Form 8949 Codes - Form 8949 department of the treasury internal revenue service sales and other dispositions. Use form 8949 to report sales and exchanges of capital assets. In this post, you'll learn key deadlines, filing instructions, and a walkthrough. For most transactions, you don't need. Form 8949 allows you and the. Form 8949 adjustment codes (1040) column (f) reports the form 8949 adjustment codes.

In this post, you'll learn key deadlines, filing instructions, and a walkthrough. Form 8949 department of the treasury internal revenue service sales and other dispositions. For most transactions, you don't need. Form 8949 adjustment codes (1040) column (f) reports the form 8949 adjustment codes. Use form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the.

Form 8949 allows you and the. For most transactions, you don't need. Form 8949 department of the treasury internal revenue service sales and other dispositions. Use form 8949 to report sales and exchanges of capital assets. In this post, you'll learn key deadlines, filing instructions, and a walkthrough. Form 8949 adjustment codes (1040) column (f) reports the form 8949 adjustment codes.

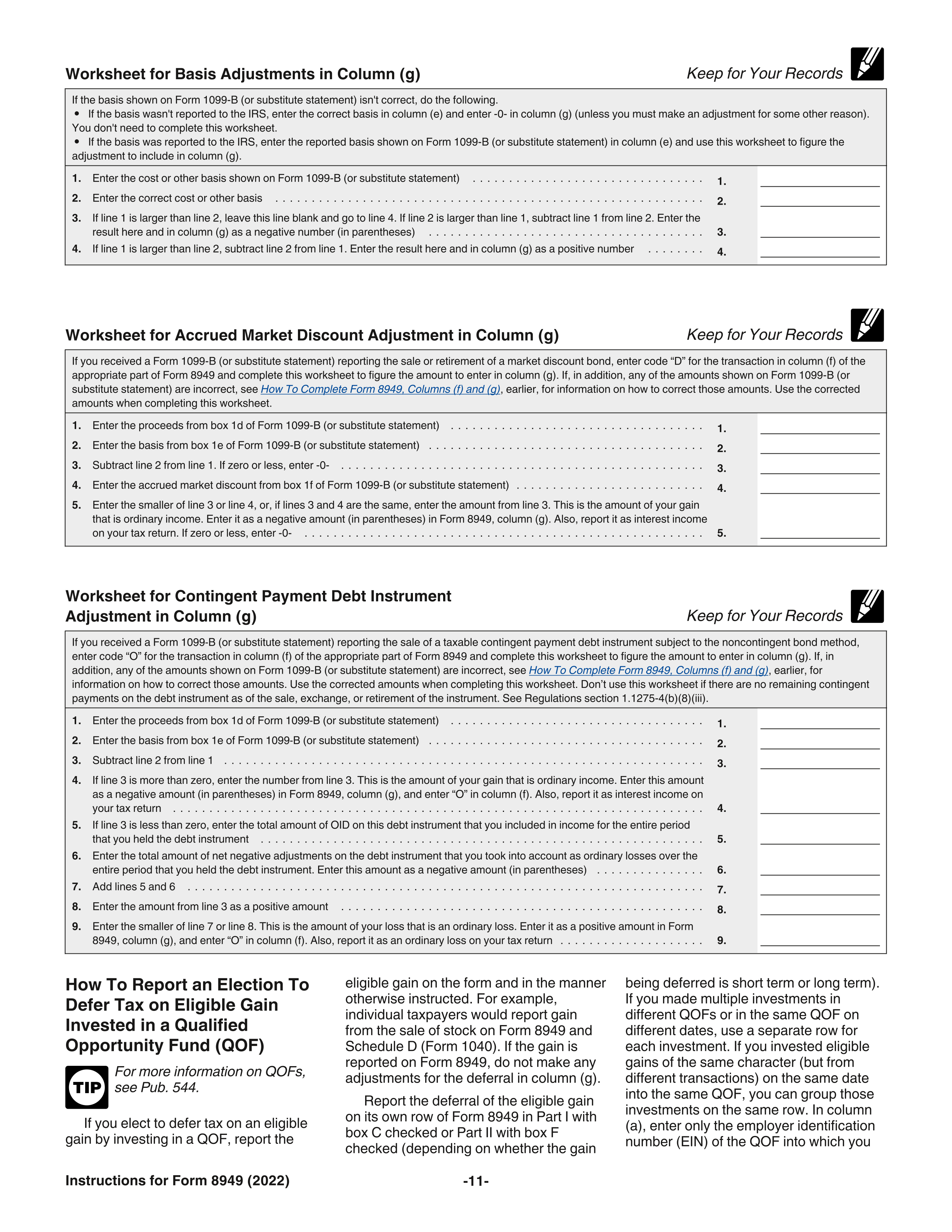

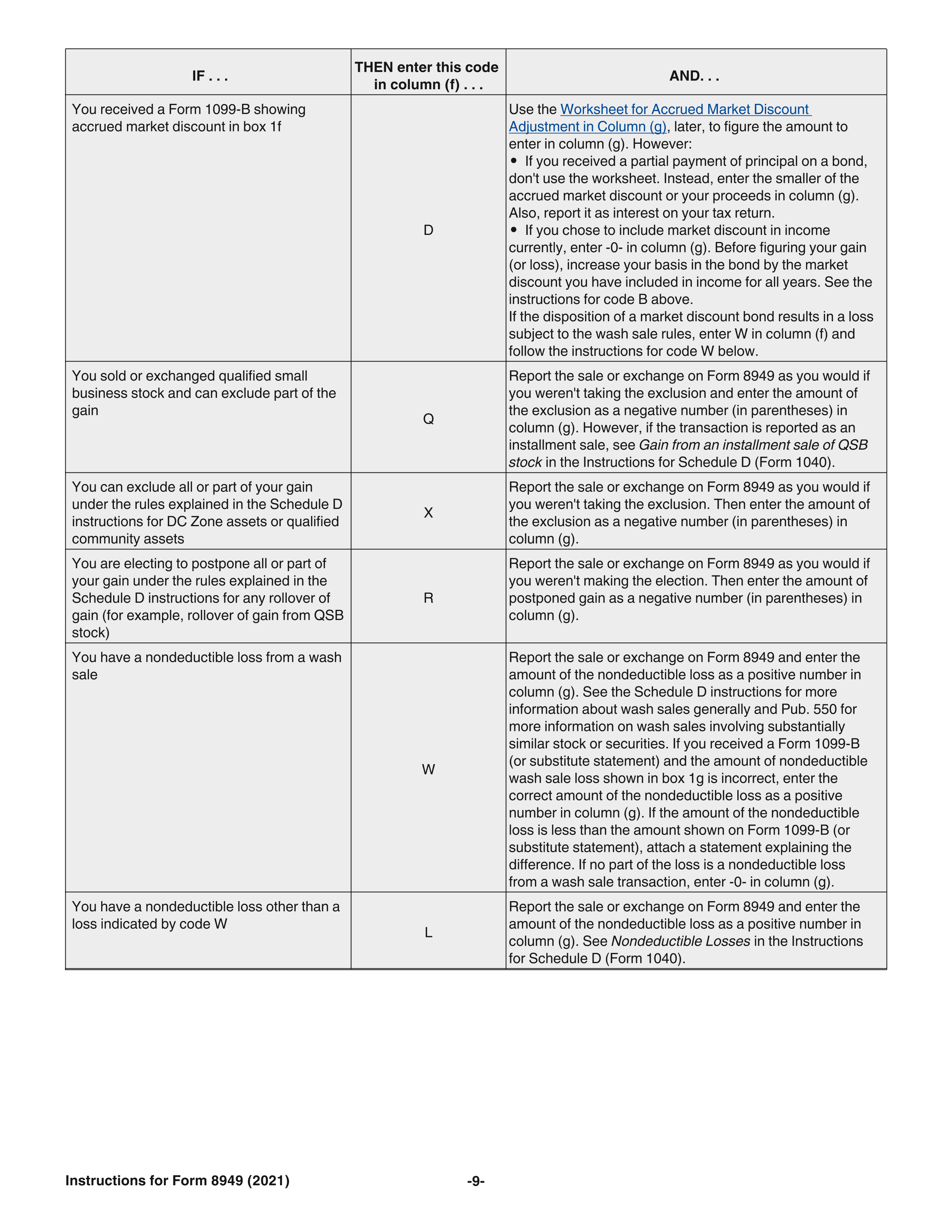

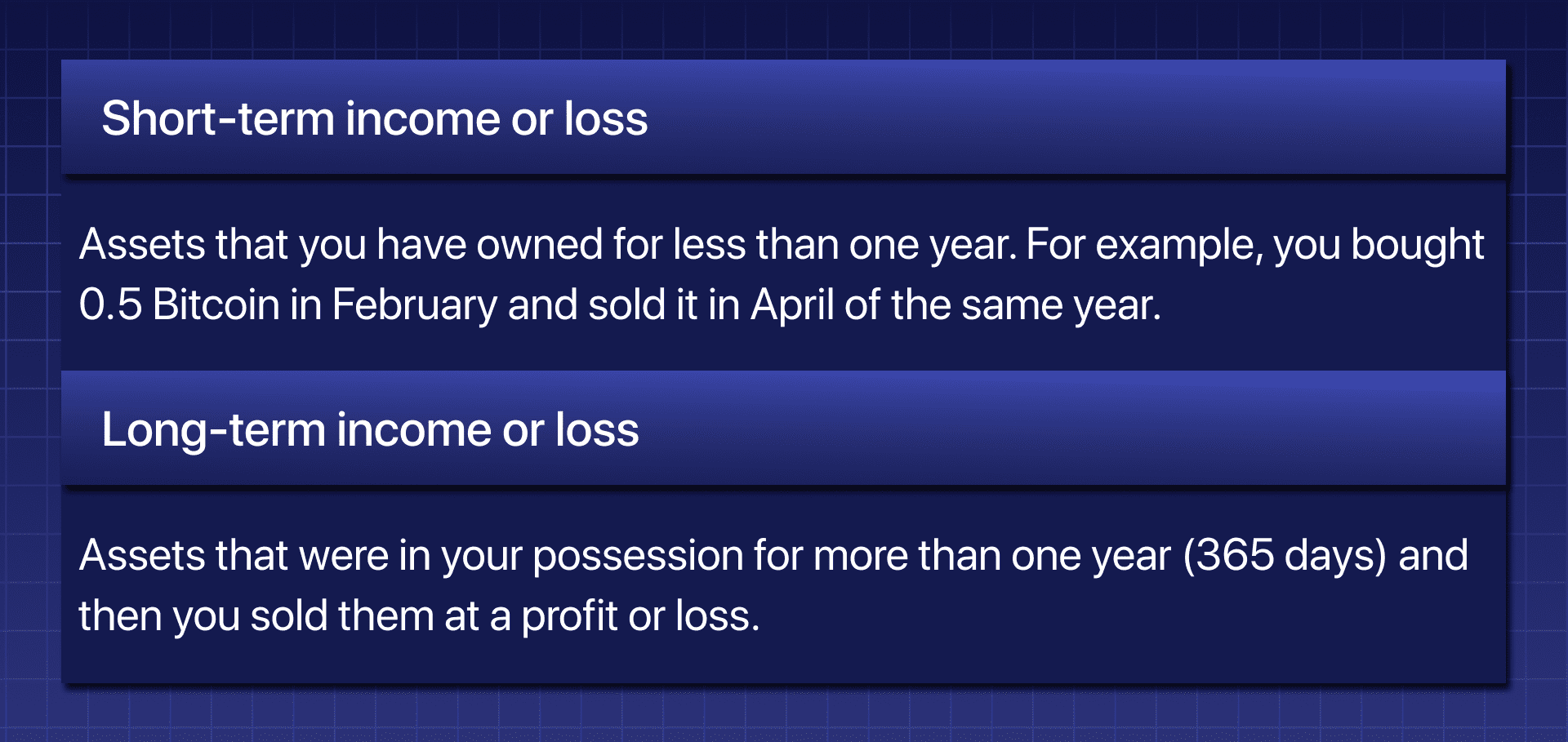

IRS Form 8949 for 2022 📝 Instructions for 8949 Tax Form Printable PDF

Form 8949 allows you and the. Form 8949 department of the treasury internal revenue service sales and other dispositions. Form 8949 adjustment codes (1040) column (f) reports the form 8949 adjustment codes. For most transactions, you don't need. Use form 8949 to report sales and exchanges of capital assets.

