Form 8606 Total Basis In Traditional Iras - Use form 8606 to report: Line 2 is always to be populated from the your total basis in traditional iras for xxxx and earlier years line of your most recent previously filed. When i check fy 2020 form 8606 column 14 your total basis in traditional iras for 2020 and earlier years, it says 11000 instead. Nondeductible contributions you made to traditional iras. You made nondeductible contributions to a traditional ira for 2023, including a repayment of a. File form 8606 if any of the following apply.

Use form 8606 to report: Line 2 is always to be populated from the your total basis in traditional iras for xxxx and earlier years line of your most recent previously filed. When i check fy 2020 form 8606 column 14 your total basis in traditional iras for 2020 and earlier years, it says 11000 instead. File form 8606 if any of the following apply. Nondeductible contributions you made to traditional iras. You made nondeductible contributions to a traditional ira for 2023, including a repayment of a.

You made nondeductible contributions to a traditional ira for 2023, including a repayment of a. File form 8606 if any of the following apply. Use form 8606 to report: When i check fy 2020 form 8606 column 14 your total basis in traditional iras for 2020 and earlier years, it says 11000 instead. Nondeductible contributions you made to traditional iras. Line 2 is always to be populated from the your total basis in traditional iras for xxxx and earlier years line of your most recent previously filed.

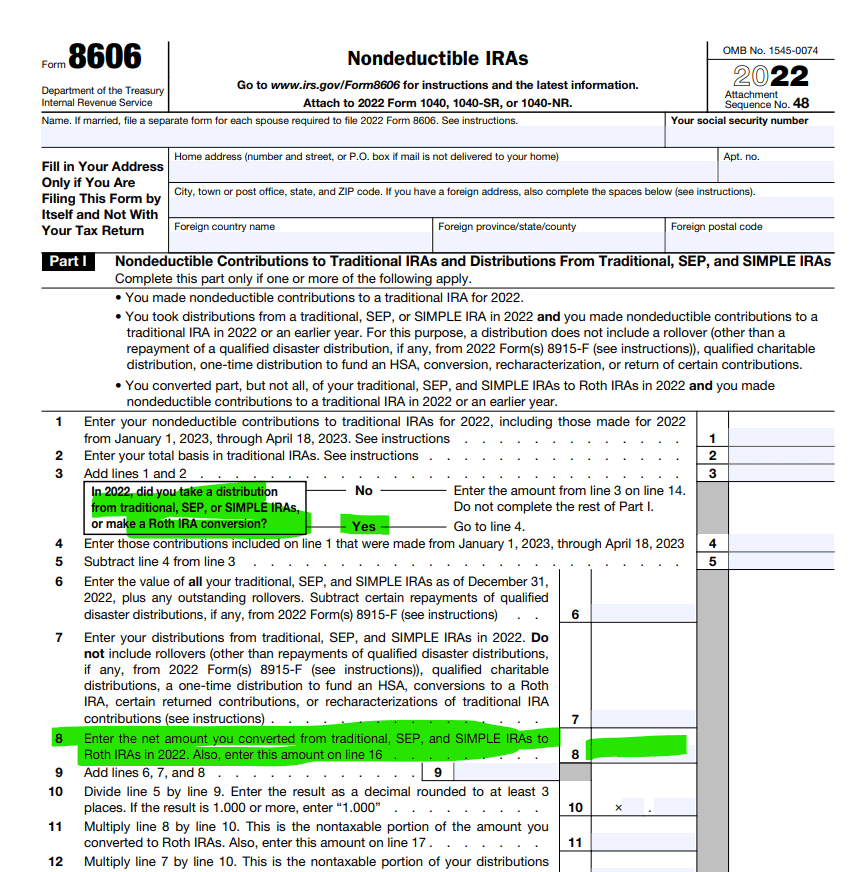

Form 8606*Nondeductible IRAs

When i check fy 2020 form 8606 column 14 your total basis in traditional iras for 2020 and earlier years, it says 11000 instead. Line 2 is always to be populated from the your total basis in traditional iras for xxxx and earlier years line of your most recent previously filed. File form 8606 if any of the following apply..

