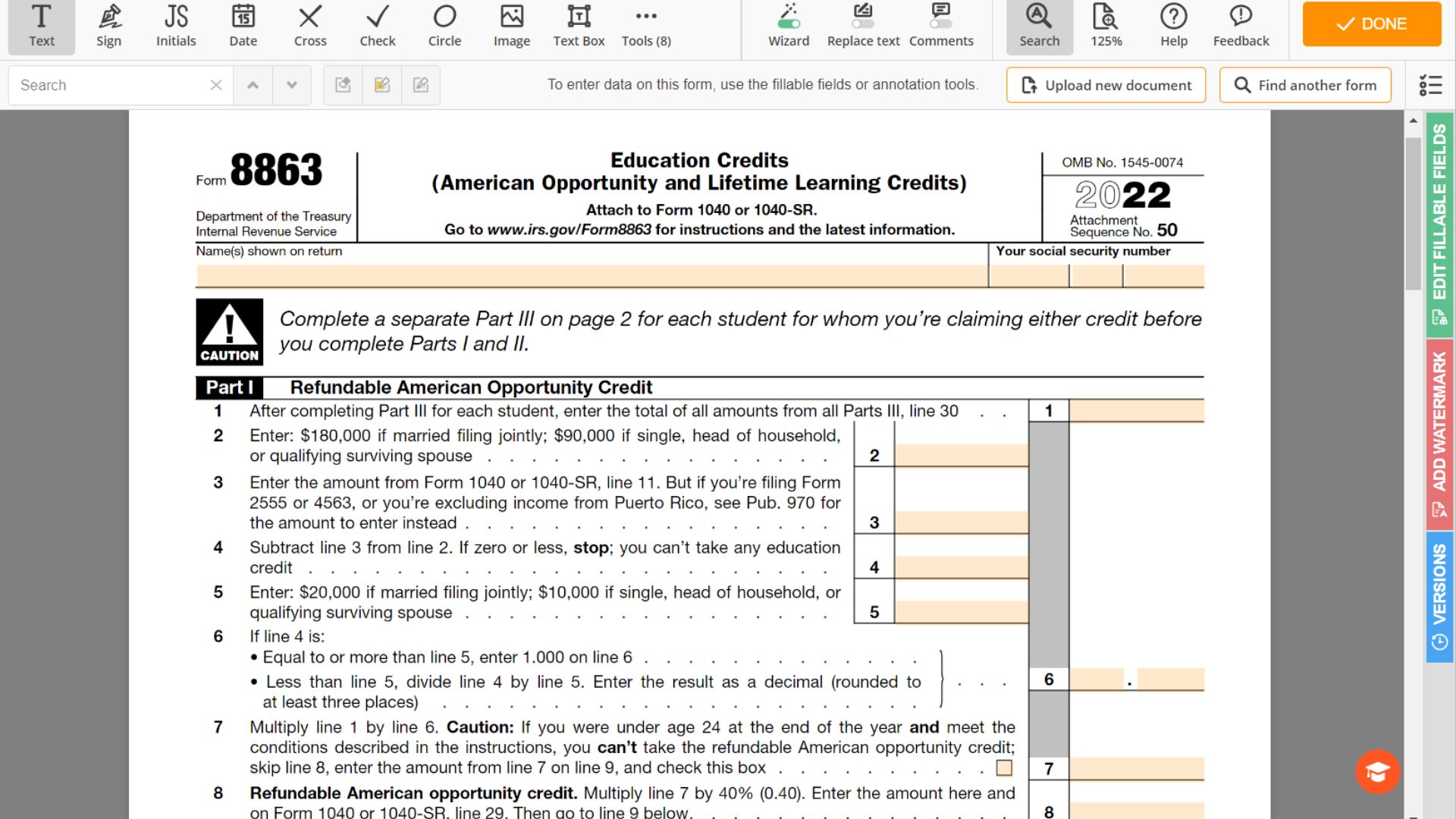

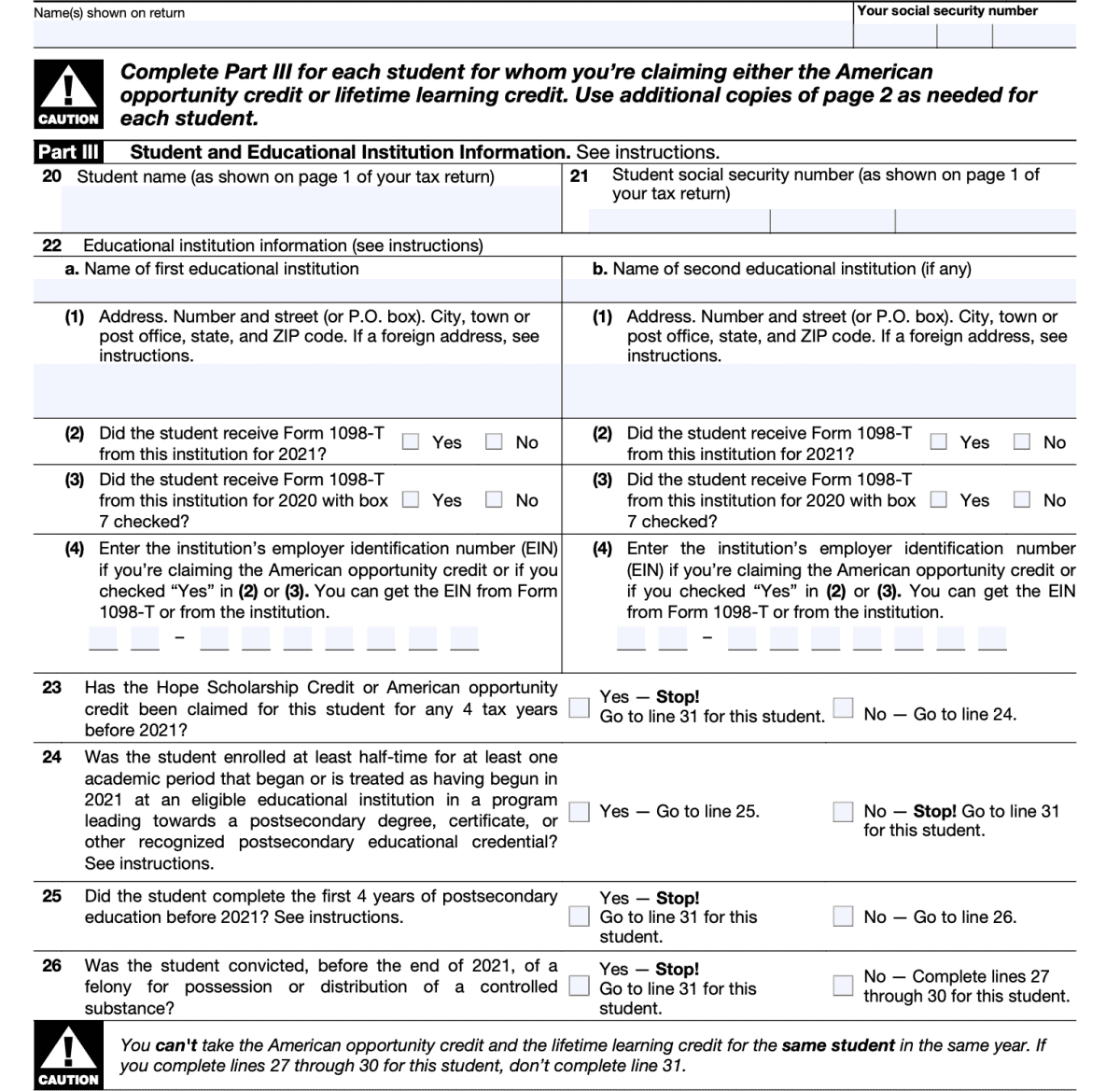

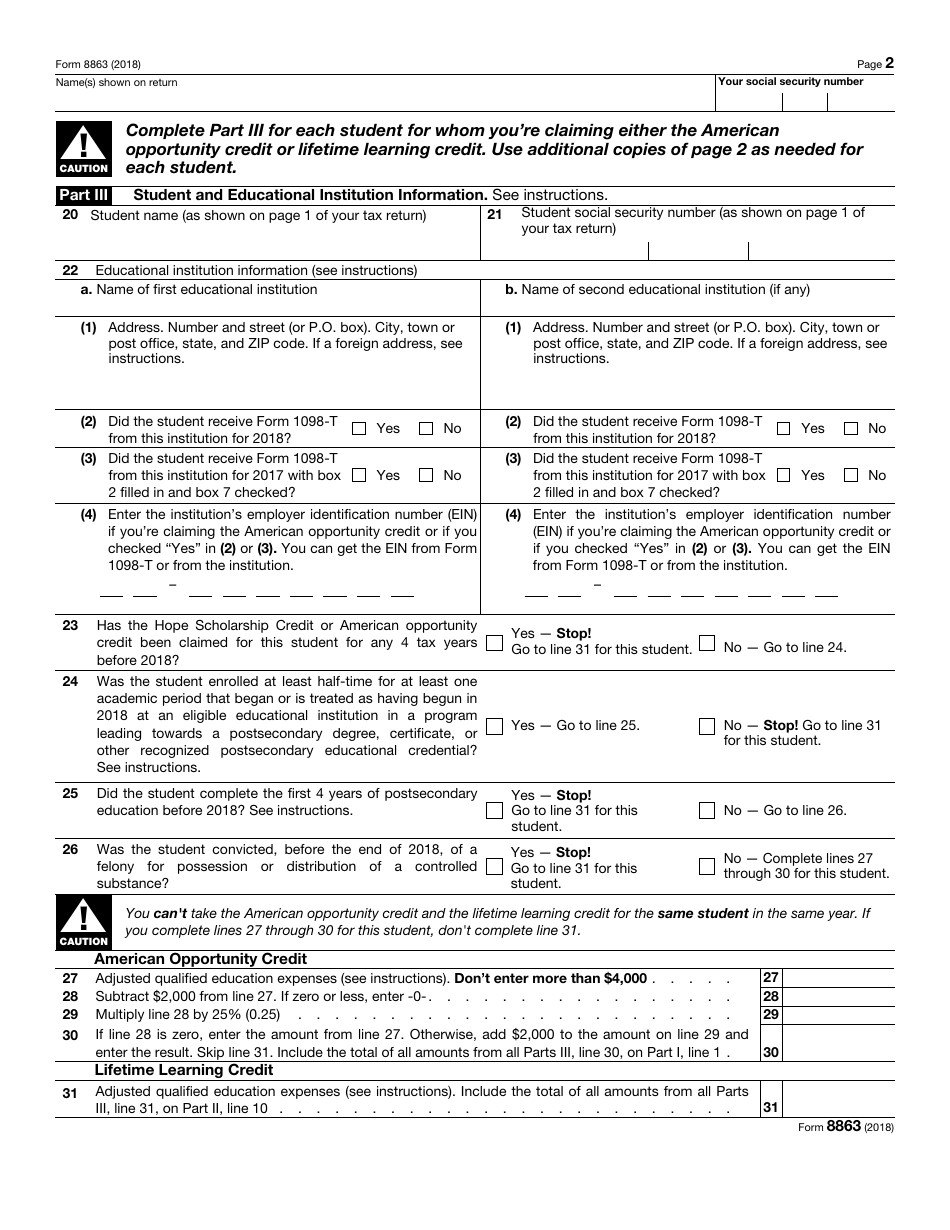

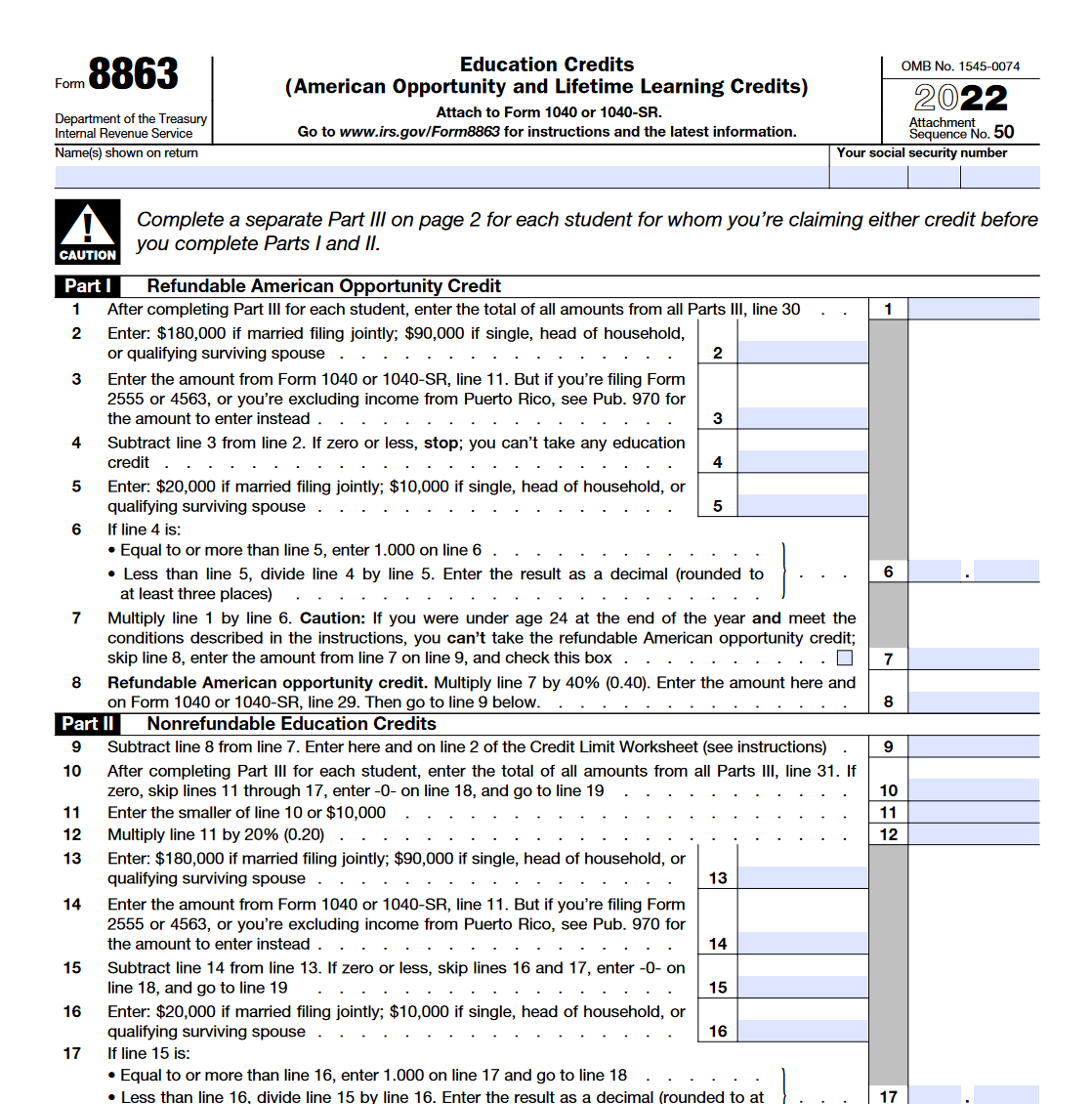

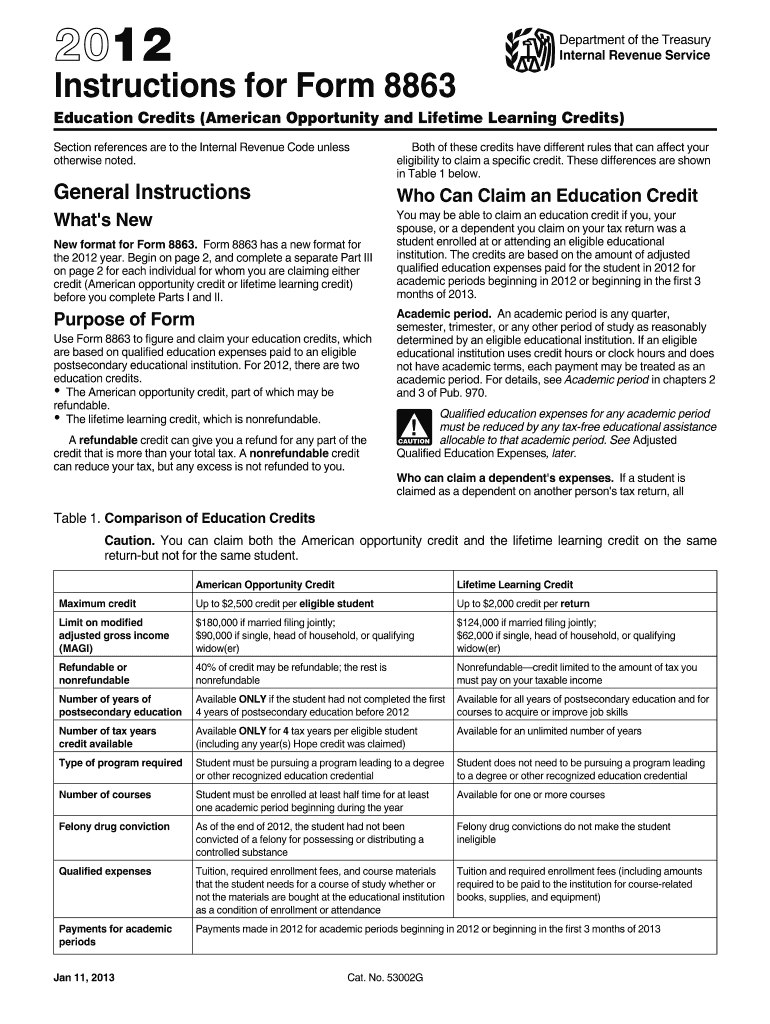

Form 8863 2021 - This document provides detailed instructions for completing form 8863, which is used to claim. Instructions for form 8863 education credits 2021. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible. Learn how to file irs form 8863 to claim education tax credits, including eligibility, types, calculations, and required documentation. Taxpayers who claim the american opportunity credit even though they are not eligible can be banned from claiming the credit for up to 10. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible.

Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible. This document provides detailed instructions for completing form 8863, which is used to claim. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. Learn how to file irs form 8863 to claim education tax credits, including eligibility, types, calculations, and required documentation. Instructions for form 8863 education credits 2021. Taxpayers who claim the american opportunity credit even though they are not eligible can be banned from claiming the credit for up to 10.