IRS Form 8949 for 2022 📝 Instructions for 8949 Tax Form Printable PDF

For most transactions, you don't need. Form 8949 department of the treasury internal revenue service sales and other dispositions. Use form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the. In this post, you'll learn key deadlines, filing instructions, and a walkthrough.

IRS Form 8949 Instructions

In this post, you'll learn key deadlines, filing instructions, and a walkthrough. For most transactions, you don't need. Form 8949 adjustment codes (1040) column (f) reports the form 8949 adjustment codes. Use form 8949 to report sales and exchanges of capital assets. Form 8949 department of the treasury internal revenue service sales and other dispositions.

IRS Form 8949 Instructions

For most transactions, you don't need. Use form 8949 to report sales and exchanges of capital assets. Form 8949 department of the treasury internal revenue service sales and other dispositions. Form 8949 allows you and the. In this post, you'll learn key deadlines, filing instructions, and a walkthrough.

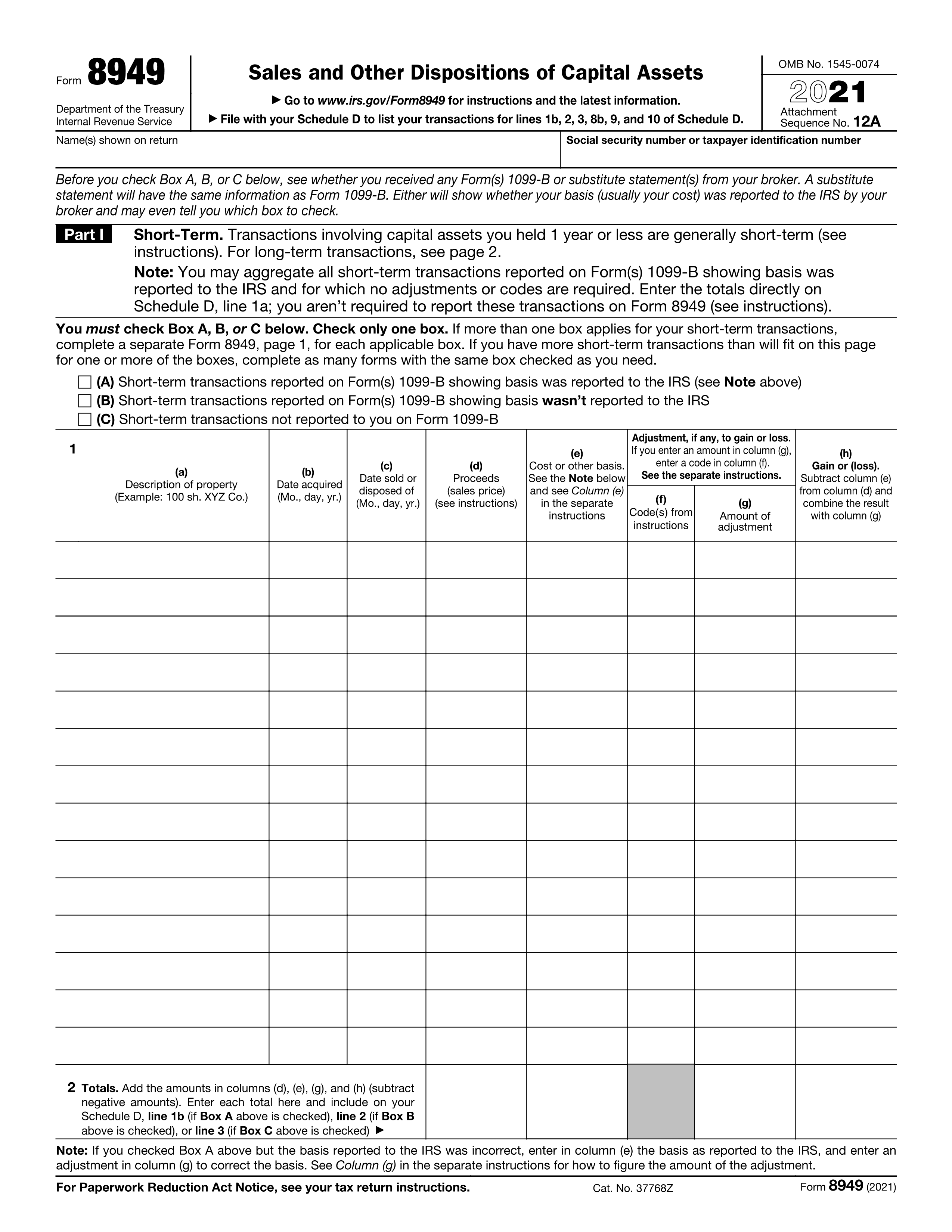

IRS Form 8949

Form 8949 department of the treasury internal revenue service sales and other dispositions. Form 8949 adjustment codes (1040) column (f) reports the form 8949 adjustment codes. Form 8949 allows you and the. Use form 8949 to report sales and exchanges of capital assets. For most transactions, you don't need.

