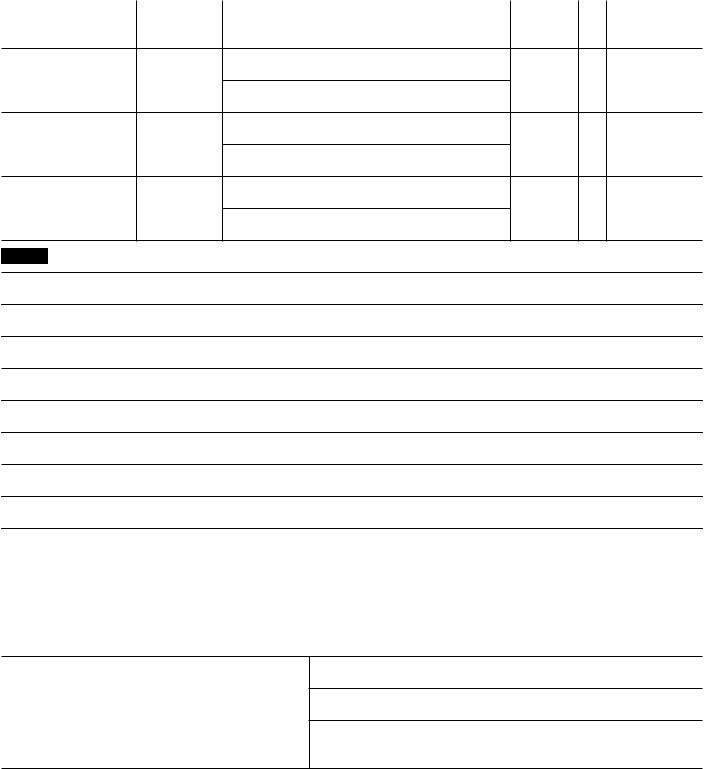

Form 8275 Example - Learn how to use this form to avoid penalties and accurately report your tax. If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: Form 8275 is a powerful tool for disclosing tax positions to the irs. Name of foreign entity employer identification. For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose. Taxpayers and tax return preparers use form 8275 to disclose items or positions that are not otherwise adequately disclosed on a tax return. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are.

Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are. Name of foreign entity employer identification. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are. Form 8275 is a powerful tool for disclosing tax positions to the irs. If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: Learn how to use this form to avoid penalties and accurately report your tax. Taxpayers and tax return preparers use form 8275 to disclose items or positions that are not otherwise adequately disclosed on a tax return. For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose.

Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are. Form 8275 is a powerful tool for disclosing tax positions to the irs. For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose. Name of foreign entity employer identification. If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: Learn how to use this form to avoid penalties and accurately report your tax. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are. Taxpayers and tax return preparers use form 8275 to disclose items or positions that are not otherwise adequately disclosed on a tax return.