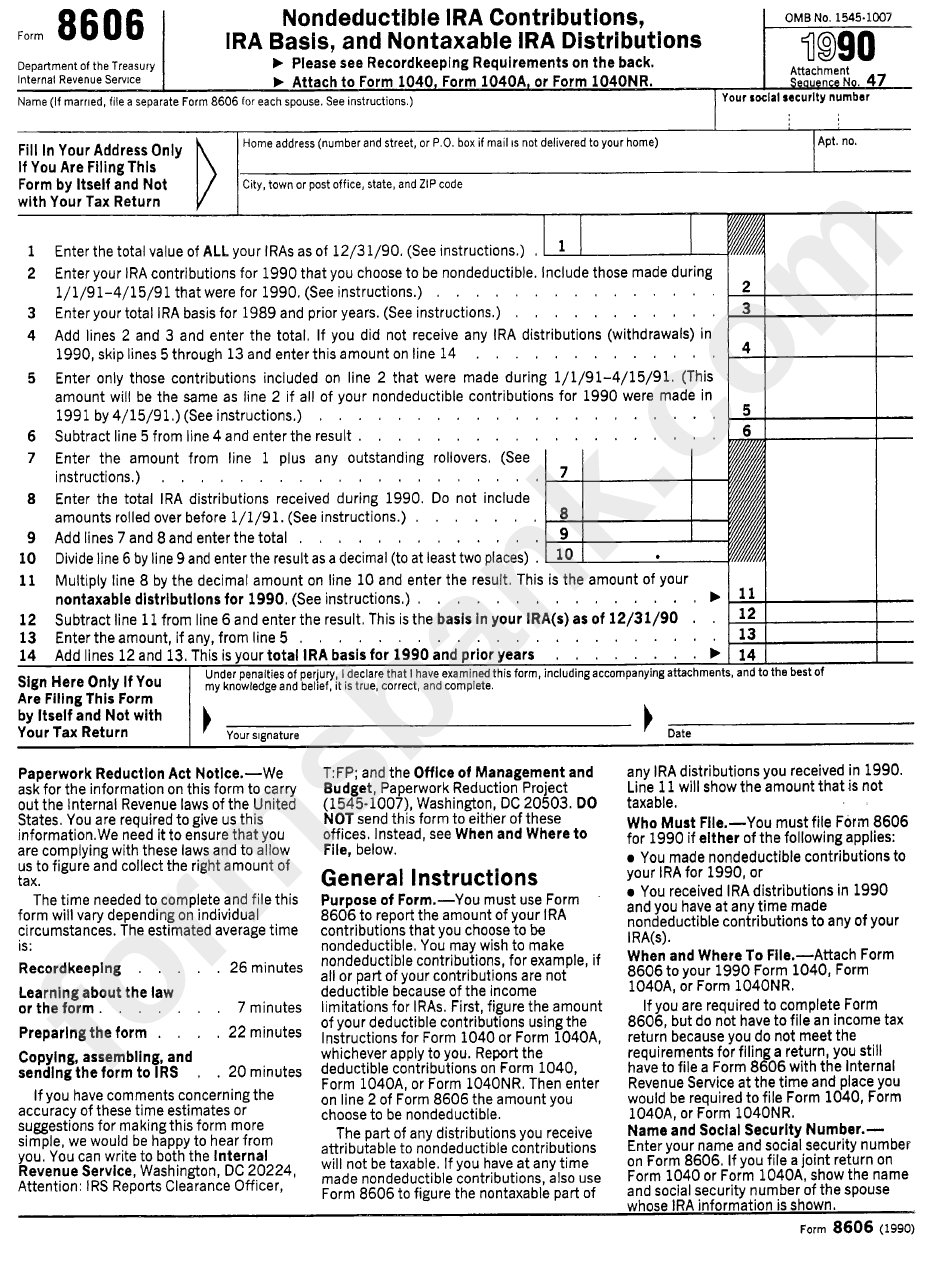

Form 8606 Nondeductible Ira Contributions, Ira Basis, And Nontaxable

Line 2 is always to be populated from the your total basis in traditional iras for xxxx and earlier years line of your most recent previously filed. Nondeductible contributions you made to traditional iras. You made nondeductible contributions to a traditional ira for 2023, including a repayment of a. Use form 8606 to report: When i check fy 2020 form.

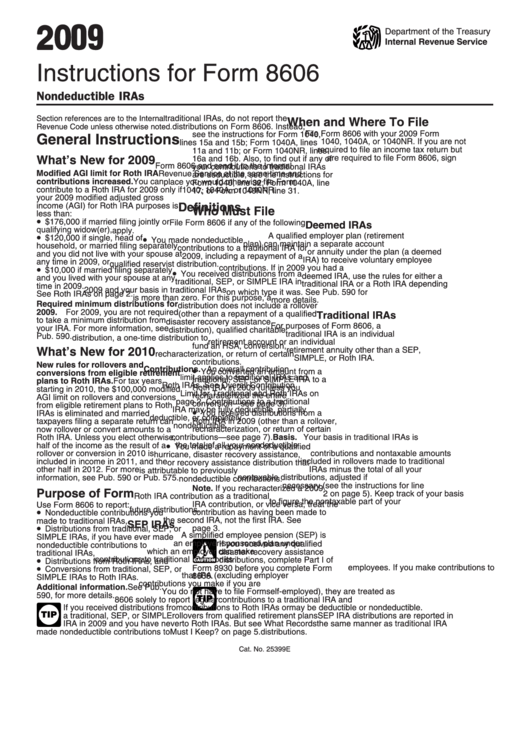

Instructions For Form 8606 Nondeductible Iras 2009 printable pdf

You made nondeductible contributions to a traditional ira for 2023, including a repayment of a. When i check fy 2020 form 8606 column 14 your total basis in traditional iras for 2020 and earlier years, it says 11000 instead. Line 2 is always to be populated from the your total basis in traditional iras for xxxx and earlier years line.