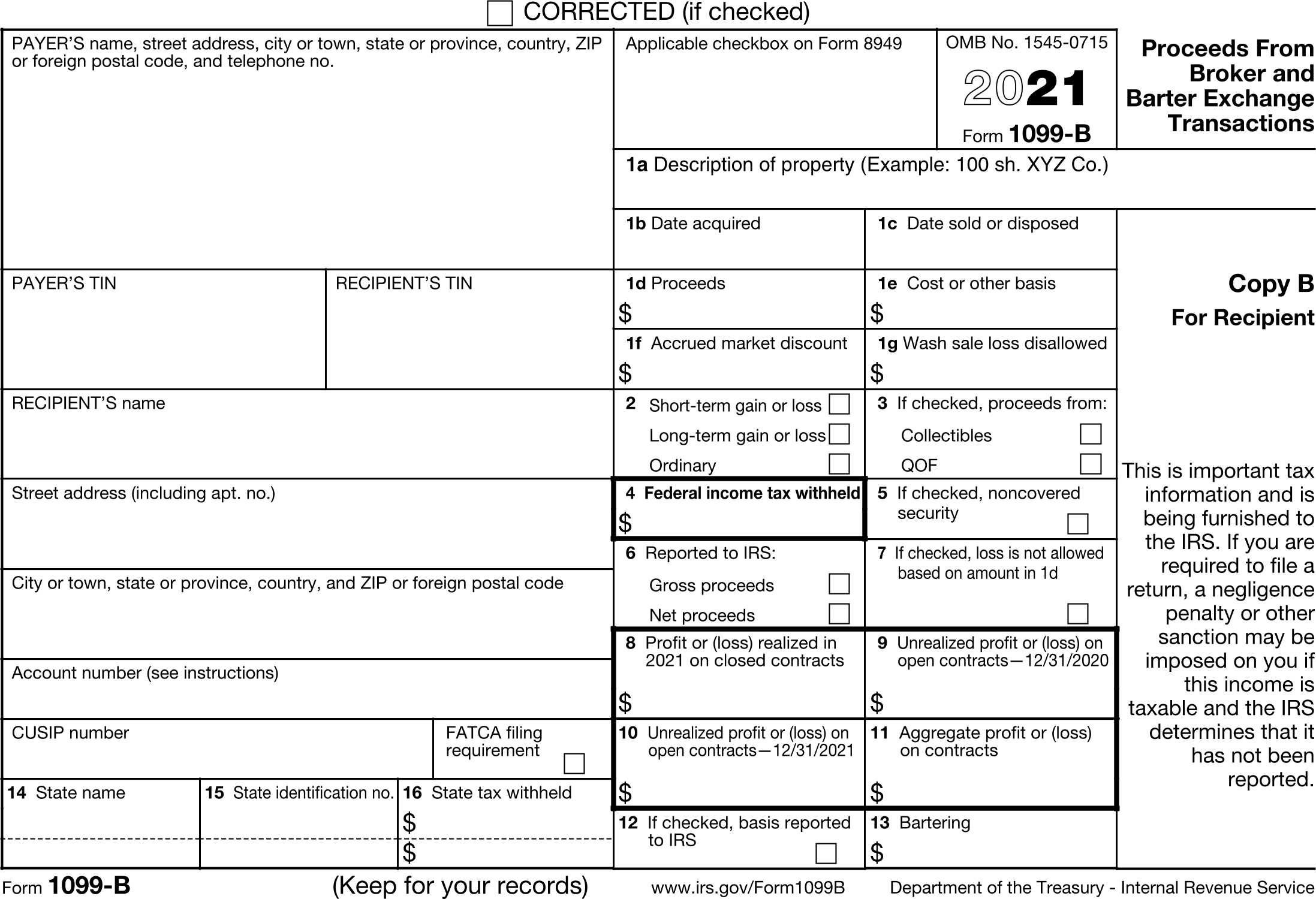

IRS Form 6781

Form 8949 allows you and the. Form 8949 department of the treasury internal revenue service sales and other dispositions. Form 8949 adjustment codes (1040) column (f) reports the form 8949 adjustment codes. Use form 8949 to report sales and exchanges of capital assets. For most transactions, you don't need.

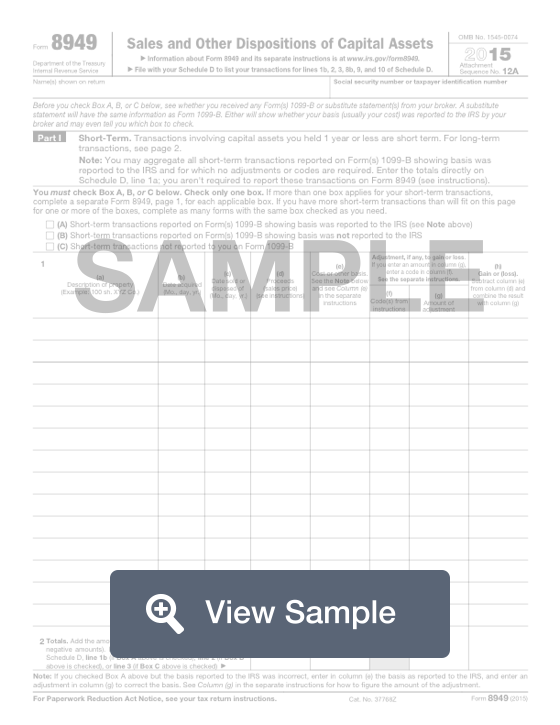

Fill out a Form 8949 Page 1 and 2 of Schedule D, and Schedule D

Use form 8949 to report sales and exchanges of capital assets. Form 8949 adjustment codes (1040) column (f) reports the form 8949 adjustment codes. Form 8949 department of the treasury internal revenue service sales and other dispositions. In this post, you'll learn key deadlines, filing instructions, and a walkthrough. For most transactions, you don't need.

IRS Form 8949 & Schedule D for Traders TradeLog

In this post, you'll learn key deadlines, filing instructions, and a walkthrough. Form 8949 department of the treasury internal revenue service sales and other dispositions. Form 8949 allows you and the. Form 8949 adjustment codes (1040) column (f) reports the form 8949 adjustment codes. For most transactions, you don't need.

Wallmer How to Fill Out IRS Form 8949 Detailed Instruction and

Form 8949 adjustment codes (1040) column (f) reports the form 8949 adjustment codes. Form 8949 department of the treasury internal revenue service sales and other dispositions. For most transactions, you don't need. Use form 8949 to report sales and exchanges of capital assets. In this post, you'll learn key deadlines, filing instructions, and a walkthrough.

Fillable IRS Form 8949 Printable PDF Sample FormSwift

Form 8949 allows you and the. For most transactions, you don't need. Form 8949 department of the treasury internal revenue service sales and other dispositions. In this post, you'll learn key deadlines, filing instructions, and a walkthrough. Use form 8949 to report sales and exchanges of capital assets.

Form 8949 Department Of The Treasury Internal Revenue Service Sales And Other Dispositions.

Form 8949 allows you and the. For most transactions, you don't need. In this post, you'll learn key deadlines, filing instructions, and a walkthrough. Use form 8949 to report sales and exchanges of capital assets.