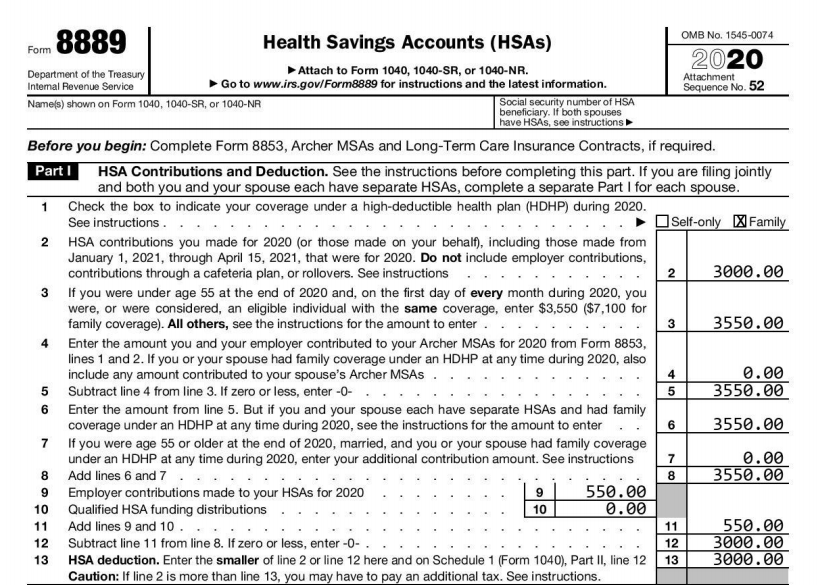

Form 8889 T December Plan Type - The workaround in this case is to just check self on line 1 of the 8889 so that you can clear the review. So my understanding is you'd select the 'family' option under form 8889. Report health savings account (hsa) contributions (including those made on your behalf and employer. To be eligible to have contributions made to your hsa, you must be covered under a high deductible health plan (hdhp) and have no other health.

To be eligible to have contributions made to your hsa, you must be covered under a high deductible health plan (hdhp) and have no other health. So my understanding is you'd select the 'family' option under form 8889. Report health savings account (hsa) contributions (including those made on your behalf and employer. The workaround in this case is to just check self on line 1 of the 8889 so that you can clear the review.

Report health savings account (hsa) contributions (including those made on your behalf and employer. So my understanding is you'd select the 'family' option under form 8889. To be eligible to have contributions made to your hsa, you must be covered under a high deductible health plan (hdhp) and have no other health. The workaround in this case is to just check self on line 1 of the 8889 so that you can clear the review.

