Form 8582 Instructions 2021 - Commercial revitalization is the rehabilitation of a building in a distressed community. When filing an individual return for your client, you may wish to generate form 8582 to figure the amount of any passive activity. Form 8582 helps individuals who earn income from rentals or businesses in which they don't actively participate—known as passive. Per irs instructions for form 8582 passive activity. Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Go to www.irs.gov/form8582 for instructions and the latest information. Rental real estate activities with active participation (for the.

When filing an individual return for your client, you may wish to generate form 8582 to figure the amount of any passive activity. Go to www.irs.gov/form8582 for instructions and the latest information. Rental real estate activities with active participation (for the. Form 8582 helps individuals who earn income from rentals or businesses in which they don't actively participate—known as passive. Commercial revitalization is the rehabilitation of a building in a distressed community. Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Per irs instructions for form 8582 passive activity.

Per irs instructions for form 8582 passive activity. Commercial revitalization is the rehabilitation of a building in a distressed community. Rental real estate activities with active participation (for the. Go to www.irs.gov/form8582 for instructions and the latest information. Form 8582 helps individuals who earn income from rentals or businesses in which they don't actively participate—known as passive. When filing an individual return for your client, you may wish to generate form 8582 to figure the amount of any passive activity. Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year.

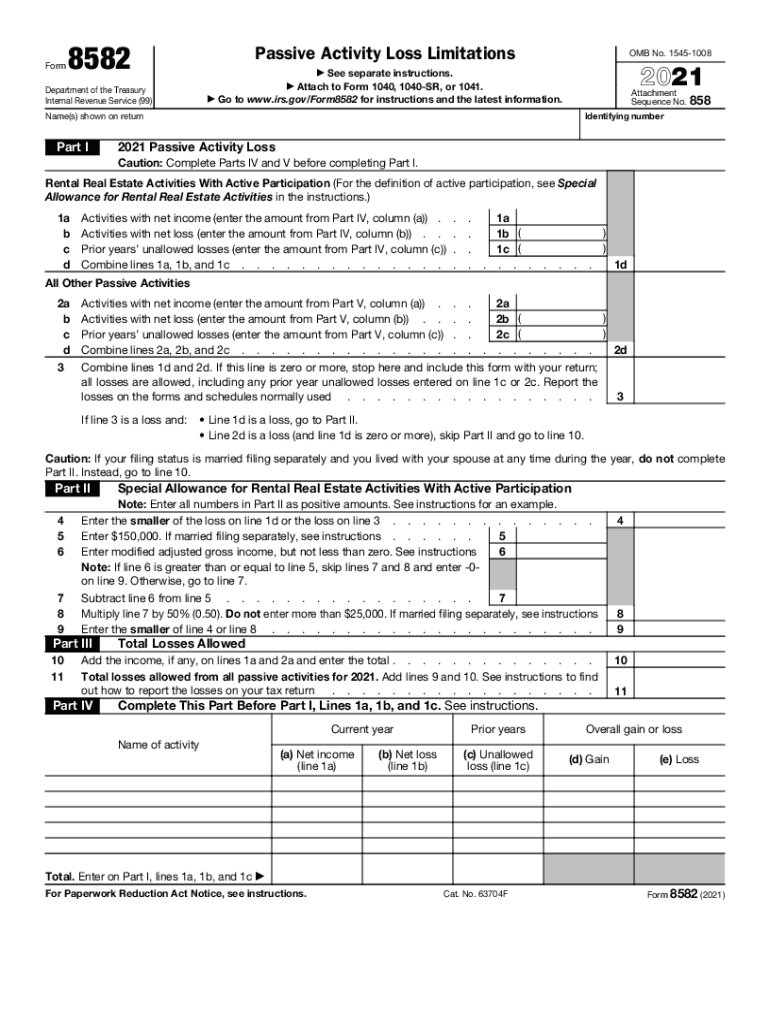

Irs Form 8582 Fillable Printable Forms Free Online

Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. When filing an individual return for your client, you may wish to generate form 8582 to figure the amount of any passive activity. Rental real estate activities with active participation (for the. Commercial revitalization is the rehabilitation of a.