Instructions for form 8863 education credits 2021. Learn how to file irs form 8863 to claim education tax credits, including eligibility, types, calculations, and required documentation. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible. Taxpayers who claim the american opportunity credit even though they are not eligible can be banned from claiming the credit for up to 10. This document provides detailed instructions for completing form 8863, which is used to claim. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible.

2022 Education Tax Credits Are You Eligible?

This document provides detailed instructions for completing form 8863, which is used to claim. Instructions for form 8863 education credits 2021. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible. Taxpayers who claim the american opportunity credit even though they are not eligible can be banned from claiming.

IRS Form 8863 📝 Get Federal Tax Form 8863 for 2022 Instructions

Instructions for form 8863 education credits 2021. This document provides detailed instructions for completing form 8863, which is used to claim. Learn how to file irs form 8863 to claim education tax credits, including eligibility, types, calculations, and required documentation. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an.

Form 8863 2024 Bee Beverie

Instructions for form 8863 education credits 2021. Taxpayers who claim the american opportunity credit even though they are not eligible can be banned from claiming the credit for up to 10. This document provides detailed instructions for completing form 8863, which is used to claim. Learn how to file irs form 8863 to claim education tax credits, including eligibility, types,.

Form 8863 Fillable Pdf Printable Forms Free Online

Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible. Taxpayers who claim the american opportunity credit even though they are not eligible can be banned from claiming the credit for up to 10. Instructions for form 8863 education credits 2021. Use form 8863 to figure and claim your.

8863 Fillable Form Printable Forms Free Online