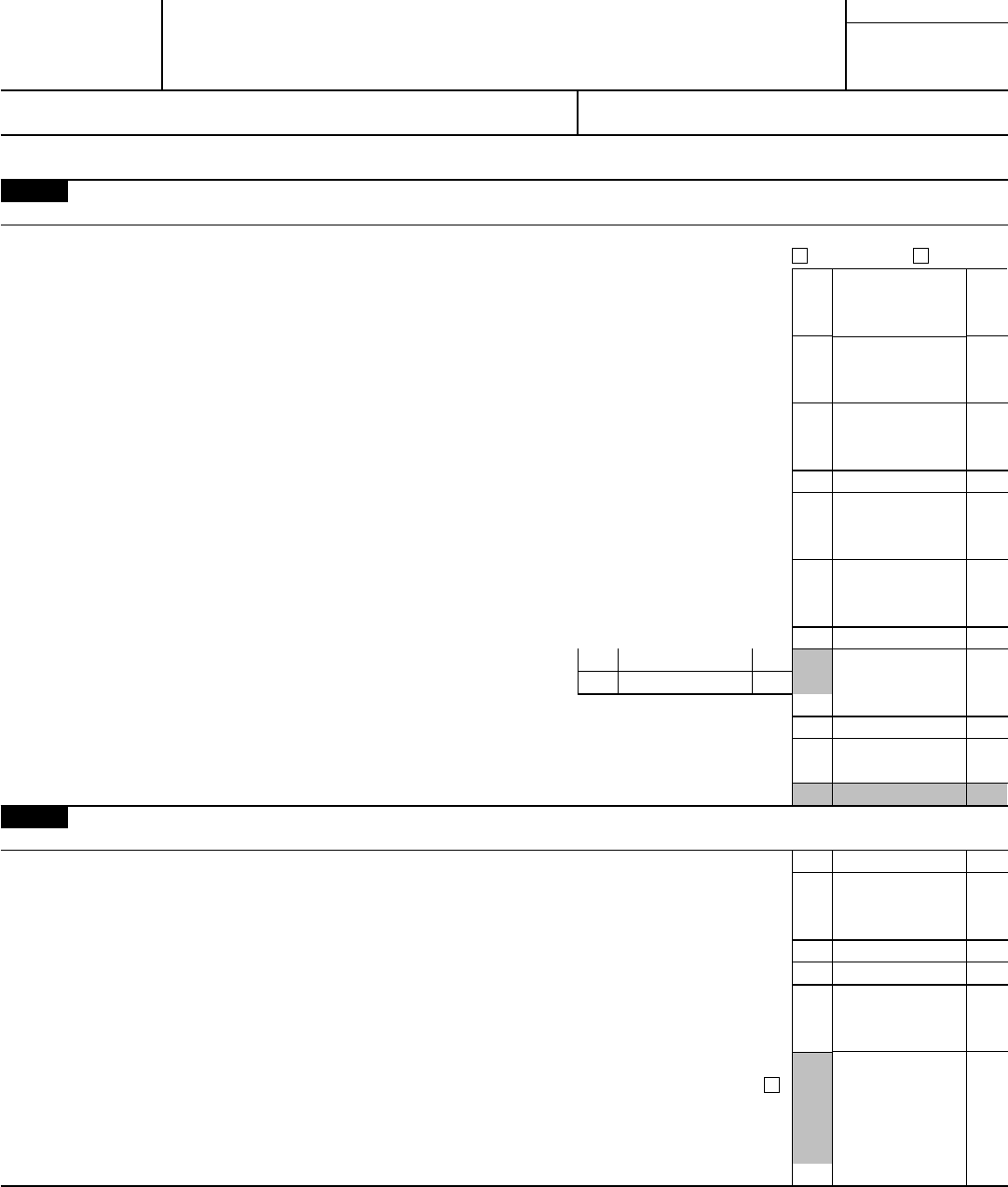

Form 8889 Edit, Fill, Sign Online Handypdf

So my understanding is you'd select the 'family' option under form 8889. The workaround in this case is to just check self on line 1 of the 8889 so that you can clear the review. To be eligible to have contributions made to your hsa, you must be covered under a high deductible health plan (hdhp) and have no other.

Form 8889 Edit, Fill, Sign Online Handypdf

So my understanding is you'd select the 'family' option under form 8889. To be eligible to have contributions made to your hsa, you must be covered under a high deductible health plan (hdhp) and have no other health. The workaround in this case is to just check self on line 1 of the 8889 so that you can clear the.

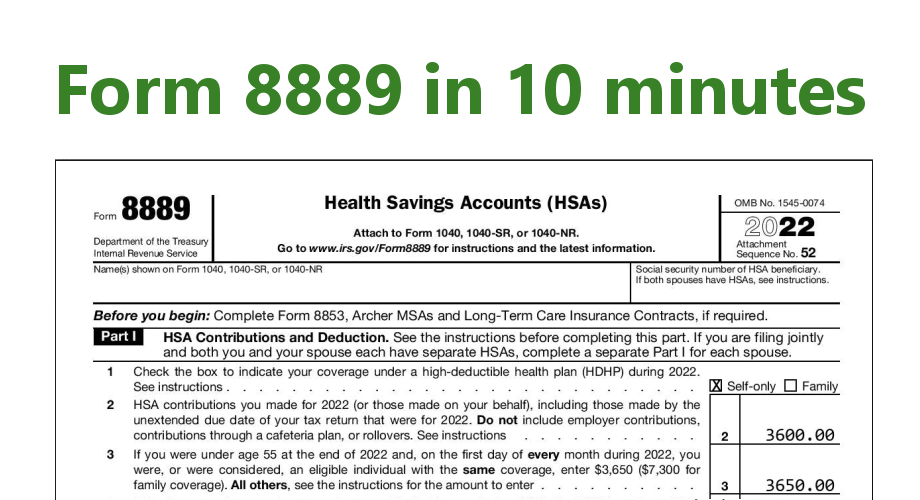

IRS Form 8889 ≡ Fill Out Printable PDF Forms Online, 41 OFF

The workaround in this case is to just check self on line 1 of the 8889 so that you can clear the review. Report health savings account (hsa) contributions (including those made on your behalf and employer. To be eligible to have contributions made to your hsa, you must be covered under a high deductible health plan (hdhp) and have.

