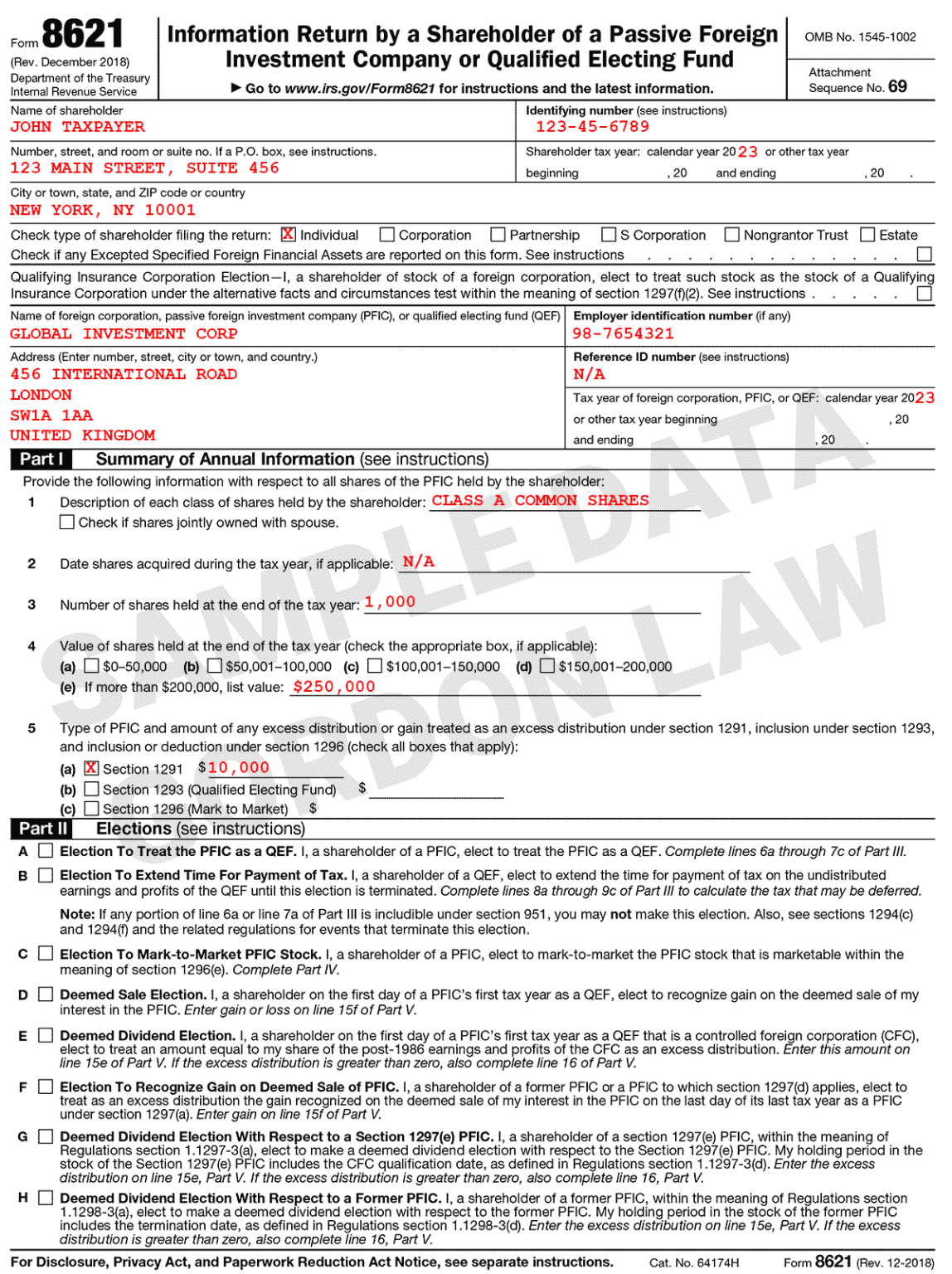

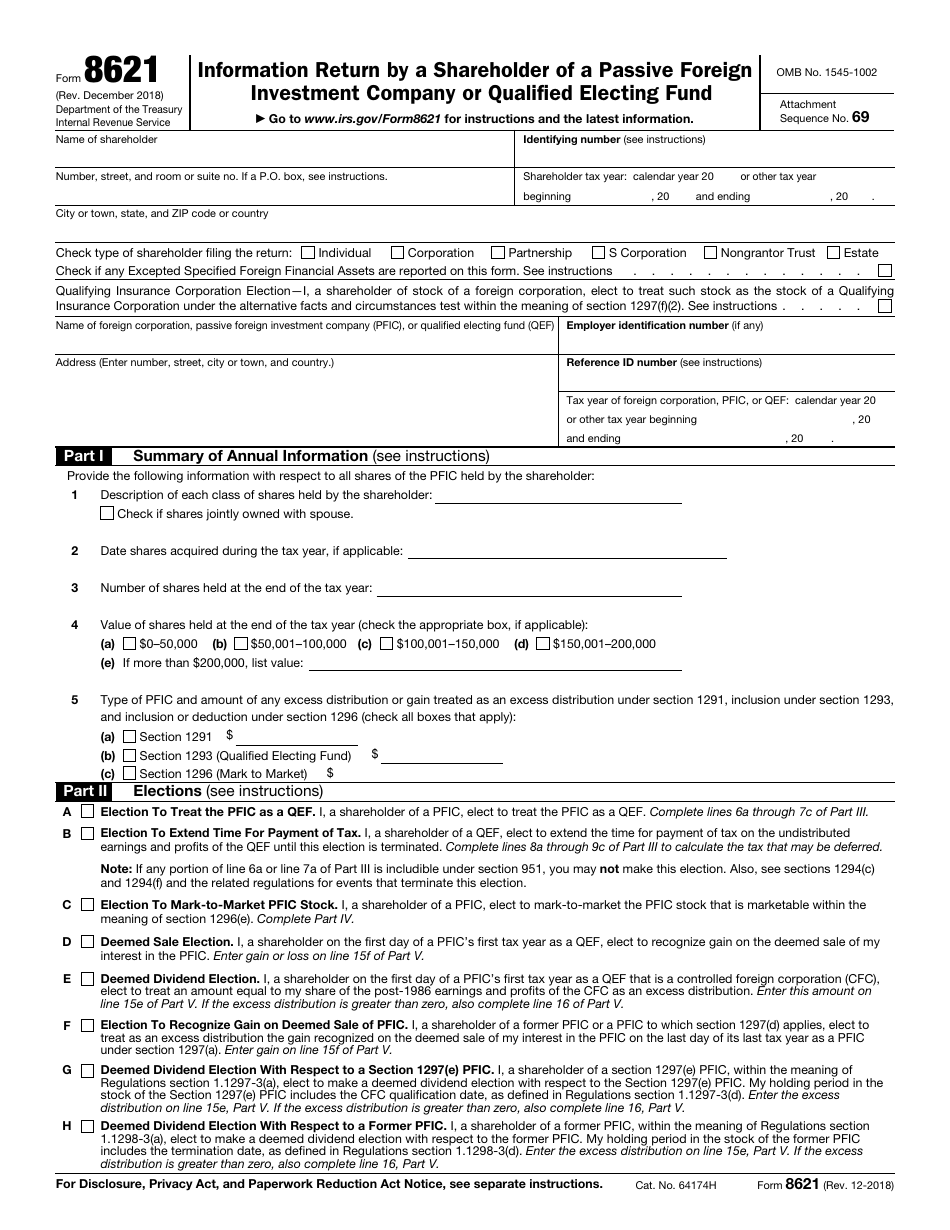

Form 8621 Turbotax - Prepare your return in turbotax. To fix this problem you will need to go back. Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. December 2018) department of the treasury internal revenue service. Fill out form 8621 manually, and then insert the completed form 8621 into their tax return. Information return by a shareholder of a. Turbotax does not support form 8621 so you will be unable to delete form 8621. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due. Information about form 8621, information. Turbotax does not include form 8621 return by a shareholder of a passive foreign investment company or qualified electing fund.

To fix this problem you will need to go back. Turbotax does not support form 8621 so you will be unable to delete form 8621. Prepare your return in turbotax. Fill out form 8621 manually, and then insert the completed form 8621 into their tax return. Information return by a shareholder of a. Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. Turbotax does not include form 8621 return by a shareholder of a passive foreign investment company or qualified electing fund. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due. December 2018) department of the treasury internal revenue service. Information about form 8621, information.

Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. Fill out form 8621 manually, and then insert the completed form 8621 into their tax return. December 2018) department of the treasury internal revenue service. Turbotax does not support form 8621 so you will be unable to delete form 8621. Information about form 8621, information. Turbotax does not include form 8621 return by a shareholder of a passive foreign investment company or qualified electing fund. To fix this problem you will need to go back. Information return by a shareholder of a. Prepare your return in turbotax. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due.

Guide to IRS Form 8621 PFICs, QEFs, and Filing Requirements Gordon

Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. Prepare your return in turbotax. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due. Fill out form 8621 manually, and then insert the completed form 8621 into their tax return. Information return by a shareholder of.

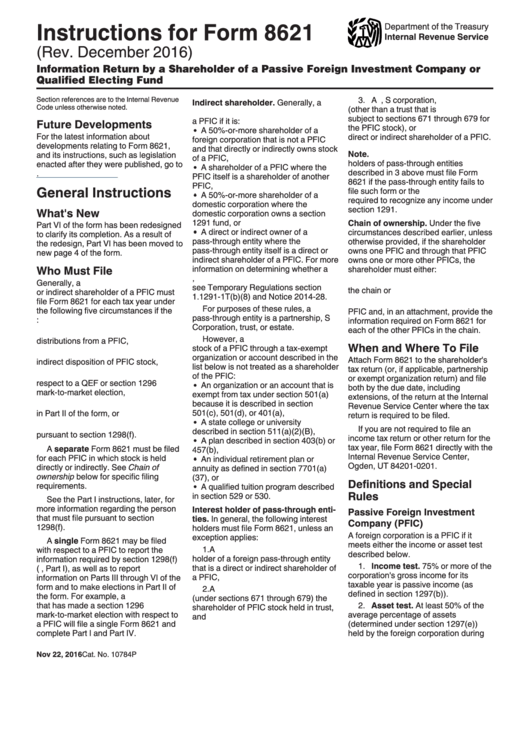

Instructions For Form 8621 2016 printable pdf download

Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due. Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. Turbotax does not support form 8621 so you will be unable to delete form 8621. Information return by a shareholder of a. To fix this problem you.

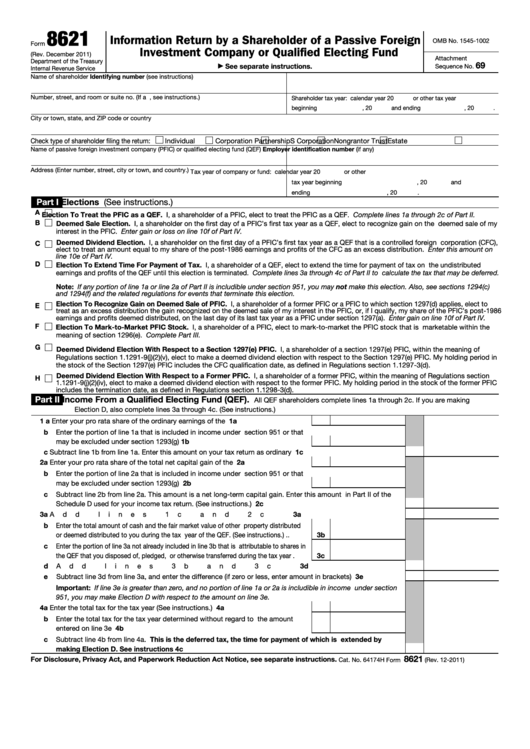

Form 8621 Fillable Printable Forms Free Online

Turbotax does not support form 8621 so you will be unable to delete form 8621. December 2018) department of the treasury internal revenue service. Information return by a shareholder of a. Fill out form 8621 manually, and then insert the completed form 8621 into their tax return. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or.