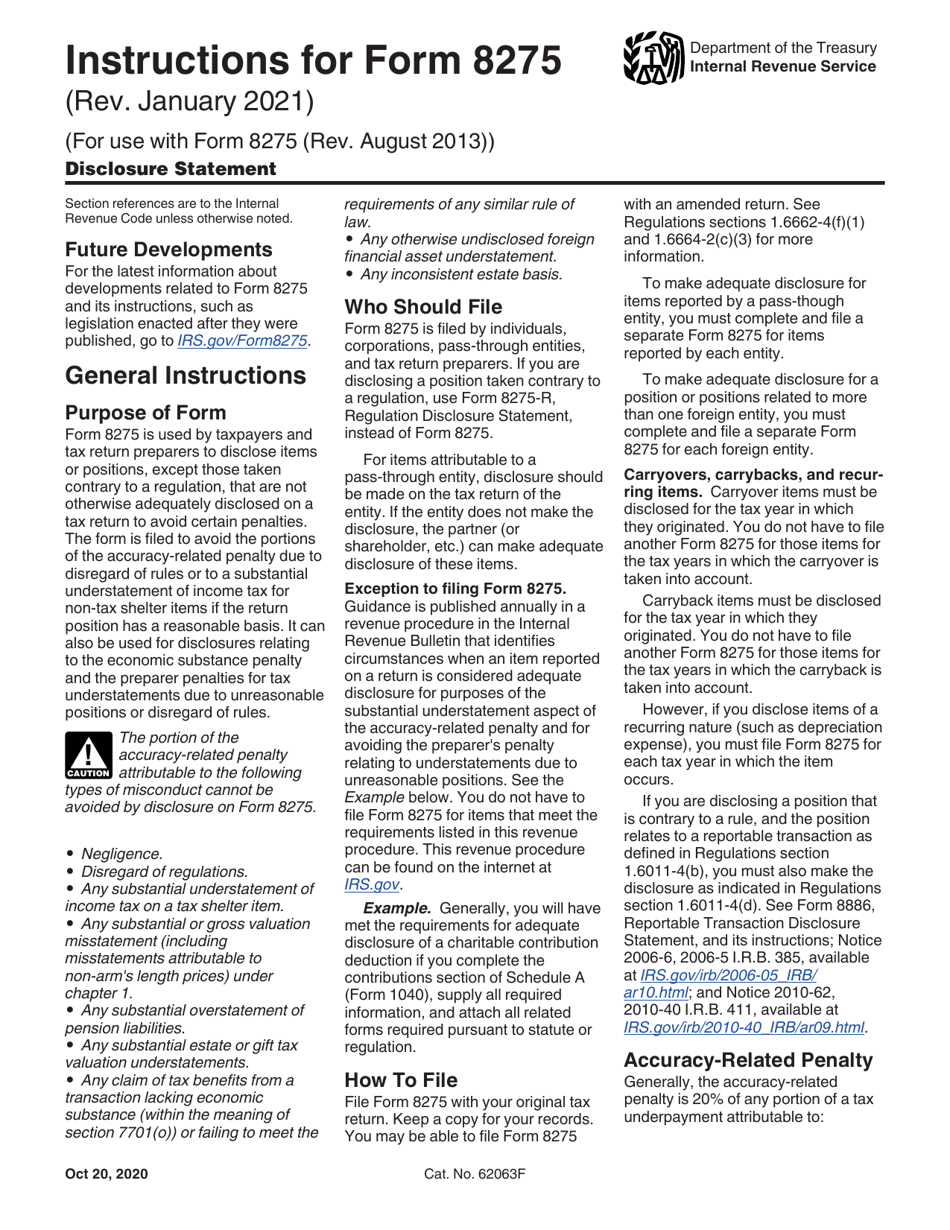

Download Instructions for IRS Form 8275 Disclosure Statement PDF 2013

If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: Learn how to use this form to avoid penalties and accurately report your tax. For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose. Form 8275 is a powerful tool for disclosing.

Top 17 Form 8275 Templates free to download in PDF format

If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: Form 8275 is a powerful tool for disclosing tax positions to the irs. Name of foreign entity employer identification. Learn how to use this form to avoid penalties and accurately report your tax. Form 8275 is used by taxpayers and tax return preparers.

IRS Form 8275 Instructions Disclosure Statement

For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose. Name of foreign entity employer identification. Taxpayers and tax return preparers use form 8275 to disclose items or positions that are not otherwise adequately disclosed on a tax return. Form 8275 is used by taxpayers and tax return preparers.

Form 8275R Regulation Disclosure Statement (2013) Free Download

Form 8275 is a powerful tool for disclosing tax positions to the irs. Taxpayers and tax return preparers use form 8275 to disclose items or positions that are not otherwise adequately disclosed on a tax return. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are..

Fillable Online Irs Form 8275. Irs Form 8275 Fax Email Print pdfFiller

Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are. Name of foreign entity employer identification. Taxpayers and tax return preparers use form 8275 to disclose items or positions that are not otherwise adequately disclosed on a tax return. If form 8275 relates to an information.

Fillable Online About Form 8275, Disclosure Statement Fax Email Print

For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose. Form 8275 is a powerful tool for disclosing tax positions to the irs. If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: Form 8275 is used by taxpayers and tax return.

Form 8275 R ≡ Fill Out Printable PDF Forms Online

If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are. Taxpayers and tax return preparers use form 8275 to disclose items or positions that are not otherwise adequately disclosed.

IRS Form 8275 Instructions Disclosure Statement

If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are. Learn how to use this form to avoid penalties and accurately report your tax. Form 8275 is a powerful.

Form 8275 Disclosure Statement (2013) Free Download

For those of you not familiar with disclosure statement, form 8275 is used by taxpayers and tax return preparers to disclose. Learn how to use this form to avoid penalties and accurately report your tax. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are. If.

IRS Form 8275 Instructions Disclosure Statement

Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are. Name of foreign entity employer identification. If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter: For those of you not familiar with disclosure statement, form 8275 is used.

Form 8275 Is A Powerful Tool For Disclosing Tax Positions To The Irs.

Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are. Form 8275 is used by taxpayers and tax return preparers to disclose items or positions, except those taken contrary to a regulation, that are. Taxpayers and tax return preparers use form 8275 to disclose items or positions that are not otherwise adequately disclosed on a tax return. If form 8275 relates to an information return for a foreign entity (for example, form 5471), enter:

For Those Of You Not Familiar With Disclosure Statement, Form 8275 Is Used By Taxpayers And Tax Return Preparers To Disclose.

Name of foreign entity employer identification. Learn how to use this form to avoid penalties and accurately report your tax.