8889 Form 2021 IRS Forms Zrivo

So my understanding is you'd select the 'family' option under form 8889. Report health savings account (hsa) contributions (including those made on your behalf and employer. The workaround in this case is to just check self on line 1 of the 8889 so that you can clear the review. To be eligible to have contributions made to your hsa, you.

Irs form 8889 instructions 2023 Fill online, Printable, Fillable Blank

To be eligible to have contributions made to your hsa, you must be covered under a high deductible health plan (hdhp) and have no other health. Report health savings account (hsa) contributions (including those made on your behalf and employer. So my understanding is you'd select the 'family' option under form 8889. The workaround in this case is to just.

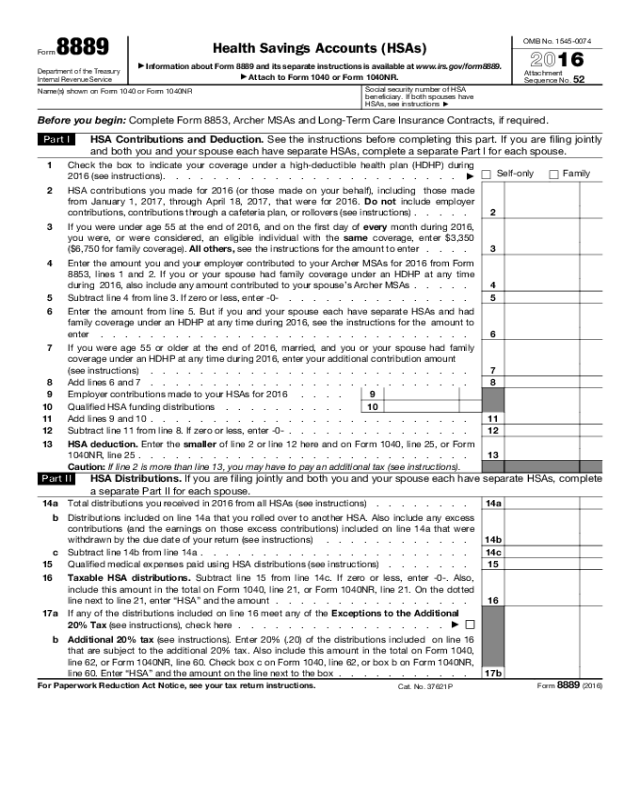

EasyForm8889 simple instructions for HSA Tax Form 8889

So my understanding is you'd select the 'family' option under form 8889. Report health savings account (hsa) contributions (including those made on your behalf and employer. To be eligible to have contributions made to your hsa, you must be covered under a high deductible health plan (hdhp) and have no other health. The workaround in this case is to just.

Navigating Your Health Savings Account (HSA) with Form 8889

So my understanding is you'd select the 'family' option under form 8889. The workaround in this case is to just check self on line 1 of the 8889 so that you can clear the review. To be eligible to have contributions made to your hsa, you must be covered under a high deductible health plan (hdhp) and have no other.

Form 8889 2023 Printable Forms Free Online

So my understanding is you'd select the 'family' option under form 8889. Report health savings account (hsa) contributions (including those made on your behalf and employer. The workaround in this case is to just check self on line 1 of the 8889 so that you can clear the review. To be eligible to have contributions made to your hsa, you.

Form 8889t line 12 Fill online, Printable, Fillable Blank

Report health savings account (hsa) contributions (including those made on your behalf and employer. The workaround in this case is to just check self on line 1 of the 8889 so that you can clear the review. To be eligible to have contributions made to your hsa, you must be covered under a high deductible health plan (hdhp) and have.

Form 8889 2023 Printable Forms Free Online

To be eligible to have contributions made to your hsa, you must be covered under a high deductible health plan (hdhp) and have no other health. So my understanding is you'd select the 'family' option under form 8889. Report health savings account (hsa) contributions (including those made on your behalf and employer. The workaround in this case is to just.

Report Health Savings Account (Hsa) Contributions (Including Those Made On Your Behalf And Employer.

The workaround in this case is to just check self on line 1 of the 8889 so that you can clear the review. So my understanding is you'd select the 'family' option under form 8889. To be eligible to have contributions made to your hsa, you must be covered under a high deductible health plan (hdhp) and have no other health.