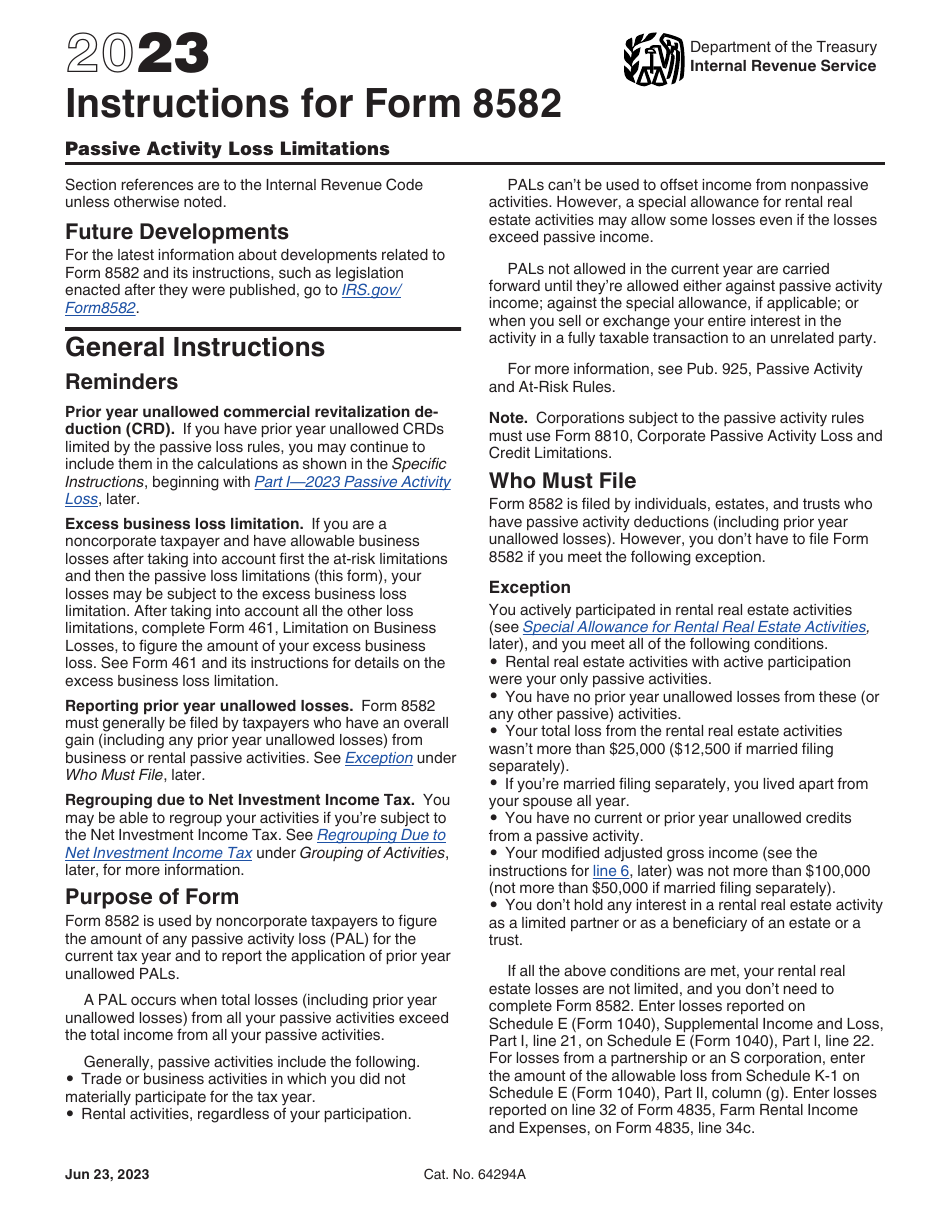

Download Instructions for IRS Form 8582 Passive Activity Loss

Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Form 8582 helps individuals who earn income from rentals or businesses in which they don't actively participate—known as passive. Rental real estate activities with active participation (for the. Per irs instructions for form 8582 passive activity. When filing an.

Download Instructions for IRS Form 8582 Passive Activity Loss

Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Rental real estate activities with active participation (for the. When filing an individual return for your client, you may wish to generate form 8582 to figure the amount of any passive activity. Form 8582 helps individuals who earn income.

IRS 8582 20212022 Fill and Sign Printable Template Online US Legal

Form 8582 helps individuals who earn income from rentals or businesses in which they don't actively participate—known as passive. Per irs instructions for form 8582 passive activity. Commercial revitalization is the rehabilitation of a building in a distressed community. When filing an individual return for your client, you may wish to generate form 8582 to figure the amount of any.

Download Instructions for IRS Form 8582 Passive Activity Loss

When filing an individual return for your client, you may wish to generate form 8582 to figure the amount of any passive activity. Per irs instructions for form 8582 passive activity. Commercial revitalization is the rehabilitation of a building in a distressed community. Go to www.irs.gov/form8582 for instructions and the latest information. Form 8582 helps individuals who earn income from.

Download Instructions for IRS Form 8582 Passive Activity Loss

When filing an individual return for your client, you may wish to generate form 8582 to figure the amount of any passive activity. Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Commercial revitalization is the rehabilitation of a building in a distressed community. Go to www.irs.gov/form8582 for.

IRS Form 8582CR Instructions Passive Activity Credit Limits

Form 8582 helps individuals who earn income from rentals or businesses in which they don't actively participate—known as passive. Per irs instructions for form 8582 passive activity. Commercial revitalization is the rehabilitation of a building in a distressed community. When filing an individual return for your client, you may wish to generate form 8582 to figure the amount of any.

Download Instructions for IRS Form 8582 Passive Activity Loss

Per irs instructions for form 8582 passive activity. Commercial revitalization is the rehabilitation of a building in a distressed community. Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Rental real estate activities with active participation (for the. When filing an individual return for your client, you may.

IRS Form 8582 Instructions A Guide to Passive Activity Losses

Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Per irs instructions for form 8582 passive activity. Rental real estate activities with active participation (for the. Form 8582 helps individuals who earn income from rentals or businesses in which they don't actively participate—known as passive. Go to www.irs.gov/form8582.

Fillable Online Instructions for Form 8582 (2021)Internal Revenue

Rental real estate activities with active participation (for the. Per irs instructions for form 8582 passive activity. Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year. Go to www.irs.gov/form8582 for instructions and the latest information. Commercial revitalization is the rehabilitation of a building in a distressed community.

When Filing An Individual Return For Your Client, You May Wish To Generate Form 8582 To Figure The Amount Of Any Passive Activity.

Form 8582 helps individuals who earn income from rentals or businesses in which they don't actively participate—known as passive. Commercial revitalization is the rehabilitation of a building in a distressed community. Per irs instructions for form 8582 passive activity. Go to www.irs.gov/form8582 for instructions and the latest information.

Rental Real Estate Activities With Active Participation (For The.

Form 8582 is used by noncorporate taxpayers to figure the amount of any passive activity loss (pal) for the current year.