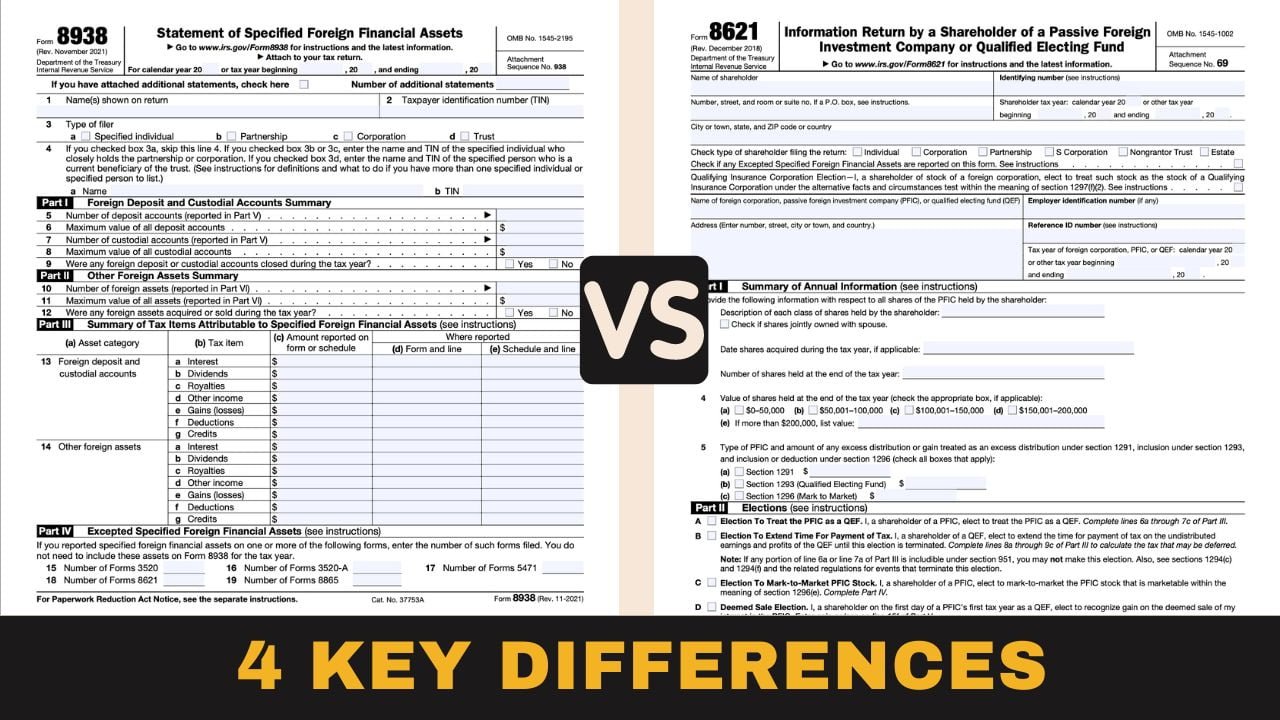

Form 8938 And Form 8621 Key Differences

December 2018) department of the treasury internal revenue service. Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. Information about form 8621, information. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due. Turbotax does not include form 8621 return by a shareholder of a passive.

Form 8621 Fillable Printable Forms Free Online

Information about form 8621, information. Turbotax does not support form 8621 so you will be unable to delete form 8621. December 2018) department of the treasury internal revenue service. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due. To fix this problem you will need to go.

Form 8621 Calculator Frequently Asked Questions and Answers (FAQ)

Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. Turbotax does not support form 8621 so you will be unable to delete form 8621. Fill out form 8621 manually, and then insert the completed form 8621 into their tax return. Prepare your return in turbotax. Information return by a shareholder of a.

Form 8621 Calculator PFIC FAQ

Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due. Turbotax does not support form 8621 so you will be unable to delete form 8621. December 2018) department of the treasury internal revenue service. Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. Prepare your return.

Fill Free fillable Form 8621A 2013 Return by a Shareholder PDF form

Information return by a shareholder of a. Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due. Information about form 8621, information. To fix this problem you will need to go back.

Form 8621 for American Expatriates and Passive Foreign Investment Companies

Information about form 8621, information. Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. Turbotax does not support form 8621 so you will be unable to delete form 8621. Prepare your return in turbotax. Information return by a shareholder of a.

IRS Form 8621 Instructions (Guidelines) Expat US Tax

Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. Turbotax does not support form 8621 so you will be unable to delete form 8621. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due. Turbotax does not include form 8621 return by a shareholder of a.

Fill Out Form 8621 Manually, And Then Insert The Completed Form 8621 Into Their Tax Return.

December 2018) department of the treasury internal revenue service. Attach form 8621 to the shareholder's tax return (or, if applicable, partnership or exempt organization return) and file both by the due. Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. To fix this problem you will need to go back.

Information About Form 8621, Information.

Information return by a shareholder of a. Turbotax does not include form 8621 return by a shareholder of a passive foreign investment company or qualified electing fund. Prepare your return in turbotax. Turbotax does not support form 8621 so you will be unable to delete form 8621.