Instructions for form 8863 education credits 2021. This document provides detailed instructions for completing form 8863, which is used to claim. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible. Taxpayers who claim the american opportunity credit even though they are not eligible can be banned from claiming.

Fillable Online 8863 form pdf. 8863 form pdf. Form 8863 instructions

Learn how to file irs form 8863 to claim education tax credits, including eligibility, types, calculations, and required documentation. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. Taxpayers who claim the american opportunity credit even though they are not eligible can be banned from claiming the.

Printable Form 8863 Printable Forms Free Online

Learn how to file irs form 8863 to claim education tax credits, including eligibility, types, calculations, and required documentation. Instructions for form 8863 education credits 2021. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible. This document provides detailed instructions for completing form 8863, which is used to.

IRS Form 8863 📝 Get Federal Tax Form 8863 for 2022 Instructions

Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. This document provides detailed instructions for completing form 8863, which is used to claim. Learn how to.

Ir's Form 8863 Instructions Fill Out and Sign Printable PDF Template

Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. Taxpayers who claim the american opportunity credit even though they are not eligible can be banned from claiming the credit for up to 10. This document provides detailed instructions for completing form 8863, which is used to claim..

Form 8863 Instructions 2024

Learn how to file irs form 8863 to claim education tax credits, including eligibility, types, calculations, and required documentation. Instructions for form 8863 education credits 2021. This document provides detailed instructions for completing form 8863, which is used to claim. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to.

This Document Provides Detailed Instructions For Completing Form 8863, Which Is Used To Claim.

Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible. Learn how to file irs form 8863 to claim education tax credits, including eligibility, types, calculations, and required documentation. Taxpayers who claim the american opportunity credit even though they are not eligible can be banned from claiming the credit for up to 10.