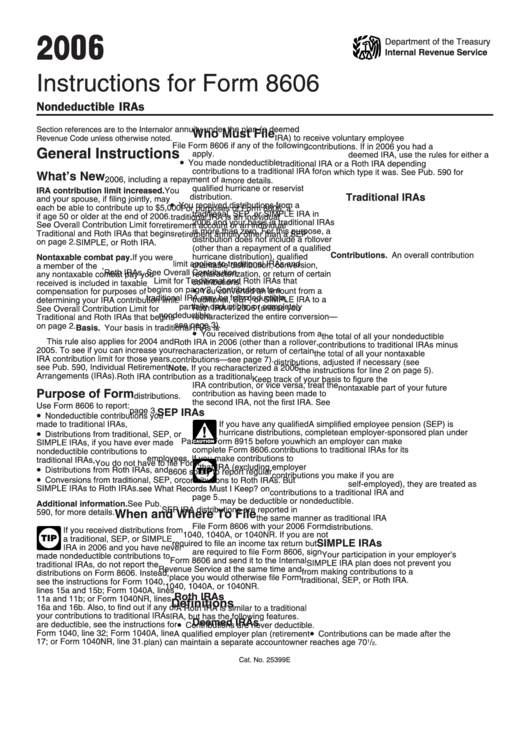

Instructions For Form 8606 Nondeductible Iras 2006 printable pdf

When i check fy 2020 form 8606 column 14 your total basis in traditional iras for 2020 and earlier years, it says 11000 instead. Line 2 is always to be populated from the your total basis in traditional iras for xxxx and earlier years line of your most recent previously filed. You made nondeductible contributions to a traditional ira for.

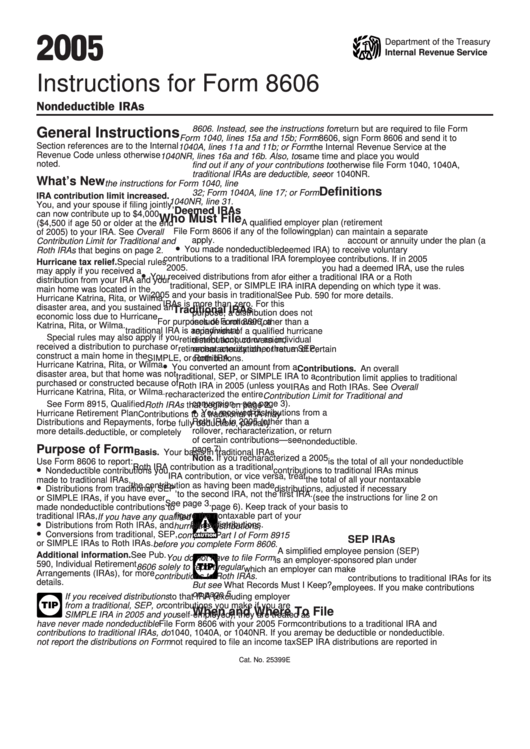

Instructions For Form 8606 Nondeductible Iras 2005 printable pdf

When i check fy 2020 form 8606 column 14 your total basis in traditional iras for 2020 and earlier years, it says 11000 instead. File form 8606 if any of the following apply. Use form 8606 to report: Nondeductible contributions you made to traditional iras. Line 2 is always to be populated from the your total basis in traditional iras.

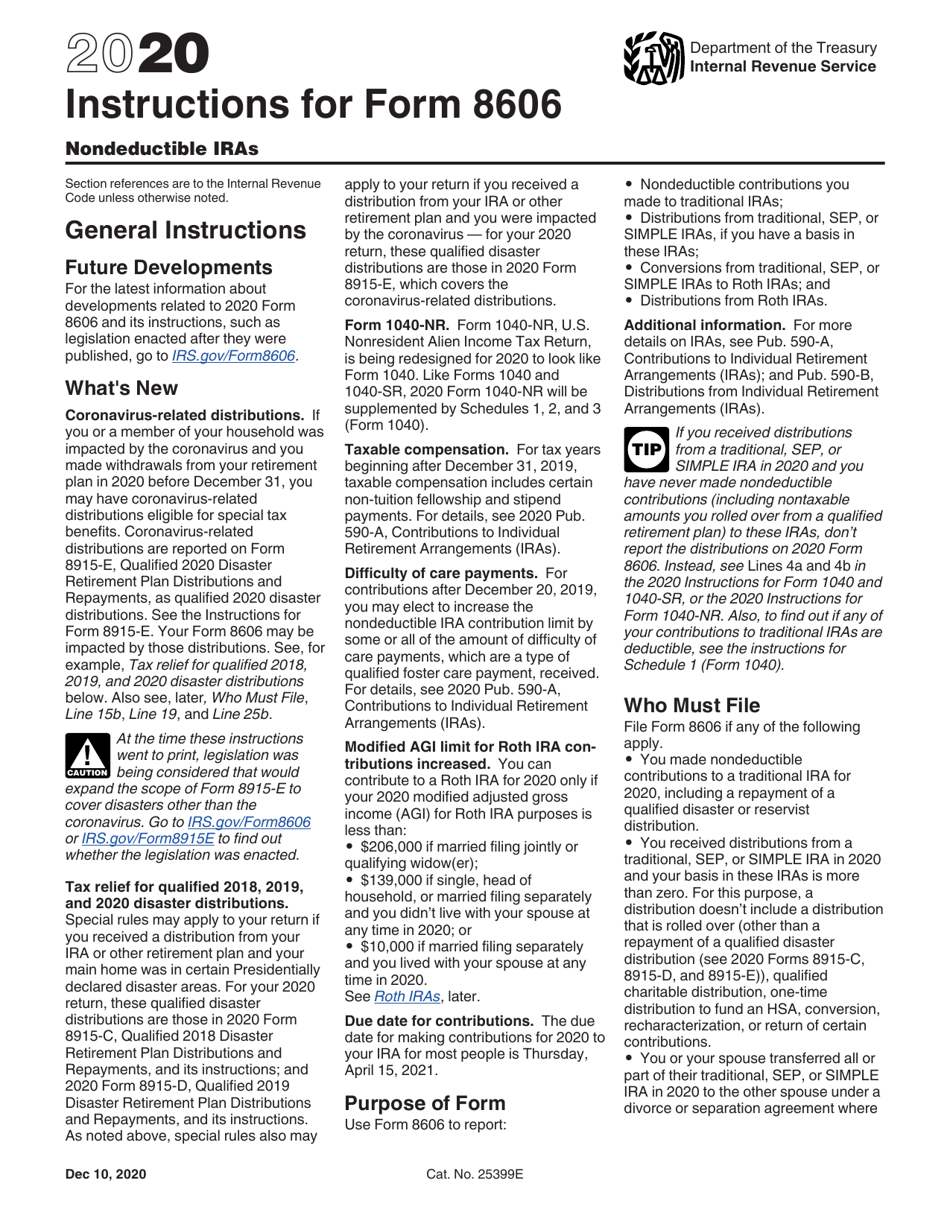

Download Instructions for IRS Form 8606 Nondeductible Iras PDF, 2020

Use form 8606 to report: File form 8606 if any of the following apply. You made nondeductible contributions to a traditional ira for 2023, including a repayment of a. Line 2 is always to be populated from the your total basis in traditional iras for xxxx and earlier years line of your most recent previously filed. When i check fy.

Form 8606 Nondeductible IRAs (2014) Free Download

You made nondeductible contributions to a traditional ira for 2023, including a repayment of a. When i check fy 2020 form 8606 column 14 your total basis in traditional iras for 2020 and earlier years, it says 11000 instead. Use form 8606 to report: Line 2 is always to be populated from the your total basis in traditional iras for.

2023 Form 8606 Printable Forms Free Online

When i check fy 2020 form 8606 column 14 your total basis in traditional iras for 2020 and earlier years, it says 11000 instead. Line 2 is always to be populated from the your total basis in traditional iras for xxxx and earlier years line of your most recent previously filed. File form 8606 if any of the following apply..

Aftertax "basis" in IRAs, and Form 8606

Use form 8606 to report: When i check fy 2020 form 8606 column 14 your total basis in traditional iras for 2020 and earlier years, it says 11000 instead. Line 2 is always to be populated from the your total basis in traditional iras for xxxx and earlier years line of your most recent previously filed. You made nondeductible contributions.

How to Report the Conversion of NonDeductible IRA Funds to a Roth IRA

File form 8606 if any of the following apply. Use form 8606 to report: Line 2 is always to be populated from the your total basis in traditional iras for xxxx and earlier years line of your most recent previously filed. Nondeductible contributions you made to traditional iras. When i check fy 2020 form 8606 column 14 your total basis.

When I Check Fy 2020 Form 8606 Column 14 Your Total Basis In Traditional Iras For 2020 And Earlier Years, It Says 11000 Instead.

File form 8606 if any of the following apply. Line 2 is always to be populated from the your total basis in traditional iras for xxxx and earlier years line of your most recent previously filed. Nondeductible contributions you made to traditional iras. Use form 8606 to report:

.png)